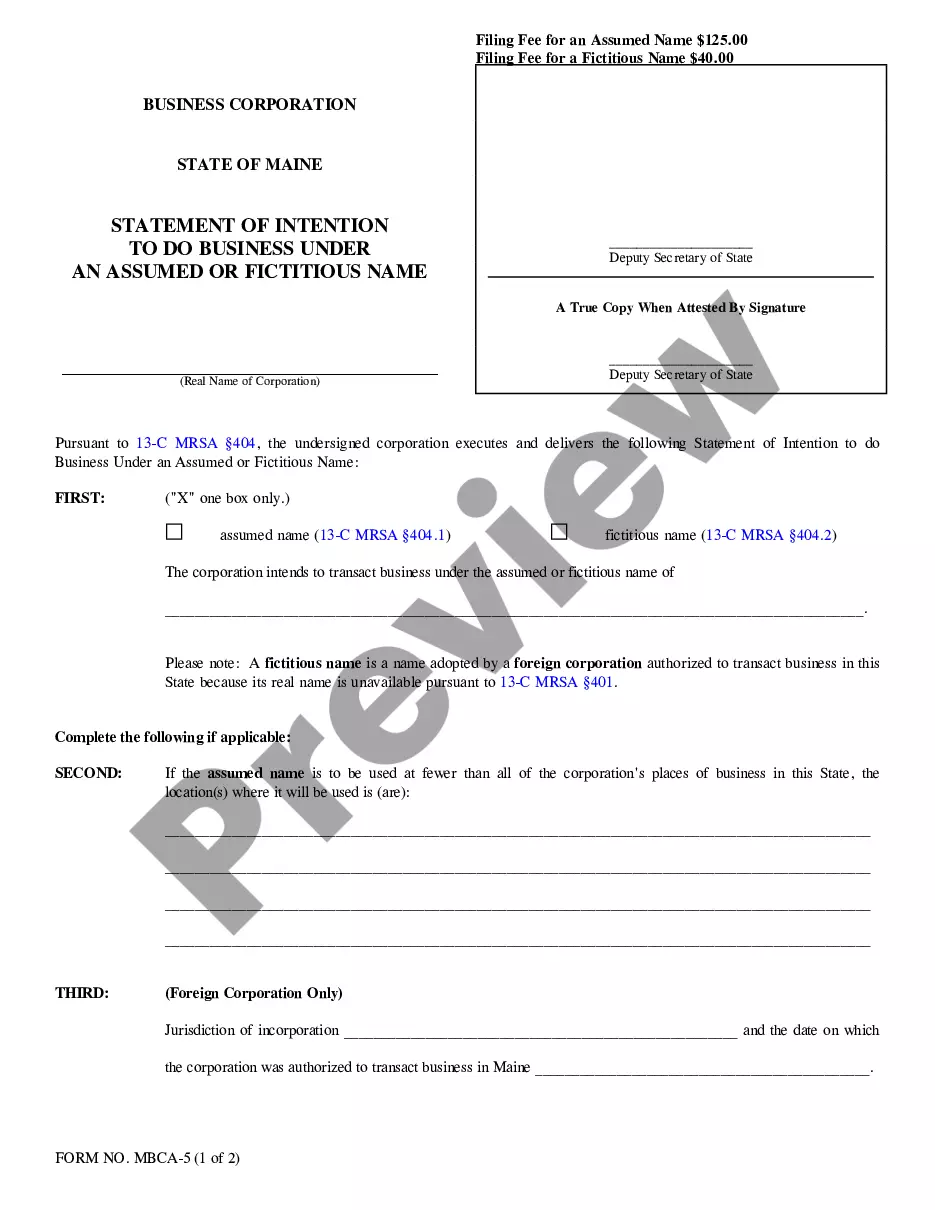

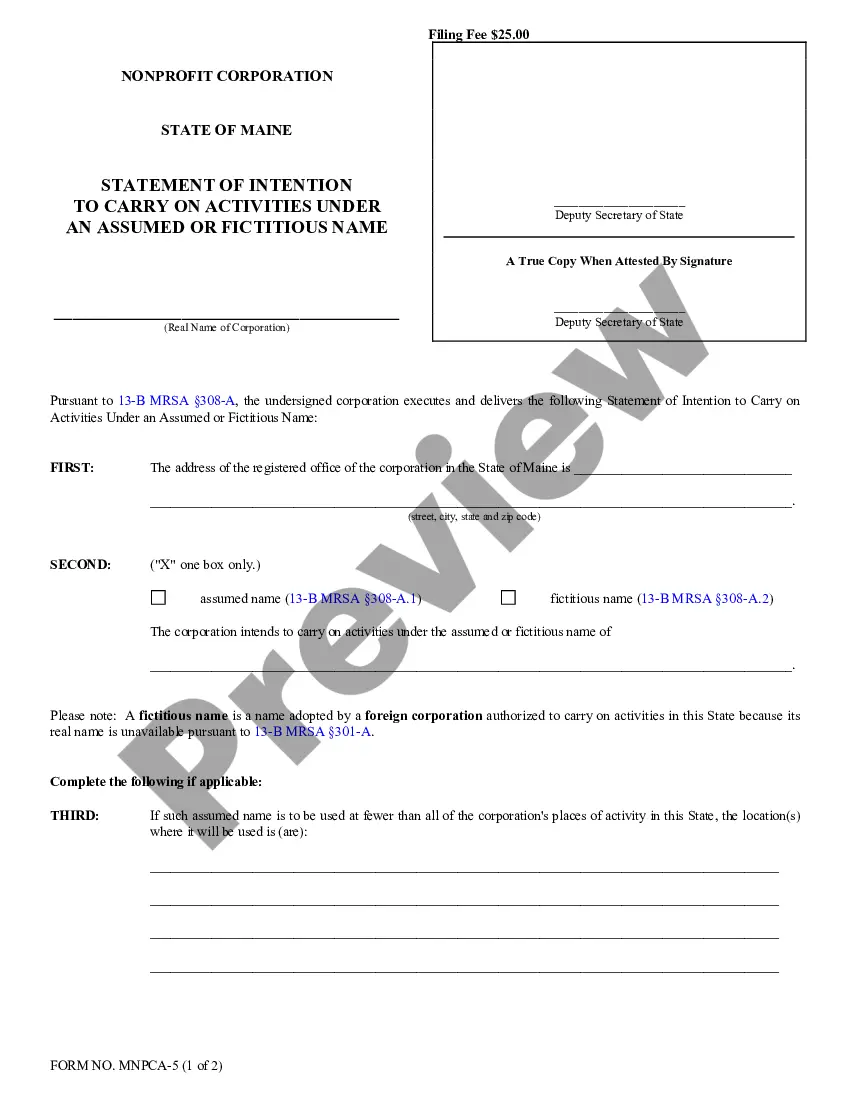

The Maine Statement of Intention To Carry On Activities Under Assumed Or Fictitious Name is a legal document filed with the Secretary of State in Maine that allows an individual or business to conduct activities under a name other than their legal name. This document is often used by businesses to conduct activities under a “Doing Business As” (DBA) name, or by individuals who use a pseudonym to conduct business activities. This document must provide the assumed or fictitious name that the individual or business intends to use, the legal name and address of the individual or business filing the statement, and a statement that the individual or business is conducting business under the assumed or fictitious name. The statement also must be signed by the individual or business filing the statement and a notary public. There are two types of Maine Statement of Intention To Carry On Activities Under Assumed Or Fictitious Name: a statement of intention for a corporation and a statement of intention for a sole proprietor. The statement for a corporation must include the name of the corporation, the state of incorporation, and the name of the corporation's registered agent. The statement for a sole proprietor must include the name of the individual and the address of the individual's primary place of business.

Maine Statement of Intention To Carry On Activities Under Assumed Or Fictitious Name

Description

How to fill out Maine Statement Of Intention To Carry On Activities Under Assumed Or Fictitious Name?

US Legal Forms is the easiest and most lucrative method to find appropriate legal templates.

It’s the largest online collection of business and personal legal documentation crafted and verified by legal experts.

Here, you can discover printable and fillable forms that adhere to federal and local standards - just like your Maine Statement of Intention To Carry On Activities Under Assumed Or Fictitious Name.

Review the form description or preview the document to confirm you’ve found the one that satisfies your needs, or search for another using the search tab above.

Click Buy now when you’re certain of its compatibility with all the requirements, and choose the subscription plan you prefer.

- Acquiring your template involves just a few straightforward steps.

- Users already having an account with an active subscription only need to Log In to the web service and download the document to their device.

- Later, they can locate it in their profile under the My documents section.

- And here’s how you can obtain a correctly drafted Maine Statement of Intention To Carry On Activities Under Assumed Or Fictitious Name if you are utilizing US Legal Forms for the first time.

Form popularity

FAQ

The biggest difference between S corporations and LLCs is how they are taxed. S corporations are taxed as pass-through entities, meaning that the profits and losses are passed through to the shareholders' personal tax returns, while LLCs can choose to be taxed as either a pass-through entity or a corporation.

One major advantage of an S corporation is that it provides owners limited liability protection, regardless of its tax status. Limited liability protection means that the owners' personal assets are shielded from the claims of business creditors?whether the claims arise from contracts or litigation.

To find your LLC's Charter Number, you can look at your approved Certificate of Formation. You can also search your LLC's name in Maine's Corporate Name Search tool, click ?Information Summary? to the right, then look for your Charter Number at the top.

To have a California S corporation, you'll need to create either a limited liability company (LLC) or a C corporation (the default form of corporation) if you haven't already done so. Then, you'll file an election form with the Internal Revenue Service (IRS).

How to Start an S-Corp in Maine Choose a name.Choose a ME Registered Agent.Choose Directors or Members/Managers.File ME Articles of Incorporation or Certificate of Formation.File Form 2553 to turn the business into an S Corporation.

LLCs can have an unlimited number of members; S corps can have no more than 100 shareholders (owners). Non-U.S. citizens/residents can be members of LLCs; S corps may not have non-U.S. citizens/residents as shareholders. S corporations cannot be owned by corporations, LLCs, partnerships or many trusts.

How much does a DBA filing cost in Maine? The DBA filing fee for sole proprietors and partnerships is $10. Maine does not offer any expedited services. For LLCs and incorporated companies, the DBA cost is $125 for an assumed name.