Maine Letter to Debt Collector - Only call me on the following days and times

Description

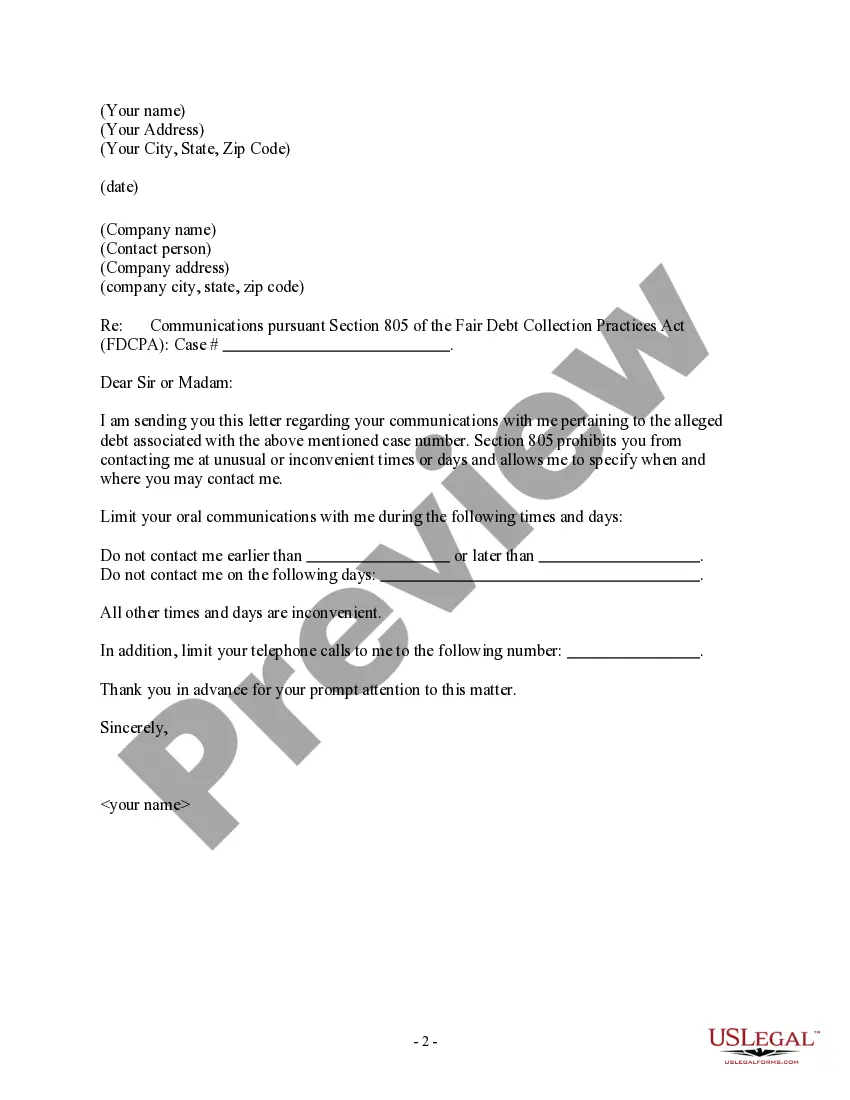

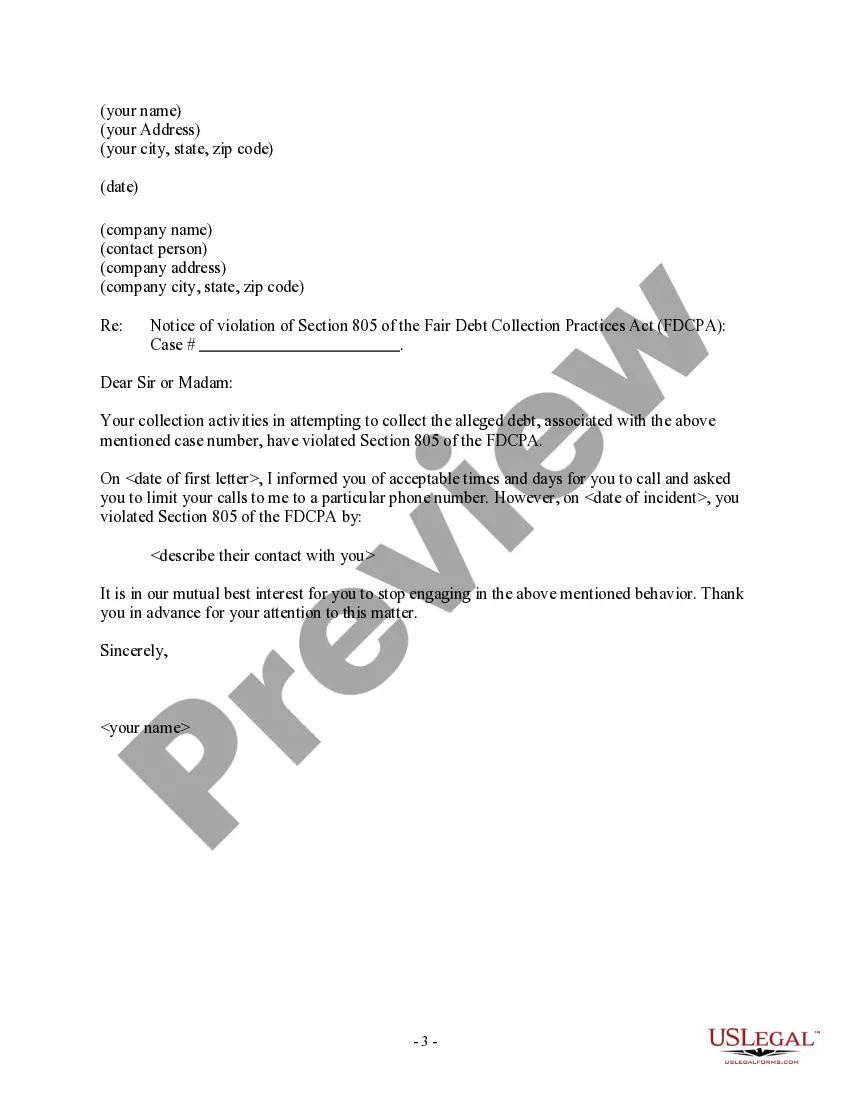

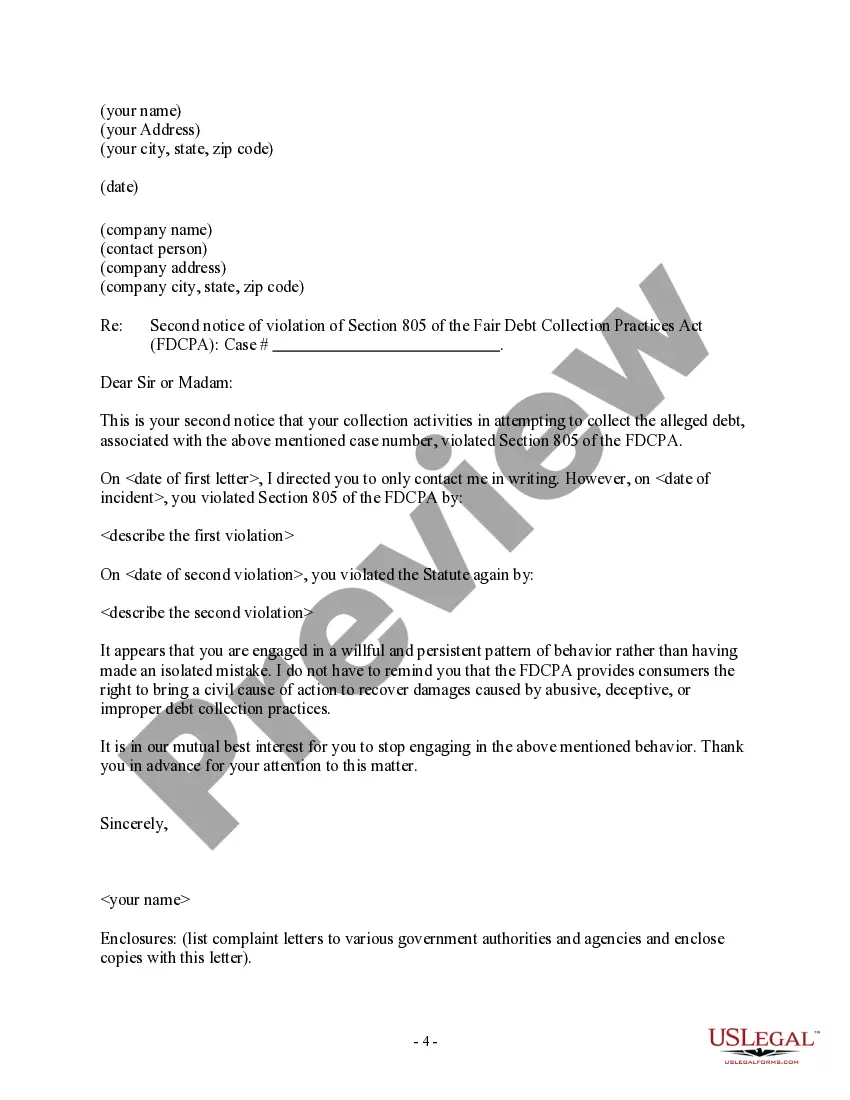

How to fill out Letter To Debt Collector - Only Call Me On The Following Days And Times?

Are you currently in a location where you require documents for possible business or personal usage nearly every day? There are numerous legal document templates available online, but locating ones you can rely on isn’t straightforward.

US Legal Forms provides thousands of template forms, including the Maine Letter to Debt Collector - Only contact me on the following days and times, which can be customized to comply with state and federal standards.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the Maine Letter to Debt Collector - Only contact me on the following days and times template.

- Obtain the document you require and confirm it's for the correct city/county.

- Use the Review option to assess the form.

- Examine the description to ensure you have selected the correct document.

- If the document isn’t what you’re looking for, utilize the Lookup field to find the form that suits your needs and requirements.

- If you find the suitable document, click on Get now.

- Choose the pricing plan you prefer, fill in the necessary details to create your account, and pay for the transaction using your PayPal or credit card.

- Select a convenient file format and download your copy.

Form popularity

FAQ

Don't be surprised if debt collectors slide into your DMs. A new rule allows debt collectors to contact you on social media, text or email not just by phone. The rule, which was approved last year by the Consumer Financial Protection Bureau's former president Kathleen L.

You may ask a debt collector to contact you only by mail, or through your attorney, or set other limitations. Make sure you send your request in writing, send it by certified mail with a return receipt, and keep a copy of the letter and receipt.

Under the Fair Credit Reporting Act, debts can appear on your credit report generally for seven years and in a few cases, longer than that. Under state laws, if you are sued about a debt, and the debt is too old, you may have a defense to the lawsuit.

The statute of limitations is a law that limits how long debt collectors can legally sue consumers for unpaid debt. The statute of limitations on debt varies by state and type of debt, ranging from three years to as long as 20 years.

Federal law doesn't give a specific limit on the number of calls a debt collector can place to you. A debt collector may not call you repeatedly or continuously intending to annoy, abuse, or harass you or others who share the number.

Even if the debt is yours, you still have the right not to talk to the debt collector and you can tell the debt collector to stop calling you. However, telling a debt collector to stop contacting you does not stop the debt collector or creditor from using other legal ways to collect the debt from you if you owe it.

3 Things You Should NEVER Say To A Debt CollectorAdditional Phone Numbers (other than what they already have)Email Addresses.Mailing Address (unless you intend on coming to a payment agreement)Employer or Past Employers.Family Information (ex.Bank Account Information.Credit Card Number.Social Security Number.

Yes, a debt collector can call on Sunday, unless you've told them that Sunday is inconvenient for you. If you tell them not to call on Sunday, and they do so anyway, then the call violates the Fair Debt Collection Practices Act.

In most cases, the statute of limitations for a debt will have passed after 10 years. This means a debt collector may still attempt to pursue it (and you technically do still owe it), but they can't typically take legal action against you.

While an account in collection can have a significant negative impact on your credit, it won't stay on your credit reports forever. Accounts in collection generally remain on your credit reports for seven years, plus 180 days from whenever the account first became past due.