Maine Checklist for Proving Entertainment Expenses

Description

How to fill out Checklist For Proving Entertainment Expenses?

Are you currently in a situation where you require documents for either business or personal needs nearly every day.

There are numerous legal document templates accessible online, but locating reliable ones can be challenging.

US Legal Forms provides a vast selection of document templates, including the Maine Checklist for Demonstrating Entertainment Expenses, designed to comply with federal and state regulations.

When you identify the appropriate document, click on Buy now.

Select your desired pricing plan, complete the necessary details to create your account, and process the payment using your PayPal or credit card. Choose a suitable file format and download your copy. Access all the document templates you have purchased from the My documents menu. You can download another copy of the Maine Checklist for Demonstrating Entertainment Expenses at any time, if necessary. Simply repeat the necessary process to download or print the template. Utilize US Legal Forms, an extensive collection of legal documents, to save time and eliminate errors. The service offers professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Afterward, you can download the Maine Checklist for Demonstrating Entertainment Expenses template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Obtain the document you need and confirm it is for the correct city/county.

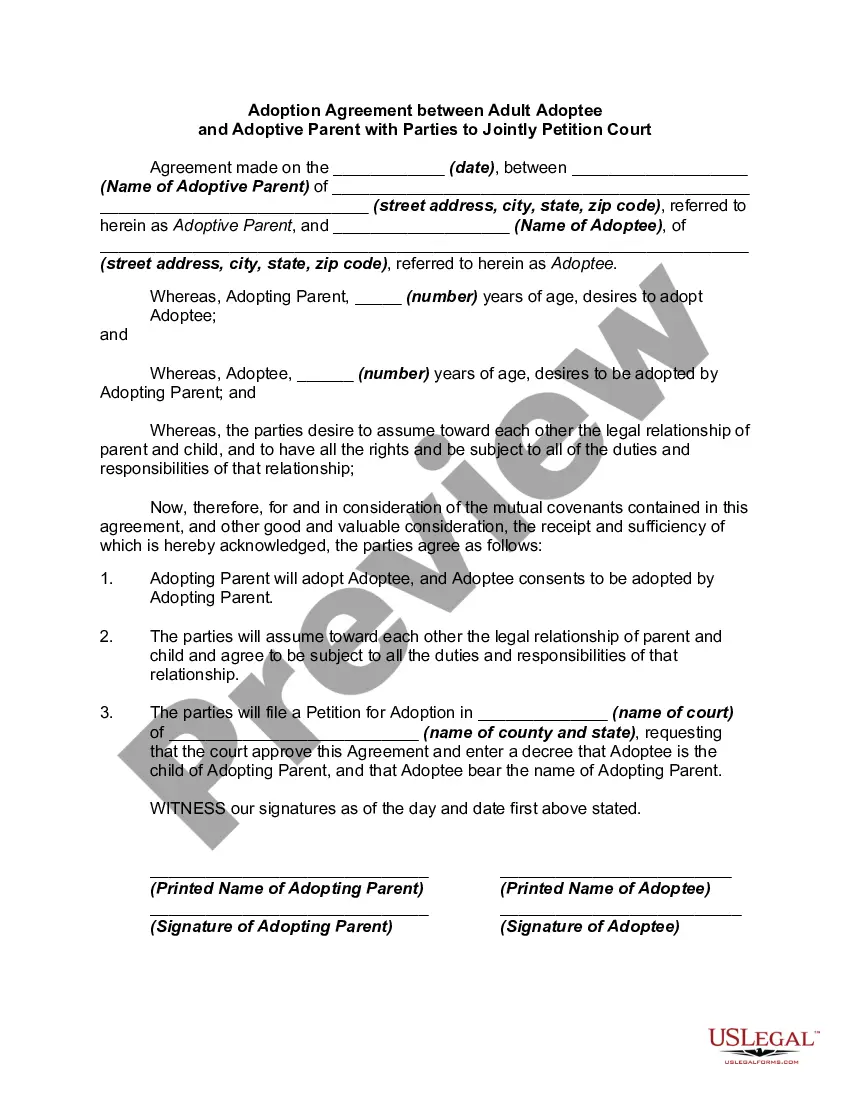

- Utilize the Review option to inspect the document.

- Check the summary to ensure you have selected the right document.

- If the document is not what you are looking for, use the Search field to find the document that meets your needs.

Form popularity

FAQ

2022 Meals And Entertainment Deductions ListBusiness meals with clients (50%)Office snacks and other food items (50%)The cost of meals while traveling for work (50%)Meals at a conference that go above the ticket price (50%)Lunch out with less than half of company employees (50%)More items...?

Entertainment expenses include the cost of entertaining customers or employees at social and sports events, restaurant meals and theater tickets, among other things. You may deduct business entertainment expenses subject to certain conditions.

Entertainment expenses, like a sporting event or tickets to a show, are still non-deductible. However, team-building activities for employees are deductible.

Entertaining clients (concert tickets, golf games, etc.) Wondering how this breaks down? If you're dining out with a client at a restaurant, you can consider that meal 100% tax-deductible. However, if you're entertaining that same client in-office with snacks purchased at a grocery store, the meal is 50% deductible.

Entertaining clients (concert tickets, golf games, etc.) Wondering how this breaks down? If you're dining out with a client at a restaurant, you can consider that meal 100% tax-deductible. However, if you're entertaining that same client in-office with snacks purchased at a grocery store, the meal is 50% deductible.

Entertainment expenses include the cost of meals you provide to customers or clients, whether the meal alone is the entertainment or it's a part of other entertainment (for example, refreshments at a football game). A meal expense includes the cost of food, beverages, taxes, and tips.

You can deduct 100% of the cost of entertainment you supply to the general public for charitable purposes. A building firm donates food to a Christmas party at a children's hospital. The expense is 100% deductible. Entertainment enjoyed or consumed outside New Zealand is 100% deductible.

Generally, the answer is that you can deduct ordinary and necessary expenses to entertain a customer or client if:Your expenses are of a type that qualifies as meals or entertainment.Your expenses bear the necessary relationship to your business activities.You keep adequate records and can substantiate the expenses.

Businesses will be permitted to fully deduct business meals that would normally be 50% deductible. Although this change will not affect your 2020 tax return, the savings will offer a 100% deduction in 2021 and 2022 for food and beverages provided by a restaurant.