Maine Reduce Capital - Resolution Form - Corporate Resolutions

Description

How to fill out Reduce Capital - Resolution Form - Corporate Resolutions?

It is feasible to spend numerous hours online trying to locate the sanctioned document template that satisfies the federal and state standards you require.

US Legal Forms provides a large collection of legal forms that are reviewed by experts.

You can easily download or print the Maine Reduce Capital - Resolution Form - Corporate Resolutions from my services.

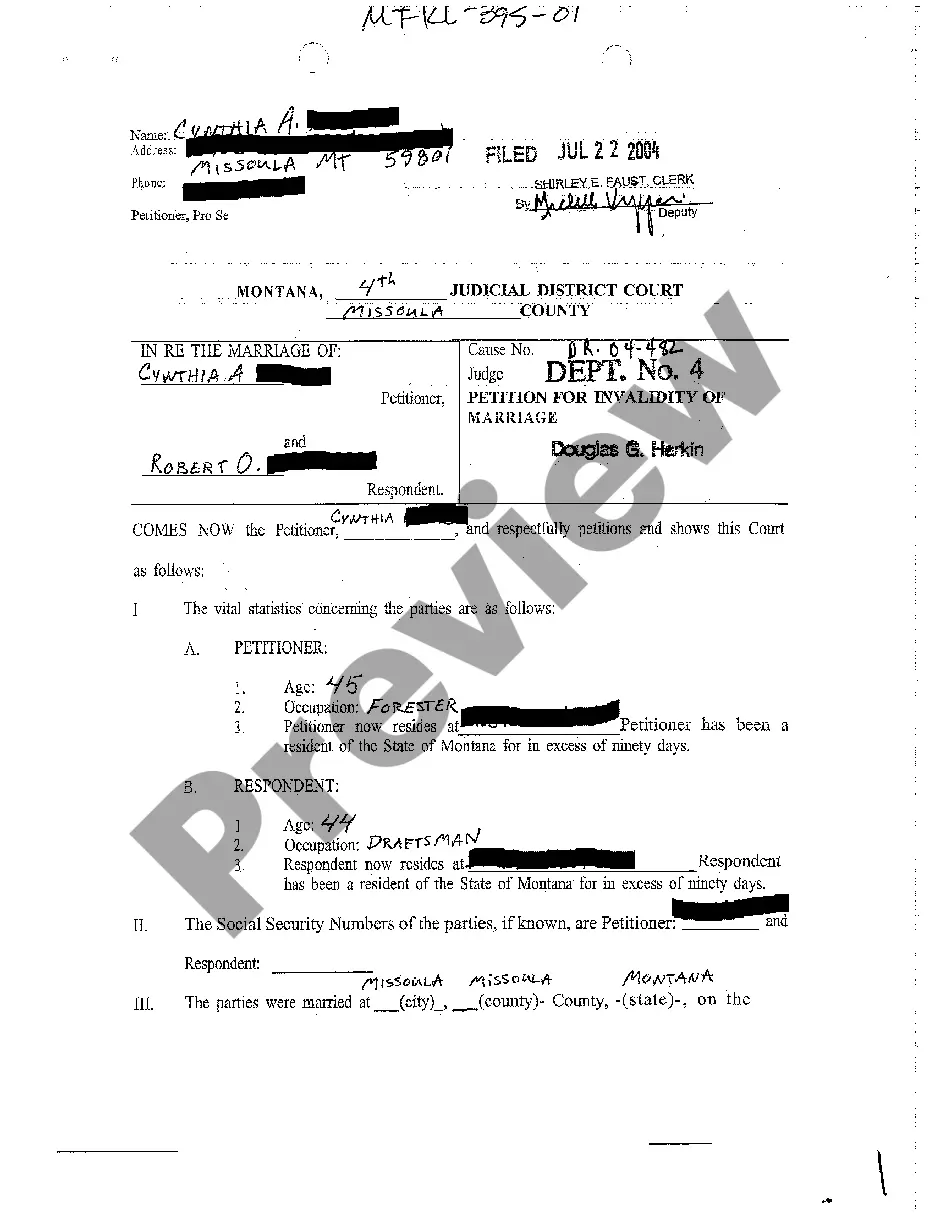

If available, utilize the Review button to preview the document template as well.

- If you possess a US Legal Forms account, you may Log In and click on the Obtain button.

- Once logged in, you can complete, modify, print, or sign the Maine Reduce Capital - Resolution Form - Corporate Resolutions.

- Every legal document template you purchase is yours forever.

- To obtain an additional copy of any purchased form, navigate to the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- Firstly, ensure that you have chosen the correct document template for the region/city of your choice.

- Review the form information to confirm that you have selected the right template.

Form popularity

FAQ

Not every LLC is required to have a corporate resolution, but many find them beneficial. Resolutions can document key decisions and maintain clear records for future reference. Using the Maine Reduce Capital - Resolution Form - Corporate Resolutions is a great way to ensure your records are organized and compliant with legal expectations, even if they are not mandatory.

Corporate resolutions are available in various formats, including online templates on legal service platforms. The Maine Reduce Capital - Resolution Form - Corporate Resolutions is an example of a valuable resource you can utilize. It provides structured guidance, making it easier for you to draft precise resolutions suited for your corporation.

Corporate resolutions can be located in corporate governance documents or through specialized legal platforms. Online resources like uslegalforms offer a variety of templates, including the Maine Reduce Capital - Resolution Form - Corporate Resolutions, which can aid in creating thorough corporate resolutions to meet your business needs.

You can find shareholder resolutions in your company’s official records or through corporate governance resources online. Additionally, the Maine Reduce Capital - Resolution Form - Corporate Resolutions provides templates that help in drafting shareholder resolutions effectively. This can save time while ensuring you meet all necessary legal requirements.

Corporate resolution documents are official records that outline decisions made by a corporation's shareholders or board of directors. They serve as formal agreements to document consent for key actions, such as opening bank accounts or approving major contracts. Using the Maine Reduce Capital - Resolution Form - Corporate Resolutions helps in creating precise and legally compliant documentation tailored to your needs.

Filling out a corporate resolution form is straightforward. Start by identifying your company’s name and the specific resolution you wish to create. Include the date, provide details about the actions approved, and ensure to include signatures from authorized individuals. The Maine Reduce Capital - Resolution Form - Corporate Resolutions simplifies this process with clear sections for completion.

Setting up an S Corporation in Maine begins with filing the necessary incorporation paperwork, including your Articles of Incorporation. Next, secure an EIN and file Form 2553 with the IRS to elect S Corp status. It is crucial to document your corporate resolutions properly, and resources like the Maine Reduce Capital - Resolution Form - Corporate Resolutions can provide valuable assistance throughout this process. Always consult a professional to navigate these steps effectively.

To form an S Corporation in Maine, start by selecting an appropriate business name and filing Articles of Incorporation with the Secretary of State. After that, you must obtain an EIN from the IRS and file Form 2553 to elect S Corporation status. Finally, ensure your corporate resolutions comply with all local laws. For assistance with the Maine Reduce Capital - Resolution Form - Corporate Resolutions, consider using uslegalforms to guide you through the process.

Choosing between an S Corporation and an LLC depends on your business goals and tax considerations. An S Corp may offer tax advantages at the corporate level, while an LLC provides flexibility in management and ownership. Both structures have unique benefits, so it's wise to evaluate your situation closely. To understand more about your options, the Maine Reduce Capital - Resolution Form - Corporate Resolutions can assist in making the best decision for your business.

Yes, you can set up an S Corporation on your own in Maine. The process involves filing specific documents with the state and obtaining an Employer Identification Number (EIN) from the IRS. While it is possible to navigate the process alone, consider utilizing resources from platforms like uslegalforms to simplify your corporate resolutions and ensure compliance with all regulations.