Maryland Subsequent Pledge Agreement between ABFS Mortgage Loan Trust and The Bank of New York

Description

How to fill out Subsequent Pledge Agreement Between ABFS Mortgage Loan Trust And The Bank Of New York?

US Legal Forms - one of several greatest libraries of authorized varieties in the States - gives an array of authorized file themes you can down load or print out. Making use of the internet site, you may get 1000s of varieties for organization and individual uses, sorted by groups, states, or keywords.You can get the most recent versions of varieties like the Maryland Subsequent Pledge Agreement between ABFS Mortgage Loan Trust and The Bank of New York in seconds.

If you already possess a subscription, log in and down load Maryland Subsequent Pledge Agreement between ABFS Mortgage Loan Trust and The Bank of New York from the US Legal Forms collection. The Obtain button can look on each develop you view. You have access to all in the past saved varieties from the My Forms tab of your accounts.

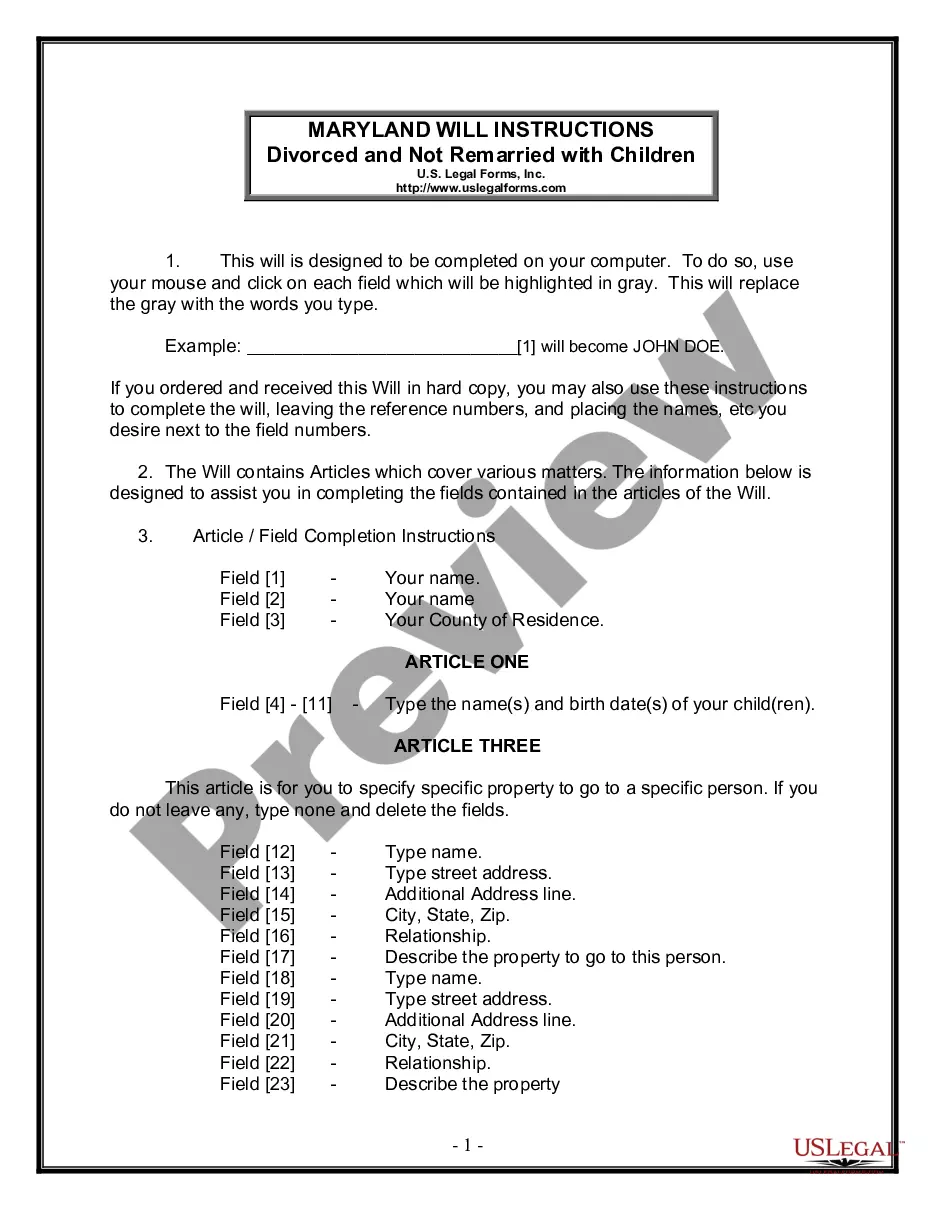

If you want to use US Legal Forms initially, here are basic directions to obtain started out:

- Be sure you have selected the best develop to your city/county. Click the Preview button to analyze the form`s articles. Look at the develop information to ensure that you have chosen the correct develop.

- If the develop doesn`t suit your specifications, utilize the Research area towards the top of the display screen to obtain the the one that does.

- When you are satisfied with the form, affirm your option by simply clicking the Get now button. Then, opt for the costs strategy you want and supply your qualifications to register for an accounts.

- Procedure the purchase. Use your credit card or PayPal accounts to complete the purchase.

- Find the structure and down load the form on your device.

- Make changes. Load, change and print out and indication the saved Maryland Subsequent Pledge Agreement between ABFS Mortgage Loan Trust and The Bank of New York.

Each design you added to your money lacks an expiration particular date and it is your own eternally. So, if you want to down load or print out yet another copy, just visit the My Forms portion and then click around the develop you require.

Get access to the Maryland Subsequent Pledge Agreement between ABFS Mortgage Loan Trust and The Bank of New York with US Legal Forms, by far the most considerable collection of authorized file themes. Use 1000s of professional and express-certain themes that satisfy your organization or individual demands and specifications.

Form popularity

FAQ

In simple words, a pledge is a promise to repay a loan, and collateral is what you lose if you don't keep your promise. For example, I can take a loan from a friend, pledge to return it within 30 days, and offer my bike as collateral. As long as I return the loan within 30 days, the bike is safe.

A mortgage is an agreement between you and a lender that gives the lender the right to take your property if you fail to repay the money you've borrowed plus interest. Mortgage loans are used to buy a home or to borrow money against the value of a home you already own. Seven things to look for in a mortgage.

Pledged loans are a kind of secured loan that requires the borrower to pledge assets as collateral to secure funding. When you don't have the money to purchase a vehicle or home outright, as most people don't, some lenders may offer you a secured loan.

A pledged asset is an asset that is used by a lender to secure a debt or loan and can include cash, stocks, bonds, and other equity or securities. A pledged asset is collateral held by a lender in return for lending funds.

Some examples of pledge are Gold /Jewellery Loans, Advance against goods,/stock, Advances against National Saving Certificates etc. (2) Hypothecation is used for creating charge against the security of movable assets, but here the possession of the security remains with the borrower itself.

This is a standard form of pledge agreement to be used in connection with a syndicated loan agreement. It is intended to create a security interest over equity interests and promissory notes owned by the grantors. The grantors are usually the borrower, its parent and its subsidiaries.