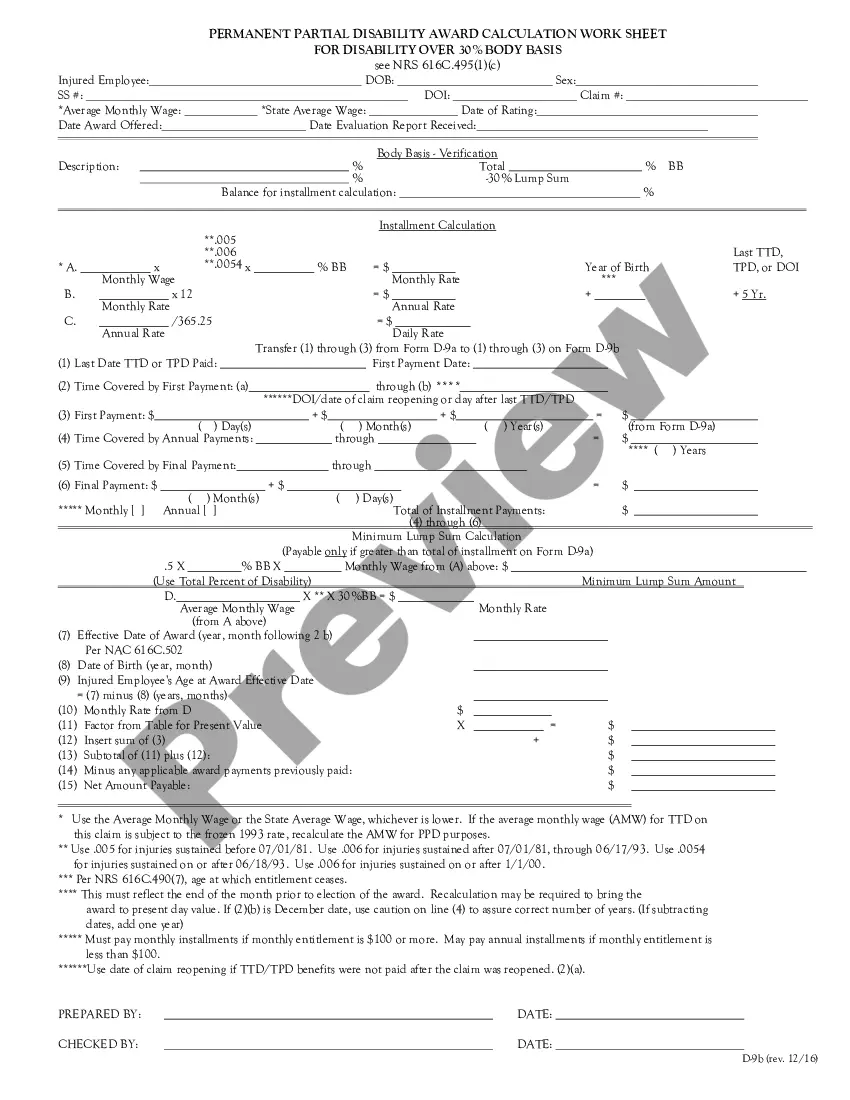

Maryland Check Requisition Worksheet

Description

How to fill out Check Requisition Worksheet?

Are you currently in a situation where you require documents for either business or personal purposes almost every day.

There are numerous legitimate document templates available online, but finding ones you can trust is challenging.

US Legal Forms provides thousands of form templates, including the Maryland Check Requisition Worksheet, which are designed to comply with state and federal regulations.

Choose a convenient document file format and download your copy.

Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Maryland Check Requisition Worksheet anytime, if needed. Click on the desired form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Next, you can download the Maryland Check Requisition Worksheet template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/area.

- Utilize the Preview option to view the form.

- Review the details to ensure you have chosen the correct form.

- If the form is not what you are looking for, use the Research section to find the form that meets your needs and requirements.

- Once you locate the correct form, click Get now.

- Select the pricing plan you want, fill out the necessary information to create your account, and pay for the order using your PayPal or Visa or Mastercard.

Form popularity

FAQ

A tax worksheet is an IRS guide to assist you in your calculations and are primarily for your records. For example, in the event the IRS questions an entry on your 1040 form, you would refer to the worksheet you used to calculate that entry to back your number up.

All other returns (including those without payment by check or money order), other payments, and correspondence regarding your personal or business tax account(s) should be sent to:: Comptroller of Maryland, Revenue Administration Division, 110 Carroll Street, Annapolis, Maryland 21411-0001.

If you are a Maryland resident, you can file long Form 502 and 502B if your federal adjusted gross income is less than $100,000. If you lived in Maryland only part of the year, you must file Form 502. If you are a nonresident, you must file Form 505 and Form 505NR.

Make sure your check or money order includes the following information:Your name and address.Daytime phone number.Social Security number (the SSN shown first if it's a joint return) or employer identification number.Tax year.Related tax form or notice number.

If you are sending a Form 502 or Form 505 (with a payment) through the US Postal Service, send it to: Comptroller of Maryland, Payment Processing, PO Box 8888, Annapolis, MD 21401-8888.

You can pay your current Maryland tax amount due by direct debit at the time of filing, if you file online using iFile, bFile or another electronic filing method such as using approved computer software, a tax professional, or IRS Free File.

Purpose of Form. Form 502CR is used to claim personal income tax credits for individuals (including resident fiduciaries).

Use Form 510 (Schedule K-1) to report the distributive or pro rata share of the member's income, additions, subtractions, nonresident tax and credits apportioned to Maryland.

You can pay your Maryland taxes with a personal check, money order or credit card. You may also choose to pay by direct debit when you file electronically. If you file and pay electronically by April 15, you have until April 30 to make the electronic payment, using direct debit or a credit card.

Make your check or money order payable to Comptroller of Maryland. 2022 Use blue or black ink only. Write the type of tax and year of tax being paid on your check. It is recommended that you include your Social Security number on your check. DO NOT SEND CASH.