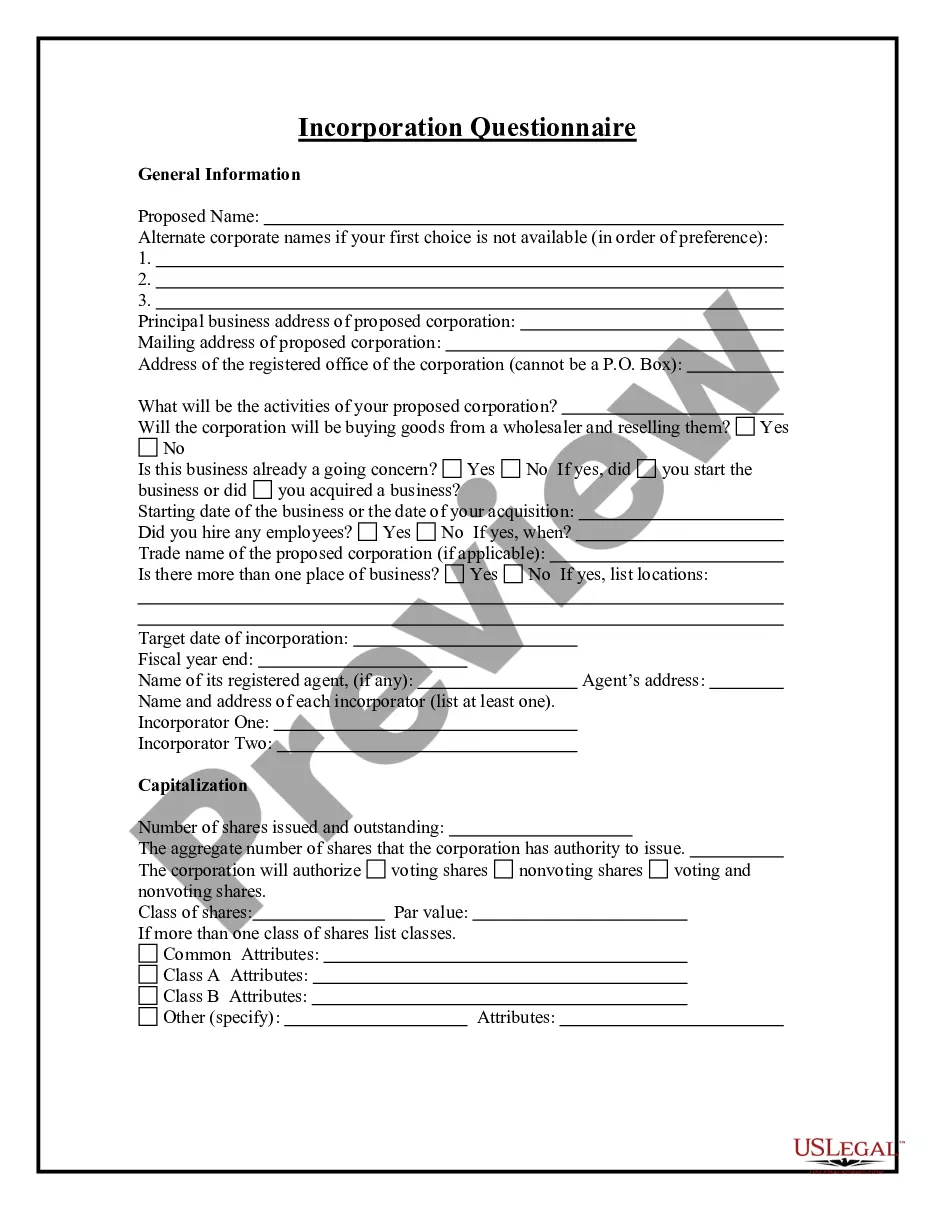

Maryland Incorporation Questionnaire

Description

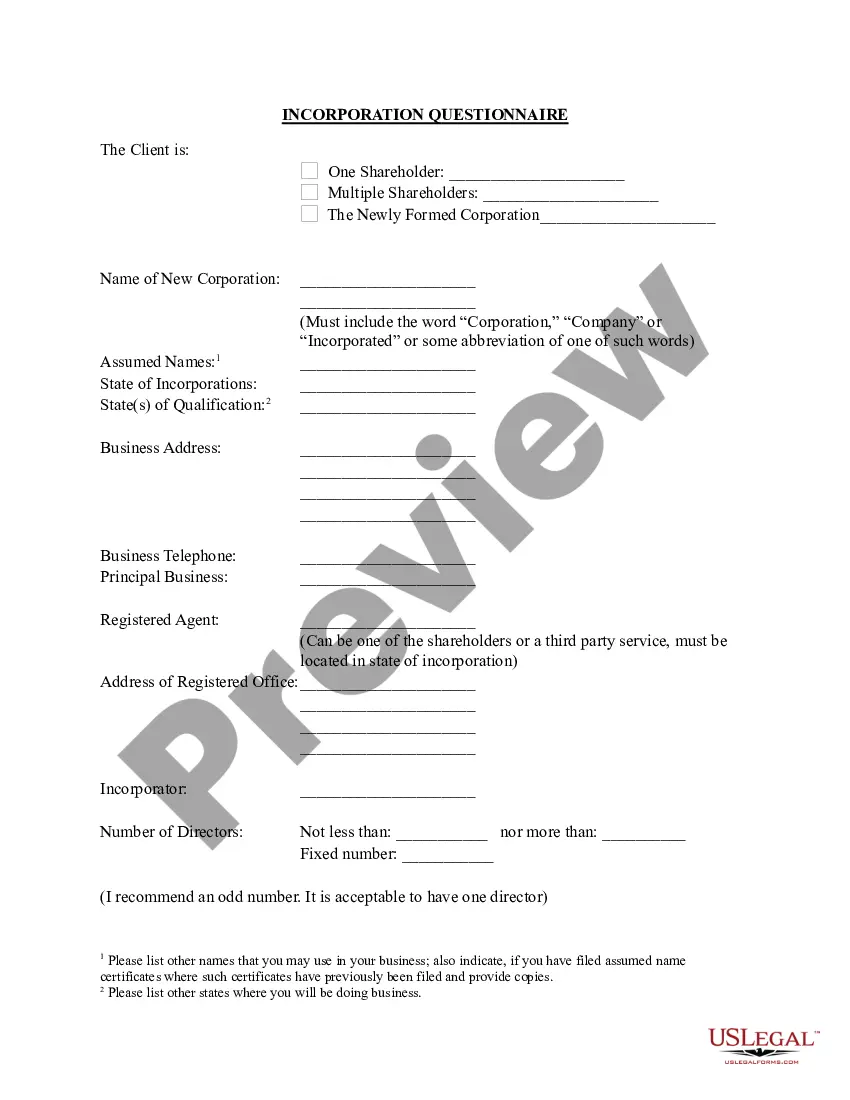

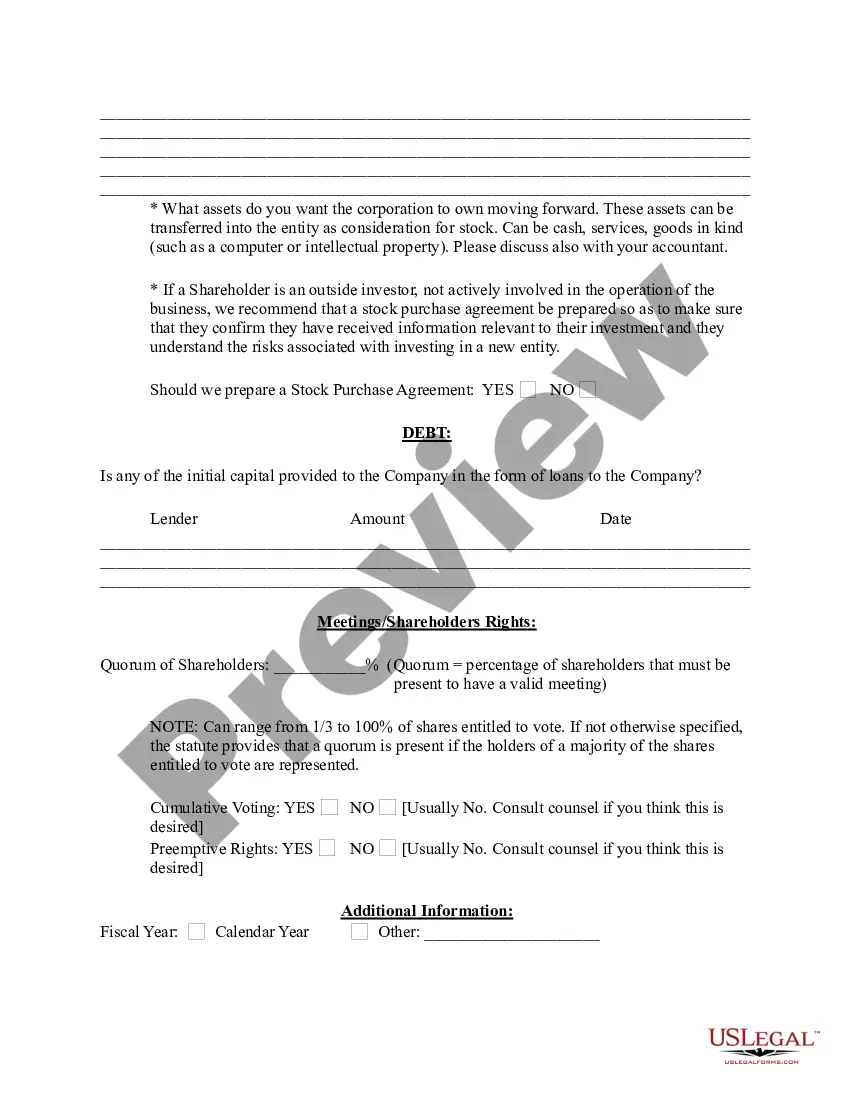

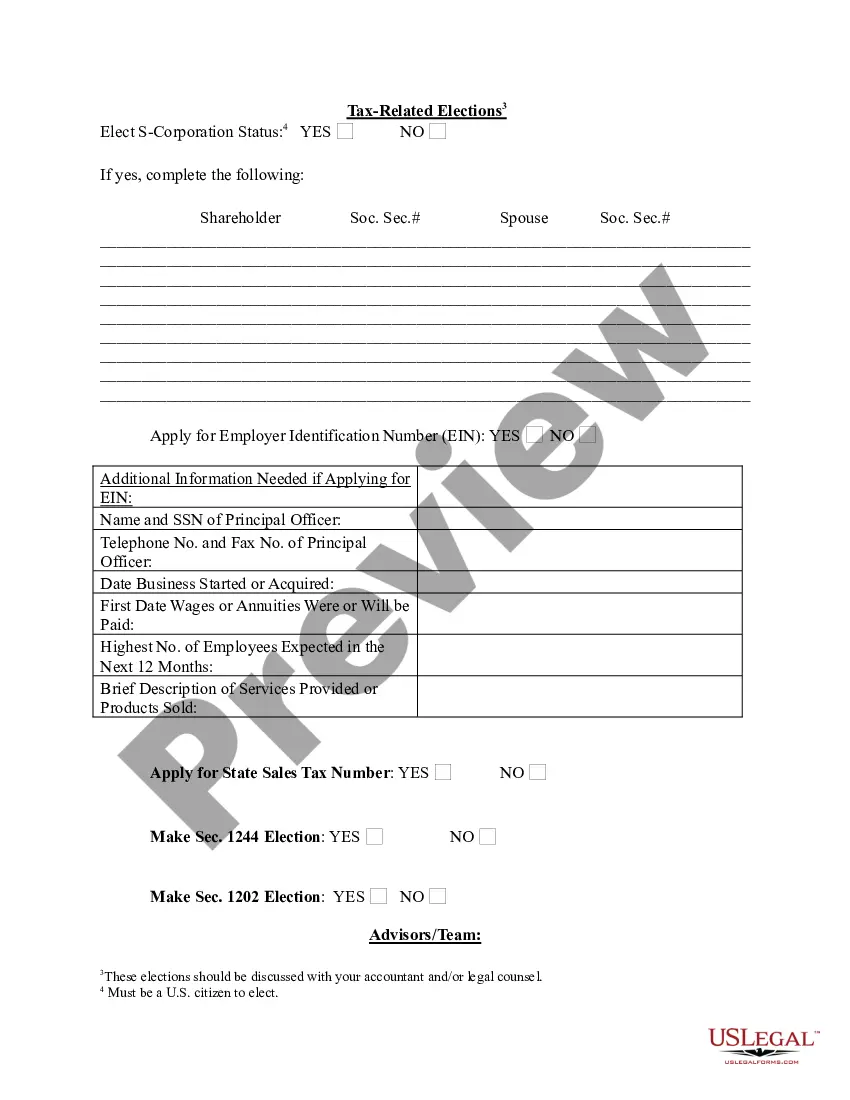

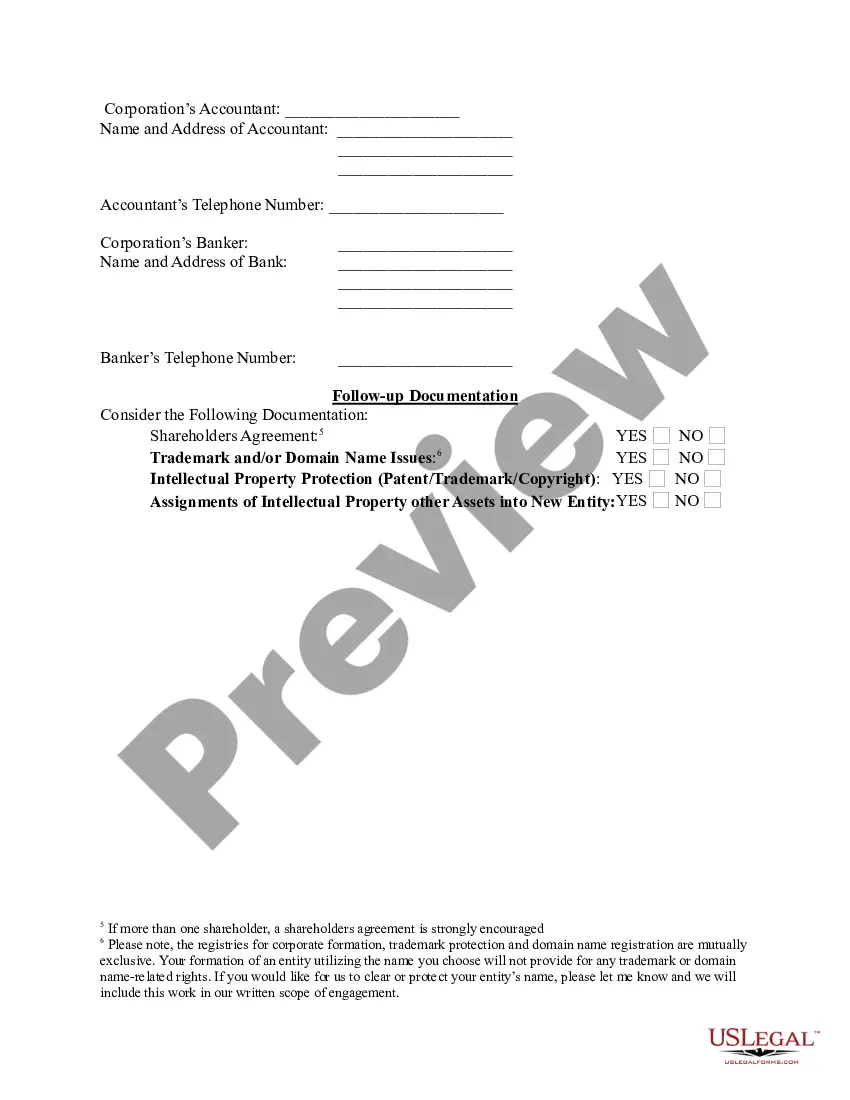

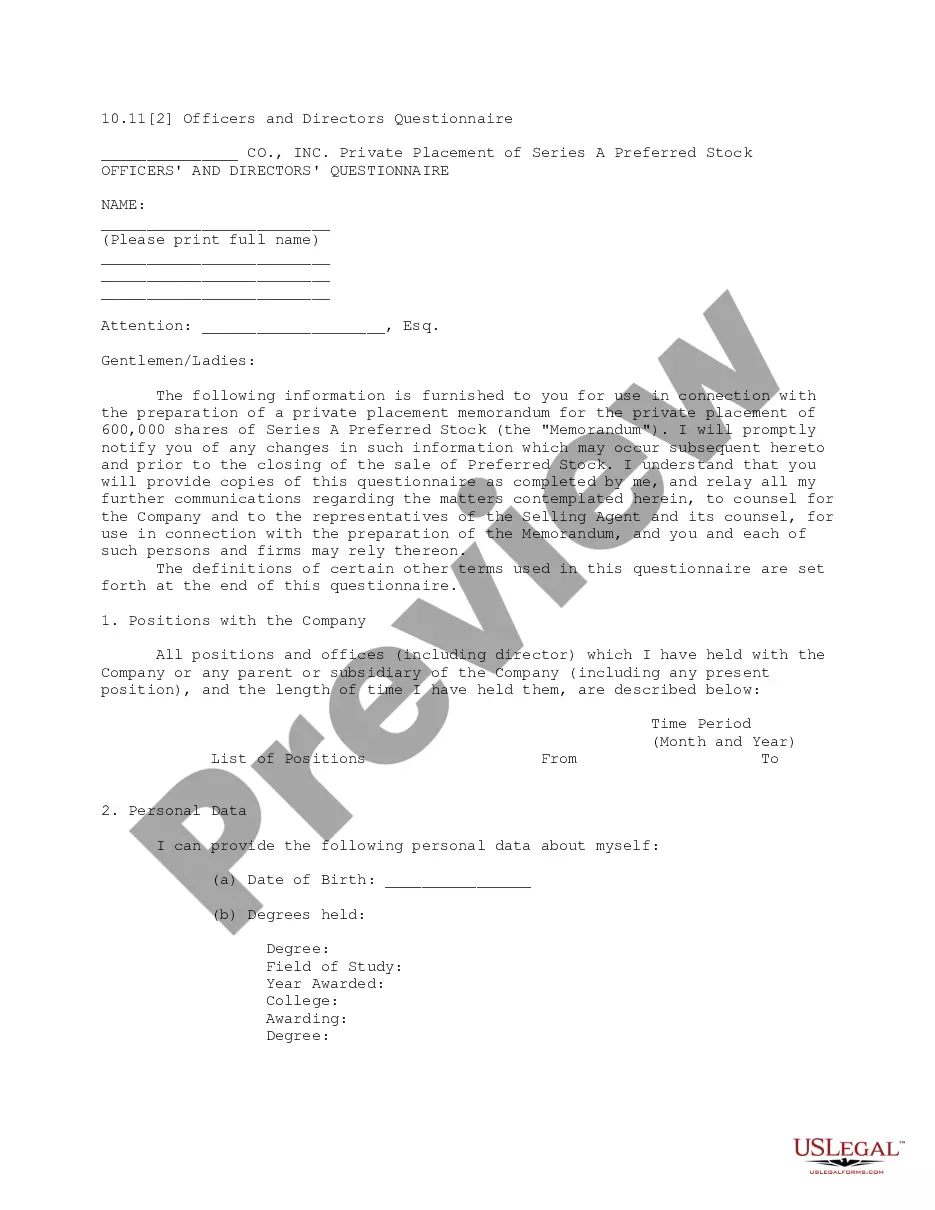

This questionnaire may also be used by an attorney as an important information gathering and issue identification tool when forming an attorney-client relationship with a new client. This form helps ensure thorough case preparation and effective evaluation of a new client's needs. It may be used by an attorney or new client to save on attorney fees related to initial interviews."

How to fill out Incorporation Questionnaire?

Choosing the best legal record template can be quite a have difficulties. Obviously, there are a lot of templates available on the Internet, but how do you get the legal develop you want? Make use of the US Legal Forms web site. The assistance gives a huge number of templates, for example the Maryland Incorporation Questionnaire, which you can use for enterprise and personal needs. All of the varieties are checked by professionals and meet state and federal specifications.

In case you are presently registered, log in for your bank account and then click the Down load switch to obtain the Maryland Incorporation Questionnaire. Make use of your bank account to search through the legal varieties you have purchased previously. Check out the My Forms tab of the bank account and have yet another version in the record you want.

In case you are a whole new user of US Legal Forms, listed here are basic guidelines that you should comply with:

- Very first, be sure you have selected the proper develop for the metropolis/county. You may look through the shape utilizing the Review switch and study the shape information to make sure this is basically the best for you.

- In the event the develop will not meet your needs, utilize the Seach industry to get the right develop.

- Once you are certain that the shape would work, click the Get now switch to obtain the develop.

- Pick the rates program you desire and enter the necessary details. Create your bank account and pay for the transaction with your PayPal bank account or charge card.

- Pick the data file file format and obtain the legal record template for your device.

- Full, edit and print and indicator the obtained Maryland Incorporation Questionnaire.

US Legal Forms may be the greatest collection of legal varieties that you can see various record templates. Make use of the company to obtain expertly-created papers that comply with state specifications.

Form popularity

FAQ

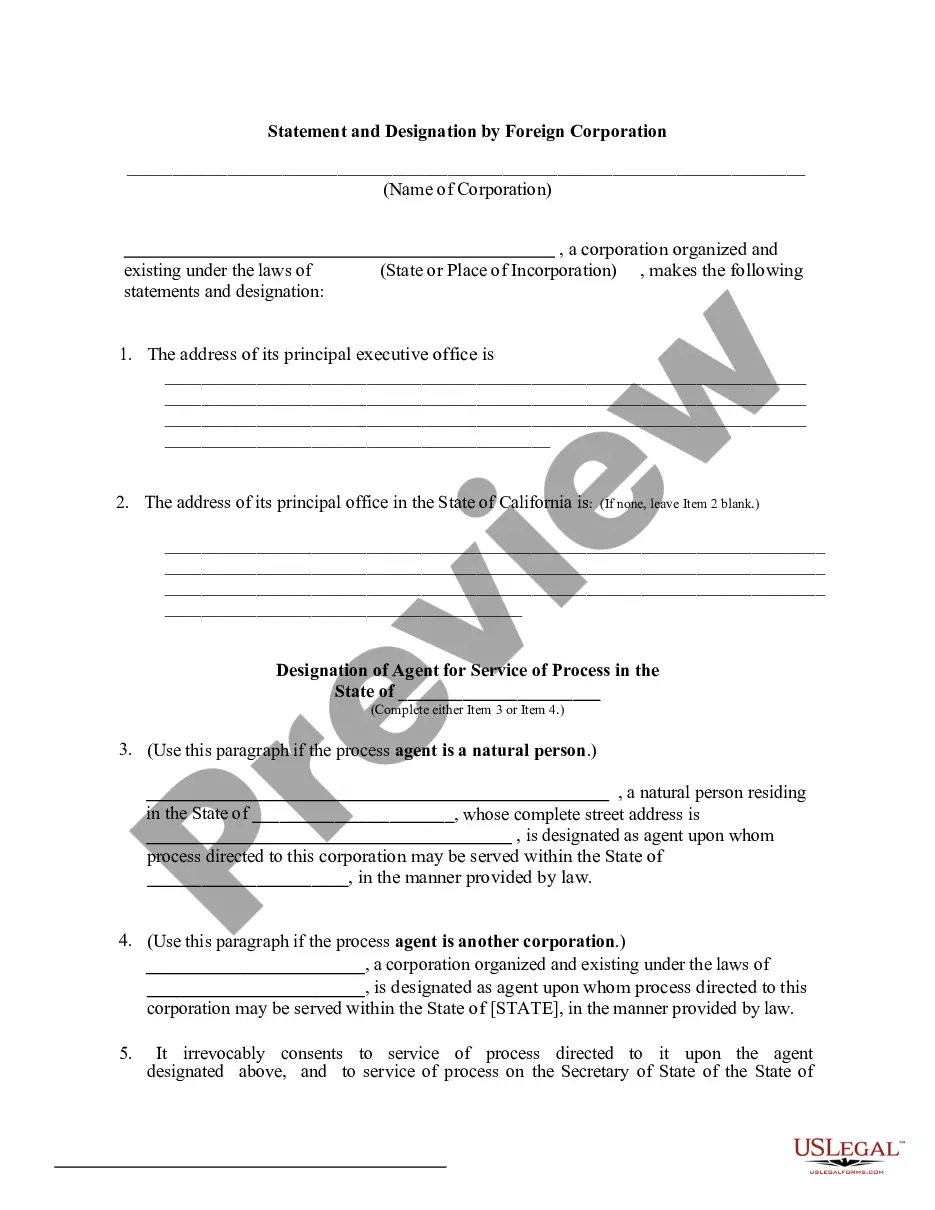

All legal business entities formed, qualified, or registered to do business in Maryland MUST file an Annual Report: Legal business entities (Corporations, LLC, LP, LLP, etc.), whether they are foreign or domestic, must file a Form 1 Annual Report (fees apply)

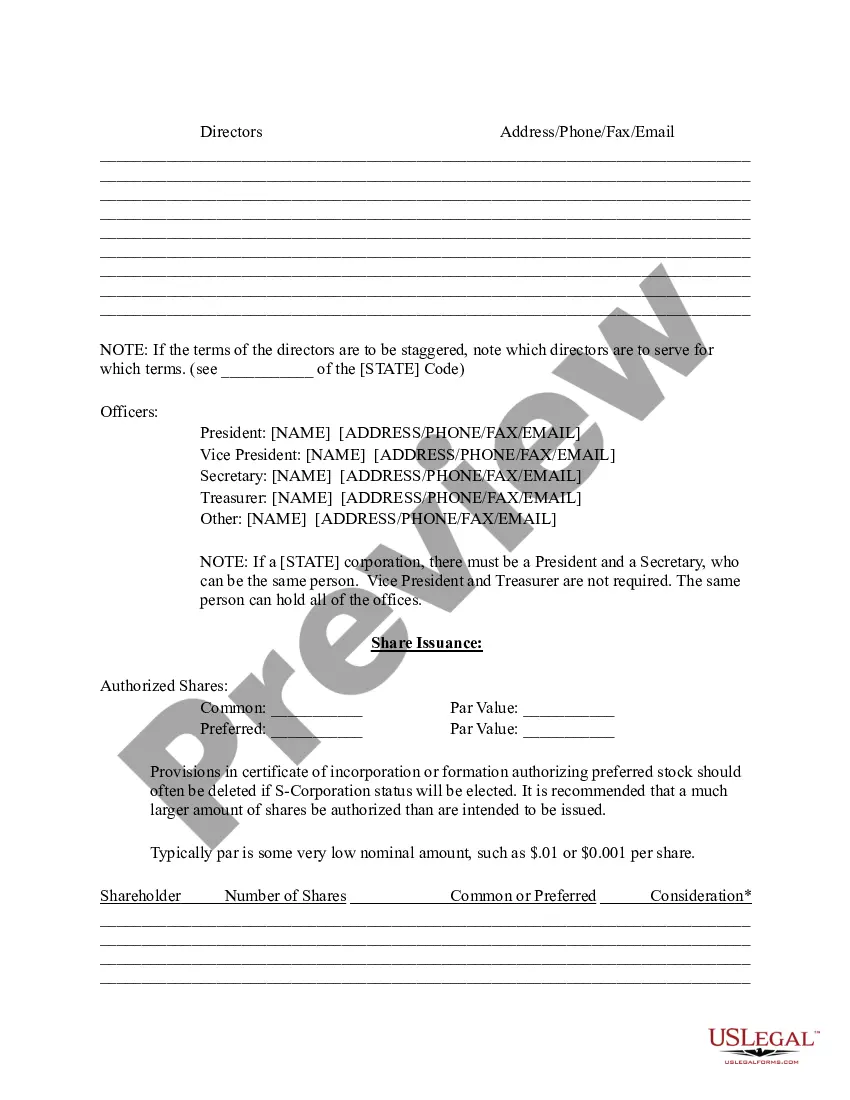

Maryland requires that each corporation have at least one director, except a statutory close corporation which may elect to have no directors at its first organizational meeting. The directors oversee the corporation and elect the officers (the senior management), who manage the day-to-day business activities.

Learn How to Form a Maryland Professional Corporation Choose a name for your Maryland PC. Select an Maryland registered agent. Complete your Maryland Certificate of Incorporation. Establish a corporate record in Maryland. Designate an Maryland PC board of directors. Create Maryland corporate bylaws.

An Annual Report must be filed by all business entities formed, qualified or registered to do business in the State of Maryland, as of January 1st. Failure to file the Annual Report may result in forfeiture of the entity's right to conduct business in the State of Maryland. The deadline to file is April 15th.

All legal business entities formed, qualified, or registered to do business in Maryland MUST file an Annual Report: Legal business entities (Corporations, LLC, LP, LLP, etc.), whether they are foreign or domestic, must file a Form 1 Annual Report (fees apply) Credit Unions must file a Form 3 Annual Report (fees apply)

The state of Maryland requires all corporations, nonprofits, LLCs, LPs, and LLPs to submit a Maryland Annual Report each year. In addition, your business may have to file a Personal Property Tax Return if your business owns, leases, or uses personal property located in the state or maintains a trader's license.

Single taxpayers under 65 are not required to file a Maryland income tax return unless their Maryland gross income was $10,400 or more in 2017. Maryland gross income is federal gross income (but do not include Social Security or Railroad Retirement income) plus Maryland additions.

Responsibility for the assessment of all personal property throughout Maryland rests with the Department of Assessments and Taxation. Personal property generally includes furniture, fixtures, office and industrial equipment, machinery, tools, supplies, inventory and any other property not classified as real property.