Maine Tax Free Exchange Agreement Section 1031

Description

How to fill out Tax Free Exchange Agreement Section 1031?

Have you ever found yourself in a situation where you require documentation for various business or specific purposes almost all the time.

There exists a multitude of authentic document templates online, but locating those that you can depend on isn't easy.

US Legal Forms offers a vast array of form templates, such as the Maine Tax-Free Exchange Agreement Section 1031, designed to comply with both state and federal regulations.

Choose the pricing plan you prefer, enter the required information to create your account, and complete the transaction using your PayPal or credit card.

Pick a convenient file format and download your copy.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Once logged in, you can download the Maine Tax-Free Exchange Agreement Section 1031 template.

- In case you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the document you require and ensure that it is suited for the correct city/region.

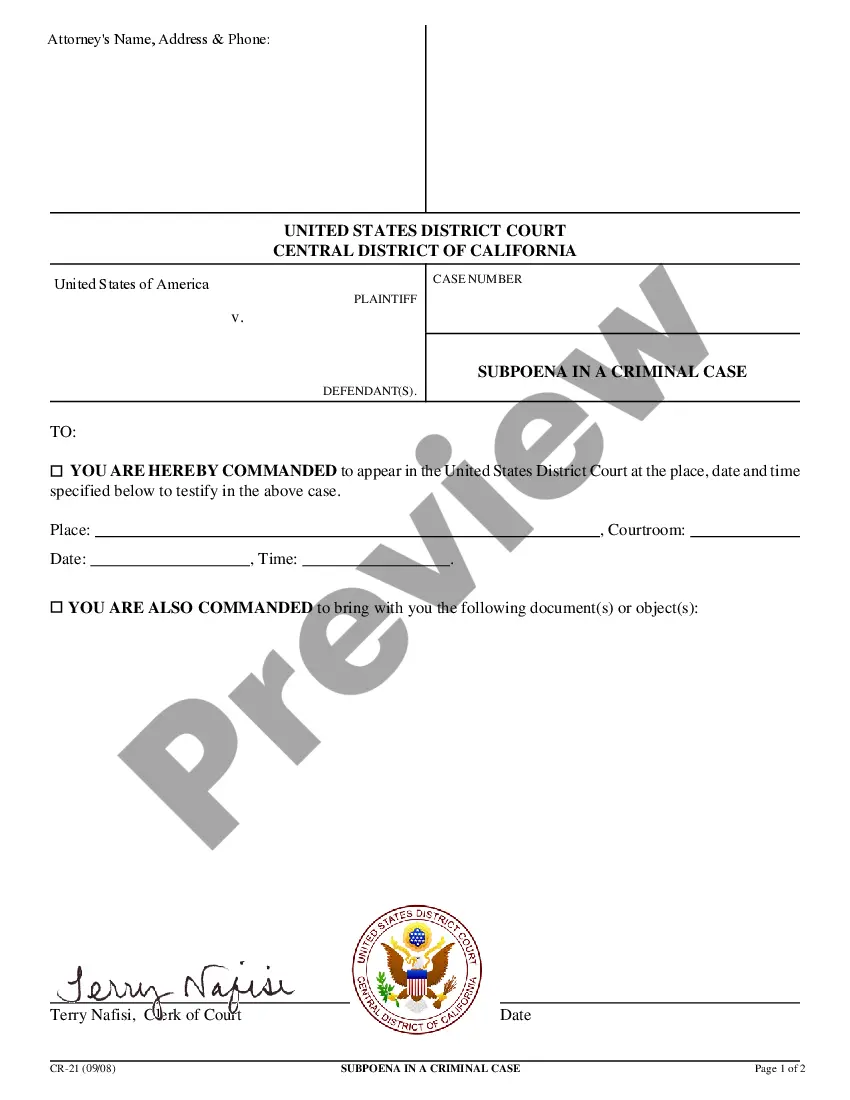

- Utilize the Preview button to examine the form.

- Review the details to confirm that you have selected the appropriate document.

- If the document doesn't meet your needs, use the Lookup field to find a form that suits you and your requirements.

- When you locate the right document, click Get now.

Form popularity

FAQ

Gain deferred in a like-kind exchange under IRC Section 1031 is tax-deferred, but it is not tax-free. The exchange can include like-kind property exclusively or it can include like-kind property along with cash, liabilities and property that are not like-kind.

Tom: The short answer is yes. Section 1031 is a federal tax code, so it is recognized in all states, so you can exchange from state to state. We regularly are dealing with transactions from our home state of Oregon and into California, Washington, and vice versa.

Section 1031 Exchange In order to qualify, the property to be acquired must be held for productive use in a trade or business or for investment. In addition, the entire transaction must be completed within 180 days and a qualified intermediary, or QI, must be used to facilitate the exchange.

Under Internal Revenue Code Section 1031, real estate located in one U.S. state is like kind to real estate located in any other state, and you can trade from one state to another. In most cases you are able to defer both federal and state tax, assuming the state has an income tax.

There are also states that have withholding requirements if the seller of a piece of property in these states is a non-resident of any of the following states: California, Colorado, Hawaii, Georgia, Maryland, New Jersey, Mississippi, New York, North Carolina, Oregon, West Virginia, Maine, South Carolina, Rhode Island,

1. Don't try to exchange a piece of personal property. 1031 exchanges can only be done between investment properties that you own, which means REITs, funds or an LLC that owns shares in another LLC don't qualify.

Maine Revenue Services follows the federal guidelines on the treatment of IRC Section 1031 like-kind exchanges. Therefore, if no gain is recognized for federal income tax purposes (due to the qualifying like-kind exchange transaction), no gain is recognized for Maine income tax purposes.

There are also states that have withholding requirements if the seller of a piece of property in these states is a non-resident of any of the following states: California, Colorado, Hawaii, Georgia, Maryland, New Jersey, Mississippi, New York, North Carolina, Oregon, West Virginia, Maine, South Carolina, Rhode Island,