Maine Plan of Conversion from state stock savings bank to federal stock savings bank

Description

How to fill out Plan Of Conversion From State Stock Savings Bank To Federal Stock Savings Bank?

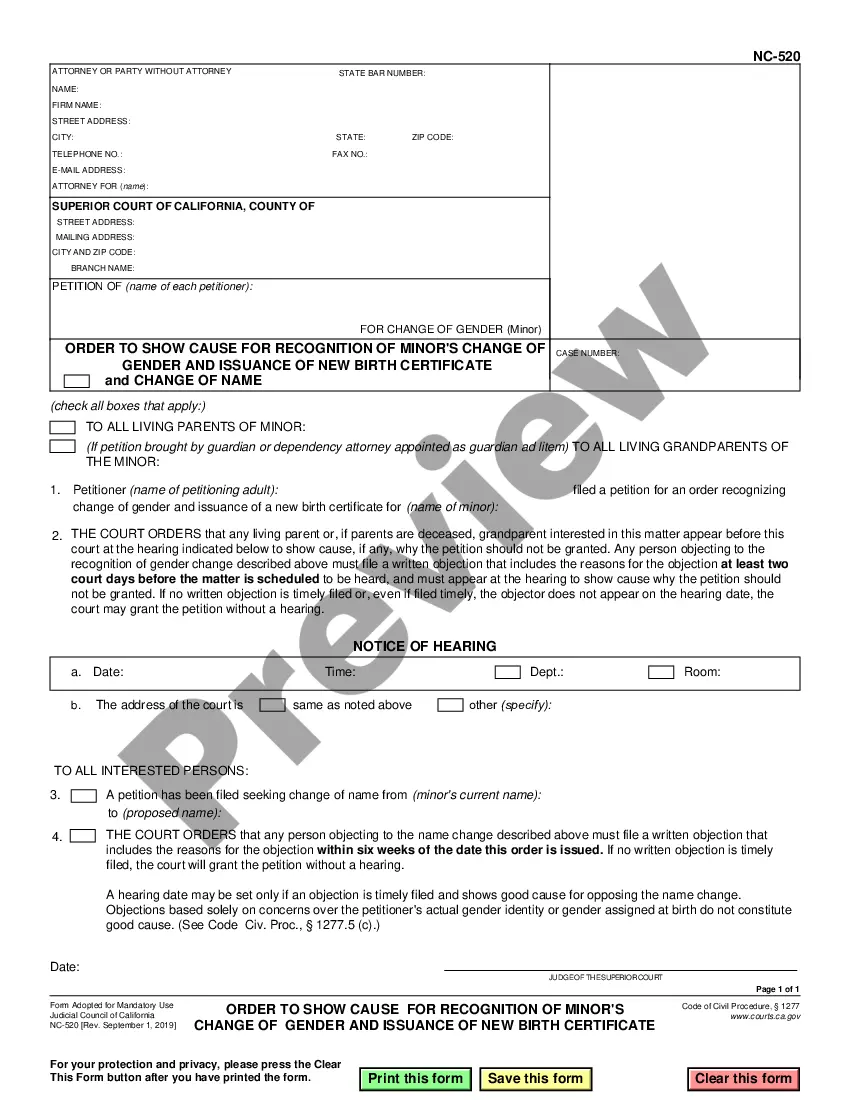

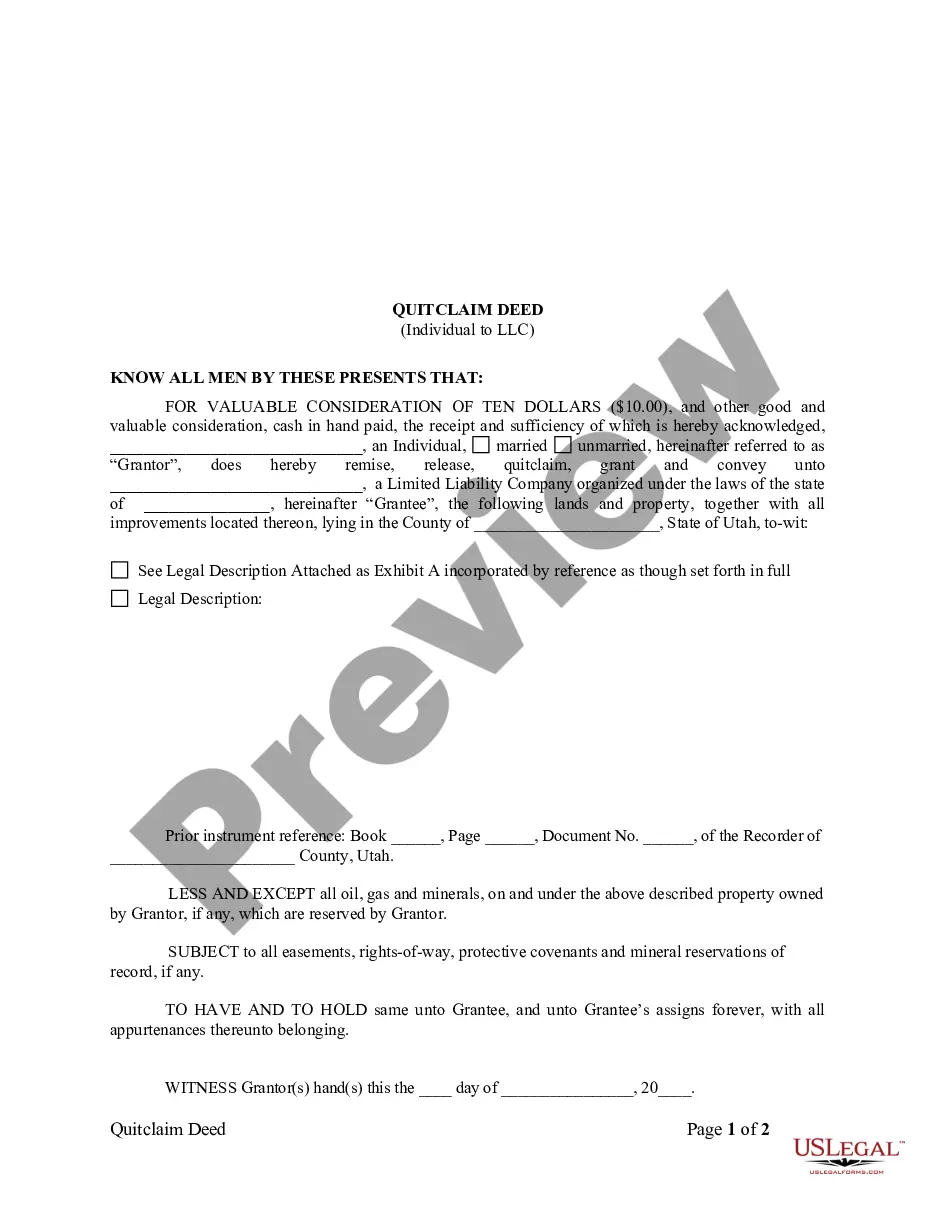

Choosing the best legal file template can be a struggle. Naturally, there are plenty of themes available on the Internet, but how will you find the legal type you require? Take advantage of the US Legal Forms site. The services offers a huge number of themes, like the Maine Plan of Conversion from state stock savings bank to federal stock savings bank, that you can use for enterprise and private requires. Every one of the kinds are checked by pros and satisfy federal and state needs.

In case you are currently signed up, log in to your profile and click on the Download option to get the Maine Plan of Conversion from state stock savings bank to federal stock savings bank. Make use of profile to check throughout the legal kinds you might have acquired formerly. Visit the My Forms tab of your own profile and obtain another version of your file you require.

In case you are a brand new end user of US Legal Forms, allow me to share simple guidelines so that you can adhere to:

- Initial, be sure you have selected the correct type to your city/state. You may check out the shape utilizing the Review option and study the shape explanation to ensure it is the right one for you.

- In the event the type will not satisfy your requirements, take advantage of the Seach area to discover the proper type.

- Once you are certain that the shape would work, go through the Purchase now option to get the type.

- Opt for the prices program you would like and enter the needed information and facts. Build your profile and pay money for an order using your PayPal profile or credit card.

- Pick the submit format and obtain the legal file template to your device.

- Comprehensive, modify and produce and signal the received Maine Plan of Conversion from state stock savings bank to federal stock savings bank.

US Legal Forms may be the biggest catalogue of legal kinds that you can see various file themes. Take advantage of the company to obtain appropriately-created paperwork that adhere to status needs.

Form popularity

FAQ

Bank Conversion means conversion of the Bank to the New Bank.

In a full demutualization, the mutual completely converts to a stock company, and passes on its own (newly issued) stock, cash, and/or policy credits to the members or policyholders. No attempt is made to preserve mutuality in any form.

Demutualization is a process by which a private, member-owned company, such as a co-op, or a mutual life insurance company, legally changes its structure, in order to become a public-traded company owned by shareholders.

A conversion merger is when a mutual institution simultaneously acquires a stock institution at the same time it completes a standard stock conversion. A mutual FSA may acquire another insured institution that is already in the stock form of ownership at the time of its stock conversion transaction.

Here's a very good post outlining the basics of a thrift conversion. Essentially, it's a small bank IPO without the selling shareholders, proceeds from the capital raise are tacked on to existing equity and all shareholders benefit; this leaves the post-conversion bank with significant excess capital to deploy.