Maryland Term Sheet for Potential Investment in a Company

Description

How to fill out Term Sheet For Potential Investment In A Company?

It is possible to invest hours on the web trying to find the legitimate papers web template which fits the state and federal demands you need. US Legal Forms supplies thousands of legitimate forms which are evaluated by specialists. It is simple to acquire or print out the Maryland Term Sheet for Potential Investment in a Company from my services.

If you already possess a US Legal Forms profile, you are able to log in and click on the Down load option. Following that, you are able to total, modify, print out, or signal the Maryland Term Sheet for Potential Investment in a Company. Every legitimate papers web template you acquire is yours forever. To acquire one more copy for any purchased form, visit the My Forms tab and click on the corresponding option.

If you are using the US Legal Forms web site the very first time, follow the simple guidelines under:

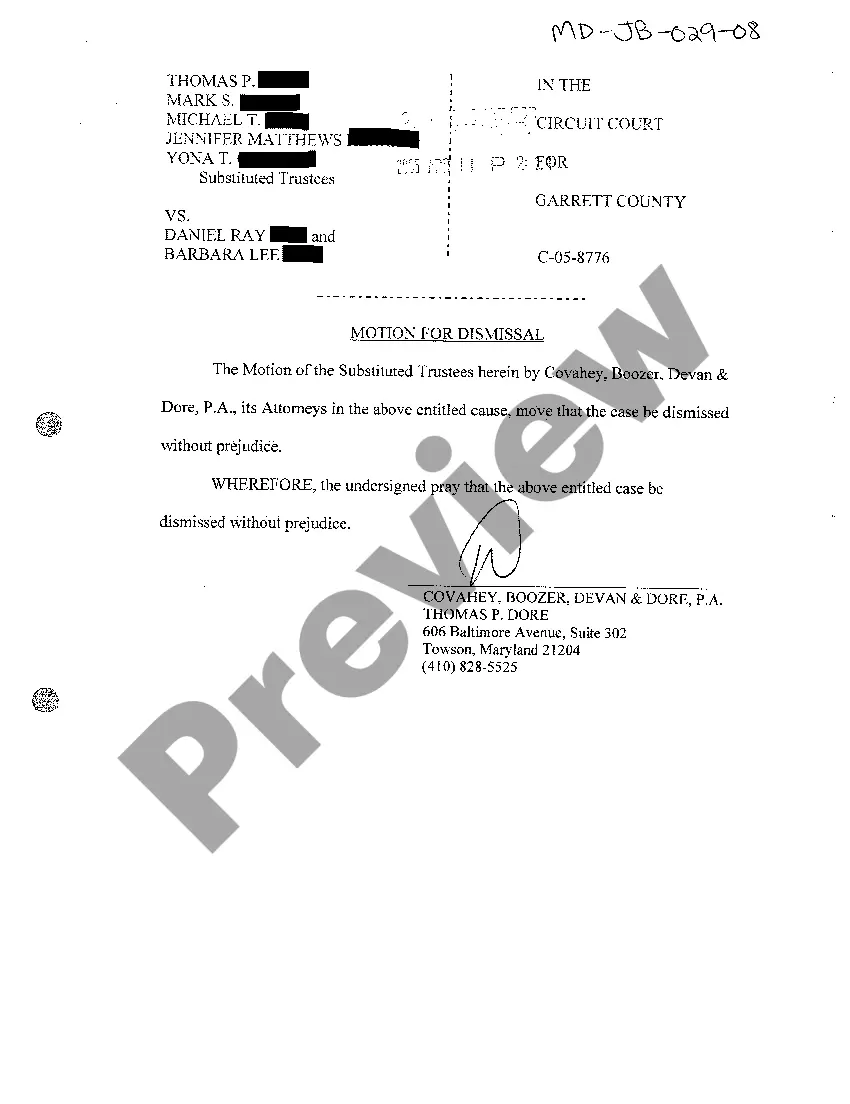

- Very first, ensure that you have selected the correct papers web template for that area/city of your choice. Look at the form information to ensure you have picked the right form. If accessible, take advantage of the Review option to appear throughout the papers web template as well.

- If you would like get one more variation from the form, take advantage of the Search industry to get the web template that meets your needs and demands.

- When you have found the web template you would like, click Get now to continue.

- Choose the costs program you would like, type in your credentials, and sign up for your account on US Legal Forms.

- Total the financial transaction. You can utilize your Visa or Mastercard or PayPal profile to fund the legitimate form.

- Choose the formatting from the papers and acquire it in your system.

- Make modifications in your papers if needed. It is possible to total, modify and signal and print out Maryland Term Sheet for Potential Investment in a Company.

Down load and print out thousands of papers templates using the US Legal Forms web site, that provides the biggest selection of legitimate forms. Use specialist and express-particular templates to deal with your small business or individual requirements.

Form popularity

FAQ

6 Tips for Writing a Term Sheet List the terms. ... Summarize the terms. ... Explain the dividends. ... Include liquidation preference. ... Include voting agreement and closing items. ... Read, edit and prepare for signatures.

A term sheet outlines the basic terms and conditions of an investment opportunity and is a non-binding agreement that serves as a starting point for more detailed agreements ? like a commitment letter, definitive agreement (share purchase agreement), or subscription agreement.

It is typically a short document that sets out the key commercial terms of a proposed business transaction. Having a term sheet helps the parties to decide on the material terms before formal documents are entered into at a later stage.

A term sheet is a nonbinding agreement outlining the basic terms and conditions under which an investment will be made. Term sheets are most often associated with start-ups. Entrepreneurs find that this document is crucial to attracting investors, such as venture capitalists (VC) with capital to fund enterprises.

But no matter who the investor is, a term sheet will always contain six key components, including: A valuation. An estimate of what a company is worth as an investment opportunity. ... Securities being issued. ... Board rights. ... Investor protections. ... Dealing with shares. ... Miscellaneous provisions.

What is a Term Sheet? A term sheet can be defined as a non-binding agreement that sets out the basic conditions for making an investment. It serves as a template for developing more detailed documents that are legally binding.

A Term Sheet sets the initial tone, outlining crucial terms and conditions. A Letter of Intent breathes life into intentions, providing a preliminary agreement framework. Finally, a Purchase Agreement seals the deal with legally binding precision. Prepare to delve into a comprehensive exploration of these documents.