Maryland Personal Guaranty of Another Person's Agreement to Pay Consultant

Description

How to fill out Personal Guaranty Of Another Person's Agreement To Pay Consultant?

If you need to acquire, download, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms accessible online.

Take advantage of the site's simple and convenient search feature to find the documents you require.

Multiple templates for business and personal purposes are organized by categories and states, or by keywords.

Step 4. Once you have found the form you need, click the Purchase Now button. Choose the payment plan you prefer and enter your details to sign up for an account.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the transaction. Step 6. Select the format of the legal form and download it to your device. Step 7. Complete, edit, and print or sign the Maryland Personal Guaranty of Another Person's Agreement to Pay Consultant.

- Make use of US Legal Forms to obtain the Maryland Personal Guaranty of Another Person's Agreement to Pay Consultant in just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and click the Download button to obtain the Maryland Personal Guaranty of Another Person's Agreement to Pay Consultant.

- You can also access forms you previously acquired in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

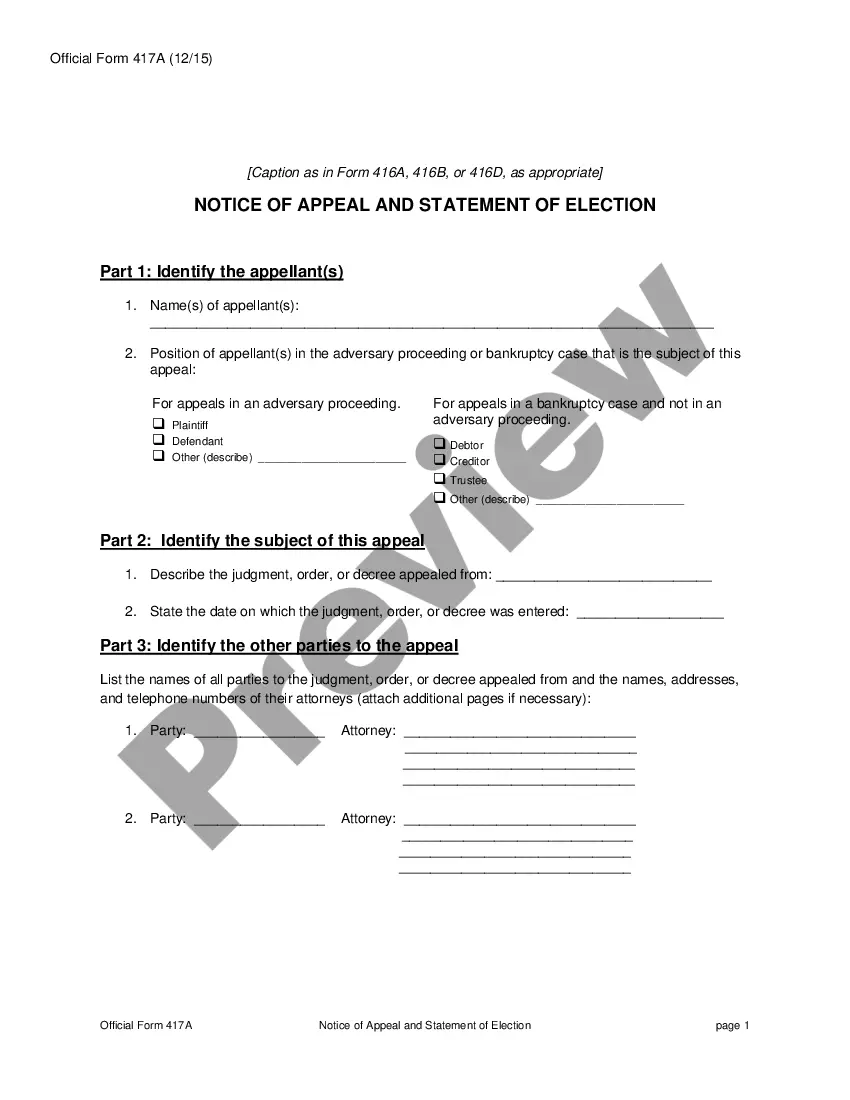

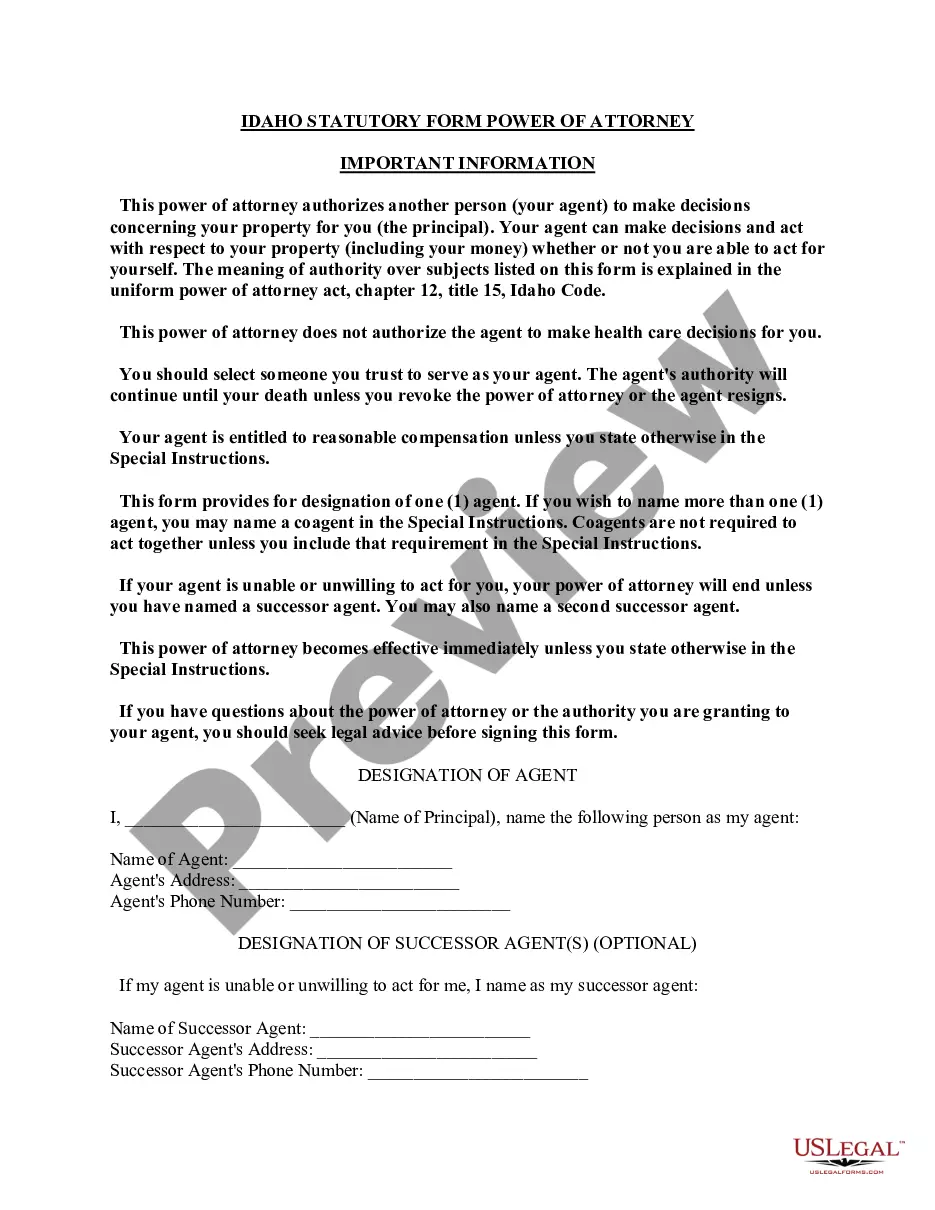

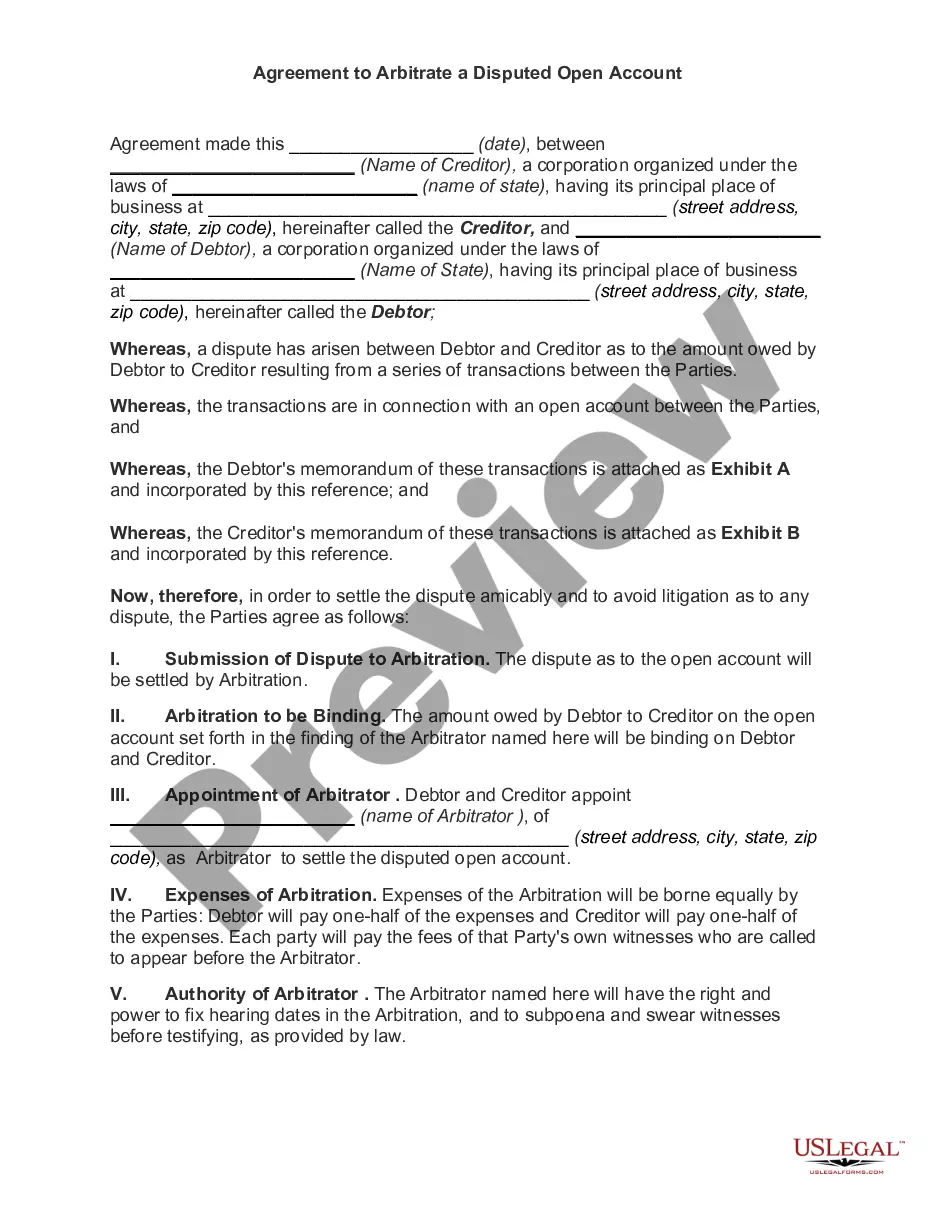

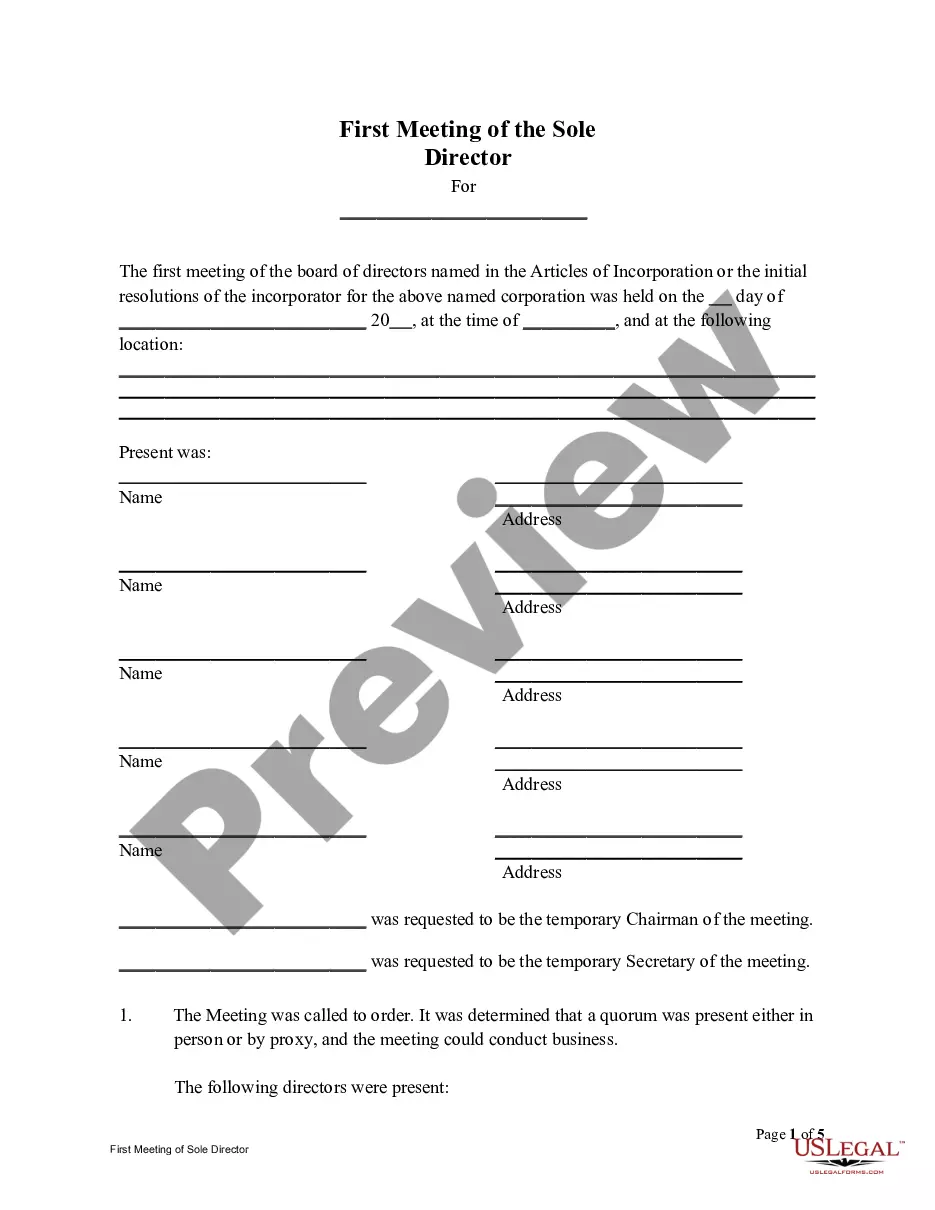

- Step 2. Utilize the Preview option to review the form’s details. Remember to check the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other variants of the legal form template.

Form popularity

FAQ

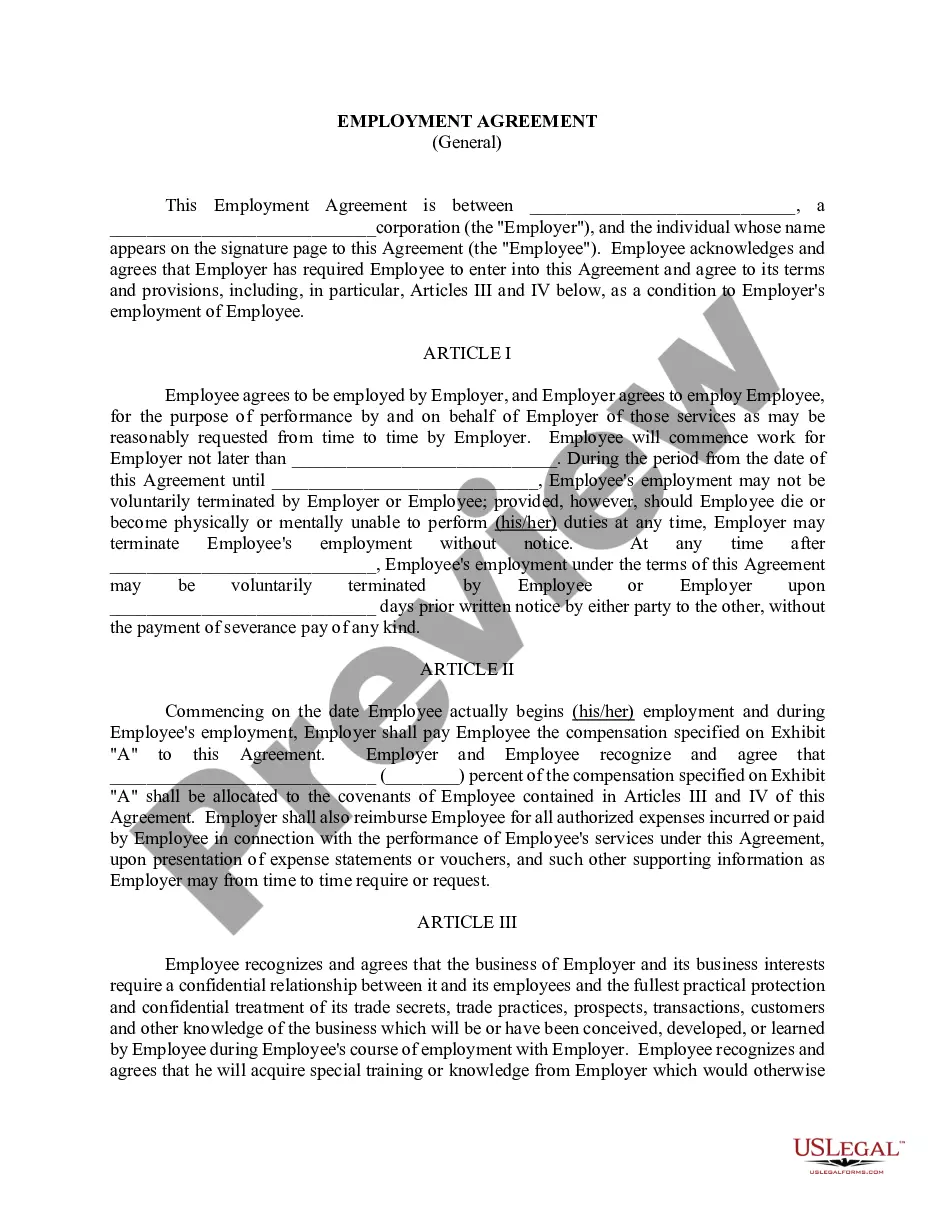

A personal guarantee is an individual's legal promise to repay credit issued to a business for which they serve as an executive or partner. Personal guarantees help businesses get credit when they aren't as established or have an inadequate credit history to qualify on their own.

A personal guaranty is not enforceable without consideration A contract is an enforceable promise. The enforceability of a contract comes from one party's giving of consideration to the other party. Here, the bank gives a loan (the consideration) in exchange for the guarantor's promise to repay it.

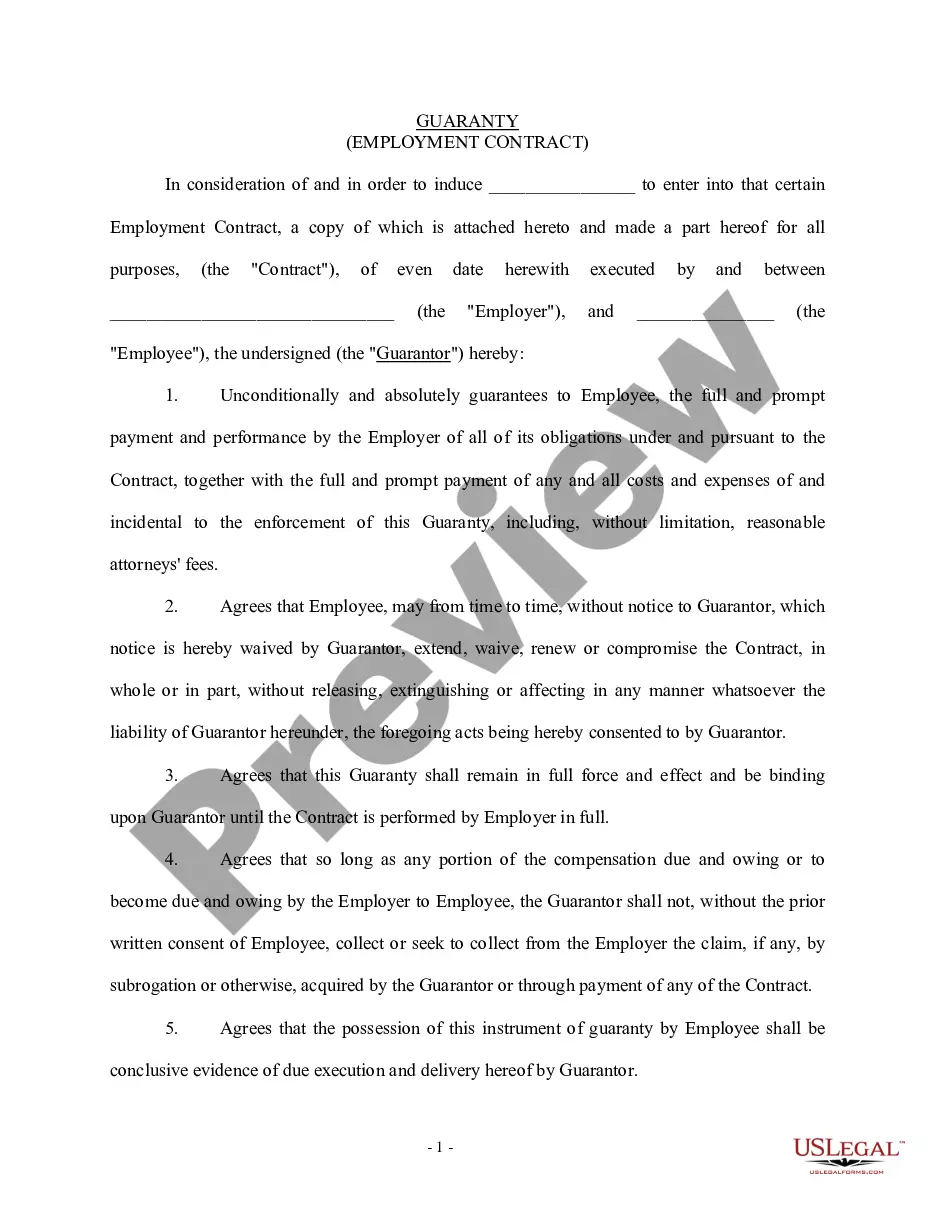

Guaranty Agreement a two-party contract in which the first party agrees to perform in the event that a second party fails to perform. Unlike a surety, a guarantor is only required to perform after the obligee has made every reasonable and legal effort to force the principal's performance.

An otherwise valid and enforceable personal guarantee can be revoked later in several different ways. A guaranty, much like any other contract, can be revoked later if both the guarantor and the lender agree in writing. Some debts owed by personal guarantors can also be discharged in bankruptcy.

A personal guarantee can be enforced the same way as any debt. If the business owner does not pay, the creditor can bring a lawsuit to receive a judgment and levy the owner's personal assets to cover the debt. The exact terms of a personal guarantee specify a creditor's options under the guarantee.

7 Ways to Avoid a Personal GuaranteeBuy insurance.Raise the interest rate.Increase Reporting.Increased the Frequency of Payments.Add a Fidelity Certificate.Limit the Guarantee Time Period.Use Other Collateral.

If you sign a personal guarantee, you are personally liable for the loan balance or a portion thereof. If your business later defaults on the loan, anyone who signed the personal guarantee can be held responsible for the remaining balance, even after the lender forecloses on the loan collateral.

A personal guarantee is a provision a lender puts in a business loan agreement that requires owners to be personally responsible for their company's debt in case of default. Lenders often ask for personal guarantees because they have concerns over the credit history, age or financial stability of your business.

A personal guarantee is an agreement between a business owner and lender, stating that the individual who signs is responsible for paying back a loan should the business ever be unable to make payments.

The term personal guarantee refers to an individual's legal promise to repay credit issued to a business for which they serve as an executive or partner. Providing a personal guarantee means that if the business becomes unable to repay the debt, the individual assumes personal responsibility for the balance.