Maine Assignment of Assets

Description

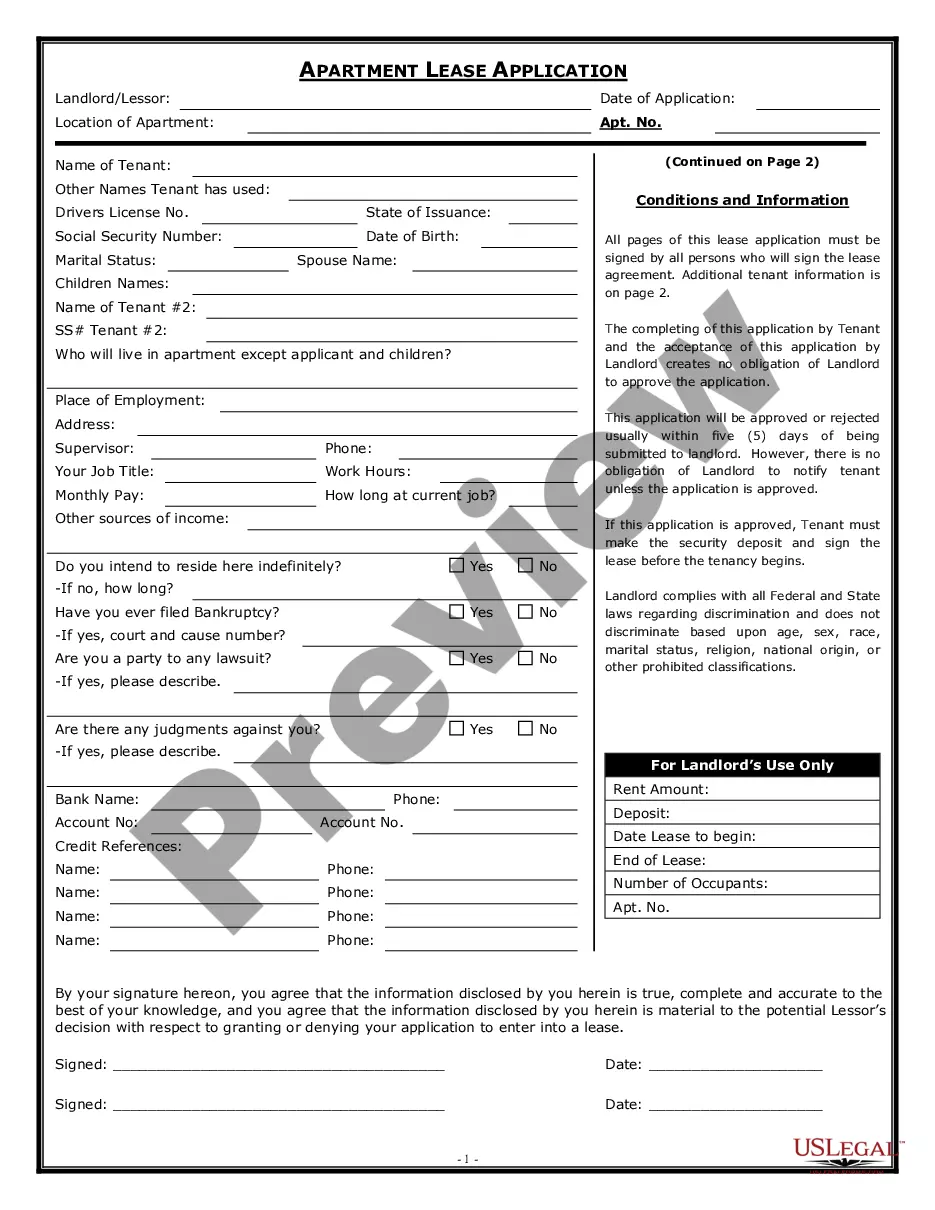

How to fill out Assignment Of Assets?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a broad assortment of legal document templates that you can download or print.

By using the website, you can find a vast selection of forms for business and personal purposes, organized by categories, states, or keywords.

You can access the latest versions of documents like the Maine Assignment of Assets within seconds.

Refer to the form description to confirm you have chosen the correct one.

If the form does not meet your requirements, utilize the Search field at the top of the page to find the one that does.

- If you already have a monthly subscription, Log In to obtain the Maine Assignment of Assets from the US Legal Forms library.

- The Download button will be visible on every form you view.

- You can access all previously acquired forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are some simple instructions to get you started.

- Make sure you have selected the correct form for your city/state.

- Click the Review button to inspect the content of the form.

Form popularity

FAQ

The easiest way to transfer ownership of a house is by utilizing a Maine Assignment of Assets. This method ensures that the transition is both straightforward and legally sound. Typically, you can achieve this by executing a deed and recording it with the local authority, which helps clarify property rights. To make the process even simpler, consider using online platforms like US Legal Forms, which offer easy access to necessary documents and guidance.

To complete a deed transfer in Maine, you must prepare a legal document that outlines the transfer of ownership. This process typically involves executing a quitclaim or warranty deed, followed by filing it with the appropriate county registry. Using the Maine Assignment of Assets can simplify this procedure, as it offers clear guidelines and forms. Engaging with essential resources can make this transition smooth and efficient.

The best way to transfer property within a family is often through a Maine Assignment of Assets. This method allows you to legally change ownership while keeping the process straightforward and beneficial for family members. By using this approach, you can avoid complications commonly associated with probate after death. Consult professionals to ensure a seamless transition and protect everyone's interests.

Yes, the administrator of an estate in Maine can receive compensation for their role in managing the estate. Typically, the fees are set by the Maine probate code and should reflect the complexity of handling the estate. This compensation helps ensure that the duties related to the Maine Assignment of Assets are performed professionally and efficiently.

An assignment of assets is a legal process wherein an owner designates their assets to another party. In Maine Assignment of Assets, this process helps in facilitating transfers of property rights. It protects both parties by clearly defining rights and responsibilities concerning the assigned assets.

In Maine, certain assets can bypass the probate process entirely, including joint tenancy properties and life insurance policies with a named beneficiary. Understanding these exemptions can be crucial when considering Maine Assignment of Assets. By knowing what assets are exempt, you can plan more effectively and simplify the estate handling process.

An example of assignment of property can be seen when a homeowner assigns their lease rights to another party. In the context of Maine Assignment of Assets, this action allows the new party to assume rights without needing to initiate a new lease. Such assignments enable flexibility in property management and tenant arrangements.

A general assignment of assets refers to a comprehensive transfer of all assets owned by a debtor to a creditor. This is often used in insolvency cases in Maine Assignment of Assets, allowing creditors to claim various assets. This method can simplify the settlement process and ensure fair distribution among creditors.

While both transfer and assignment involve moving assets, they differ in their legal implications. A transfer typically implies a broader alteration of ownership, while an assignment specifically refers to the delegation of rights regarding the asset. In Maine Assignment of Assets, understanding this distinction can affect the terms of the deal and the parties involved.

To assign assets means to formally transfer the rights and interests in those assets from one person or entity to another. This process is crucial in Maine Assignment of Assets, as it establishes clear ownership. An assignment may involve various types of property, such as real estate, personal property, or financial assets.