Maine Assessing the Primary Activities in the Value Chain

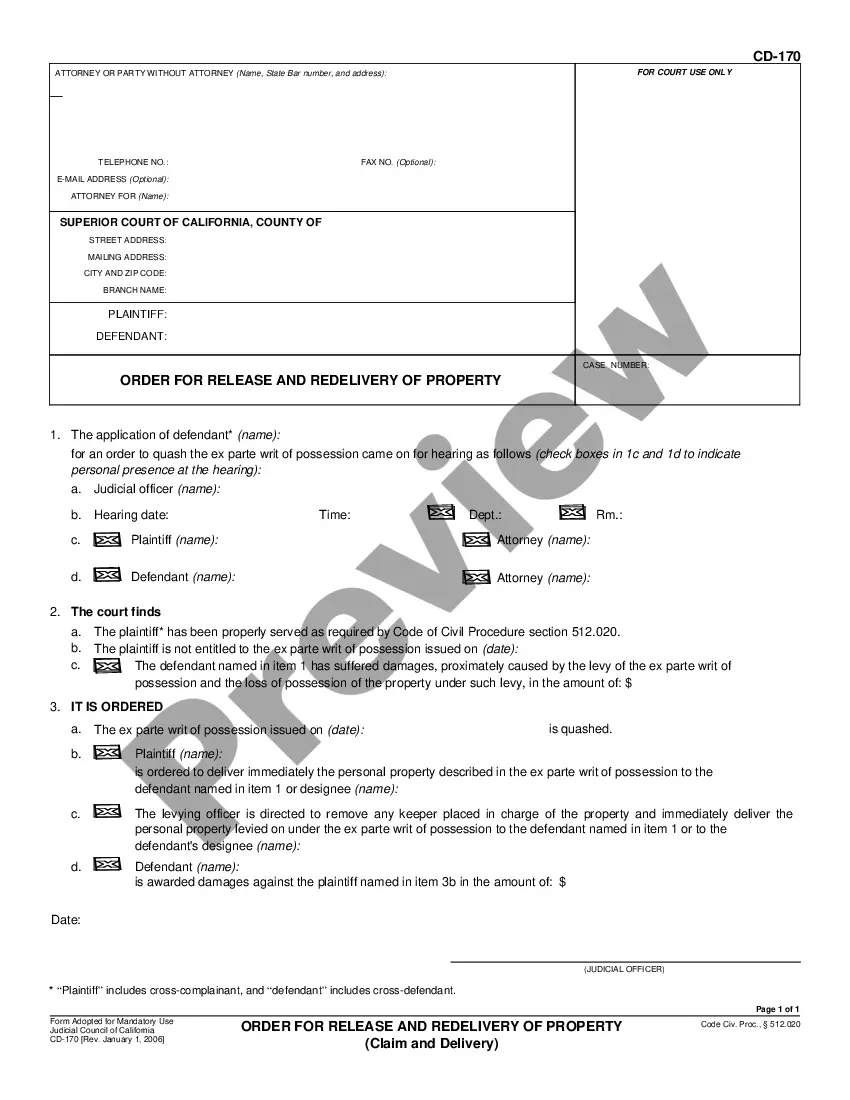

Description

How to fill out Assessing The Primary Activities In The Value Chain?

Selecting the optimal legal document format can be somewhat challenging. Of course, there are numerous templates available online, but how can you find the legal template you need? Utilize the US Legal Forms website.

The platform offers a vast array of templates, including the Maine Assessing the Key Activities in the Value Chain, suitable for both business and personal use. All forms are reviewed by specialists and meet federal and state requirements.

If you are currently registered, sign in to your account and click the Download button to locate the Maine Assessing the Key Activities in the Value Chain. Use your account to browse through the legal forms you have obtained previously. Navigate to the My documents section of your account and download another copy of the document you need.

Choose the file format and download the legal document format to your device. Finally, complete, modify, print, and sign the obtained Maine Assessing the Key Activities in the Value Chain. US Legal Forms is the largest repository of legal templates where you can find various document formats. Utilize the service to download professionally crafted documents that conform to state requirements.

- Firstly, ensure you have selected the correct form for your region/state.

- You can preview the form using the Review button and examine the form description to verify it is the right one for you.

- If the form does not meet your needs, use the Search field to find the appropriate form.

- Once you are confident the form is accurate, click the Download now button to obtain the document.

- Select the pricing plan you prefer and enter the necessary information.

- Create your account and complete your purchase using your PayPal account or Visa/Mastercard.

Form popularity

FAQ

During a home assessment, a tax assessor inspects various features of your property to determine its market value. They will examine the interior, exterior, and land associated with the home. All findings contribute to an official valuation report, which then influences property tax calculations. This process highlights the importance of Maine assessing the primary activities in the value chain for property owners.

The certified ratio in Maine is a measure that evaluates the relationship between assessed values and market values for properties. It reflects how accurately a municipality assesses property compared to its market value. Keeping the certified ratio within an acceptable range ensures fair taxation among property owners. For more detailed insights into the ratio and its implications, visit US Legal Forms for comprehensive resources.

Tax assessors evaluate various aspects of a house to accurately determine its value. Key factors include architectural style, materials used in construction, age, and overall condition. They also assess the yard, landscaping, and any additional structures on the property. By understanding these criteria, you can better comprehend how the value is computed during Maine assessing the primary activities in the value chain.

In Maine, you are not legally required to let a tax assessor into your house. However, not allowing access might result in an estimate based on external factors only. This could lead to an inaccurate assessment that does not truly reflect your property's value. Consider the benefits of transparency and how it may positively affect your property tax obligations.

When assessing a house, a tax assessor examines various factors that contribute to its overall value. This includes the condition of the structure, square footage, number of rooms, and any renovations. Additionally, assessors look for features that enhance property value, such as pools, basements, and energy-efficient installations. Understanding these aspects can help homeowners better prepare for the assessing process.

Allowing a tax assessor into your house can provide a more accurate assessment of your property's value. While it is not mandatory in Maine, access allows the assessor to evaluate improvements and unique features that could affect your property's market value. If you have concerns about the assessment process, consider consulting with the US Legal Forms platform for guidance and resources. This may help you make an informed decision about welcoming the assessor.

The best way to assess property value involves a careful combination of market analysis, property inspection, and consultation with experienced professionals. Utilizing tools such as comparative market analysis and engaging with experts in real estate or appraisal can provide additional insights. When discussing Maine assessing the primary activities in the value chain, leveraging platforms like US Legal Forms can facilitate access to valuable resources and guide you through the property assessment process.

Yes, tax assessors in Maine have the authority to enter properties for inspection, but they typically provide notice to the property owner beforehand. This access allows them to accurately assess property conditions and values. Understanding this process is vital for those involved in Maine assessing the primary activities in the value chain, ensuring transparency in how property assessments are conducted.

The Board of Assessment Review serves as a quasi-judicial committee that addresses appeals from property owners regarding assessed values. This board reviews claims for discrepancies and ensures compliance with state property assessment laws. Knowing the role of this board enhances your understanding of Maine assessing the primary activities in the value chain, providing a route for fair treatment in taxation.

A town assesses property value by employing a team of assessors who review property information and sales data within its jurisdiction. This team considers property characteristics, market conditions, and tax regulations to determine an accurate assessed value. Understanding how towns operate in Maine assessing the primary activities in the value chain assists residents in navigating property tax implications and appeals.