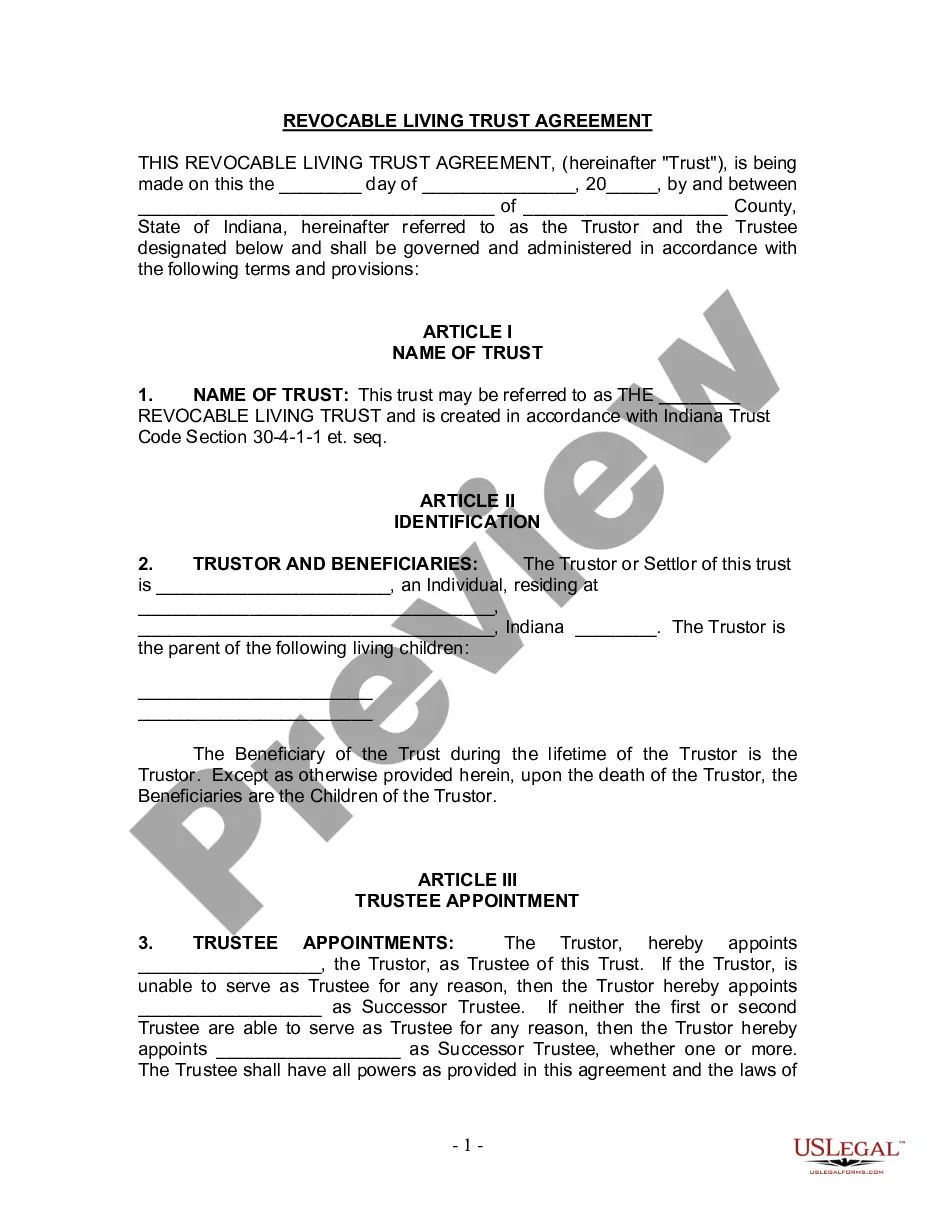

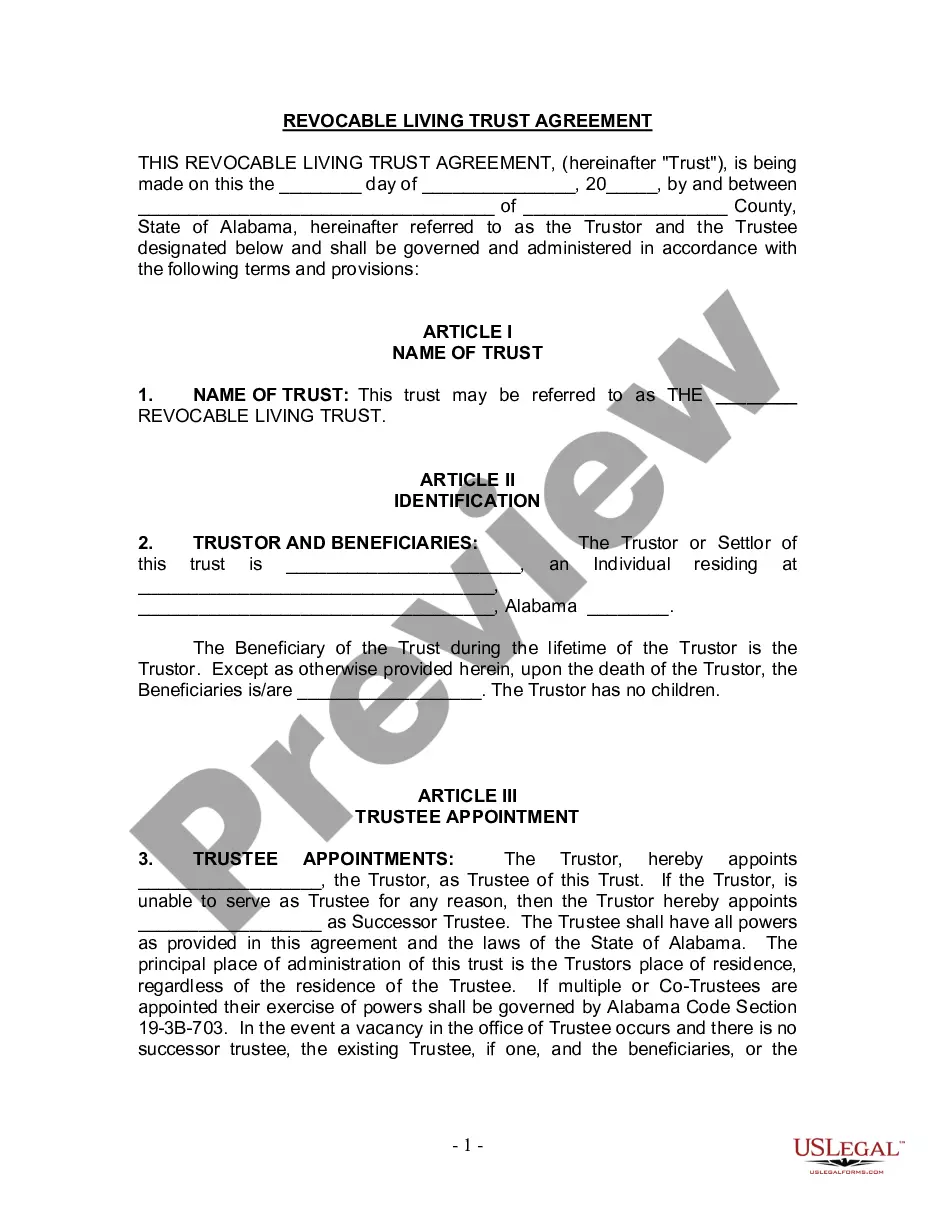

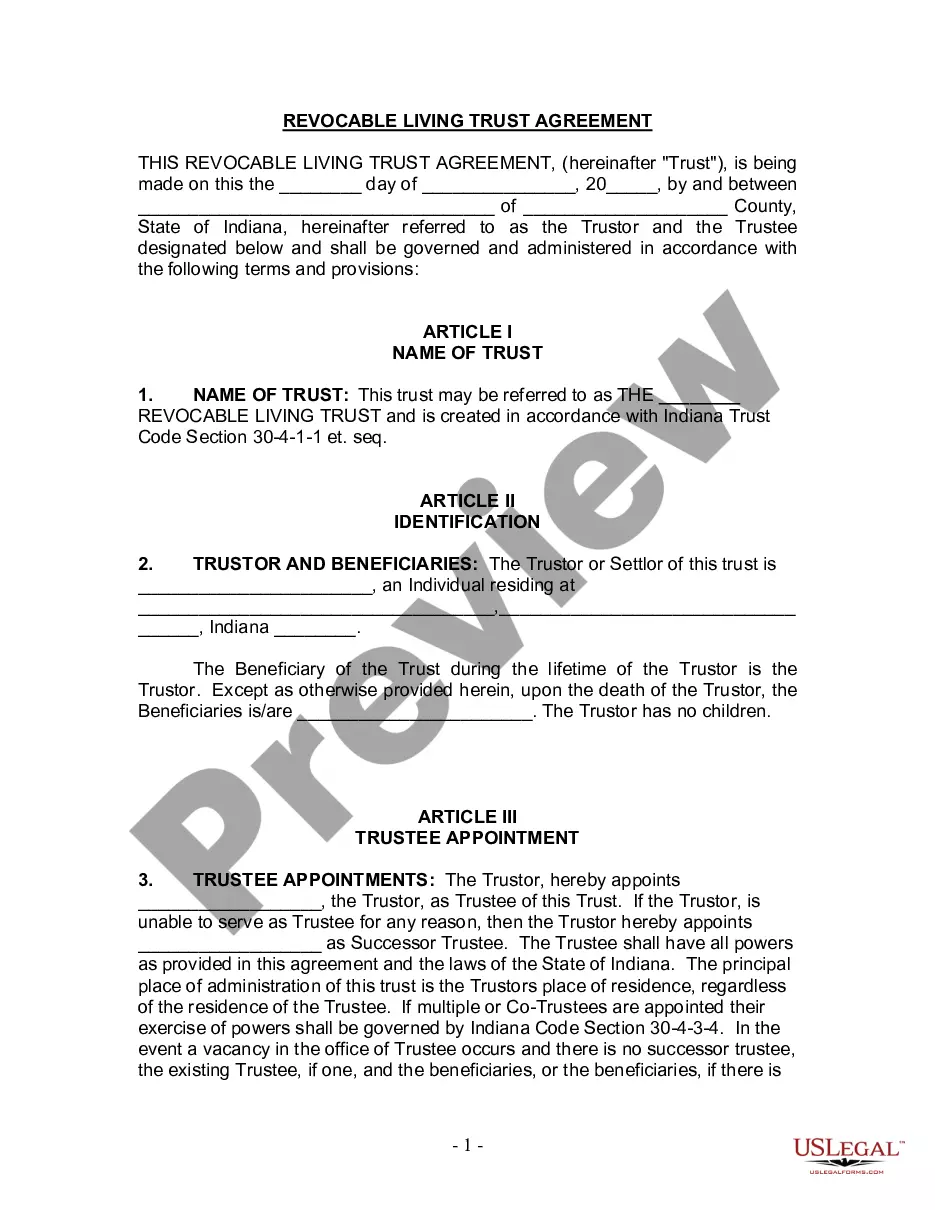

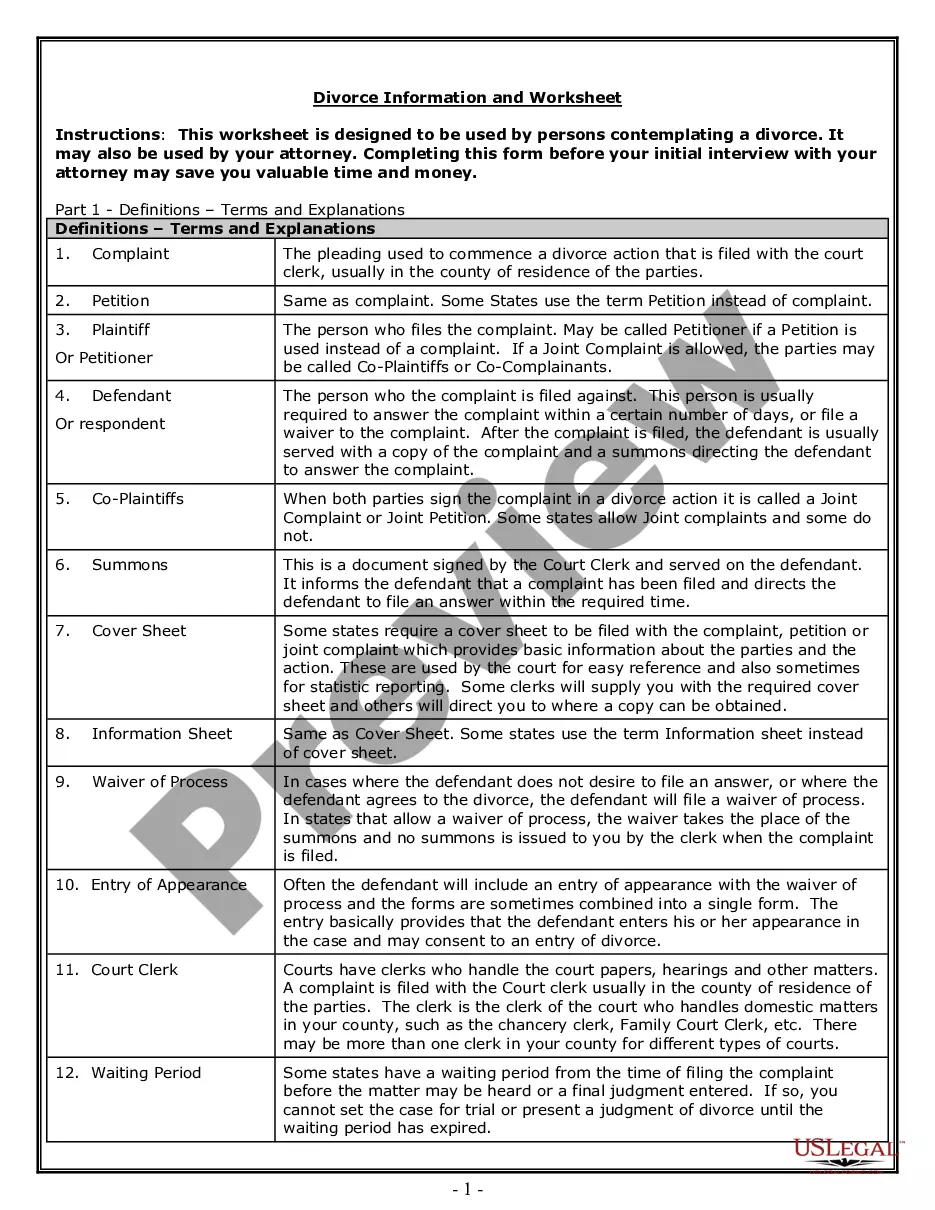

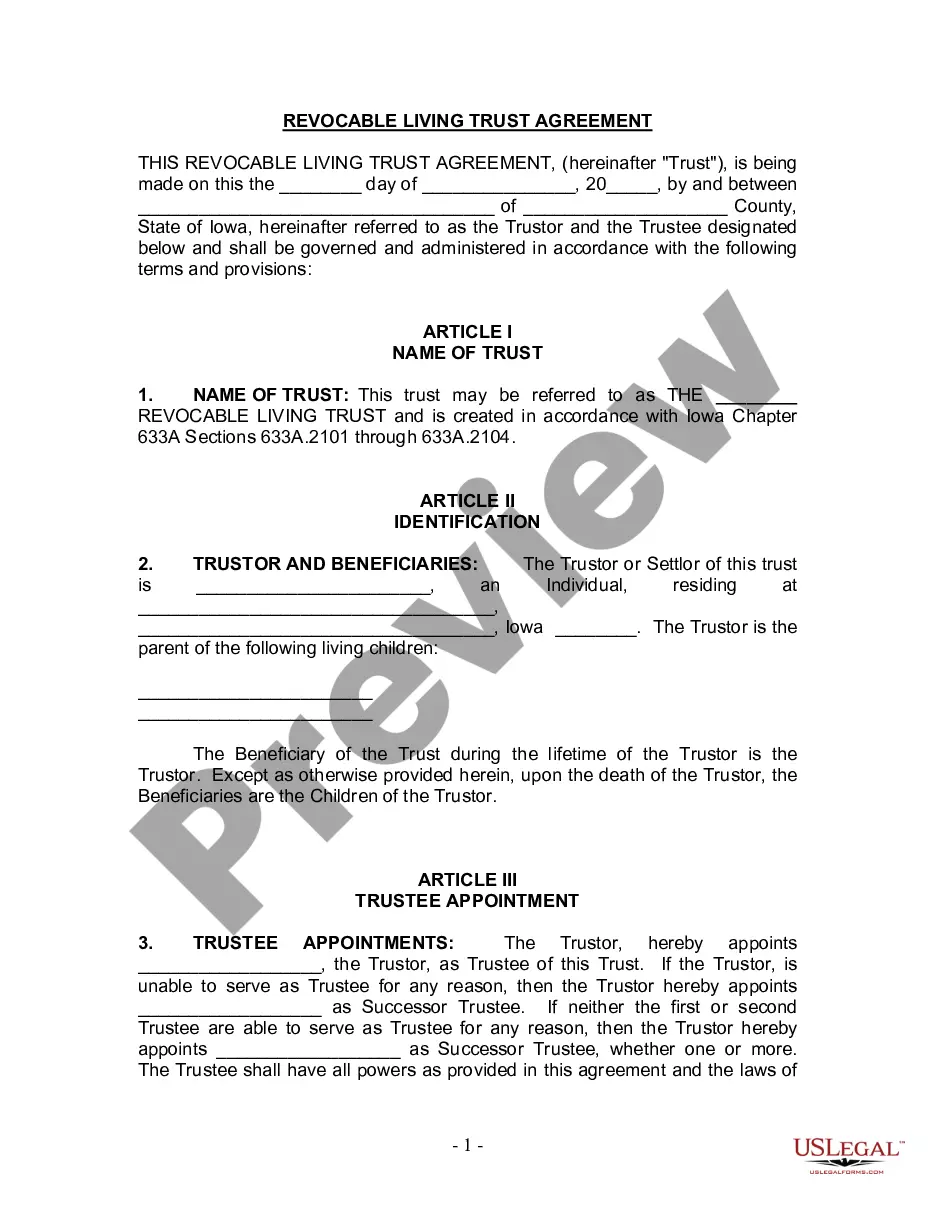

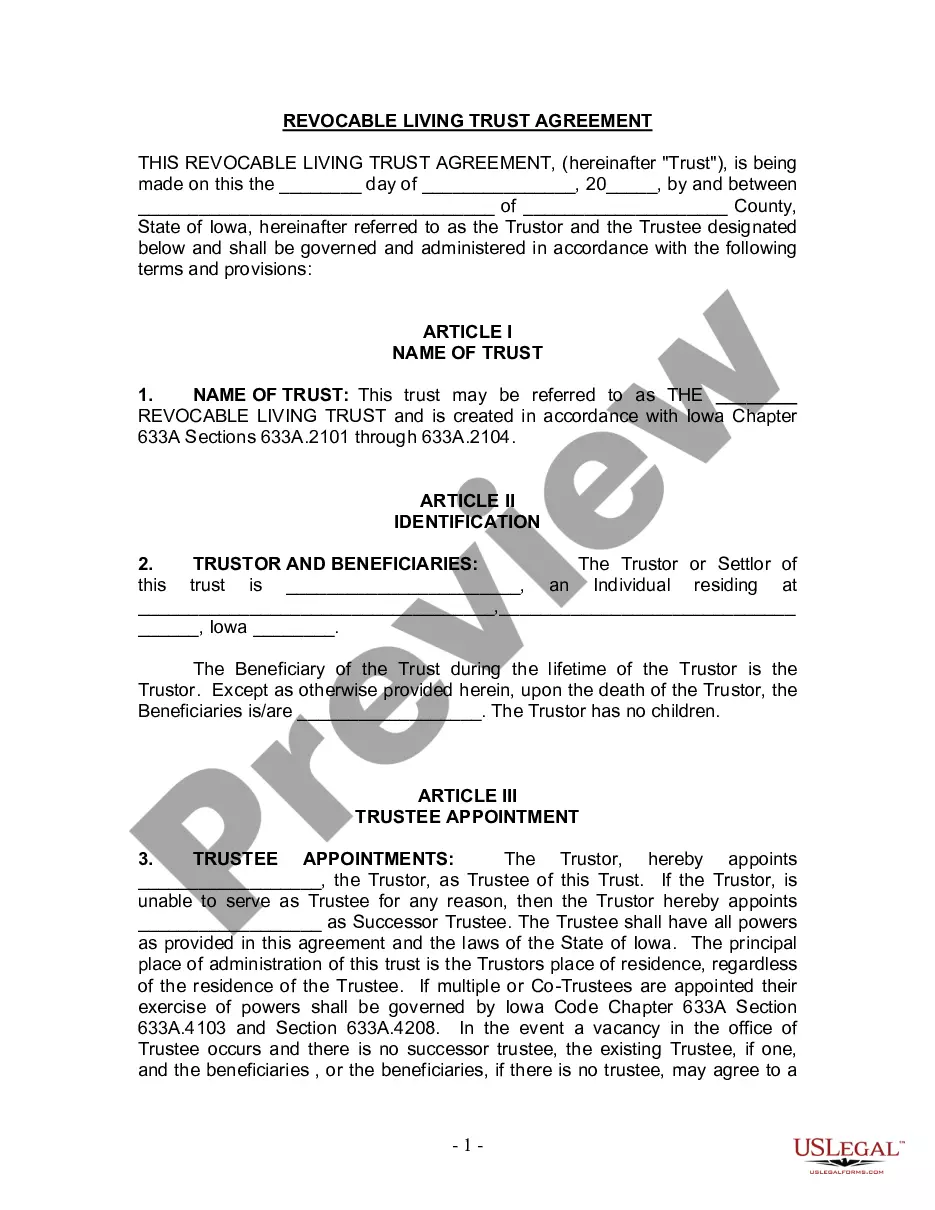

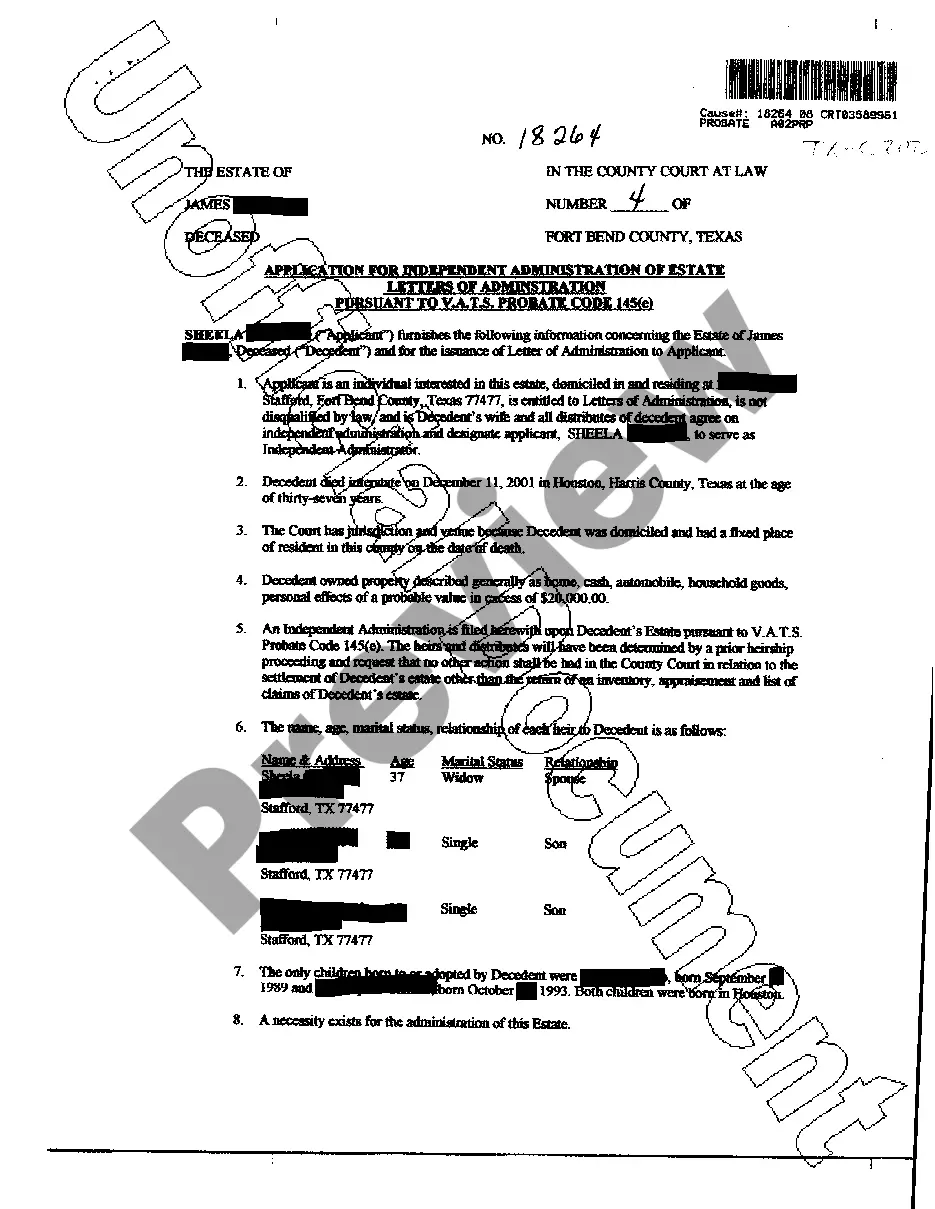

This Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children form is a living trust form prepared for your state. It is for an individual who is either single, divorced or widowed with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Maine Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children

Description

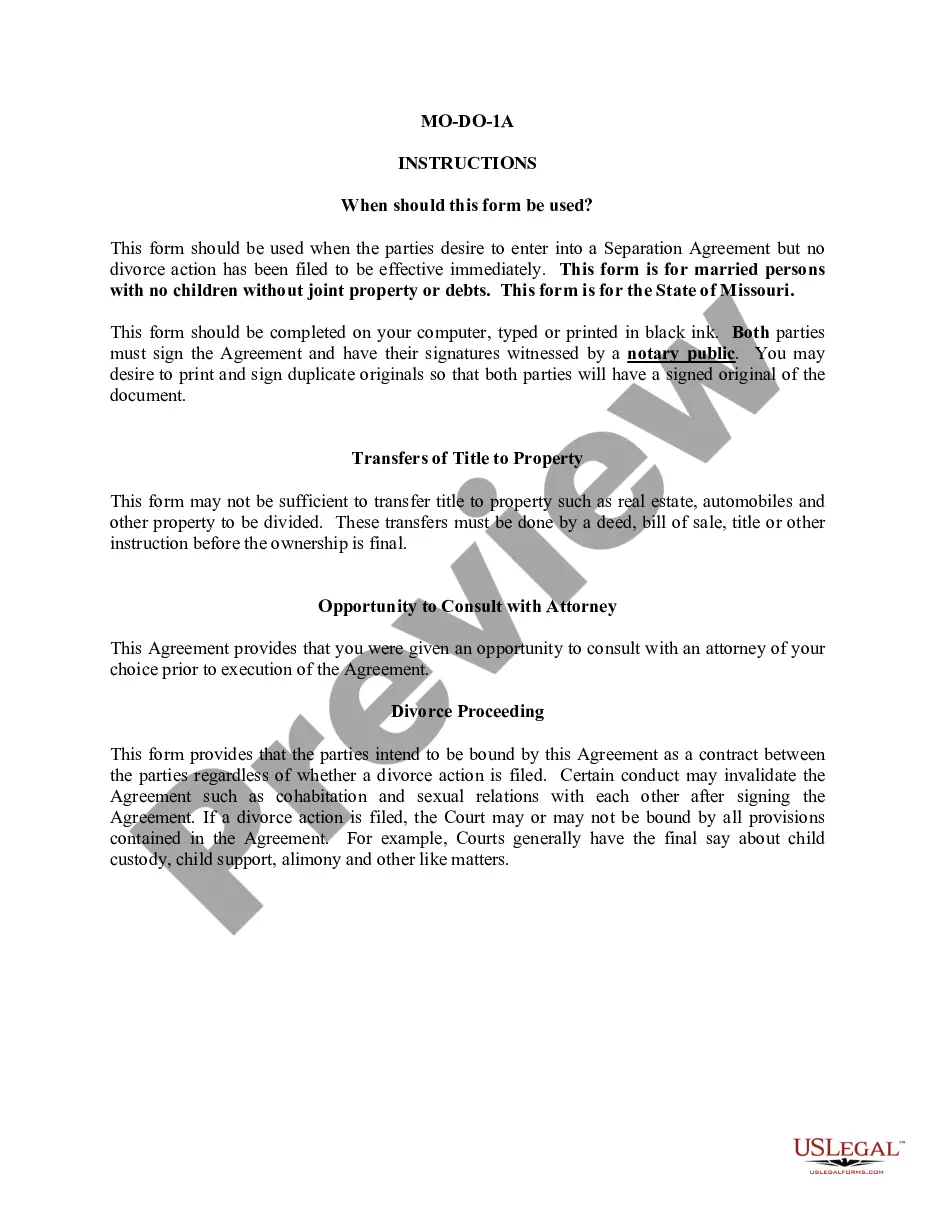

How to fill out Maine Living Trust For Individual Who Is Single, Divorced Or Widow (or Widower) With No Children?

Greetings to the most important collection of legal documents, US Legal Forms. Here, you can discover various templates, including the Maine Living Trust for Individuals Who Are Unmarried, Divorced, or Widowed (with No Children), and download as many as you require.

Prepare official paperwork in just a few hours instead of days or even weeks, without incurring hefty costs from an attorney. Obtain the state-specific form in just a few clicks, and rest easy knowing it was created by our certified legal experts.

If you are already a registered user, simply Log Into your account and select Download next to the Maine Living Trust for Individuals Who Are Unmarried, Divorced, or Widowed (with No Children) that you need. Since US Legal Forms is an online resource, you will always have access to your downloaded forms, regardless of the device you use. Find them in the My documents section.

Print the document and fill it in with your or your company's information. After completing the Maine Living Trust for Individuals Who Are Unmarried, Divorced, or Widowed (with No Children), consult your attorney for verification. It’s an important step to ensure you’re fully protected. Join US Legal Forms today and gain access to a plethora of reusable templates.

- If you haven’t created an account yet, what are you waiting for.

- Verify the validity of the state-specific document in your residence state.

- Review the description (if available) to ensure it’s the correct template.

- Utilize the Preview feature to see additional content.

- If the sample fulfills all your requirements, simply click Buy Now.

- To establish an account, choose a pricing plan.

- Register using a credit card or PayPal account.

- Download the template in your preferred format (Word or PDF).

Form popularity

FAQ

A living trust, specifically a revocable living trust, is a legal document that places your assetsinvestments, bank accounts, real estate, vehicles and valuable personal propertyin trust for your benefit during your lifetime, and spells out where you'd like these things to go upon your death.

Bank accounts. Brokerage or investment accounts. Retirement accounts and pension plans. A life insurance policy.

Property in a living trust. One of the ways to avoid probate is to set up a living trust. Retirement plan proceeds, including money from a pension, IRA, or 401(k) Stocks and bonds held in beneficiary. Proceeds from a payable-on-death bank account.

A will can also be declared invalid if someone proves in court that it was procured by undue influence. This usually involves some evil-doer who occupies a position of trust -- for example, a caregiver or adult child -- manipulating a vulnerable person to leave all, or most, of his property to the manipulator instead

Paperwork. Setting up a living trust isn't difficult or expensive, but it requires some paperwork. Record Keeping. After a revocable living trust is created, little day-to-day record keeping is required. Transfer Taxes. Difficulty Refinancing Trust Property. No Cutoff of Creditors' Claims.

A living trust is designed to allow for the easy transfer of the trust creator or settlor's assets while bypassing the often complex and expensive legal process of probate. Living trust agreements designate a trustee who holds legal possession of assets and property that flow into the trust.

A living trust holds your assets during your lifetime and allows them to be distributed to the people you choose upon your death. To more easily understand how a living trust works, think of a trust as an empty box. You can put your assets into this box, including financial accounts and real estate.

An executor of a will cannot take everything unless they are the will's sole beneficiary.However, the executor cannot modify the terms of the will. As a fiduciary, the executor has a legal duty to act in the beneficiaries and estate's best interests and distribute the assets according to the will.

You and your spouse may have one of the most common types of estate plans between married couples, which is a simple will leaving everything to each other. With this type of plan, you leave all of your assets outright to your surviving spouse. The kids or other beneficiaries only get something after you are both gone.