This checklist is an outline of all matters considered and reviewed in by the due diligence team in the acquisition of a company.

Maine Checklist Due Diligence for Acquisition of a Company

Description

How to fill out Checklist Due Diligence For Acquisition Of A Company?

You can spend hours online trying to locate the legal document template that satisfies the federal and state requirements you need.

US Legal Forms offers a vast array of legal forms that are vetted by professionals.

You can easily obtain or print the Maine Checklist Due Diligence for Acquisition of a Company from our platform.

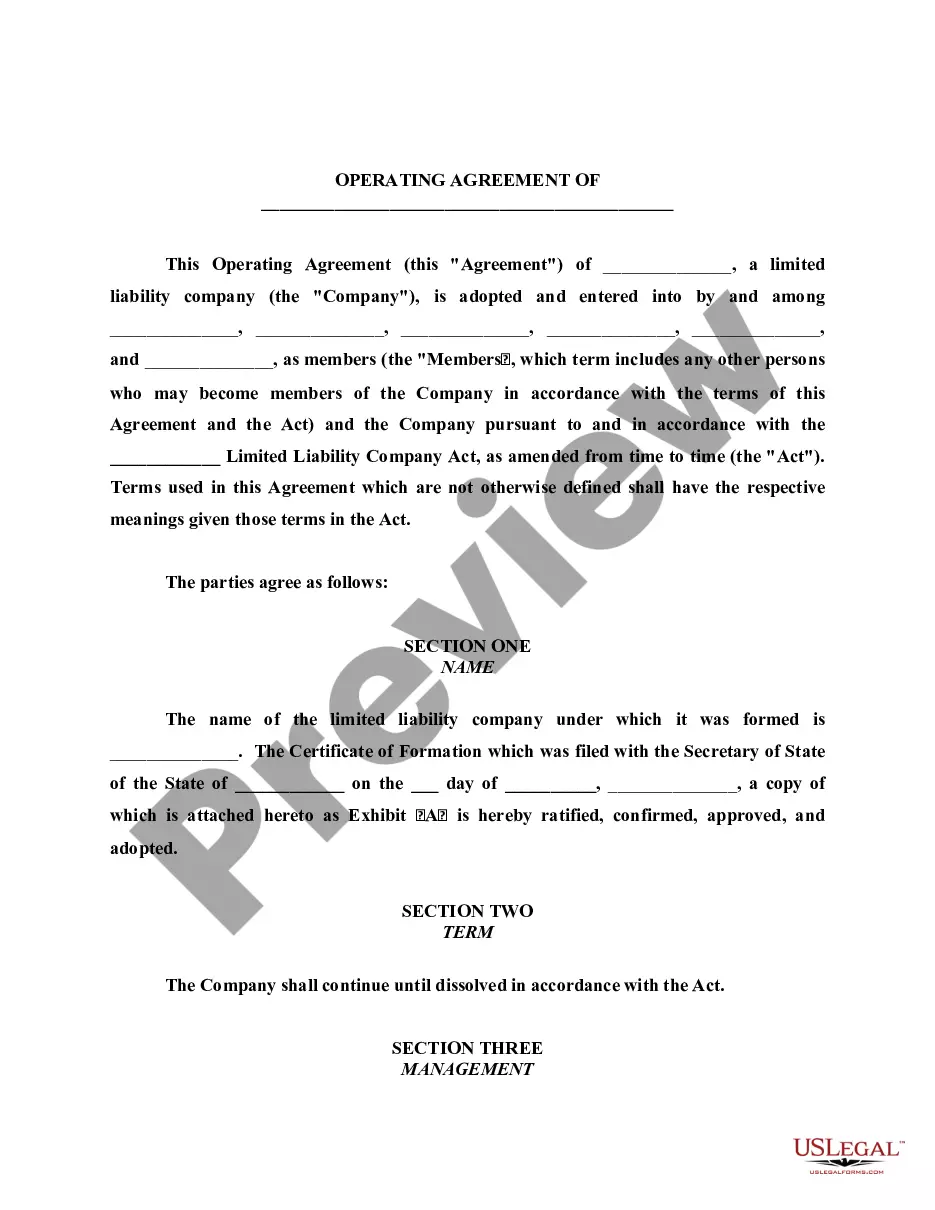

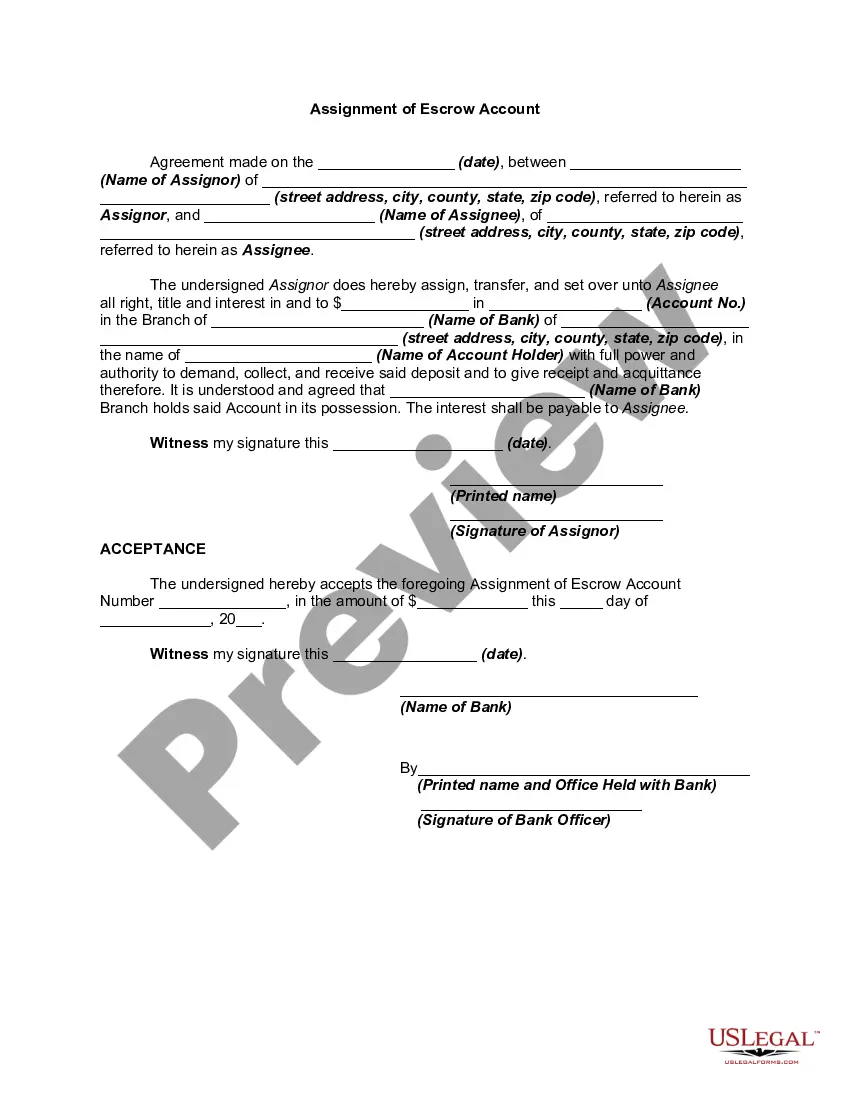

If available, utilize the Review button to view the document template simultaneously.

- If you have a US Legal Forms account, you can Log In and then click the Obtain button.

- After that, you can complete, modify, print, or sign the Maine Checklist Due Diligence for Acquisition of a Company.

- Every legal document template you acquire is yours permanently.

- To retrieve an additional copy of a purchased form, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple guidelines below.

- First, ensure that you have selected the correct document template for the state/area of your choice.

- Review the form description to confirm you have chosen the right form.

Form popularity

FAQ

The 4 P's of due diligence refer to People, Product, Processes, and Projections. Evaluating these elements helps buyers understand the management team, the product or service offerings, internal operational processes, and financial forecasts of the target company. Incorporating insights from a Maine Checklist Due Diligence for Acquisition of a Company enhances your examination of these critical areas.

Preparing a due diligence checklist starts with identifying key areas of concern related to the acquisition. Consider aspects like financial documents, employee agreements, and regulatory compliance. Utilizing a Maine Checklist Due Diligence for Acquisition of a Company can provide a robust framework, guiding you through the necessary items to include for a comprehensive review.

The due diligence process for acquisition involves a thorough investigation of the target company’s financials, operations, and legal obligations. This process aims to uncover any potential liabilities and assess the overall viability of the acquisition. Following a Maine Checklist Due Diligence for Acquisition of a Company helps ensure that you conduct an exhaustive assessment and make informed decisions.

An acquisition checklist is a detailed list of tasks and information that a buyer needs to review before purchasing a company. It serves as a roadmap to ensure comprehensive evaluation of key areas like financial performance, legal matters, and operational risks. A Maine Checklist Due Diligence for Acquisition of a Company can help streamline this process, making it easier to manage.

Yes, a buyer can back out after due diligence, provided they have valid reasons tied to the findings during this phase. If significant issues arise, such as undisclosed liabilities or discrepancies in financial statements, the buyer may choose to withdraw from the deal. Having a Maine Checklist Due Diligence for Acquisition of a Company can help identify these issues early.

Below, we take a closer look at the three elements that comprise human rights due diligence identify and assess, prevent and mitigate and account , quoting from the Guiding Principles.

A due diligence checklist is an organized way to analyze a company that you are acquiring through sale, merger, or another method. By following this checklist, you can learn about a company's assets, liabilities, contracts, benefits, and potential problems.

It's a process of verifying, investigating, and auditing a potential deal or investment opportunity to corroborate facts, financial information, and other pertinent data. People and organizations perform due diligence in many areas, including the sales of securities, IPOs, private equity funding, and real estate.

A tax due diligence requirements checklist includes property taxes, tax assets, audits, returns and any overseas activities. Target companies should provide extensive documentation on their tax history to prove their legality, legitimacy, and viability.

Documents Required During Company Due DiligenceMemorandum of Association.Articles of Association.Certificate of Incorporation.Shareholding Pattern.Financial Statements.Income Tax Returns.Bank Statements.Tax Registration Certificates.More items...