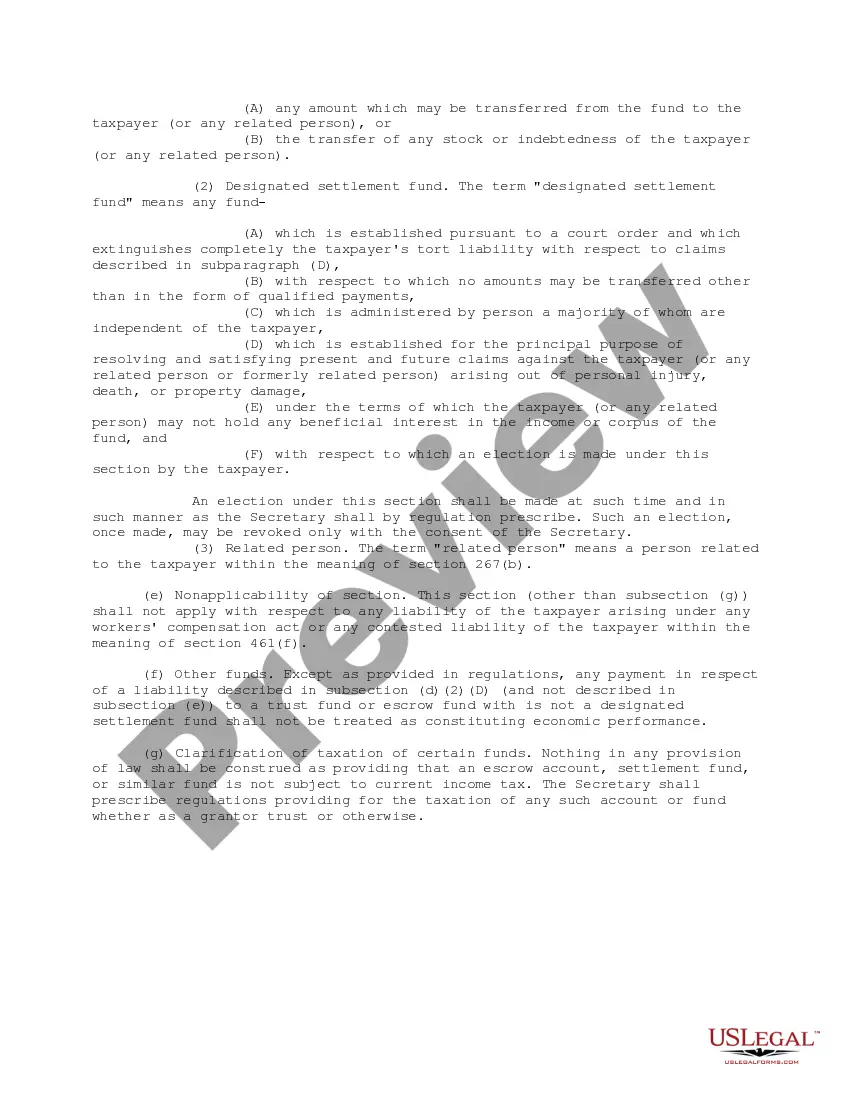

Statutory Guidelines [Appendix A(4) IRC 468B] regarding special rules for designated settlement funds.

Maine Special Rules for Designated Settlement Funds IRS Code 468B

Description

How to fill out Special Rules For Designated Settlement Funds IRS Code 468B?

If you want to complete, acquire, or print legal record layouts, use US Legal Forms, the most important variety of legal forms, which can be found on the web. Make use of the site`s basic and practical lookup to get the files you require. Various layouts for enterprise and personal uses are sorted by types and suggests, or key phrases. Use US Legal Forms to get the Maine Special Rules for Designated Settlement Funds IRS Code 468B within a few clicks.

When you are already a US Legal Forms buyer, log in in your profile and click on the Obtain option to get the Maine Special Rules for Designated Settlement Funds IRS Code 468B. You may also accessibility forms you earlier downloaded inside the My Forms tab of your respective profile.

If you are using US Legal Forms for the first time, follow the instructions under:

- Step 1. Ensure you have chosen the form to the correct town/region.

- Step 2. Make use of the Preview solution to look over the form`s content. Do not overlook to read the description.

- Step 3. When you are unsatisfied with the type, utilize the Search discipline on top of the screen to get other types from the legal type design.

- Step 4. Once you have located the form you require, click the Buy now option. Select the rates program you choose and include your qualifications to sign up for an profile.

- Step 5. Method the purchase. You can utilize your bank card or PayPal profile to finish the purchase.

- Step 6. Pick the file format from the legal type and acquire it in your system.

- Step 7. Complete, edit and print or signal the Maine Special Rules for Designated Settlement Funds IRS Code 468B.

Each legal record design you purchase is your own property permanently. You may have acces to every type you downloaded with your acccount. Select the My Forms portion and pick a type to print or acquire once more.

Be competitive and acquire, and print the Maine Special Rules for Designated Settlement Funds IRS Code 468B with US Legal Forms. There are many professional and condition-particular forms you can use for the enterprise or personal needs.

Form popularity

FAQ

A Qualified Settlement Fund (QSF) allows tax payers involved in litigation to receive settlement funds and potentially avoid tax ramifications until the funds are otherwise paid to the taxpayer. Often times a QSF is used in mass tort or other types of class action litigation.

Generally, settlement funds and damages received from a lawsuit are taxable income ing to the IRS. Nonetheless, personal injury settlements - specifically those resulting from car accidents or slip and fall incidents - are typically exempt from taxes.

A QSF is a trust established to receive settlement proceeds from a defendant or group of defendants. Its primary purpose is to allocate the monies deposited into it amongst various claimants and disburse the funds based upon agreement of the parties or court order, if required.

A Qualified Settlement Fund (QSF), also referred to as a 468B Trust, is an exceptionally useful settlement tool that allows time to properly resolve mass tort litigation and other cases involving multiple claimants.