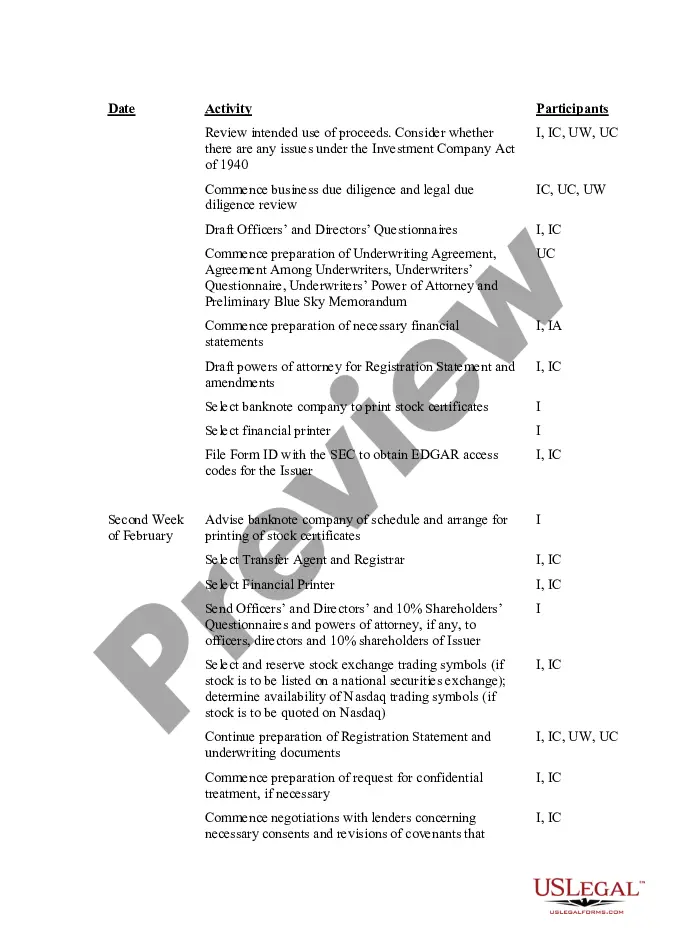

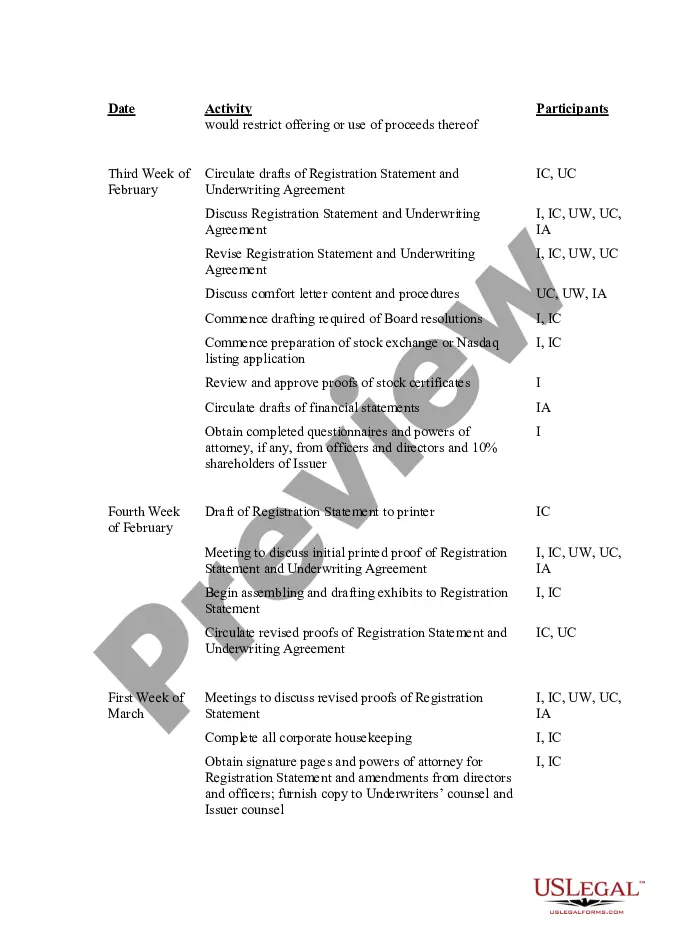

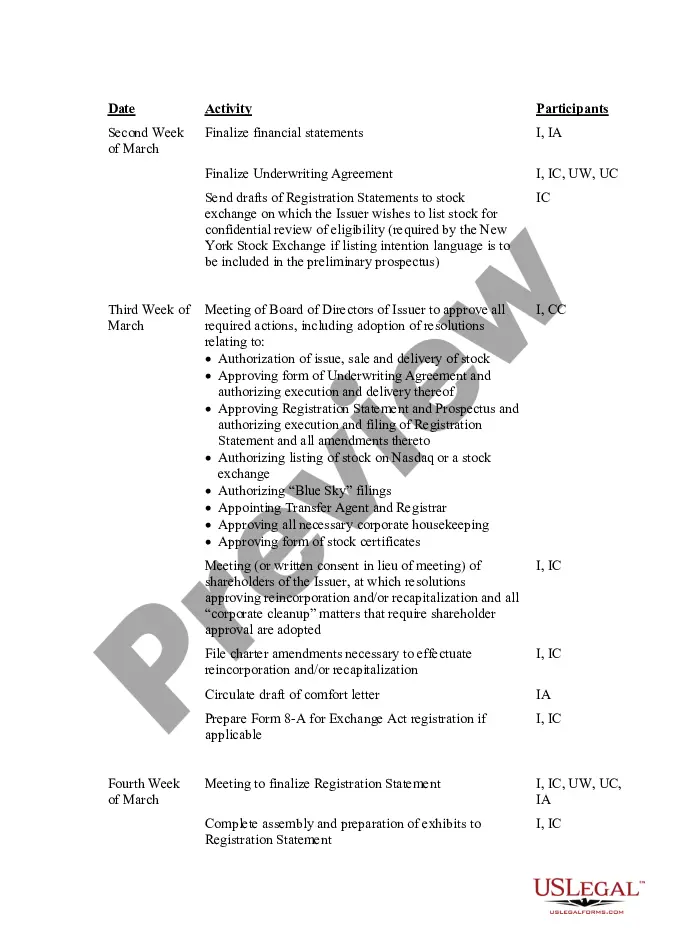

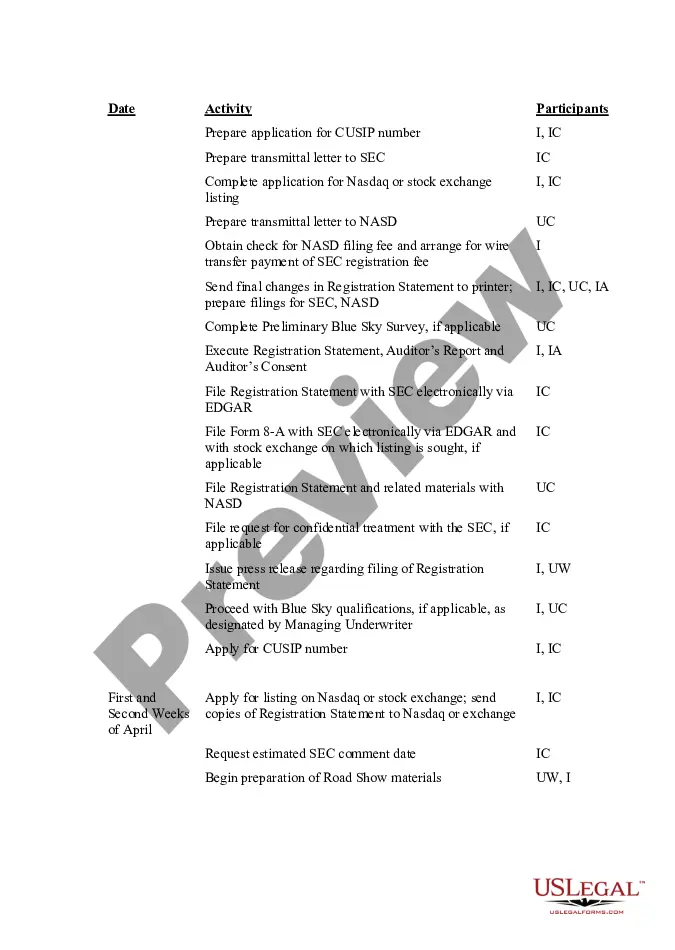

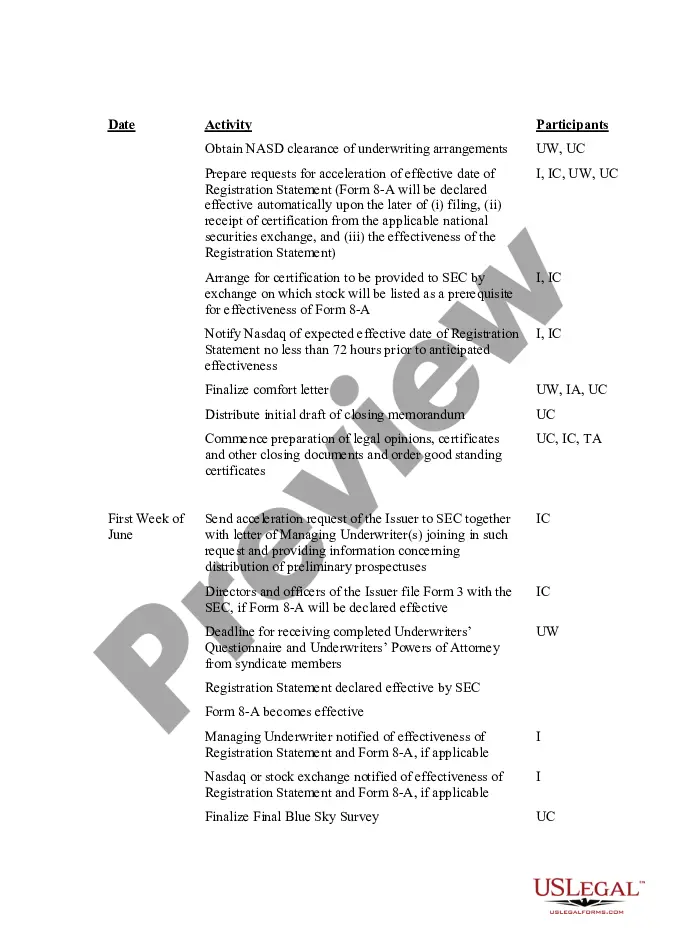

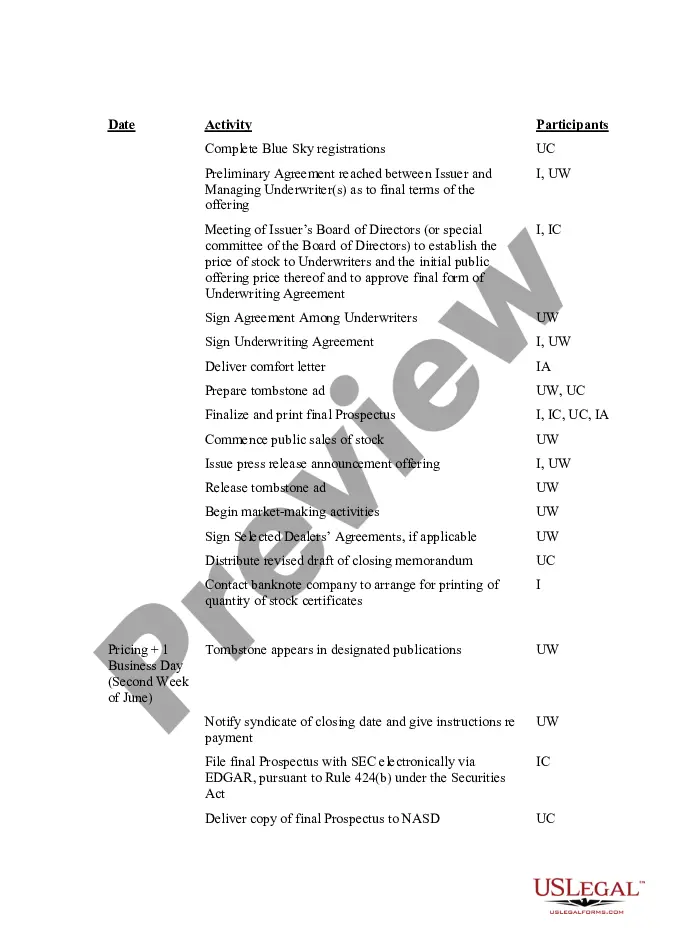

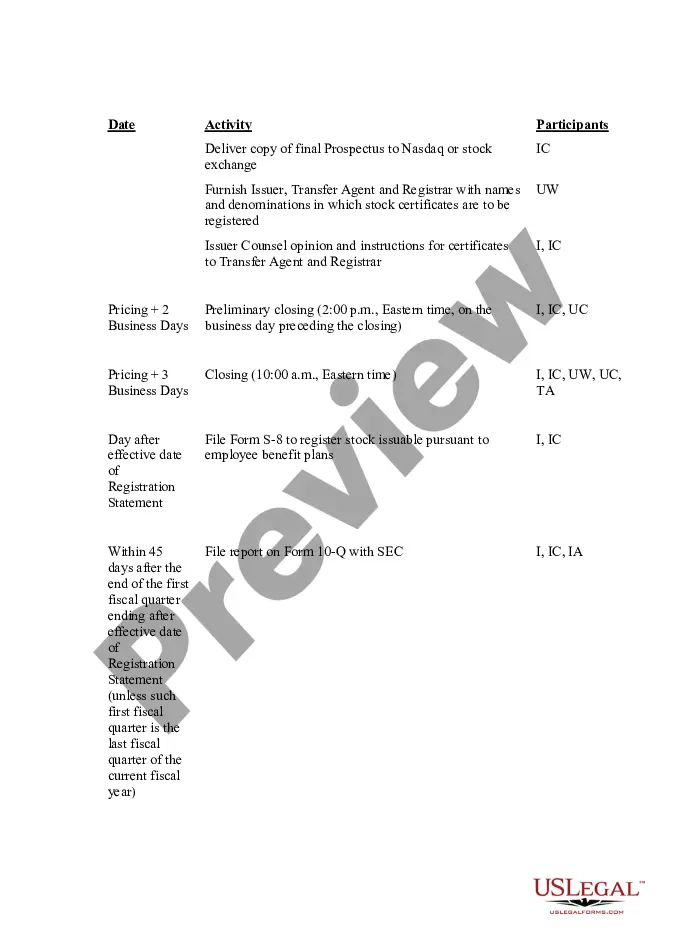

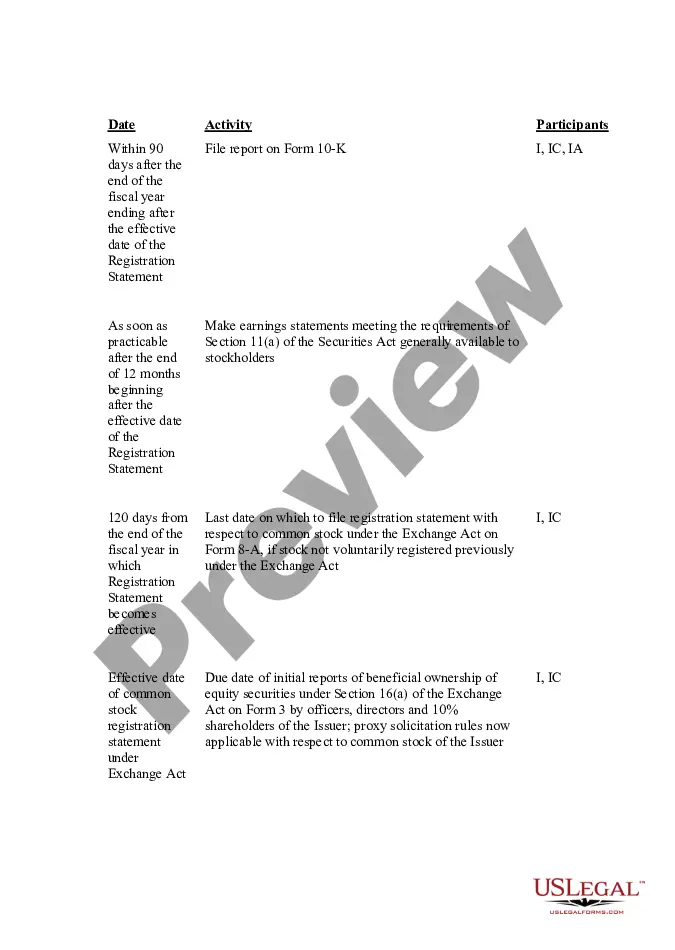

This IPO Time and Responsibility Schedule details, week by week, the tasks to be performed in the months leading up to the IPO. It lists the activities to be undertaken and the participants assigned to each task.

Maryland IPO Time and Responsibility Schedule

Description

How to fill out IPO Time And Responsibility Schedule?

It is possible to devote hours on the web searching for the authorized document format that fits the state and federal specifications you want. US Legal Forms offers thousands of authorized kinds which can be examined by pros. It is possible to acquire or printing the Maryland IPO Time and Responsibility Schedule from our support.

If you already have a US Legal Forms profile, you are able to log in and then click the Acquire switch. Afterward, you are able to total, revise, printing, or signal the Maryland IPO Time and Responsibility Schedule. Each and every authorized document format you buy is your own property for a long time. To have one more copy for any purchased kind, visit the My Forms tab and then click the corresponding switch.

If you use the US Legal Forms web site the very first time, stick to the simple guidelines under:

- Initially, ensure that you have selected the correct document format for the area/city that you pick. See the kind outline to ensure you have picked the correct kind. If available, use the Preview switch to look throughout the document format too.

- If you would like get one more variation from the kind, use the Research industry to obtain the format that meets your requirements and specifications.

- After you have found the format you desire, just click Acquire now to carry on.

- Find the costs plan you desire, enter your accreditations, and sign up for a merchant account on US Legal Forms.

- Complete the transaction. You can utilize your Visa or Mastercard or PayPal profile to purchase the authorized kind.

- Find the formatting from the document and acquire it for your product.

- Make modifications for your document if required. It is possible to total, revise and signal and printing Maryland IPO Time and Responsibility Schedule.

Acquire and printing thousands of document layouts making use of the US Legal Forms site, that provides the most important selection of authorized kinds. Use skilled and status-particular layouts to handle your organization or specific needs.

Form popularity

FAQ

Evaluate your growth strategy and market viability. Prospective investors often value consistent revenues, strong earnings or growth potential, or a unique offering. Be prepared to communicate clearly and concisely to investors the ?why? behind the company's story, leadership team, and its objectives in going public. How do I know when I am ready to take my company public? SEC.gov ? capitalraising ? building-blocks SEC.gov ? capitalraising ? building-blocks

Things to Consider Before Going Public Is the timing right in your company's industry? ... Does your company have enough money to make a successful IPO? ... Is your company willing and able to fully commit to an IPO? ... Can your company afford the distraction of an IPO? ... Is your company set to look like a star performer? Ten Things to Think About before Making an Initial Public Offering findlaw.com ? business-finances ? ten-things... findlaw.com ? business-finances ? ten-things...

Many experts say when a startup's revenue hits $100 million, it's time to go public. But getting ready for an IPO shouldn't rely on your revenue; rather, the metric to use is your growth potential. Let's look at an example. How Big Does a Company Need to Be to Go Public? - Listing Partners listingpartners.com ? how-big-does-a-compa... listingpartners.com ? how-big-does-a-compa...

Any planned exchange listing will typically be disclosed in the prospectus for the IPO. The new public company will also be required on a going-forward basis to disclose certain information to the public, including its quarterly and annual financial statements on Forms 10-Q and 10-K.

A company that would like to conduct an IPO must complete several steps including filing a preliminary prospectus (referred to as a Red Herring) and registration statement to the SEC, develop a partnership with an investment bank for the bookbuilding process that determines the final IPO price (which is determined ...

Typically, underwriting fees range from 2% to 7% of the total offering size. These fees are paid to the underwriters as compensation for their services and can include expenses such as legal and accounting fees. In conclusion, the underwriting process is a critical component of the IPO process.

IPO preparation process Develop a Strong Understanding of Your Index. Any equity index comes with its own requirements. ... Put Together Your IPO Team. A good team is as important for an IPO as it is for due diligence. ... Construct a Board of Directors. ... Get the Timing Right. ... Preparing the Roadshow. ... Ongoing Communication.

IPO preparation phase External IPO advisors selection support. Internal controls, internal audit, risk and compliance management. GAAP conversion into international accounting standards, e.g., IFRS or US GAAP. Segment reporting and CSR reporting establishment. IPO readiness assessment | EY ? India ey.com ? en_in ? ipo ? readiness-assessment ey.com ? en_in ? ipo ? readiness-assessment