Maine Door Contractor Agreement - Self-Employed

Description

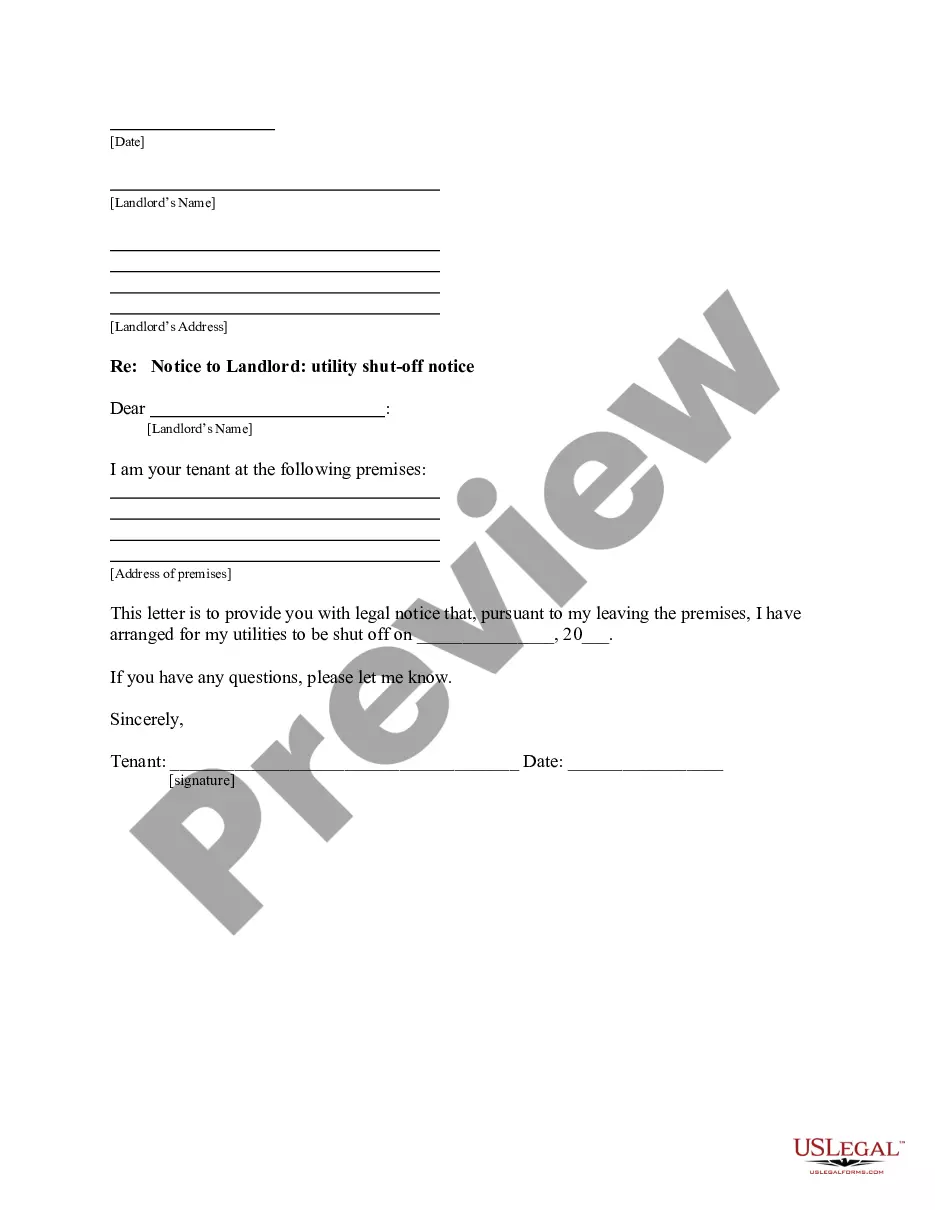

How to fill out Door Contractor Agreement - Self-Employed?

If you require to complete, obtain, or generate legal document templates, utilize US Legal Forms, the finest assortment of legal forms, that are accessible online.

Utilize the site`s straightforward and effective search to find the documents you seek.

Multiple templates for business and individual purposes are categorized by types and states, or keywords. Use US Legal Forms to acquire the Maine Door Contractor Agreement - Self-Employed in just a few steps.

- If you are already a US Legal Forms user, Log In to your profile and click the Acquire button to obtain the Maine Door Contractor Agreement - Self-Employed.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct area/state.

- Step 2. Utilize the Review option to examine the form`s content. Don’t forget to read the explanation.

- Step 3. If you are dissatisfied with the document, use the Search field at the top of the page to find alternative versions of the legal document template.

- Step 4. After identifying the form you desire, click the Purchase now button. Choose the payment plan you prefer and enter your information to register an account.

Form popularity

FAQ

To set up as a self-employed contractor, you first need to obtain the necessary licenses and permits required in your location. Next, consider creating a detailed business plan and opting for the Maine Door Contractor Agreement - Self-Employed to formalize your operations. This agreement can help clarify your responsibilities, payment terms, and project details, ensuring that both you and your clients are on the same page. Additionally, think about consulting with a financial advisor to manage your business effectively.

Yes, an independent contractor is generally considered self-employed. This status means they run their own business and are responsible for their own taxes and expenses. The Maine Door Contractor Agreement - Self-Employed can provide a clear outline of the terms and responsibilities in this arrangement. By using this agreement, you can ensure that all aspects of your business relationship are properly addressed.

When filling out an independent contractor form, begin by gathering basic information about the contractor and the work to be performed. Ensure that you include accurate dates, payment terms, and an outline of the responsibilities. This form should also indicate the nature of the contractor's business and any relevant tax information. For those looking for efficiency, a Maine Door Contractor Agreement - Self-Employed template can help streamline the required information.

Filling out an independent contractor agreement involves entering clear details about the project, including the contractor's name, address, and business details. Specify the services provided and the payment arrangement in detail. Make sure to review and add any special clauses that apply to your situation, like liability or indemnification statements. Using a Maine Door Contractor Agreement - Self-Employed template can guide you through this process effortlessly.

To write an independent contractor agreement, start by defining the scope of work, including specific tasks and deadlines. Clearly outline payment terms, such as rates and due dates. Additionally, include legal protections, like confidentiality clauses and termination conditions, to safeguard both parties. Utilizing a template for a Maine Door Contractor Agreement - Self-Employed can simplify this process, ensuring you cover all necessary aspects.

Both terms can be used interchangeably, but there are subtle differences. Saying 'self-employed' encompasses a broader range of independent work structures, while 'independent contractor' specifically refers to those providing services on a contract basis. When discussing a Maine Door Contractor Agreement - Self-Employed, using 'independent contractor' may clarify your role in specific discussions. Choose the term that best fits your context.

Yes, being a contractor qualifies you as self-employed. This applies whether you are providing services independently or under a Maine Door Contractor Agreement - Self-Employed. As a contractor, you manage your own work and client relationships, giving you the freedom and responsibility associated with self-employment. It's important to understand this status for tax purposes and legal protections.

Absolutely, self-employed individuals can and should have contracts. A Maine Door Contractor Agreement - Self-Employed sets clear expectations for both you and your clients, detailing aspects like payment schedules and project timelines. Contracts protect your interests and foster trust in professional relationships. Make sure your agreements are thorough to cover all essential points.

New rules for the self-employed often involve tax changes and eligibility for benefits. Under recent adjustments, self-employed individuals may have access to more structured funding options and support. Staying informed about updates related to the Maine Door Contractor Agreement - Self-Employed is crucial to ensure compliance and take advantage of available benefits. Regularly reviewing these updates helps you manage your business effectively.

Yes, independent contractors are considered self-employed. They operate their own businesses and provide services to clients without being tied to a single employer. When you work under a Maine Door Contractor Agreement - Self-Employed, your status as an independent contractor solidifies your self-employment. This distinction is essential for tax purposes and business operations.