Maine Self-Employed Part Time Employee Contract

Description

How to fill out Self-Employed Part Time Employee Contract?

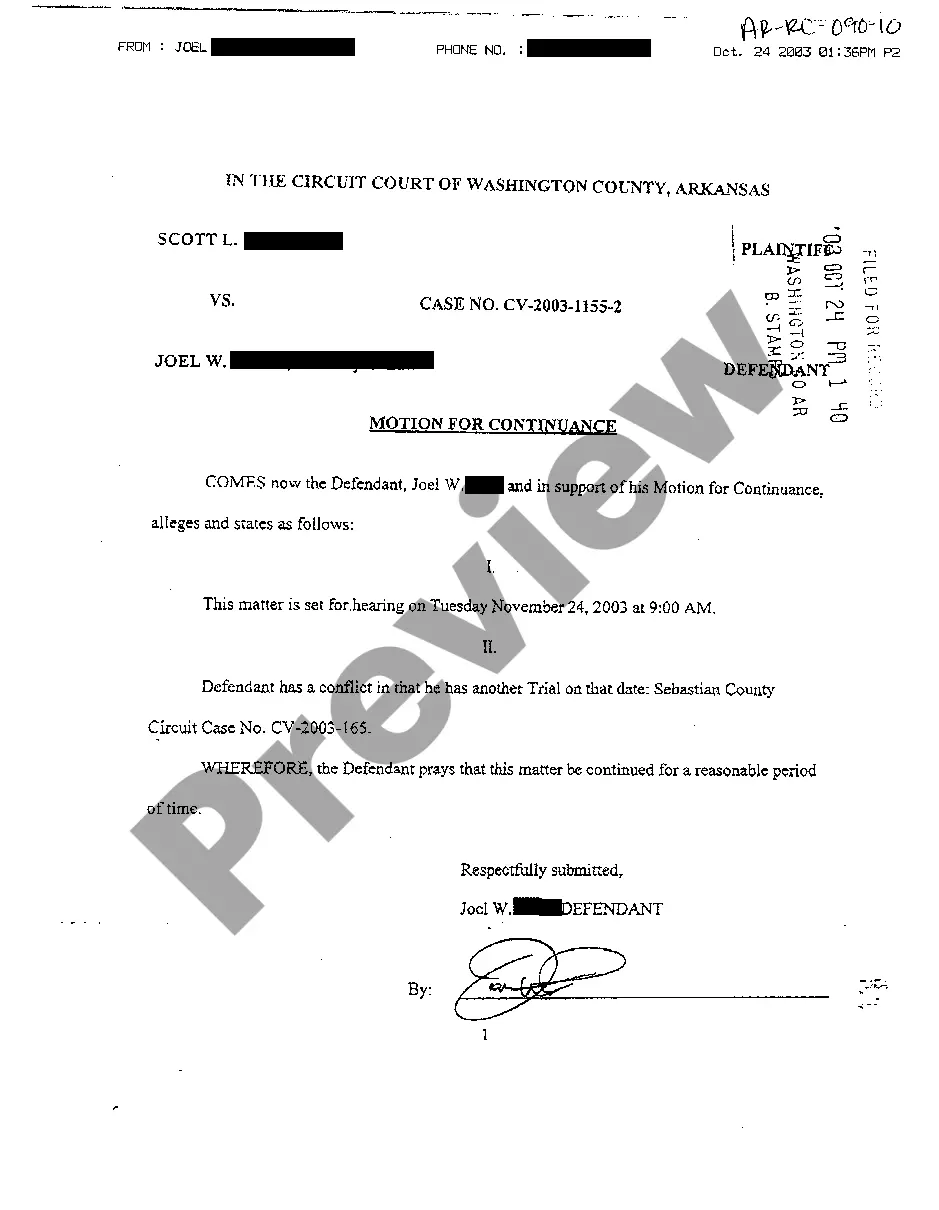

Selecting the correct sanctioned document template can be a challenge. Obviously, there are numerous templates accessible online, but how do you locate the sanctioned form you need? Visit the US Legal Forms website. The service offers thousands of templates, including the Maine Self-Employed Part Time Employee Agreement, that can be utilized for business and personal needs. All the forms are verified by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and hit the Acquire button to locate the Maine Self-Employed Part Time Employee Agreement. Use your account to browse the legal forms you have purchased previously. Check the My documents section of your account to obtain another copy of the document you require.

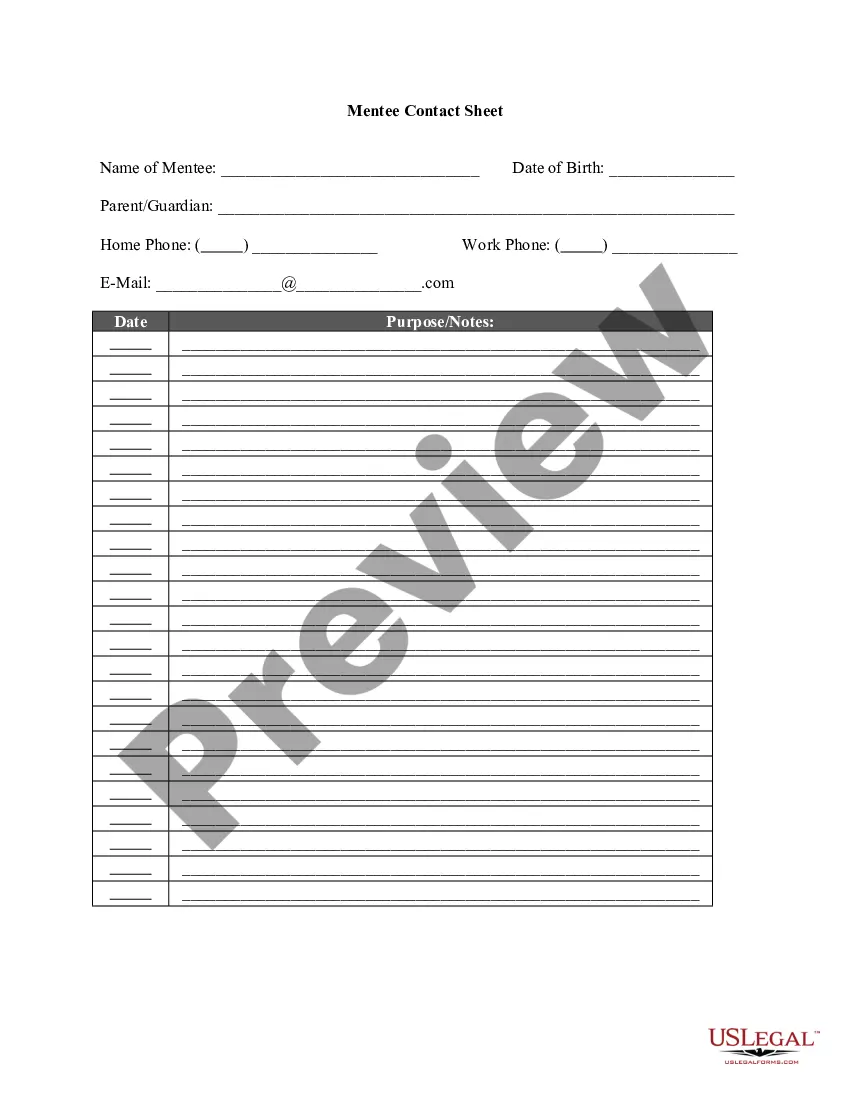

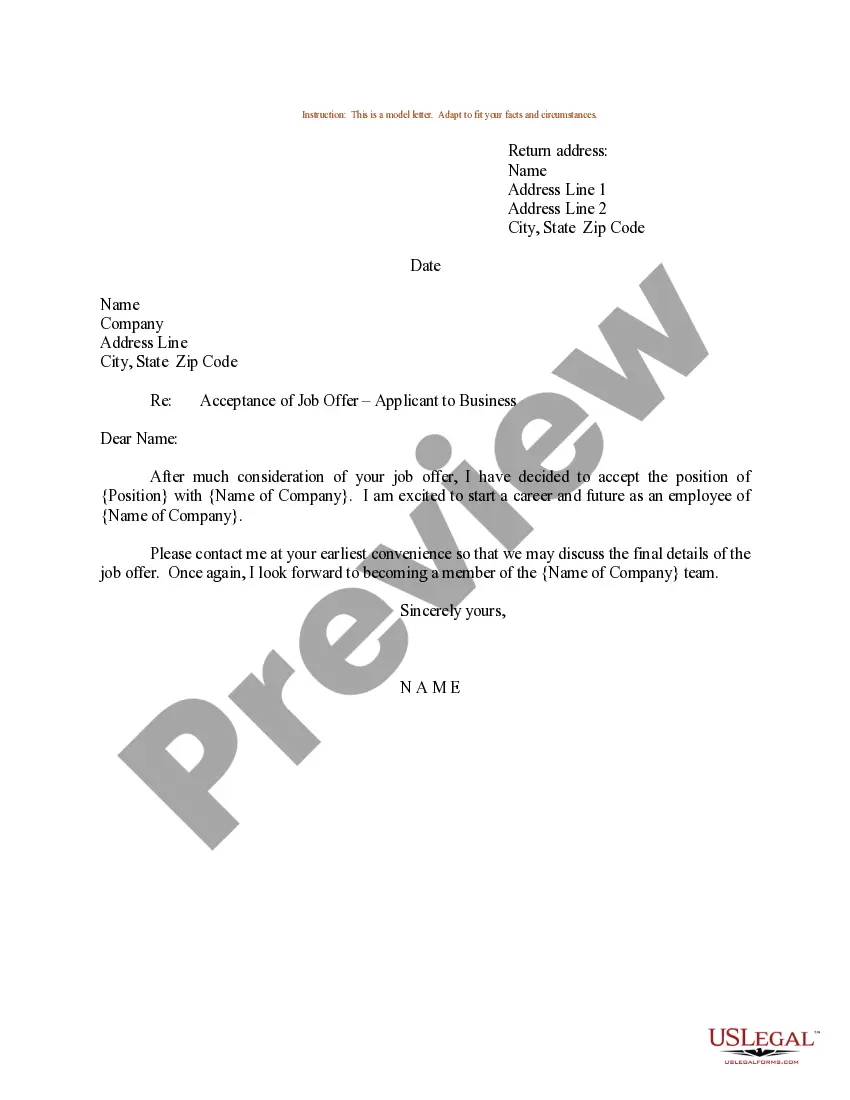

If you are a new user of US Legal Forms, here are straightforward instructions for you to follow: Initially, ensure you have selected the right form for your area/county. You can review the form using the Preview option and read the form details to confirm that it is indeed the right one for you.

US Legal Forms is the largest collection of legal forms where you can find various document templates. Use the service to download properly crafted documents that adhere to state regulations.

- If the form does not meet your needs, use the Search feature to find the appropriate form.

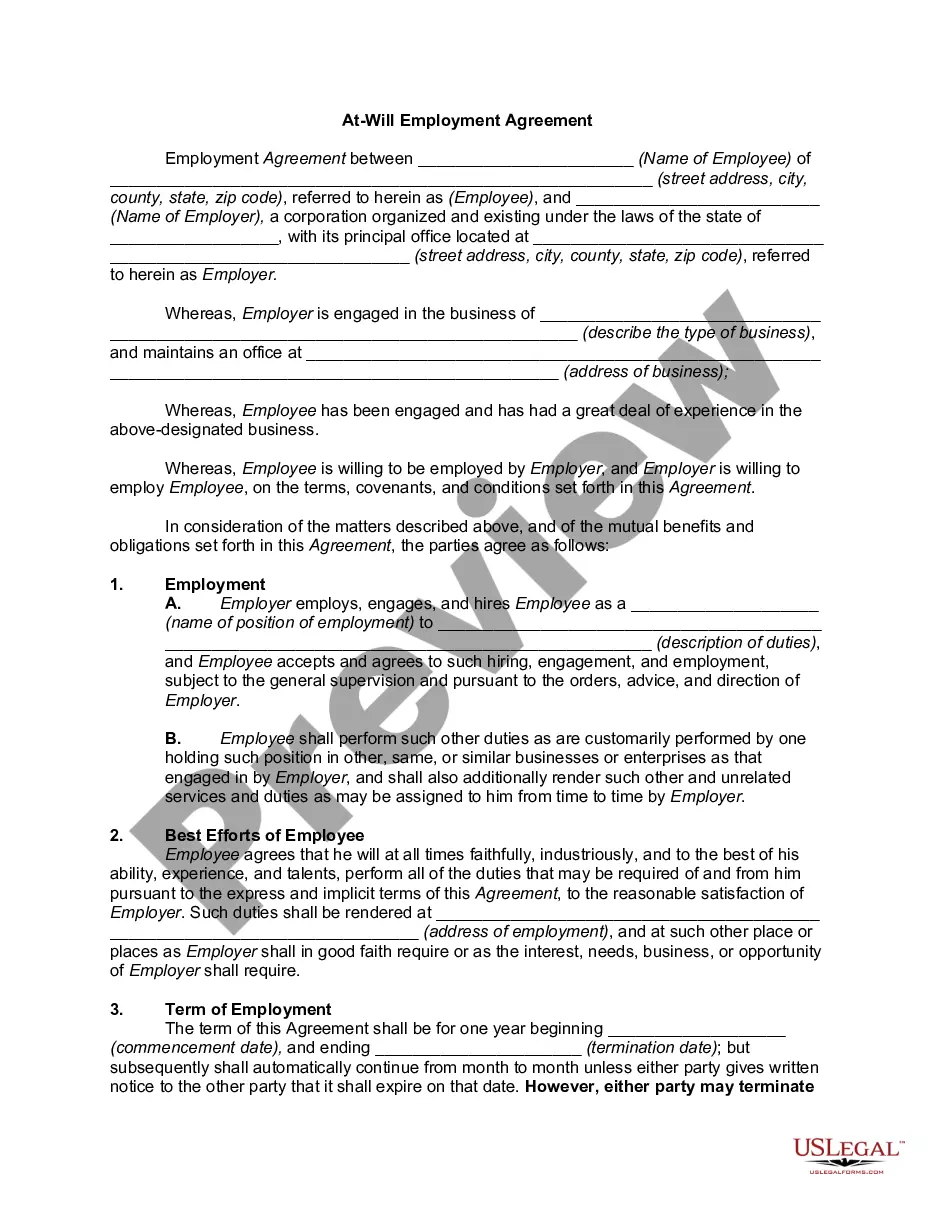

- Once you are sure that the form is suitable, click the Buy now button to purchase the form.

- Select the payment plan you want and enter the required information. Create your account and pay for the order using your PayPal account or credit card.

- Choose the file format and download the authorized document template to your device.

- Complete, edit, print, and sign the received Maine Self-Employed Part Time Employee Agreement.

Form popularity

FAQ

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Self-employed people earn a living by working for themselves, not as employees of someone else or as owners (shareholders) of a corporation.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

As a freelancer, you also have to manage invoicing and following up on payments. When you work as an independent contractor, you work on an hourly or project-based rate that may vary from client to client or job to job. If you work independently, you have control over setting and negotiating your rates.

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

Step 3: Last Employer Self-employed individuals may enter "self-employed" for the last employer's name and include his/her own address and contact information in lieu of the "last employer's address and contact information."

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Whatever you call yourself, if you are self-employed, an independent contractor, or a sole proprietor, a partner in a partnership, or an LLC member, you must pay self-employment taxes (Social Security and Medicare). Since you are not an employee, no Social Security/Medicare taxes are withheld from your wages.

Yes. Even part time staff must have a contract. The law applies if employees: Have a fixed employment period.