Maine Revocable Trust for Lifetime Benefit of Trustor, Lifetime Benefit of Surviving Spouse after Trustor's Death with Trusts for Children

Description

How to fill out Revocable Trust For Lifetime Benefit Of Trustor, Lifetime Benefit Of Surviving Spouse After Trustor's Death With Trusts For Children?

It is feasible to spend hours online looking for the legal document template that matches the federal and state requirements you need.

US Legal Forms offers an extensive variety of legal templates that can be reviewed by experts.

You can easily download or print the Maine Revocable Trust for Lifetime Benefit of Trustor, Lifetime Benefit of Surviving Spouse after Trustor's Death along with Trusts for Children from your services.

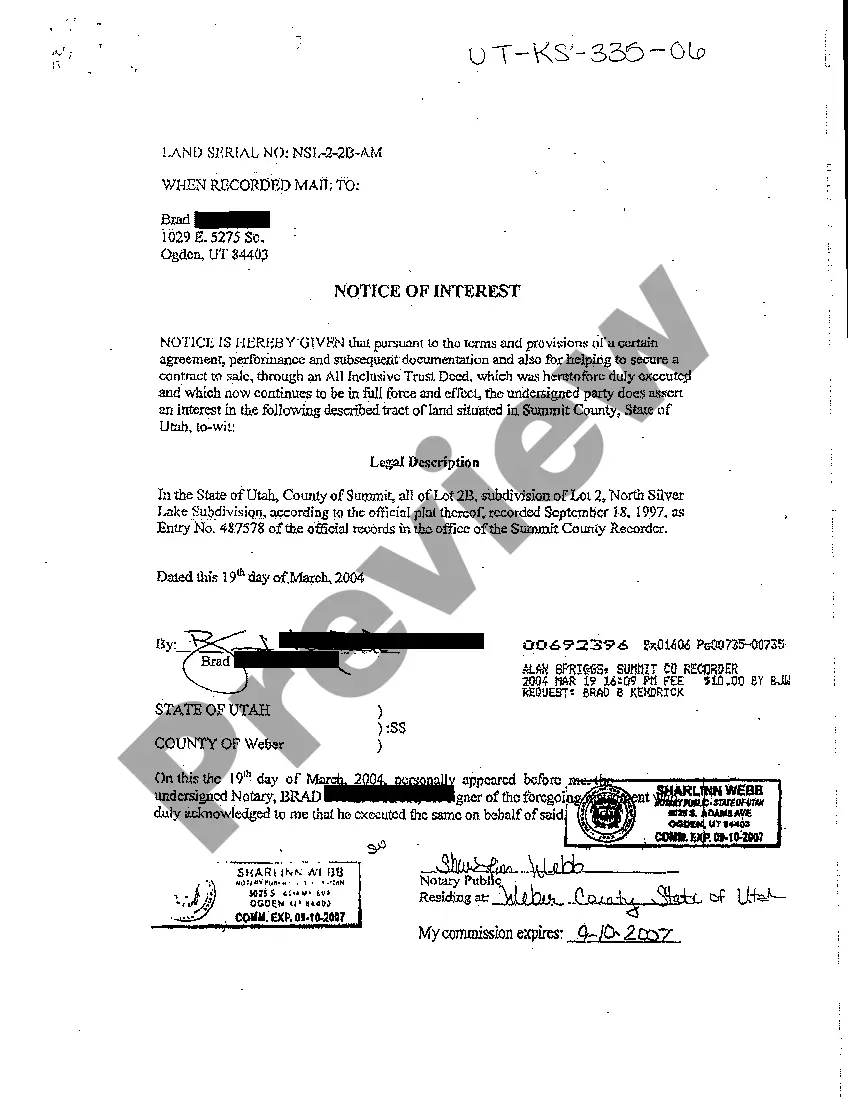

Review the document description to confirm you have chosen the right one. If available, use the Preview button to view the document template simultaneously.

- If you already possess a US Legal Forms account, you can Log In and click on the Download button.

- Afterward, you can fill out, modify, print, or sign the Maine Revocable Trust for Lifetime Benefit of Trustor, Lifetime Benefit of Surviving Spouse after Trustor's Death with Trusts for Children.

- Each legal document template you purchase is yours for an extended period.

- To obtain another copy of any downloaded form, navigate to the My documents tab and click the corresponding button.

- If you are accessing the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the county/city of your choice.

Form popularity

FAQ

Living trusts allow you to enjoy the benefits of your assets while you're alive and pass them automatically to your chosen beneficiaries once you're gone.

What happens in this type of trust is that the trust is a joint revocable trust when both spouses are alive. When one of the spouses dies, the trust will then split into two trusts automatically. Each trust will have half the assets of the trust along with the separate property of the spouse.

The Pros and Cons of Revocable Living TrustsProbate can be avoided.Ancillary probate in another state can also be avoided.Protection in case of incapacitation.No immediate tax benefits.No asset protection.It requires some administrative work.More items...

After one spouse dies, the surviving spouse is free to amend the terms of the trust document that deal with his or her property, but can't change the parts that determine what happens to the deceased spouse's trust property. You can make a valid living trust online, quickly and easily, with Nolo's Online Living Trust.

Under typical circumstances, the surviving spouse would become the sole trustee after the death of one spouse. The surviving spouse would control the shared property, and the personal property of the deceased spouse would be distributed to the beneficiaries.

A living trust does not protect your assets from a lawsuit. Living trusts are revocable, meaning you remain in control of the assets and you are the legal owner until your death. Because you legally still own these assets, someone who wins a verdict against you can likely gain access to these assets.

200dThe bottom line is that if you are using revocable living trusts as an estate tax planning vehicle, the trust should be listed as the primary beneficiary of your life insurance policy as opposed to your spouse.

The main benefit of a living trust over a will is that property held in living trusts don't go through probate. This can be very important if you live in a state like California, where probate is particularly lengthy and expensive. In this case, a living trust can save your estate a significant amount.

No Asset Protection A revocable living trust does not protect assets from the reach of creditors. Administrative Work is Needed It takes time and effort to re-title all your assets from individual ownership over to a trust. All assets that are not formally transferred to the trust will have to go through probate.

A revocable living trust becomes irrevocable once the sole grantor or dies or becomes mentally incapacitated. If you have a joint trust for you and your spouse, then a portion of the joint trust can become irrevocable when the first spouse dies and will become irrevocable when the last spouse dies.