Maine Declaration of Trust

Description

How to fill out Maine Declaration Of Trust?

You are invited to the most crucial legal document repository, US Legal Forms. Here, you will discover any form like Maine Declaration of Trust templates and save them (as many as you desire/require). Prepare formal documents within a few hours, rather than days or even weeks, without needing to spend a fortune on a lawyer. Obtain the state-specific sample in just a few clicks and feel confident knowing that it was created by our licensed attorneys.

If you're already a registered user, simply Log In to your account and click Download next to the Maine Declaration of Trust you wish to obtain. Since US Legal Forms is a web-based solution, you’ll always have access to your saved forms, regardless of what device you are using. Find them under the My documents section.

If you haven't created an account yet, what are you waiting for? Follow our guidelines below to begin.

Once you've finalized the Maine Declaration of Trust, forward it to your lawyer for validation. It’s an additional step but an essential one to ensure you’re fully protected. Sign up for US Legal Forms today and gain access to numerous reusable templates.

- If this is a state-specific template, verify its relevance in your state.

- Examine the description (if available) to determine if it’s the correct form.

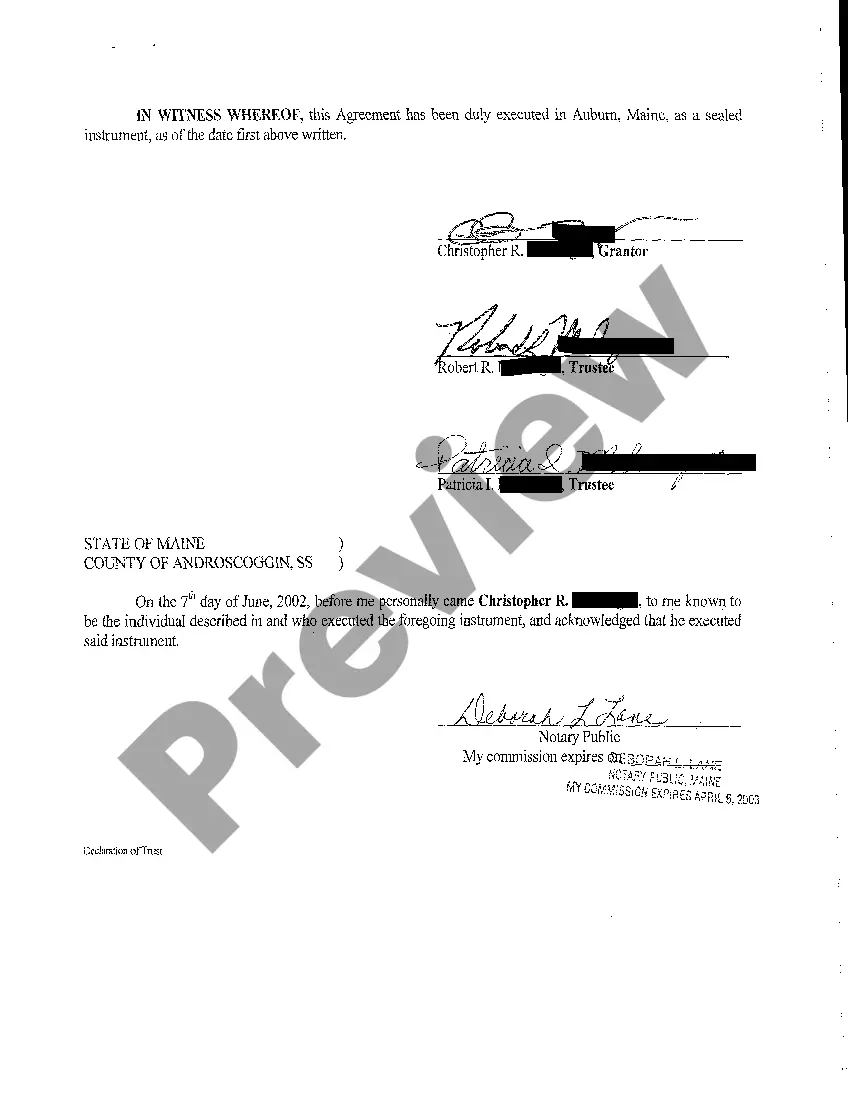

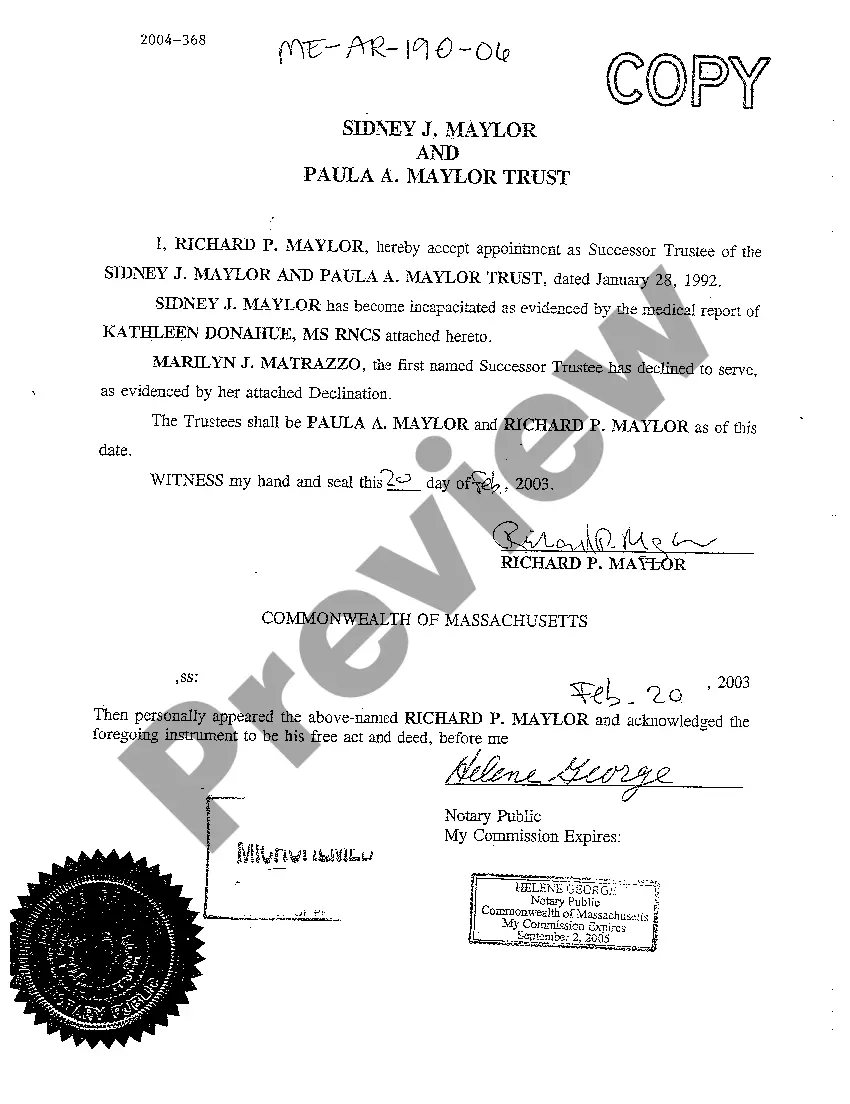

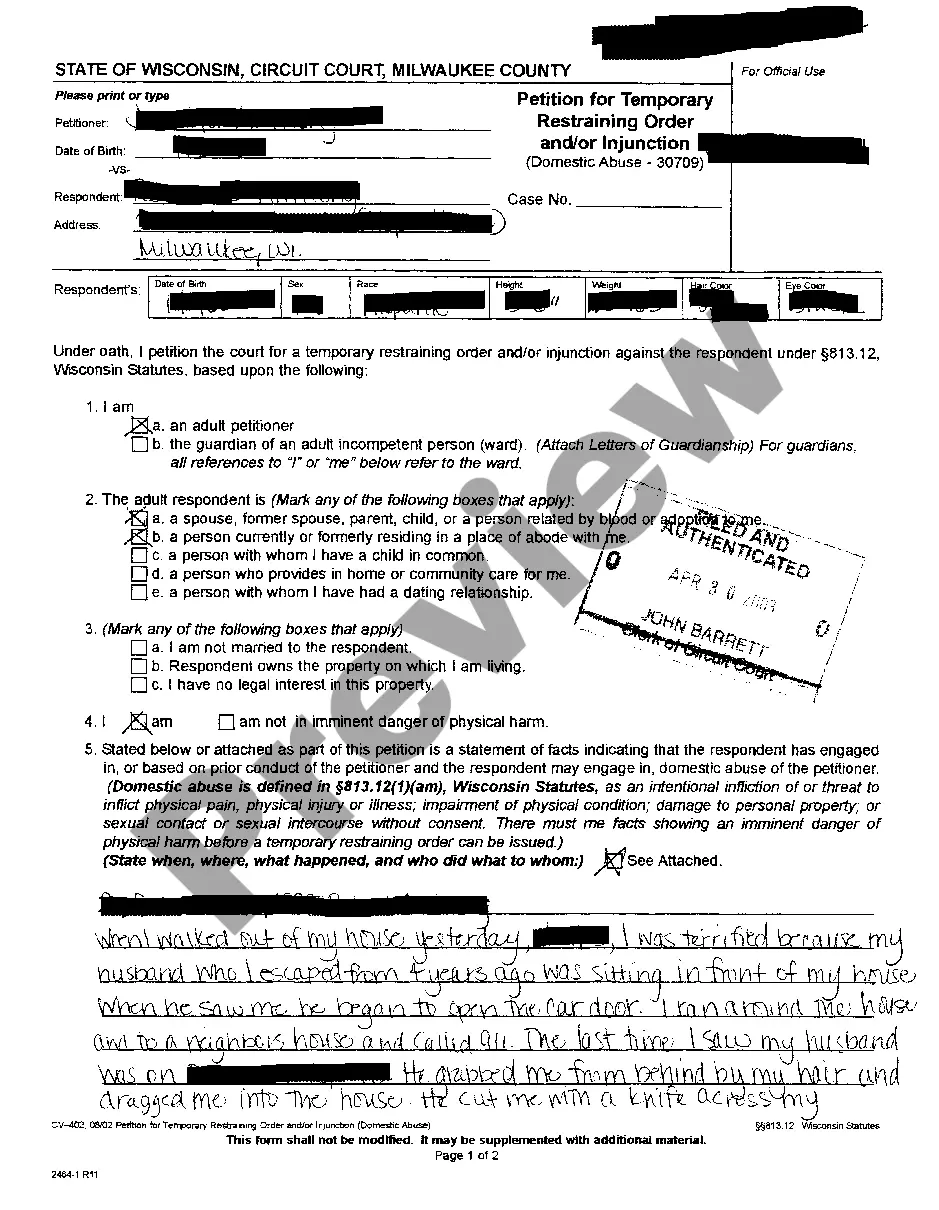

- Explore more details using the Preview feature.

- If the template suits your needs, click Buy Now.

- To create an account, choose a pricing option.

- Utilize a credit card or PayPal account to register.

- Save the form in the format you prefer (Word or PDF).

- Print the document and complete it with your/your business’s information.

Form popularity

FAQ

A Declaration of Trust (also known as a Deed of Trust) is a legally binding document in which the legal owners of the property declare that they hold the property on trust for the beneficial owners and sets out the shares in which the beneficial interests are held.

Once a declaration of trust has been executed, subsequent declarations can be issued to confirm current terms or amend the existing agreement. Depending on the jurisdiction, the declaration of trust can also be referred to as a trust agreement or a trust document.

The declaration of trust is your trust. The certificate of trust is not needed but can help keep things private and provide a easier way to open bank or stock accounts...

A trust is traditionally used for minimizing estate taxes and can offer other benefits as part of a well-crafted estate plan. A trust is a fiduciary arrangement that allows a third party, or trustee, to hold assets on behalf of a beneficiary or beneficiaries.

A trust is a fiduciary relationship in which one party, known as a trustor, gives another party, the trustee, the right to hold title to property or assets for the benefit of a third party, the beneficiary.

A document in which a person declares that he holds (or two or more persons declare that they hold) assets on trust for the benefit of one or more beneficiaries.

A trust is a type of legal relationship that arises where at least one entity holds property on behalf of another entity. The entity which holds the property is called a trustee, and is subject to specific duties as a result of that role. The entity which the trustee holds the property for is called a beneficiary.

The key characteristic of a trust is that it permits the separation of legal ownership and beneficial interest: the trustees become the owners of the trust property as far as third parties are concerned, and the beneficiaries are entitled to expect that the trustees will manage the trust property for their benefit.

What is a Trust Will? A Trust is a legal structure which can be included as part of your Will and can offer increased asset protection for your loved ones. These types of Wills are called Trust Wills. We would always recommend that you consider the benefits of setting up a Trust as part of your Will.