An irrevocable trust established to qualify contributions for the annual federal gift tax exclusion for gifts of a present interest. The trust is named Crummey because of a case involving a family named Crummey. The trust contains Crummey Powers, enabling a beneficiary to withdraw assets contributed to the trust for a limited period of time.

Maine Sprinkling Trust for Children During Grantor's Life, and for Surviving Spouse and Children after Grantor's Death - Crummey Trust Agreement

Description

How to fill out Sprinkling Trust For Children During Grantor's Life, And For Surviving Spouse And Children After Grantor's Death - Crummey Trust Agreement?

Are you in a position where you require documents for potential business or personal activities almost every single day.

There are numerous legal document templates accessible online, but finding ones you can trust is challenging.

US Legal Forms offers a wide range of form templates, such as the Maine Sprinkling Trust for Children During Grantor's Life, and for Surviving Spouse and Children after Grantor's Death - Crummey Trust Agreement, which are crafted to meet federal and state regulations.

Choose the subscription plan you prefer, fill in the required information to create your account, and complete your purchase using your PayPal or credit card.

Select a convenient document format and download your copy. Access all the document templates you have purchased in the My documents menu. You can obtain an additional copy of the Maine Sprinkling Trust for Children During Grantor's Life, and for Surviving Spouse and Children after Grantor's Death - Crummey Trust Agreement at any time, if necessary. Just click on the needed form to obtain or print the document template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service provides professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Maine Sprinkling Trust for Children During Grantor's Life, and for Surviving Spouse and Children after Grantor's Death - Crummey Trust Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/area.

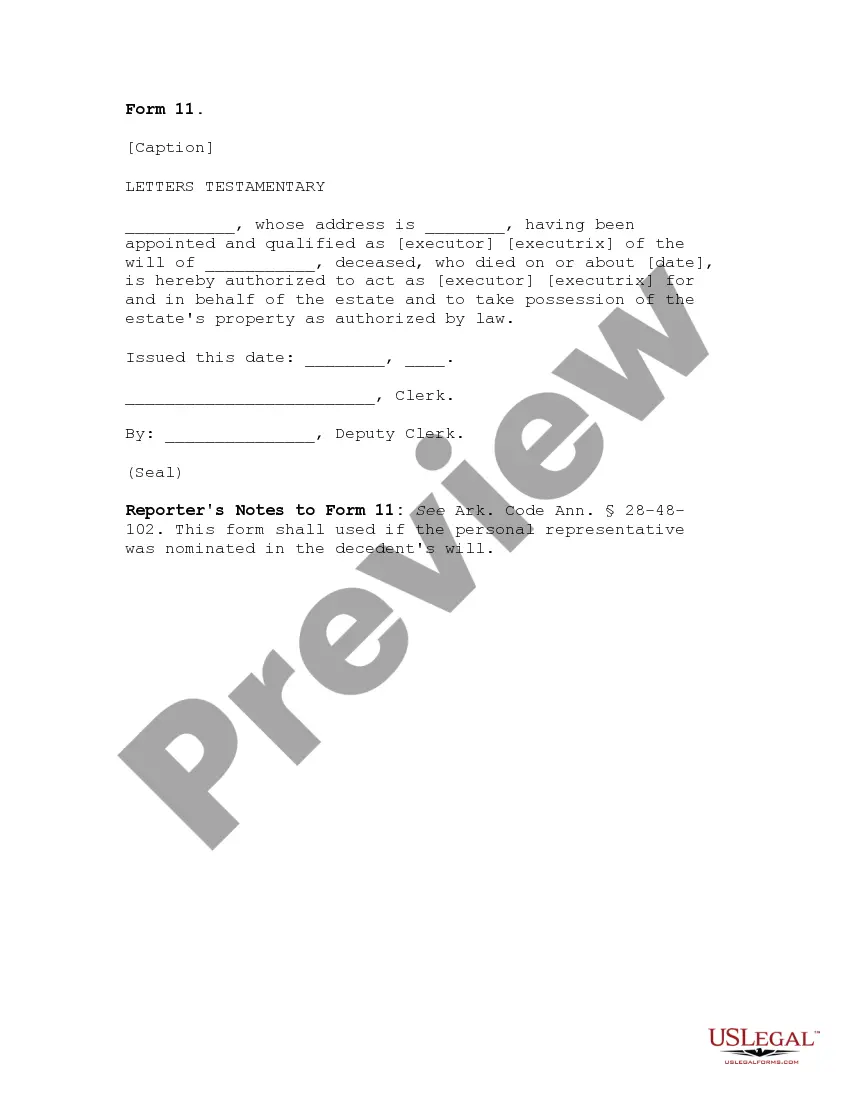

- Use the Review button to evaluate the form.

- Examine the overview to confirm that you have selected the right form.

- If the form isn’t what you’re looking for, utilize the Lookup field to find the form that meets your needs.

- If you discover the right form, click on Acquire now.

Form popularity

FAQ

In a Maine Sprinkling Trust for Children During Grantor's Life and for Surviving Spouse and Children after Grantor's Death - Crummey Trust Agreement, beneficiaries usually have the right to withdraw contributions within a specified period after each gift. This amount is limited to what qualifies for the annual gift tax exclusion, which is currently set at a specific dollar amount. It’s crucial that the trust is structured correctly to allow these withdrawals while maintaining compliance with tax regulations. Consulting with an expert can ensure optimal benefit from the trust.

When one party dies, the Maine Sprinkling Trust for Children During Grantor's Life and for Surviving Spouse and Children after Grantor's Death - Crummey Trust Agreement typically transitions to the successor trustee. This person continues to manage the trust in accordance with the established terms. The assets in the trust remain protected and accessible to the beneficiaries as specified in the agreement. This helps ensure continuity and stability during a challenging time.

A potential negative side of a trust, such as the Maine Sprinkling Trust for Children During Grantor's Life and for Surviving Spouse and Children after Grantor's Death - Crummey Trust Agreement, is the initial setup and ongoing maintenance costs. Creating and managing a trust can be more expensive than other estate planning tools due to legal fees and administrative overhead. Additionally, mistrust among family members might arise regarding the management of trust assets, which can complicate relationships.

One disadvantage of a Maine Sprinkling Trust for Children During Grantor's Life and for Surviving Spouse and Children after Grantor's Death - Crummey Trust Agreement is the administrative complexity. The trust requires careful management and periodic notices to beneficiaries regarding their withdrawal rights. This can be cumbersome for some grantors. Additionally, improper handling can lead to unintended tax consequences, making expertise in trust administration essential.

The Maine Sprinkling Trust for Children During Grantor's Life, and for Surviving Spouse and Children after Grantor's Death - Crummey Trust Agreement can be an effective way to minimize taxes. This type of trust allows for contributions that qualify for the annual gift tax exclusion. This strategy leads to potential tax savings while ensuring the trust beneficiaries receive support. By using a properly structured trust, you can navigate potential tax implications efficiently.

When a grantor dies, a family trust usually retains its status and continues to manage assets for beneficiaries. The Maine Sprinkling Trust for Children During Grantor's Life, and for Surviving Spouse and Children after Grantor's Death - Crummey Trust Agreement is designed to ensure that distributions continue according to the trust's terms. Trust administration continues seamlessly, allowing beneficiaries access to benefits outlined in the trust.

Yes, a grantor trust can indeed have Crummey powers. This flexibility allows for the Maine Sprinkling Trust for Children During Grantor's Life, and for Surviving Spouse and Children after Grantor's Death - Crummey Trust Agreement to allocate annual exclusion gifts effectively. The grantor can maintain control while benefiting from gift tax exclusions, thereby offering financial support to beneficiaries.

After a grantor dies, the trust generally becomes irrevocable, meaning no changes can be made without the beneficiaries' consent. The Maine Sprinkling Trust for Children During Grantor's Life, and for Surviving Spouse and Children after Grantor's Death - Crummey Trust Agreement ensures that assets are distributed according to the terms specified by the grantor. Beneficiaries may receive distributions according to the trust's guidelines, possibly providing ongoing financial support.

When one spouse dies, a living trust often transitions to a revocable trust for the surviving spouse. This change maintains the benefits of the Maine Sprinkling Trust for Children During Grantor's Life, and for Surviving Spouse and Children after Grantor's Death - Crummey Trust Agreement structure, allowing for the seamless management of assets. The surviving spouse typically continues to manage the trust without significant tax implications or legal hurdles.

A Crummey letter must clearly notify beneficiaries of their right to withdraw funds from the Maine Sprinkling Trust for Children During Grantor's Life, and for Surviving Spouse and Children after Grantor's Death - Crummey Trust Agreement. This document should specify the amount that can be withdrawn and the timeframe for withdrawal, typically lasting around 30 days. By providing this letter, you help ensure that the contributions qualify for the annual gift tax exclusion.