Maine Accounts Receivable - Guaranty

Description

How to fill out Accounts Receivable - Guaranty?

Are you in the place where you will need papers for possibly company or personal reasons almost every day time? There are plenty of lawful document layouts accessible on the Internet, but discovering kinds you can depend on is not simple. US Legal Forms offers a huge number of form layouts, much like the Maine Accounts Receivable - Guaranty, that are written to satisfy state and federal needs.

When you are already acquainted with US Legal Forms website and get a free account, just log in. Next, it is possible to download the Maine Accounts Receivable - Guaranty format.

If you do not provide an accounts and need to begin to use US Legal Forms, follow these steps:

- Obtain the form you will need and ensure it is for your correct metropolis/region.

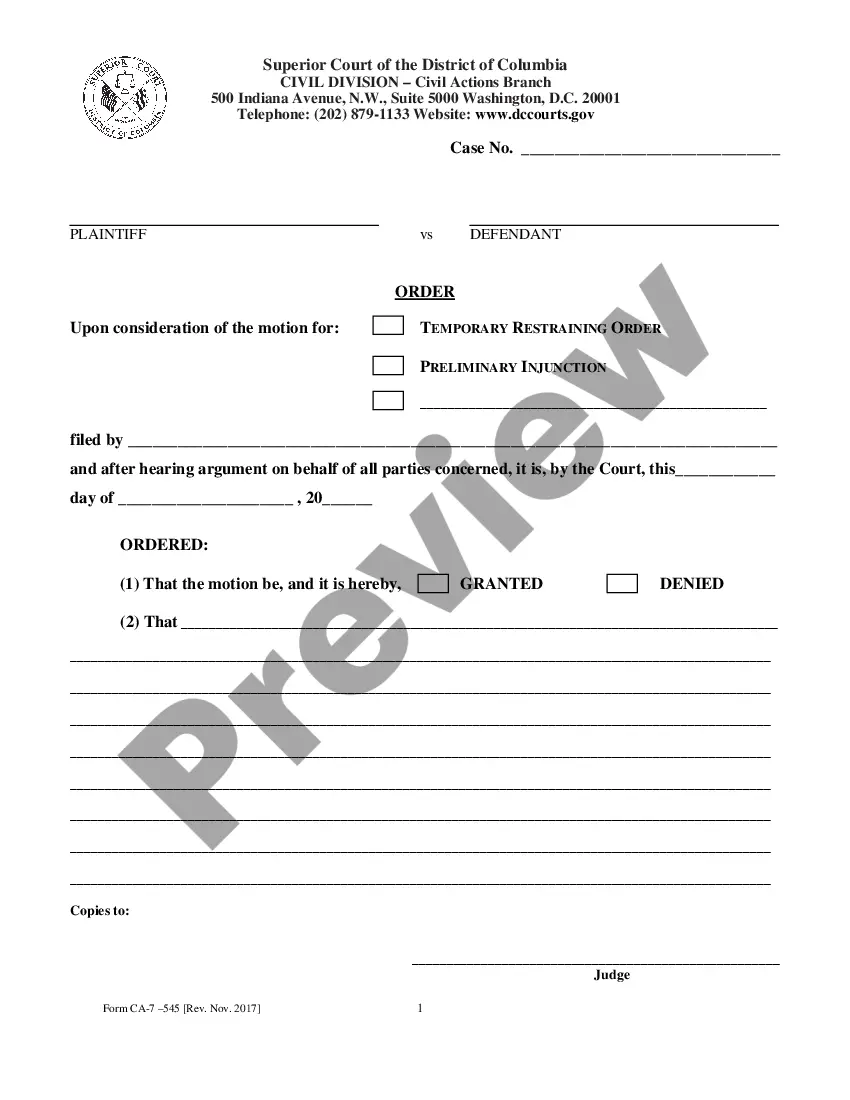

- Make use of the Preview button to examine the shape.

- See the outline to actually have selected the proper form.

- If the form is not what you are trying to find, utilize the Search discipline to find the form that meets your needs and needs.

- If you find the correct form, click Get now.

- Select the pricing plan you need, complete the required info to make your account, and buy an order making use of your PayPal or credit card.

- Choose a convenient file file format and download your copy.

Get all the document layouts you might have purchased in the My Forms food selection. You can obtain a further copy of Maine Accounts Receivable - Guaranty whenever, if necessary. Just go through the needed form to download or printing the document format.

Use US Legal Forms, one of the most comprehensive variety of lawful types, to save lots of time and prevent faults. The services offers skillfully created lawful document layouts which you can use for a range of reasons. Make a free account on US Legal Forms and start creating your lifestyle a little easier.

Form popularity

FAQ

The accrual basis of accounting recognizes revenues when earned (a product is sold or a service has been performed), regardless of when cash is received. Expenses are recognized as incurred, whether or not cash has been paid out.

The government-wide financial statements (i.e. the Statement of Net Position and the Statement of Activities) report information on all of the non-fiduciary activities of the primary government and its component units.

Explanation: In accrual basis accounting, expenses are recorded when they are incurred, not when the related cash transaction happens.

Under accrual accounting, revenue is recognized: when cash is received, and expenses, when cash is paid.

The revenue recognition principle is a key component of accrual-basis accounting. This accounting method recognizes the revenue once it is considered earned, unlike the alternative cash-basis accounting, which recognizes revenue at the time cash is received.

Accrual-Basis Accounting Transactions recorded in the periods in which the events occur. Revenues are recognized when services performed, even if cash was not received. Expenses are recognized when incurred, even if cash was not paid.