No particular language is necessary for the return of an account as uncollectible so long as the notice or letter used clearly conveys the necessary information.

Maine Collection Agency's Return of Claim as Uncollectible

Description

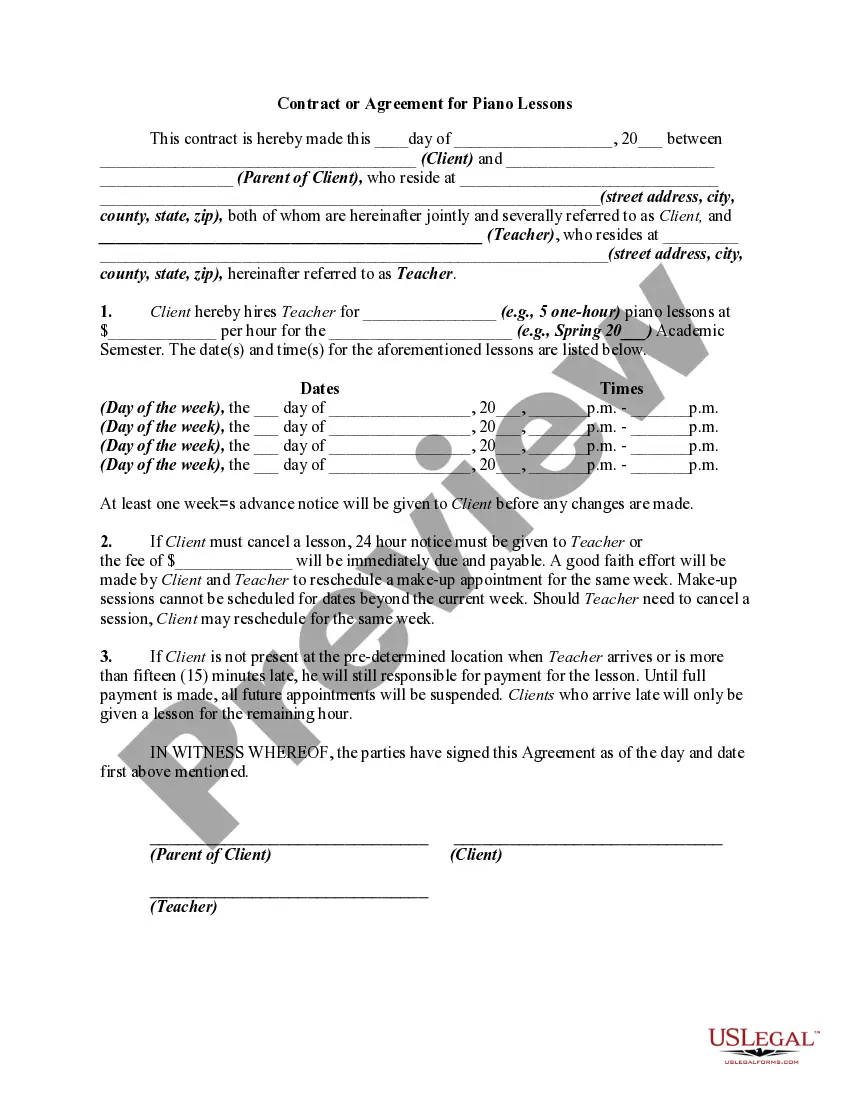

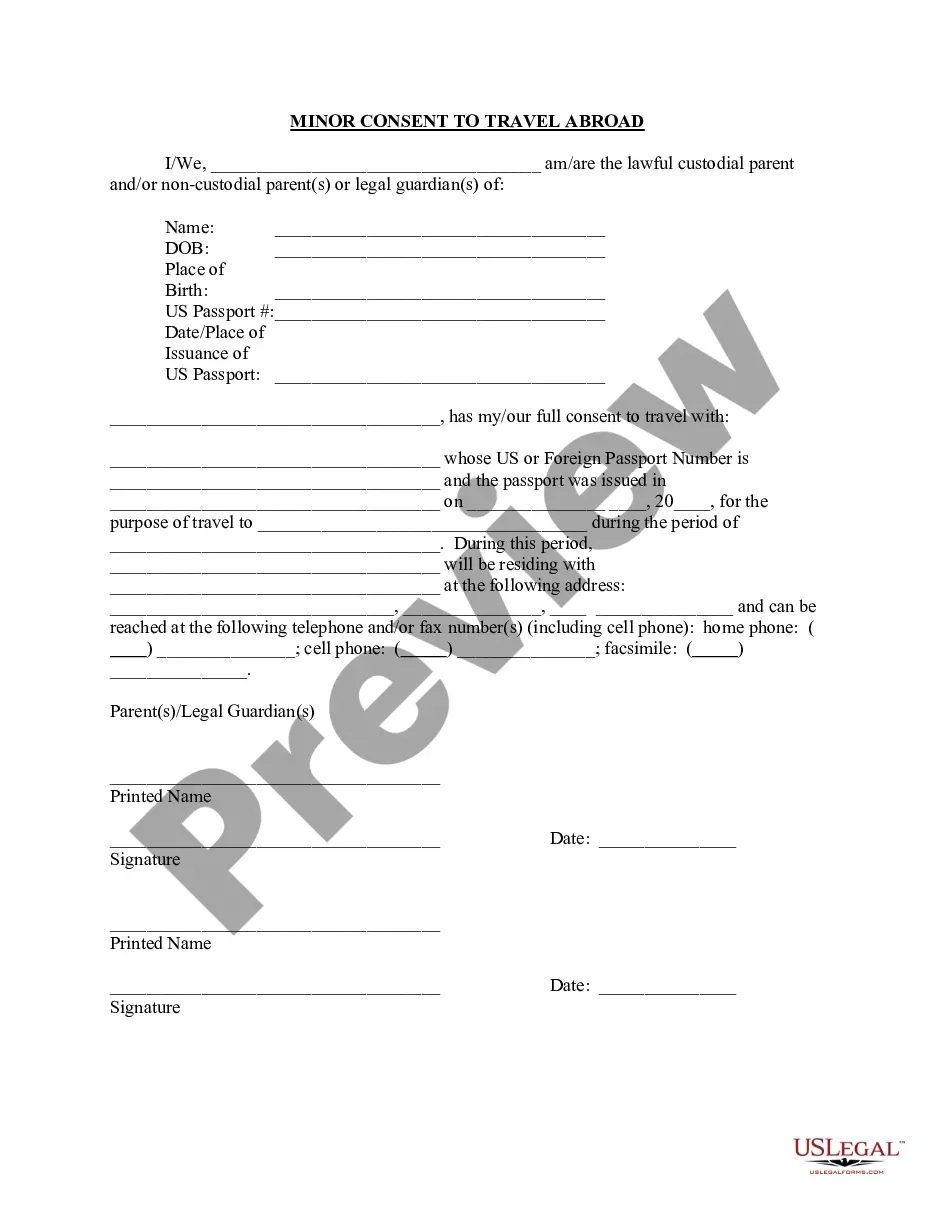

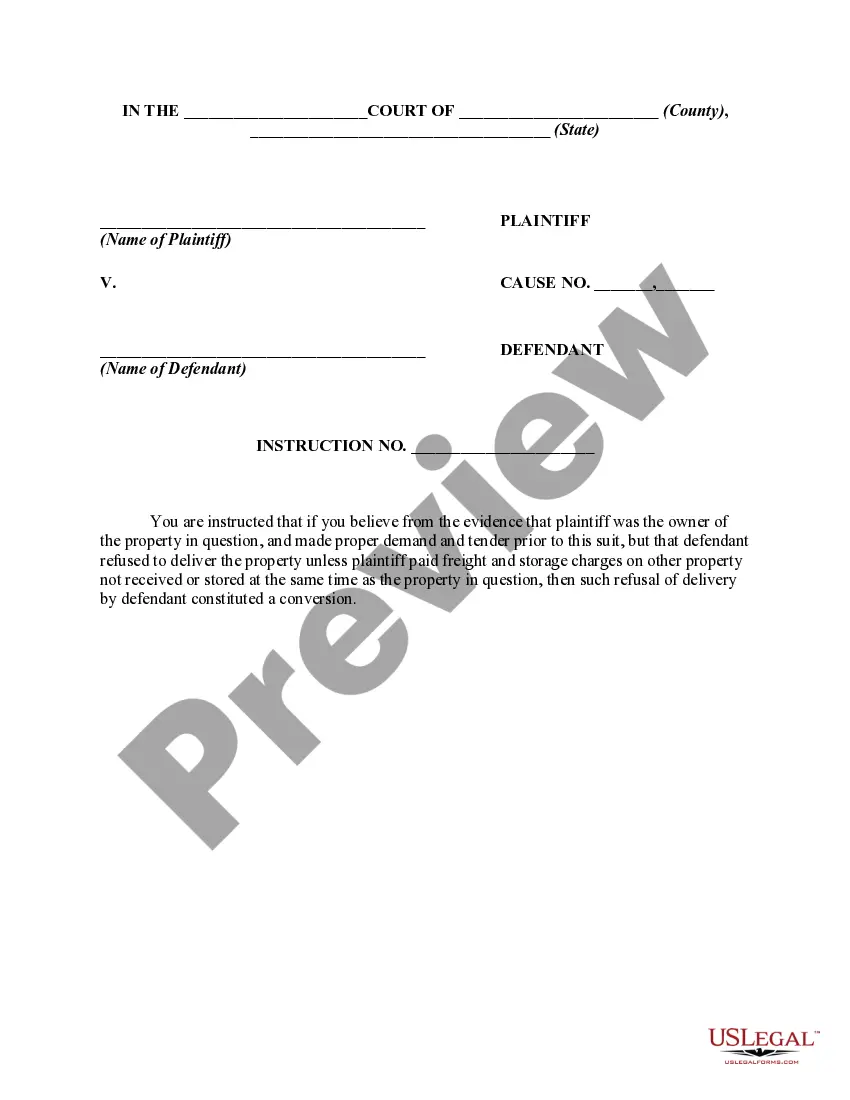

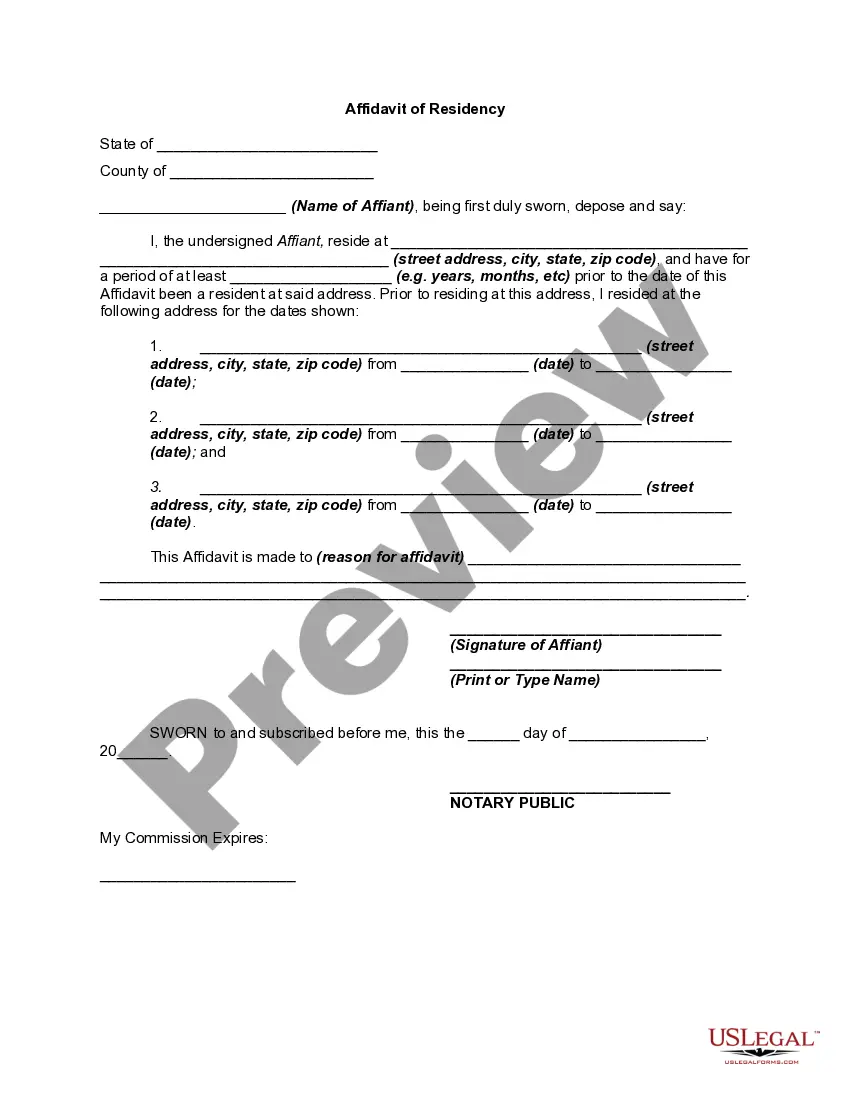

How to fill out Collection Agency's Return Of Claim As Uncollectible?

Have you ever been in a scenario where you require documents for various business or personal activities almost daily.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms provides thousands of template documents, including the Maine Collection Agency's Return of Claim as Uncollectible, designed to comply with federal and state regulations.

Choose a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents menu. You can obtain an additional copy of the Maine Collection Agency's Return of Claim as Uncollectible at any time if needed. Click the required template to download or print the document design. Use US Legal Forms, the largest collection of legal forms, to save time and prevent errors. The service offers expertly crafted legal document templates for various purposes. Create your account on US Legal Forms and start simplifying your life.

- If you are already acquainted with the US Legal Forms website and have an account, just Log In.

- Then, you can download the Maine Collection Agency's Return of Claim as Uncollectible template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the template you need and ensure it corresponds to your specific region/state.

- Utilize the Preview button to view the template.

- Review the details to confirm you have selected the correct document.

- If the template is not what you are looking for, use the Search field to find the template that meets your needs and requirements.

- Once you obtain the right document, click on Purchase now.

- Select the payment plan you desire, complete the necessary information to create your account, and pay for your order with PayPal or credit card.

Form popularity

FAQ

It's possible in some cases to negotiate with a lender to repay a debt after it's already been sent to collections. Working with the original creditor, rather than dealing with debt collectors, can be beneficial.

Taking action means they send you court papers telling you they're going to take you to court. The time limit is sometimes called the limitation period. For most debts, the time limit is 6 years since you last wrote to them or made a payment.

Making a payment: Making a payment on an old debt, whether in full or part, revives it, essentially restarting the clock on old debt. Agreeing to pay: If you acknowledge that the debt is yours and agree to pay, the statute of limitations on your debt will start over.

Highlights: Most negative information generally stays on credit reports for 7 years. Bankruptcy stays on your Equifax credit report for 7 to 10 years, depending on the bankruptcy type. Closed accounts paid as agreed stay on your Equifax credit report for up to 10 years.

Contact the creditor's customer service department. You may be able to explain your situation and negotiate a payment plan. The creditor can reclaim the debt from the collector and you can work with them directly. However, there's no law requiring the original creditor to accept your proposal.

Contact the creditor's customer service department. You may be able to explain your situation and negotiate a payment plan. The creditor can reclaim the debt from the collector and you can work with them directly. However, there's no law requiring the original creditor to accept your proposal.

Does debt go away after 7 years? In the UK, for most people, unsecured debts go away after a period of 6 years from the point when they started or 6 years from the point when they last made a payment to, or had contact with, their creditor. This period can be 12 years for some mortgage debts.