Maryland Door Contractor Agreement - Self-Employed

Description

How to fill out Door Contractor Agreement - Self-Employed?

US Legal Forms - one of the most prominent collections of legal documents in the USA - provides a vast selection of legal paperwork templates available for purchase or printing.

By utilizing the site, you can access numerous forms for both business and personal purposes, categorized by types, states, or keywords. You can quickly find the newest versions of documents such as the Maryland Door Contractor Agreement - Self-Employed.

If you already have a monthly subscription, Log In and retrieve the Maryland Door Contractor Agreement - Self-Employed from your US Legal Forms library. The Obtain option will appear on every document you view.

Process the transaction. Use your credit card or PayPal account to finalize the purchase.

Select the format and download the document onto your device. Make edits. Fill out, modify, print, and sign the downloaded Maryland Door Contractor Agreement - Self-Employed.

Each template added to your account does not expire and is yours indefinitely. Therefore, if you wish to obtain or print another copy, just head to the My documents section and click on the document you need.

- You can access all previously downloaded forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple instructions to get started.

- Ensure you have selected the appropriate document for your city/state.

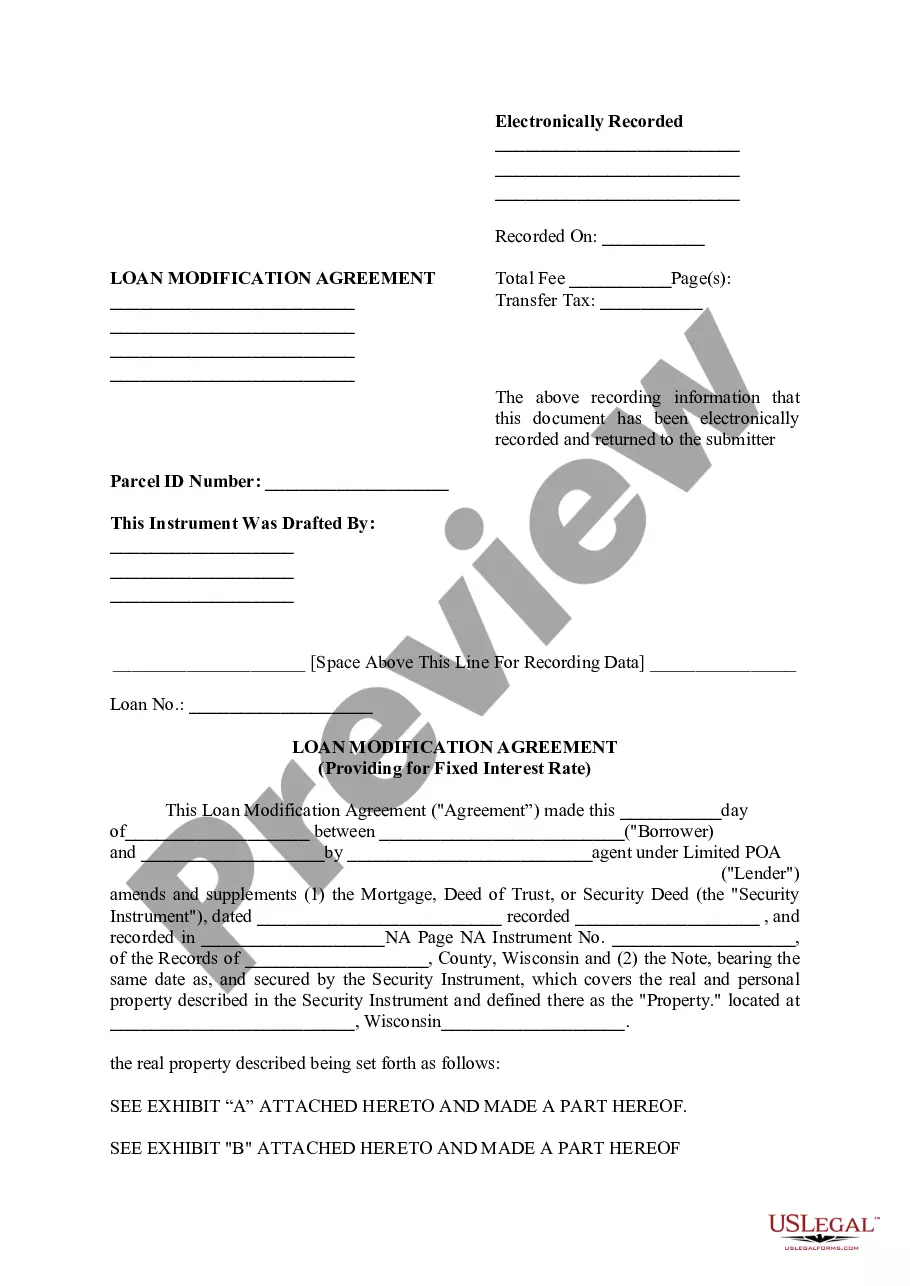

- Click the Review button to examine the contents of the document.

- Check the document details to confirm you have selected the correct form.

- If the document doesn’t meet your requirements, use the Search box at the top of the page to find one that does.

- When you are satisfied with the document, confirm your selection by clicking the Buy now button.

- Then, choose the pricing plan you prefer and provide your credentials to register for the account.

Form popularity

FAQ

Creating an independent contractor agreement involves outlining the terms under which work will be performed. Start by identifying the parties involved and detailing the scope of work, payment terms, and deadlines. Clearly state that this is a Maryland Door Contractor Agreement - Self-Employed to ensure both parties understand their independent status. Using platforms like uslegalforms can simplify this process by providing templates tailored to legal requirements in Maryland.

If you exclusively hire 1099 employees in Maryland, you typically do not need to provide workers' compensation insurance for them. However, assessing the risks associated with your business operations is essential. To make informed decisions regarding a Maryland Door Contractor Agreement - Self-Employed, consider consulting with a professional to understand your specific responsibilities.

In Maryland, whether you need workers' compensation for 1099 employees depends on your industry and the nature of the work. Generally, independent contractors are not deemed employees and may not require coverage. However, for those with a Maryland Door Contractor Agreement - Self-Employed, ensuring clarity on this point can help you avoid future liabilities.

An independent contractor should consider several types of insurance to protect against risks, including general liability insurance and professional liability insurance. Additionally, if you are working in construction, you may want to look into specific coverage such as workers' compensation. This need is particularly relevant if you engage in a Maryland Door Contractor Agreement - Self-Employed, where your risk exposure can vary significantly.

In Maryland, certain individuals may be exempt from workers' compensation insurance, including sole proprietors and certain types of independent contractors. However, it is important to assess your specific situation carefully. If you have a Maryland Door Contractor Agreement - Self-Employed, consulting with a legal expert can provide clarity on your insurance obligations.

Yes, hiring an unlicensed contractor is illegal in Maryland. Hiring a licensed contractor ensures that your project meets state regulations and standards. For those entering into a Maryland Door Contractor Agreement - Self-Employed, working with a licensed contractor not only protects your interests but also enhances your credibility in the industry.

The Door to Door Sales Act in Maryland safeguards consumers from aggressive sales tactics. It requires door-to-door salespeople to inform customers of their rights regarding cancellations. For independent contractors, such as those with a Maryland Door Contractor Agreement - Self-Employed, understanding this act is vital to ensure compliance and avoid legal pitfalls.

Independent contractors in Maryland generally do not need workers' compensation insurance, but certain exceptions apply. If you are involved in high-risk industries, such as construction, you may want to consider this coverage. For those entering into a Maryland Door Contractor Agreement - Self-Employed, reviewing your insurance needs is crucial to protect your business and assets.