The decree of the bankruptcy court which terminates the bankruptcy proceedings is generally a discharge that releases the debtor from most debts. A bankruptcy court may refuse to grant a discharge under certain conditions.

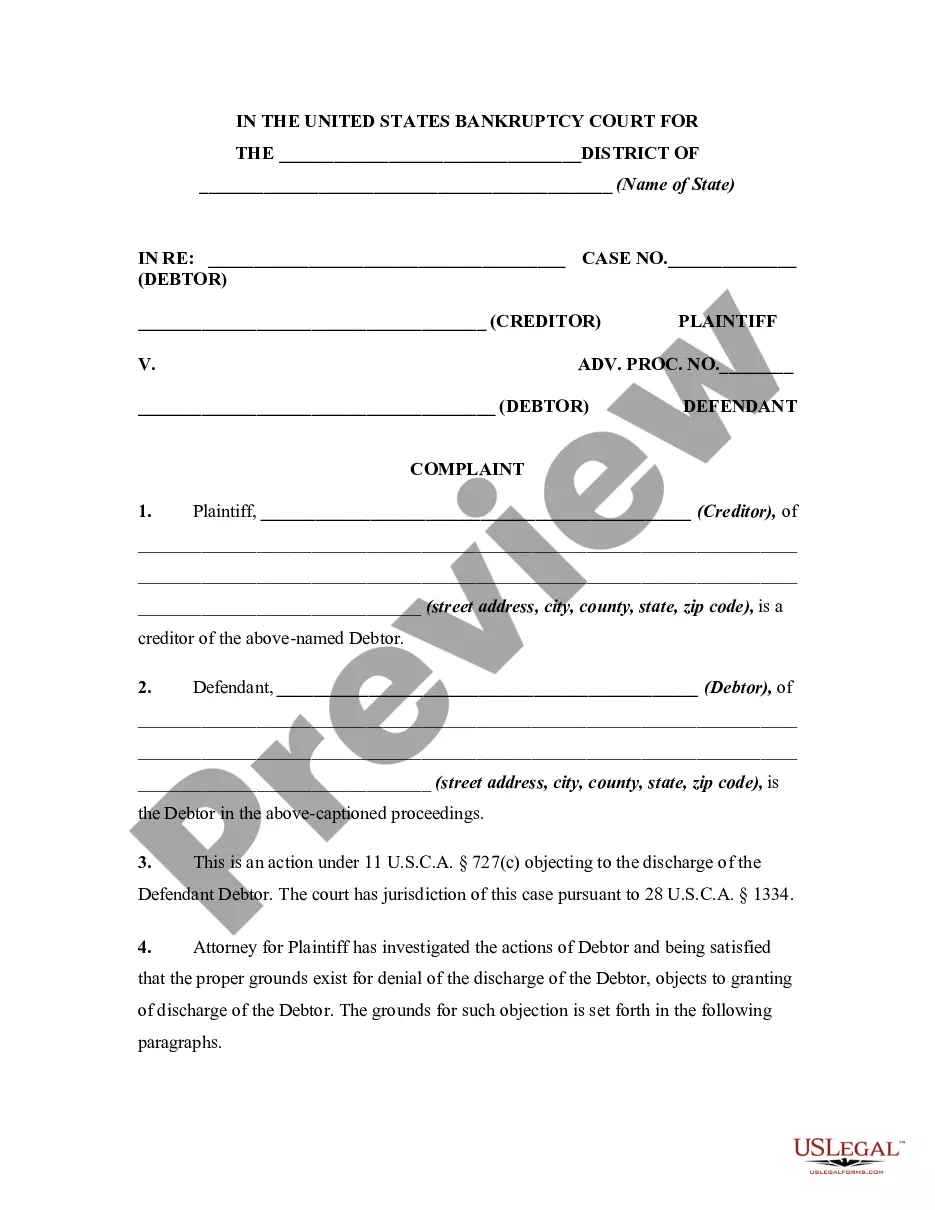

Maine Complaint Objecting to Discharge in Bankruptcy Proceeding for Failure to Keep or Preserve Books or Records that Explains Loss or Deficiency in Assets,

Description

How to fill out Complaint Objecting To Discharge In Bankruptcy Proceeding For Failure To Keep Or Preserve Books Or Records That Explains Loss Or Deficiency In Assets,?

If you have to complete, download, or print legitimate file web templates, use US Legal Forms, the biggest variety of legitimate types, which can be found online. Take advantage of the site`s simple and hassle-free look for to obtain the files you will need. Various web templates for organization and individual purposes are categorized by types and states, or key phrases. Use US Legal Forms to obtain the Maine Complaint Objecting to Discharge in Bankruptcy Proceeding for Failure to Keep or Preserve Books or Records that Explains within a handful of mouse clicks.

In case you are currently a US Legal Forms client, log in to the accounts and click the Down load key to get the Maine Complaint Objecting to Discharge in Bankruptcy Proceeding for Failure to Keep or Preserve Books or Records that Explains. You can also accessibility types you in the past downloaded inside the My Forms tab of the accounts.

Should you use US Legal Forms the very first time, refer to the instructions listed below:

- Step 1. Be sure you have chosen the form for that correct city/region.

- Step 2. Take advantage of the Preview solution to look through the form`s content material. Never forget about to see the outline.

- Step 3. In case you are not satisfied using the develop, use the Research area at the top of the screen to discover other versions in the legitimate develop design.

- Step 4. Upon having found the form you will need, select the Buy now key. Choose the prices plan you favor and add your references to register for the accounts.

- Step 5. Process the purchase. You can use your credit card or PayPal accounts to perform the purchase.

- Step 6. Find the formatting in the legitimate develop and download it in your system.

- Step 7. Full, revise and print or indicator the Maine Complaint Objecting to Discharge in Bankruptcy Proceeding for Failure to Keep or Preserve Books or Records that Explains.

Every single legitimate file design you purchase is your own property for a long time. You have acces to each and every develop you downloaded with your acccount. Go through the My Forms segment and choose a develop to print or download once more.

Compete and download, and print the Maine Complaint Objecting to Discharge in Bankruptcy Proceeding for Failure to Keep or Preserve Books or Records that Explains with US Legal Forms. There are millions of specialist and express-particular types you can use for the organization or individual requirements.

Form popularity

FAQ

Key Takeaways. Types of debt that cannot be discharged in bankruptcy include alimony, child support, and certain unpaid taxes. Other types of debt that cannot be alleviated in bankruptcy include debts for willful and malicious injury to another person or property.

The debtor knowingly made a false oath or account, presented a false claim, etc. Failure to comply with a bankruptcy court order.

In fact, the federal courts (which handle bankruptcy cases) list 19 different types of debt that are not eligible for discharge. 2 The most common ones are child support, alimony payments, and debts for willful and malicious injuries to a person or property.

The court may deny a chapter 7 discharge for any of the reasons described in section 727(a) of the Bankruptcy Code, including failure to provide requested tax documents; failure to complete a course on personal financial management; transfer or concealment of property with intent to hinder, delay, or defraud creditors; ...

If a debt arose from the debtor's intentional wrongdoing, the creditor can object to discharging it. This might involve damages related to a drunk driving accident, for example, or costs caused by intentional damage to an apartment or other property.

Chapter 7 Bankruptcy Doesn't Clear All Debts Mortgages, car loans, and other "secured" debts if you keep the property. ... Recent income taxes, support obligations, and other "priority" debt. ... Debts incurred by fraud or criminal acts. ... Student loans.

Debts not discharged include debts for alimony and child support, certain taxes, debts for certain educational benefit overpayments or loans made or guaranteed by a governmental unit, debts for willful and malicious injury by the debtor to another entity or to the property of another entity, debts for death or personal ...

Filing for Chapter 7 bankruptcy eliminates credit card debt, medical bills and unsecured loans; however, there are some debts that cannot be discharged. Those debts include child support, spousal support obligations, student loans, judgments for damages resulting from drunk driving accidents, and most unpaid taxes.