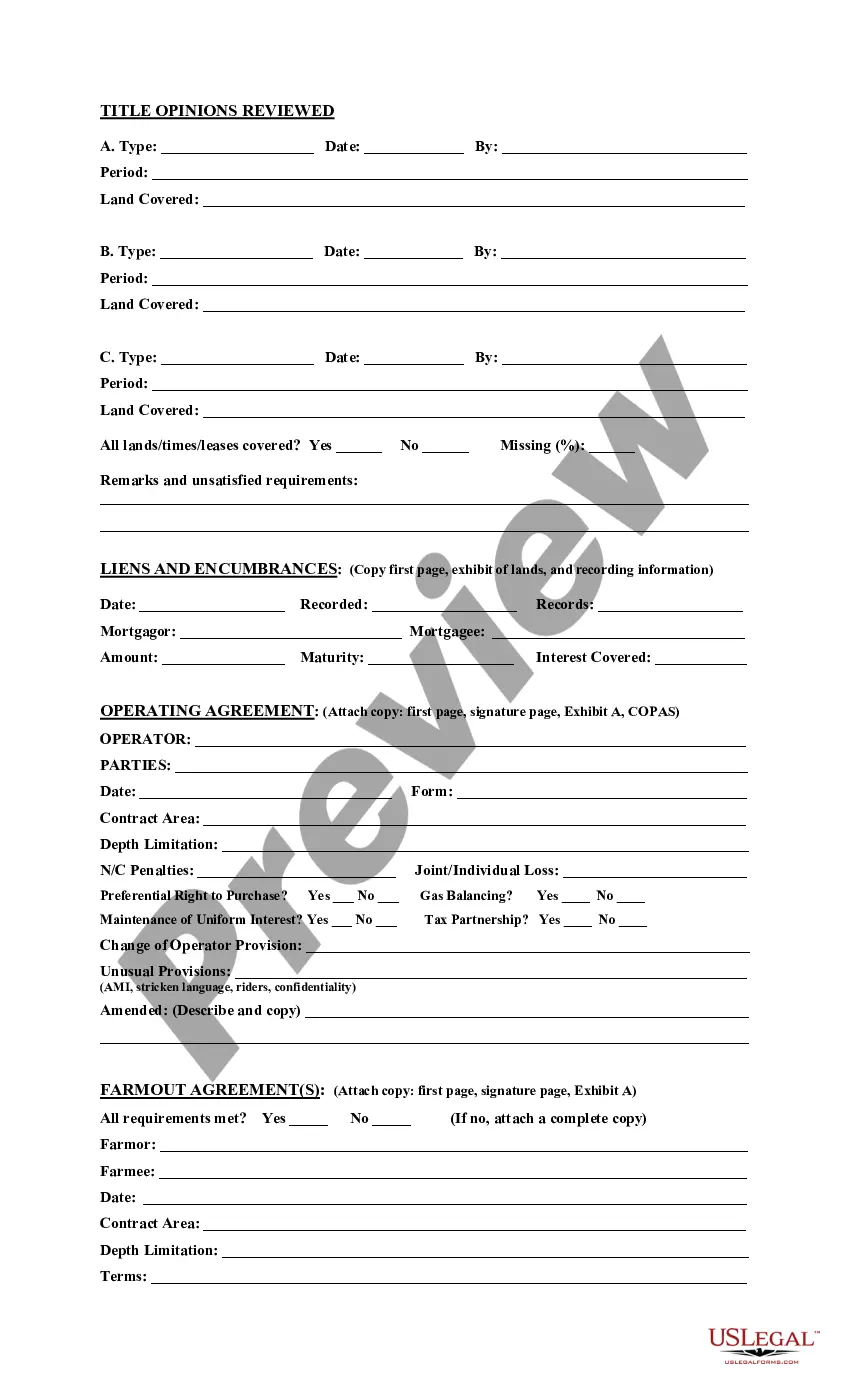

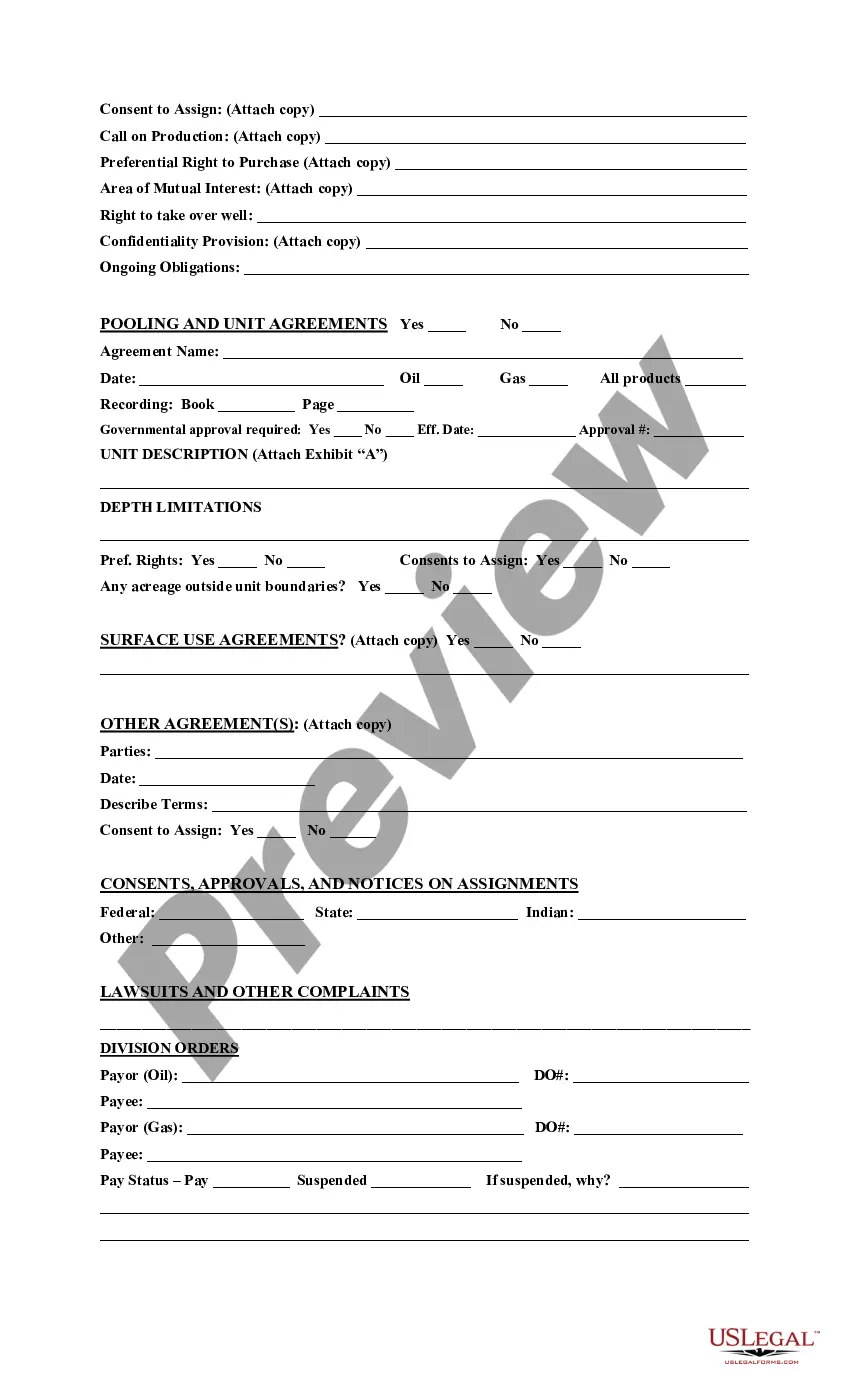

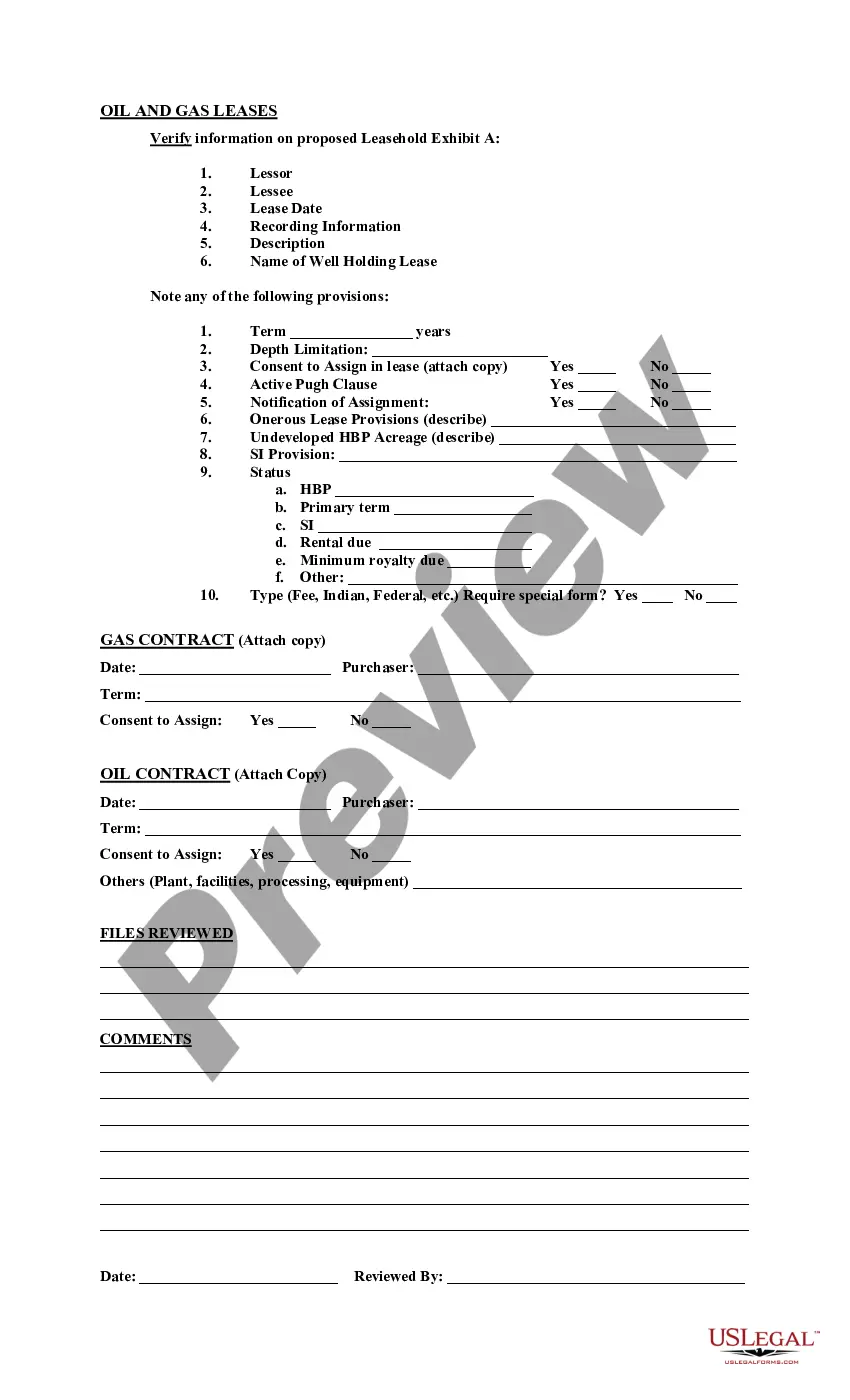

Maryland Acquisition Due Diligence Report

Description

How to fill out Acquisition Due Diligence Report?

If you want to complete, acquire, or produce legal papers templates, use US Legal Forms, the biggest assortment of legal varieties, that can be found on the web. Make use of the site`s easy and handy search to obtain the documents you require. Various templates for organization and person reasons are categorized by classes and states, or key phrases. Use US Legal Forms to obtain the Maryland Acquisition Due Diligence Report in a couple of mouse clicks.

When you are already a US Legal Forms client, log in to the bank account and click on the Download key to have the Maryland Acquisition Due Diligence Report. You can even access varieties you previously acquired in the My Forms tab of the bank account.

If you are using US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Ensure you have selected the shape for your correct metropolis/land.

- Step 2. Utilize the Review option to look over the form`s information. Do not overlook to see the information.

- Step 3. When you are unhappy with all the type, utilize the Look for field near the top of the screen to locate other variations from the legal type design.

- Step 4. After you have identified the shape you require, click the Acquire now key. Opt for the rates program you like and put your accreditations to sign up for the bank account.

- Step 5. Approach the transaction. You can utilize your credit card or PayPal bank account to accomplish the transaction.

- Step 6. Find the structure from the legal type and acquire it on your system.

- Step 7. Comprehensive, change and produce or sign the Maryland Acquisition Due Diligence Report.

Each and every legal papers design you get is your own property permanently. You may have acces to every type you acquired with your acccount. Click on the My Forms portion and select a type to produce or acquire once more.

Contend and acquire, and produce the Maryland Acquisition Due Diligence Report with US Legal Forms. There are thousands of skilled and state-distinct varieties you can utilize for your personal organization or person requires.

Form popularity

FAQ

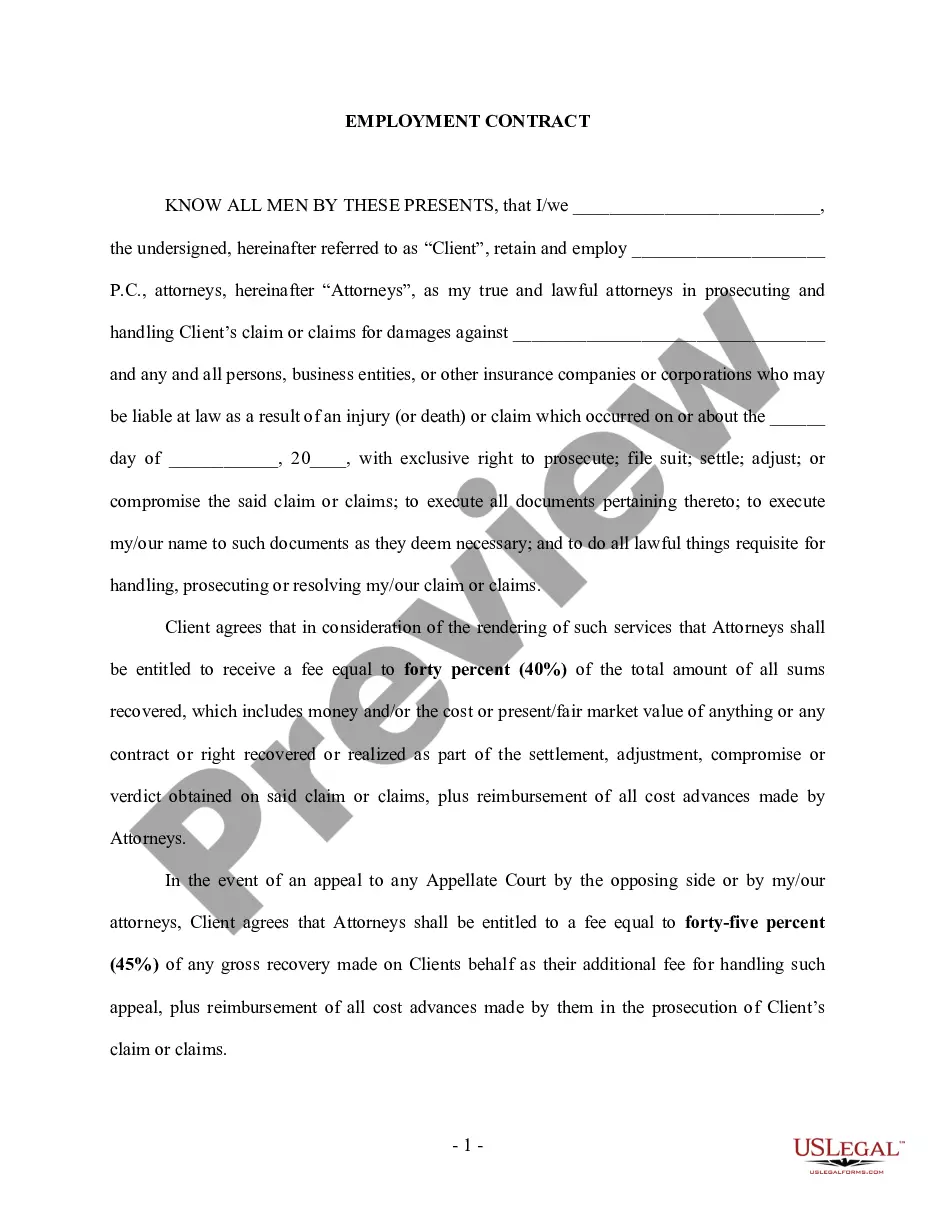

Legal due diligence is the process of collecting and assessing all of the legal documents and information relating to the target company. It gives both the buyer and seller the chance to scrutinize any legal risks, such as lawsuits or intellectual property details, before closing the deal.

The due diligence process helps stakeholders understand the synergies and potential scalability of the businesses after the merger/acquisition. During the process, all internal and external factors that create risk in the acquisition are identified and focus is driven towards key factors that drive profitability.

Due diligence involves taking reasonable steps to make sure that you are not making risky or poor decisions, paying too much or breaking any regulations or rules. When purchasing a business, you are responsible for assessing the business thoroughly to confirm that it is as ethical, compliant and profitable as claimed.

A legal due diligence report typically includes the following information: Company structure and governance. ... Contracts and agreements. ... Litigation history. ... Intellectual Property. ... Compliance documents. ... Real estate and land use. ... Data privacy and security. ... Taxation.

The primary objective of due diligence in mergers and acquisitions is to validate and verify the seller's critical information, including financials, contracts, and compliance standards.

What Should Be in a Due Diligence Report Checklist? Information on the finances of the company. ... Information about the company's employees. ... Information on the assets of the company. ... Information on partners, suppliers, and customers. ... Legal information about the company.

What is HR due diligence? HR due diligence is where the target company's HR processes and human capital are put under the microscope. The culture of the company, as well as the roles, capabilities and attitudes of its people are investigated.

Across most industries, a comprehensive due diligence report should include the company's financial data, information about business operations and procurement, and a market analysis. It may also include data about employees and payroll, taxes, intellectual property, and the board of directors.