Maine Plan of Liquidation

Description

How to fill out Plan Of Liquidation?

If you wish to complete, down load, or printing lawful file templates, use US Legal Forms, the greatest assortment of lawful varieties, that can be found on the Internet. Use the site`s simple and easy hassle-free search to discover the files you will need. A variety of templates for enterprise and personal reasons are sorted by types and says, or search phrases. Use US Legal Forms to discover the Maine Plan of Liquidation in a few click throughs.

Should you be presently a US Legal Forms client, log in in your bank account and click on the Acquire button to obtain the Maine Plan of Liquidation. You may also access varieties you in the past delivered electronically inside the My Forms tab of your bank account.

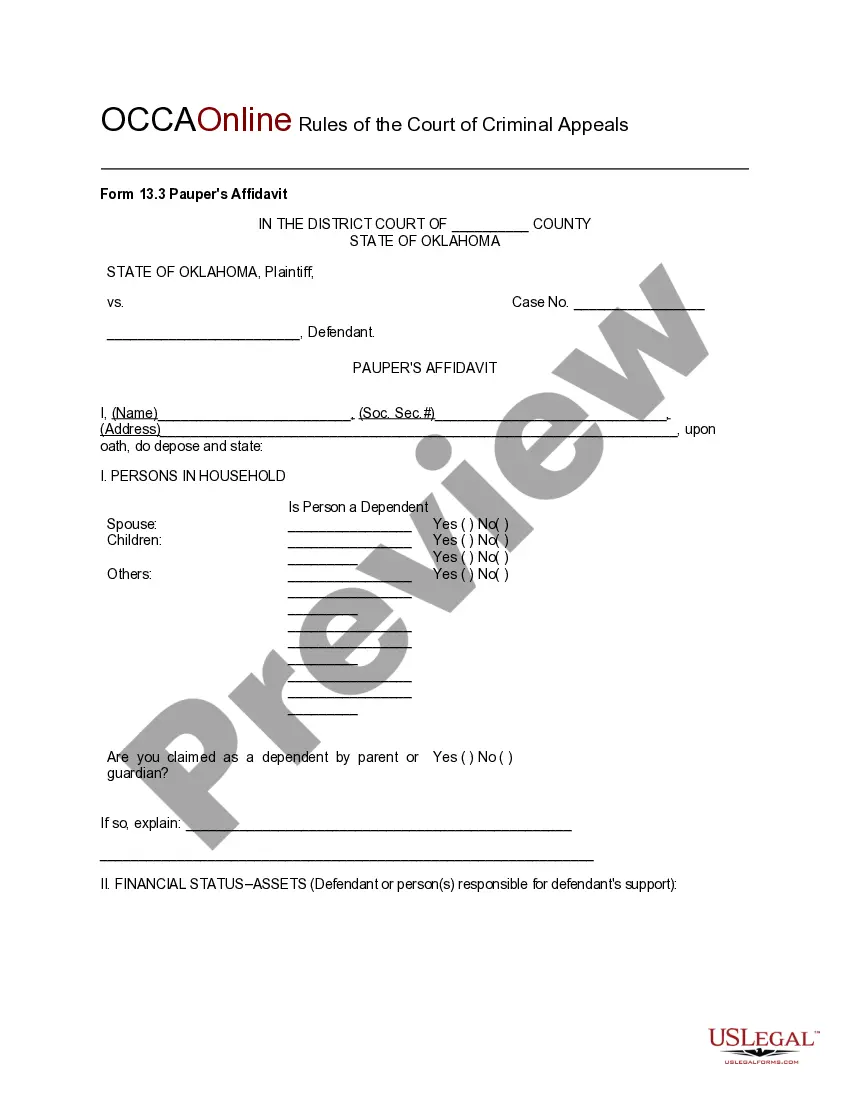

Should you use US Legal Forms initially, refer to the instructions listed below:

- Step 1. Be sure you have selected the form to the correct city/nation.

- Step 2. Utilize the Review option to look over the form`s information. Never forget to learn the description.

- Step 3. Should you be not satisfied with the kind, take advantage of the Research area near the top of the screen to get other types of the lawful kind format.

- Step 4. Once you have located the form you will need, click on the Get now button. Opt for the rates plan you favor and add your credentials to sign up for an bank account.

- Step 5. Process the transaction. You can use your Мisa or Ьastercard or PayPal bank account to perform the transaction.

- Step 6. Pick the formatting of the lawful kind and down load it on your own system.

- Step 7. Total, edit and printing or indicator the Maine Plan of Liquidation.

Every single lawful file format you get is your own forever. You have acces to each kind you delivered electronically within your acccount. Click the My Forms section and decide on a kind to printing or down load yet again.

Compete and down load, and printing the Maine Plan of Liquidation with US Legal Forms. There are many specialist and status-specific varieties you can use for your enterprise or personal requires.

Form popularity

FAQ

The liquidation of a company is when the company's assets are sold and the company ceases operations and is deregistered. The assets are sold to pay back various claimants, such as creditors and shareholders.

Liquidation Plan means with respect to any Company or any Fund, a plan of liquidation, a plan to dispose of a substantial portion of its assets out of the ordinary course of business (except in connection with a Permitted Merger) or any other plan of action with similar effect.

The purpose of liquidation is to ensure that all the company's affairs have been dealt with and all its assets realised. When this has been done, the liquidator will apply to have the company removed from the register at the Companies House and dissolved, which means it ceases to exist.

If a Maine LLC is administratively dissolved, it has to file all the annual reports and fees it missed before it can reinstate. The annual report fee for domestic LLCs is $85. There is also a $150 reinstatement penalty fee assessed for each year the LLC failed to file an annual report.