This package contains the forms that are necessary for a person to effectively protect their identifying information and reduce the risk of identity theft. It is designed to assist a person in protecting their credit, financial assets, and job opportunities, as well as preventing the misuse of benefits, false arrests, and other fraudulent uses of their identification. The documents in this package include the following:

1) Identity Theft Protection Guide;

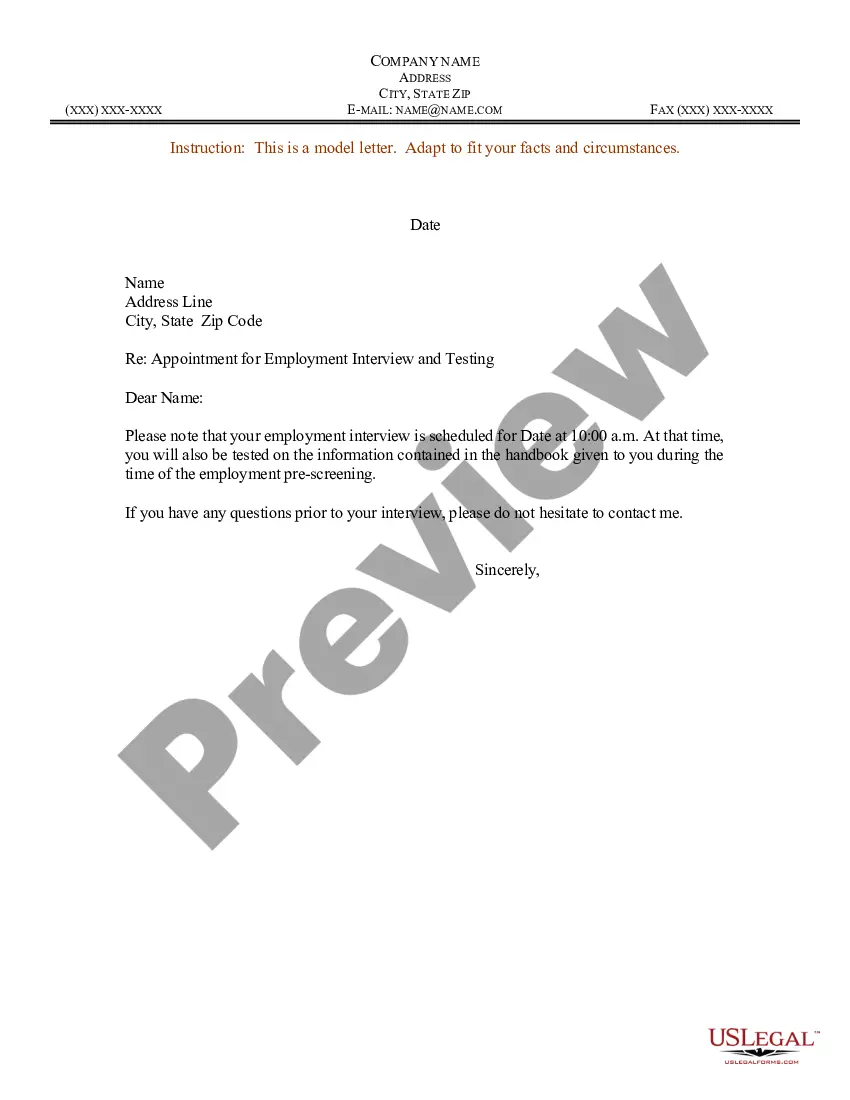

2) Letter to Credit Card Issuer Regarding Replacement Card;

3) Letter to Creditor or Service Provider Regarding Receipt of Bills;

4) Letter to Remove Name from Mail Marketing Lists;

5) Letter to Credit Reporting Bureaus or Agencies to Prevent Identity Theft;

Purchase this package and save up to 40% over purchasing the forms separately!