Maine Demand for Information from Limited Liability Company LLC by Member regarding Financial Records, etc.

Description

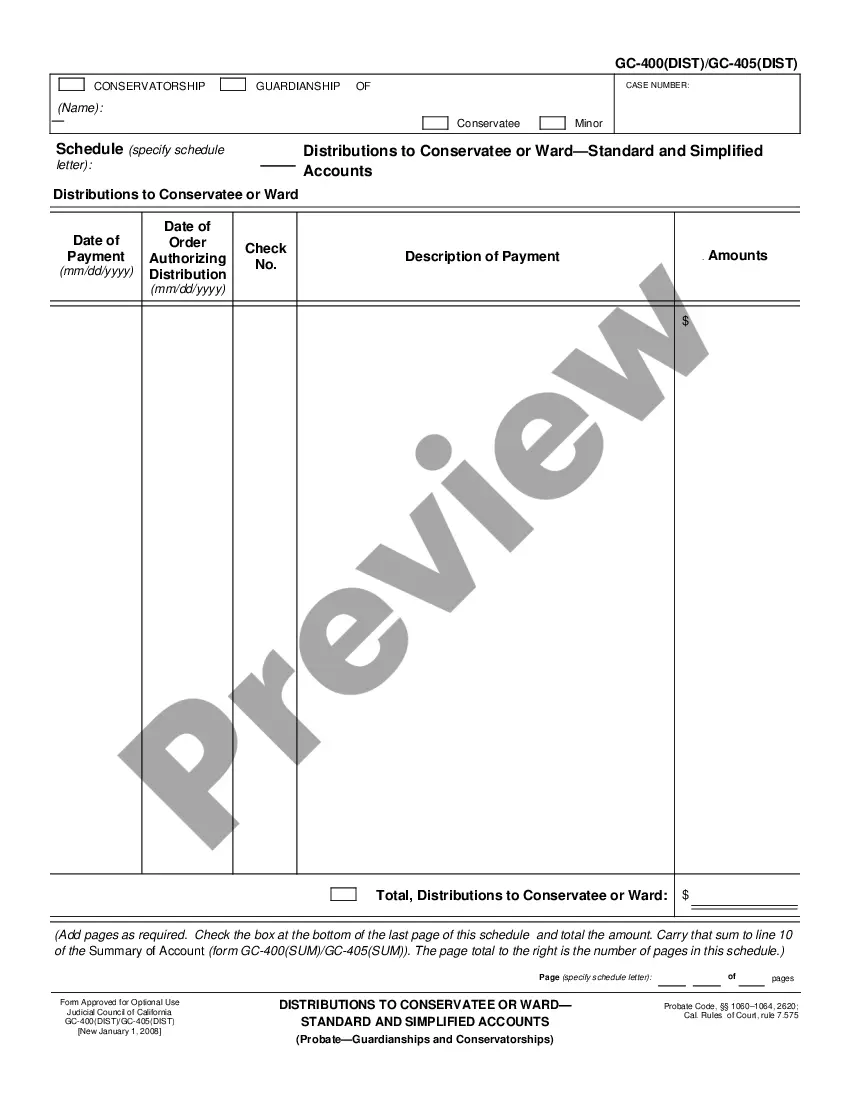

How to fill out Demand For Information From Limited Liability Company LLC By Member Regarding Financial Records, Etc.?

Choosing the right lawful document web template can be a have difficulties. Obviously, there are a variety of themes accessible on the Internet, but how will you discover the lawful kind you want? Use the US Legal Forms website. The assistance provides a large number of themes, including the Maine Demand for Information from Limited Liability Company LLC by Member regarding Financial Records, etc., which you can use for business and personal requirements. All the forms are checked out by professionals and meet up with federal and state requirements.

Should you be previously listed, log in to the accounts and click on the Download switch to obtain the Maine Demand for Information from Limited Liability Company LLC by Member regarding Financial Records, etc.. Use your accounts to search throughout the lawful forms you may have acquired in the past. Check out the My Forms tab of your own accounts and obtain one more version of the document you want.

Should you be a brand new end user of US Legal Forms, allow me to share basic recommendations that you should follow:

- Very first, make certain you have selected the appropriate kind for your personal area/state. You can check out the form utilizing the Review switch and read the form explanation to make sure it will be the right one for you.

- In the event the kind is not going to meet up with your requirements, utilize the Seach discipline to obtain the correct kind.

- When you are certain that the form is suitable, go through the Buy now switch to obtain the kind.

- Select the rates program you desire and type in the necessary info. Create your accounts and pay money for your order utilizing your PayPal accounts or Visa or Mastercard.

- Select the document structure and download the lawful document web template to the gadget.

- Total, edit and produce and sign the attained Maine Demand for Information from Limited Liability Company LLC by Member regarding Financial Records, etc..

US Legal Forms will be the largest collection of lawful forms that you can find numerous document themes. Use the company to download expertly-made documents that follow express requirements.

Form popularity

FAQ

A typical annual report for a public company must have the following sections: A letter from the CEO. Corporate financial data. Operations and impact. Market segment information. Plans for new products. Subsidiary activities. Research and development activities.

An annual report is required to be filed every year in order to maintain a good standing status. The legal filing deadline is June 1st. Annual Reports for the following entities can be filed online at Annual Reports Online.

Annual Report for Domestic and Foreign Corporations Every corporation authorized to transact business in the commonwealth MUST file an annual report with the Corporations Division within two and one half (2½) months after the close of the corporation's fiscal year end.

All Maine corporations, LLCs, nonprofits, LPs, and LLPs must file an annual report each year. These reports must be submitted to the Maine Secretary of State, Bureau of Corporations, Elections, & Commissions.

Yes. Unlike most states?in which an operating agreement is encouraged but not required?Maine's statutes clearly state that ?a limited liability company agreement must be entered into or otherwise existing? before an LLC can be formed. (A ?company agreement? is the same thing as an operating agreement.)

Most states require an annual report, also called a periodic report, statement of information, or annual registration. However, there are exceptions. For example, Arizona doesn't require an LLC annual report, and if you formed your company in Indiana, you only need to send the report every two years.

Maine requires that all registered businesses appoint a registered agent. Your business registration filing will be rejected by the Maine Division of Corporations if you do not appoint a registered agent.

It is signed by a person authorized to create the LLC. The cost is $175, and it takes up to 30 business days to process the form. Expedited processing is available for an additional fee.