Maine Exemption Statement

Description

How to fill out Exemption Statement?

Have you been in the placement that you need paperwork for both organization or person reasons nearly every day? There are tons of lawful document layouts available on the net, but finding types you can rely on isn`t simple. US Legal Forms provides a huge number of develop layouts, such as the Maine Exemption Statement - Texas, which can be written to satisfy federal and state demands.

Should you be already familiar with US Legal Forms site and have a merchant account, merely log in. Following that, it is possible to download the Maine Exemption Statement - Texas format.

If you do not come with an profile and would like to start using US Legal Forms, adopt these measures:

- Discover the develop you want and make sure it is to the appropriate town/region.

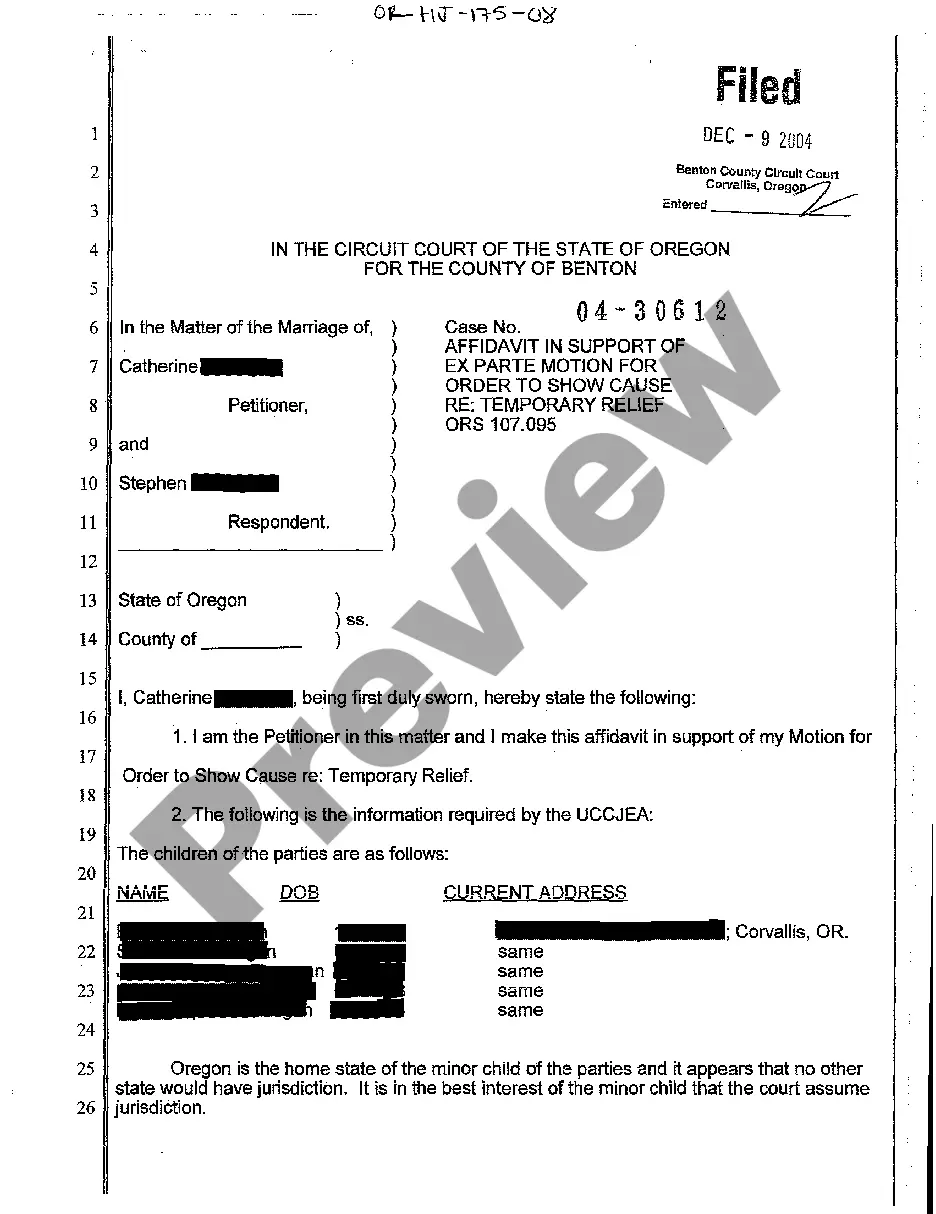

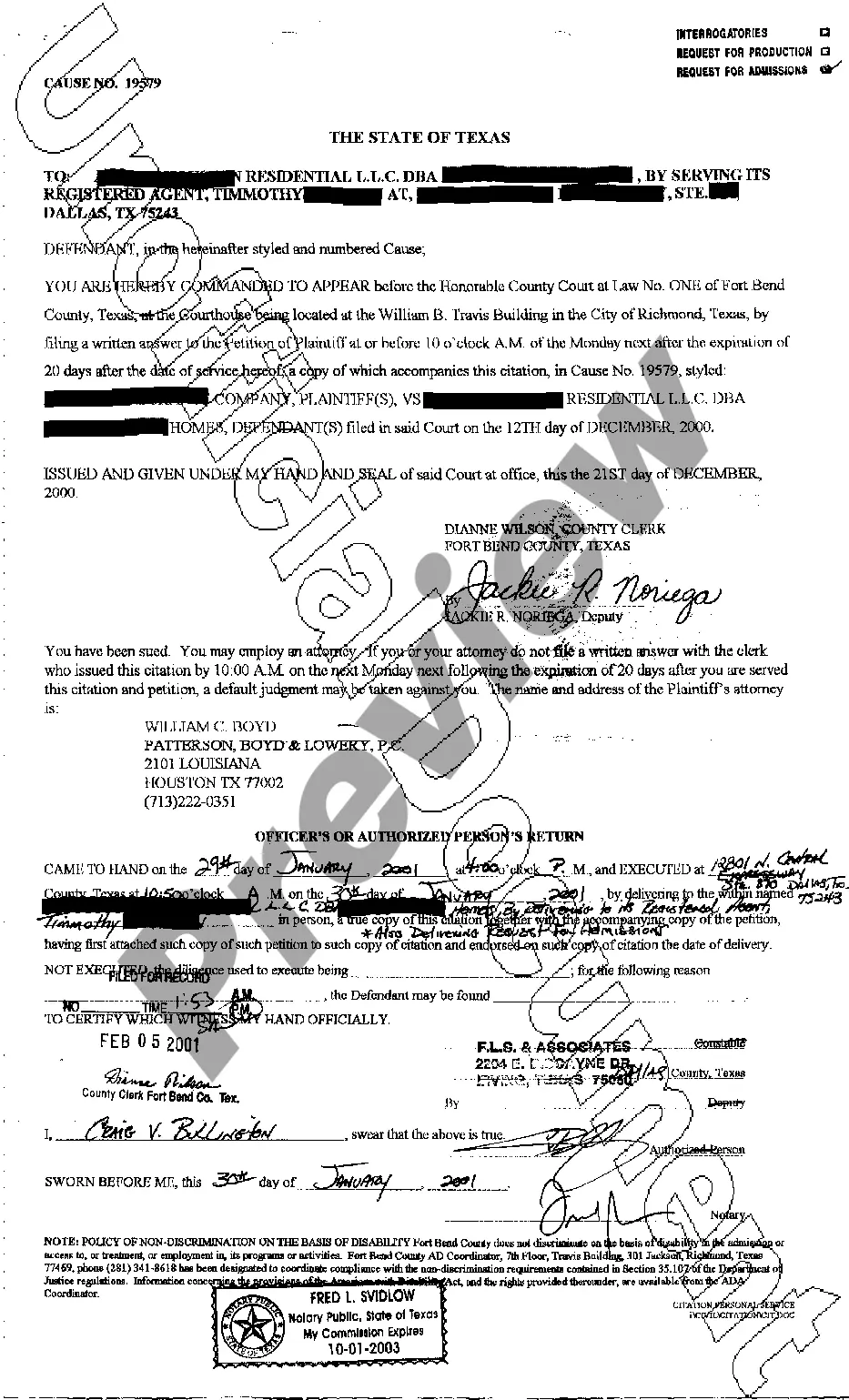

- Utilize the Review key to review the shape.

- Look at the outline to actually have selected the proper develop.

- In the event the develop isn`t what you`re seeking, make use of the Look for field to find the develop that meets your needs and demands.

- When you discover the appropriate develop, just click Acquire now.

- Choose the costs prepare you would like, submit the desired information to create your account, and buy an order utilizing your PayPal or Visa or Mastercard.

- Choose a convenient document formatting and download your backup.

Discover each of the document layouts you possess purchased in the My Forms menu. You may get a more backup of Maine Exemption Statement - Texas whenever, if necessary. Just select the essential develop to download or printing the document format.

Use US Legal Forms, probably the most considerable assortment of lawful kinds, in order to save efforts and steer clear of faults. The service provides expertly manufactured lawful document layouts that can be used for a selection of reasons. Generate a merchant account on US Legal Forms and start generating your daily life easier.

Form popularity

FAQ

About the Maine Homestead Exemption Program This is the largest tax cut for Maine homeowners in history. Residents who have owned a home in Maine for the past 12 months qualify. The application is quick and easy but you must act swiftly. Apply once and you probably will not have to apply again unless you move.

You can apply for a Maine Sales Tax Exemption in the Maine Tax Portal by clicking here, navigate to the Business panel, and selecting the Exemptions link. If you are unable to apply using the Maine Tax Portal, you can click on the application number next to the type of organization to download an application form.

An exemption certificate must show: (1) the name and address of the purchaser; (2) a description of the item to be purchased; (3) the reason the purchase is exempt from tax; (4) the signature of the purchaser and the date; and. (5) the name and address of the seller.

Resale Certificates expire on December 31st. A Resale Certificate issued before October 1st is valid for the remainder of that calendar year and the following three calendar years. A Resale Certicate issued after October 1st is valid for the remainder of that calendar year and the following four calendar years.

You can apply for a Maine Sales Tax Exemption in the Maine Tax Portal by clicking here, navigate to the Business panel, and selecting the Exemptions link. If you are unable to apply using the Maine Tax Portal, you can click on the application number next to the type of organization to download an application form.

The 2022 Maine personal exemption amount is $4,450 and the Maine basic standard deduction amounts are $12,950* for single and $25,900* for married individuals filing joint returns.

To qualify for a resale certificate, a retailer must have an active account and report gross sales of $3,000 or more per year. MRS reviews all active sales tax accounts that do not have an active resale certificate each year. Resale certificates are automatically issued to retailers that qualify.

Make sure you get your federal tax ID number before applying for a Maine state tax ID. When you're ready, make use of our Maine state tax ID number obtainment services. Answer a few questions about your business using our online form, and you'll receive your state tax ID in just 4 to 6 weeks.