Unless limited or prohibited by the articles or bylaws, action required or permitted by the RNPCA to be approved by the members may be approved without a meeting of members if the action is approved by members holding at least eighty percent (80%) of the voting power. The action must be evidenced by one or more consents in the form of a record bearing the date of signature and describing the action taken, signed by those members representing at least eighty percent (80%) of the voting power, and delivered to the corporation for inclusion in the minutes or filing with the corporate records.

Maine Consent to Action by the Board of Trustees of a Non-Profit Church Corporation in Lieu of Meeting

Description

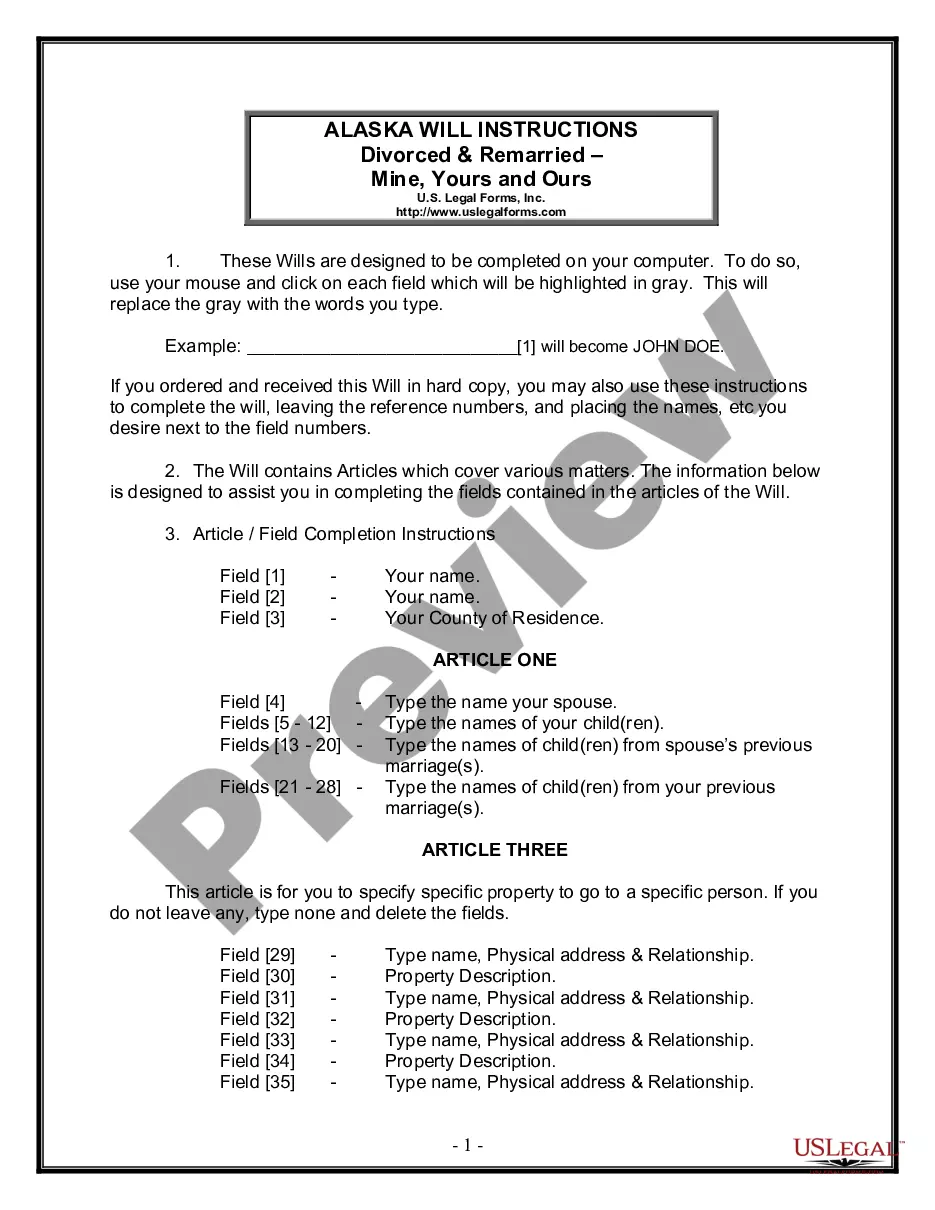

How to fill out Consent To Action By The Board Of Trustees Of A Non-Profit Church Corporation In Lieu Of Meeting?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal template options that you can acquire or create.

By using the site, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords.

You can find the latest versions of forms such as the Maine Consent to Action by the Board of Trustees of a Non-Profit Church Corporation in Lieu of Meeting in moments.

Check the form details to confirm you have chosen the appropriate document.

If the form does not meet your requirements, utilize the Search box at the top of the screen to locate the one that does.

- If you already have a monthly subscription, Log In and retrieve Maine Consent to Action by the Board of Trustees of a Non-Profit Church Corporation in Lieu of Meeting from the US Legal Forms library.

- The Download button will appear on each form you view.

- You can access all previously acquired forms from the My documents section of your account.

- If you are new to US Legal Forms, here are simple instructions to get started.

- Ensure you have selected the correct form for your region/area.

- Click the Preview button to review the form's content.

Form popularity

FAQ

Churches and ministries are formed as non-profit corporations. Unlike for-profit corporations, non-profit corporations have no owners / shareholders and do not issues shares. They are not C Corporations or Subchapter S Corporations, although the C Corporation designation is sometimes used to describe them.

The Top 10 Legal Risks Facing Nonprofit BoardsExposures from social media use, misuse and naivete.Unhappy staff and volunteers.IRS Form 990 and federal tax-exempt status.Copyrights and trademarks.Lobbying and political activity compliance.Third-party sexual harassment.More items...

Your board of directors is the primary decision maker for your nonprofit and is responsible for overseeing its management. As a result, your board should approve any decision involving significant financial, legal, or tax issues, or any major program-related matter.

Nonprofit Financial ReportingNot only can a charity sell its assets, but it also must put into place adequate procedures to record the sales and publish accurate financial reports. This publication must conform to generally accepted government accounting standards.

A church's nonprofit articles should typically classify it as a membership-based nonprofit corporation and not the type of nonprofit corporation that requires a board of directors.

A conflict of interest occurs when a director, officer, key employee, or other person in a position to influence the nonprofit (an insider) may benefit personally in some way from a transaction or relationship with the nonprofit organization that he or she serves.

Nonprofit organizations should review their bylaws at least every two years to ensure that the information they're putting on IRS Form 990 is accurate.

The short answer is that the Board of Directors generally does not have the power to vote to suspend a provision in the Bylaws apart from the formal Bylaws amendment process (although you should check the applicable state nonprofit corporation statute to be sure).

Even a very small church can face risks. Any time a group gathers for a lawful purpose the law treats it as an unincorporated association, a kind of legal entity. As a nonprofit association, a church can be sued as an organization even if no other formal steps have been taken to organize it.

Yes. An organization can suspend its operations for a short period without losing its 501(c)(3) status.