Maine Contract with Employee to Work in a Foreign Country

Description

How to fill out Contract With Employee To Work In A Foreign Country?

Selecting the ideal legal document template can be challenging. Obviously, there are numerous designs available online, but how can you identify the legal form you require? Visit the US Legal Forms website. This platform provides thousands of templates, including the Maine Contract with Employee to Work in a Foreign Country, which can fulfill both business and personal needs. All documents are verified by professionals and comply with state and federal regulations.

If you are already registered, Log In to your account and click on the Download button to access the Maine Contract with Employee to Work in a Foreign Country. Use your account to search through the legal forms you may have acquired previously. Go to the My documents section of your account to retrieve another copy of the document you need.

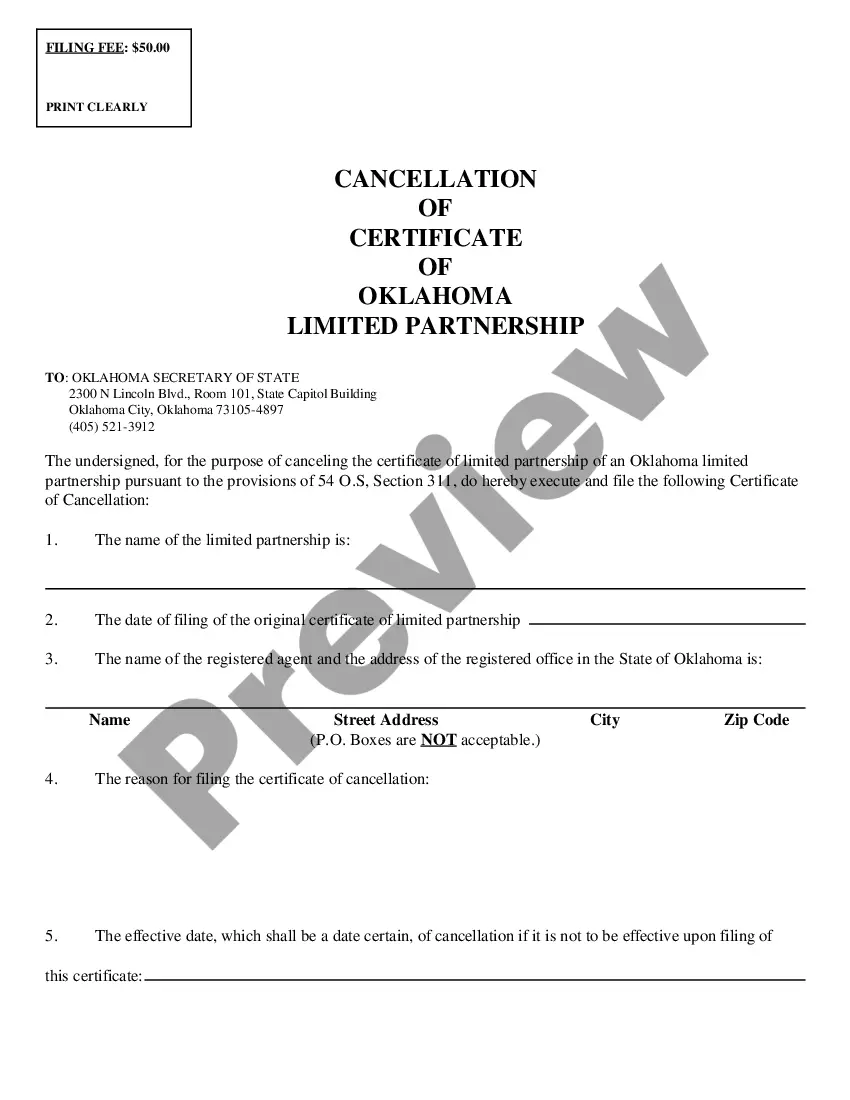

If you are a new user of US Legal Forms, here are straightforward instructions you can follow: First, ensure you have selected the correct form for your area/region. You can preview the document using the Preview button and review the form outline to confirm it meets your needs. If the form does not meet your expectations, utilize the Search field to find the suitable form.

- Once you are confident the form is appropriate, click on the Purchase now button to acquire the form.

- Choose the pricing option you prefer and enter the necessary information.

- Create your account and process your purchase using your PayPal account or credit card.

- Select the file format and download the legal document template to your device.

- Complete, modify, print, and sign the obtained Maine Contract with Employee to Work in a Foreign Country.

- US Legal Forms is the largest repository of legal documents where you can find various file designs. Utilize the service to obtain properly crafted documents that adhere to state requirements.

Form popularity

FAQ

Yes, you can work remotely for a US company while living in another country, provided the company is willing to accommodate such arrangements. However, it's important to consider tax implications and local employment laws that may apply. Establishing a Maine Contract with Employee to Work in a Foreign Country is advisable to clarify your working relationship and avoid potential legal issues.

In Maine, salaried employees are generally expected to fulfill the requirements of their job without a specific limit on hours. However, employers must ensure that employees receive fair compensation and do not violate labor laws concerning overtime. A Maine Contract with Employee to Work in a Foreign Country can detail work expectations, helping to set clear boundaries and prevent misunderstandings.

To hire a foreigner, a US company typically needs to follow specific legal procedures. This might involve obtaining work visas, ensuring compliance with immigration laws, and drafting a Maine Contract with Employee to Work in a Foreign Country that outlines job duties, compensation, and benefits. Utilizing platforms like uslegalforms can provide templates and guidance to streamline this process.

A foreign contract employee is an individual hired by a company located in one country to provide services while residing in another country. These employees usually work under a contractual agreement that defines their responsibilities and compensations. It is essential for employers to create a Maine Contract with Employee to Work in a Foreign Country that ensures compliance with applicable laws and provides clarity for the employee.

A US company can indeed employ someone in another country, provided they comply with local labor laws and regulations. This involves establishing a legal entity or using a third-party service to handle payroll and benefits. A well-drafted Maine Contract with Employee to Work in a Foreign Country is crucial to define the working relationship and ensure both parties are protected.

Yes, a US company can hire a foreign employee to work in another country. This process typically requires understanding both US employment laws and the local laws where the employee will work. It's essential to create a clear Maine Contract with Employee to Work in a Foreign Country that outlines the terms of employment, as this helps avoid legal complications.

U.S. employment laws can apply to American employees working abroad, but the specifics depend on various factors, including the employer's location and the nature of employment. It’s crucial to understand how these regulations affect your situation. For those drafting a Maine Contract with Employee to Work in a Foreign Country, clear guidance from legal experts is advisable to ensure compliance.

The Maine Fair Chance in Employment Act aims to reduce employment discrimination against individuals with criminal records. It prohibits employers from inquiring about an applicant’s criminal history until after an interview. If you are drafting a Maine Contract with Employee to Work in a Foreign Country, consider how this law affects hiring practices.

To hire a foreign contractor in the U.S., you must verify their eligibility to work and consider applicable laws. Review requirements, such as visas and tax obligations. Creating a structured agreement, like a Maine Contract with Employee to Work in a Foreign Country, can outline expectations and ensure compliance with both local and international regulations.

Employment at-will is a widespread principle in the U.S., but not all states follow it strictly. While most states allow at-will employment, exceptions exist based on public policy and contractual agreements. For a Maine Contract with Employee to Work in a Foreign Country, specific terms may override the at-will doctrine.