Maryland Affidavit of No Coverage by Another Group Health Plan

Description

How to fill out Affidavit Of No Coverage By Another Group Health Plan?

It is feasible to spend hours on the internet endeavoring to locate the approved document template that satisfies the federal and state requirements you desire.

US Legal Forms offers thousands of legal forms that are reviewed by specialists.

You can easily obtain or print the Maryland Affidavit of No Coverage by Another Group Health Plan from my service.

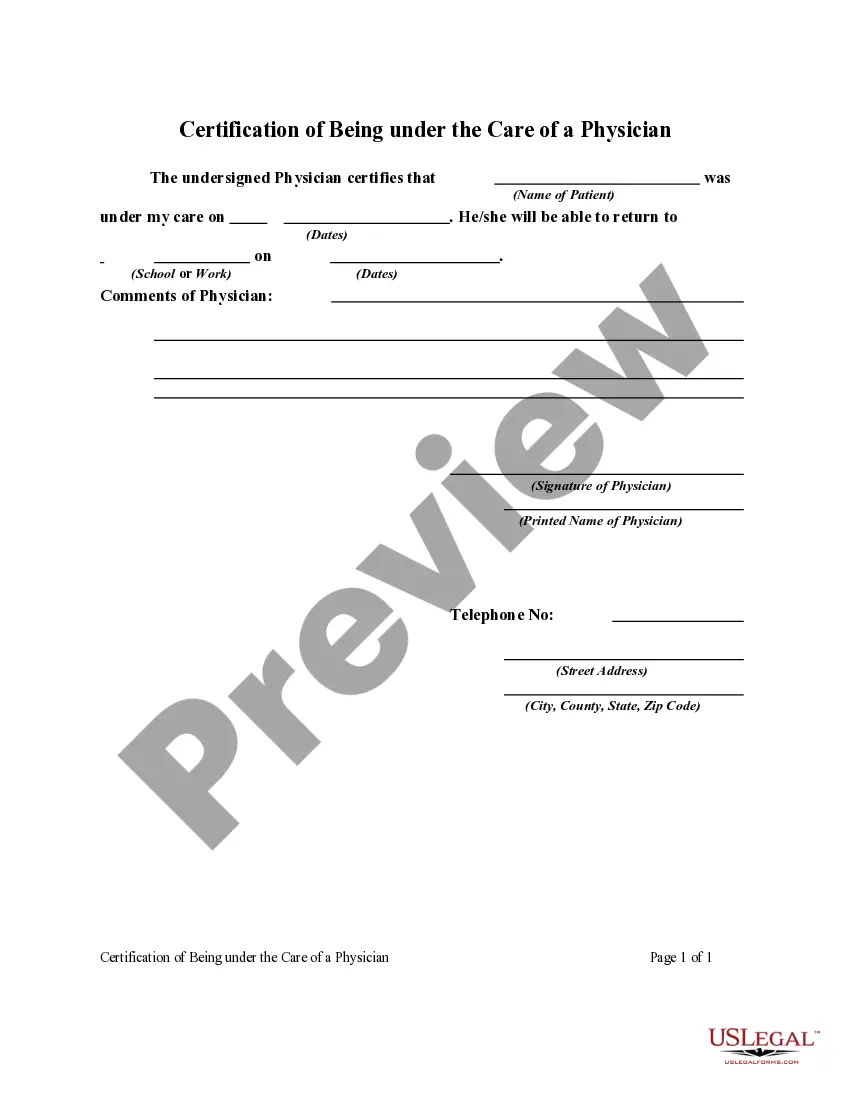

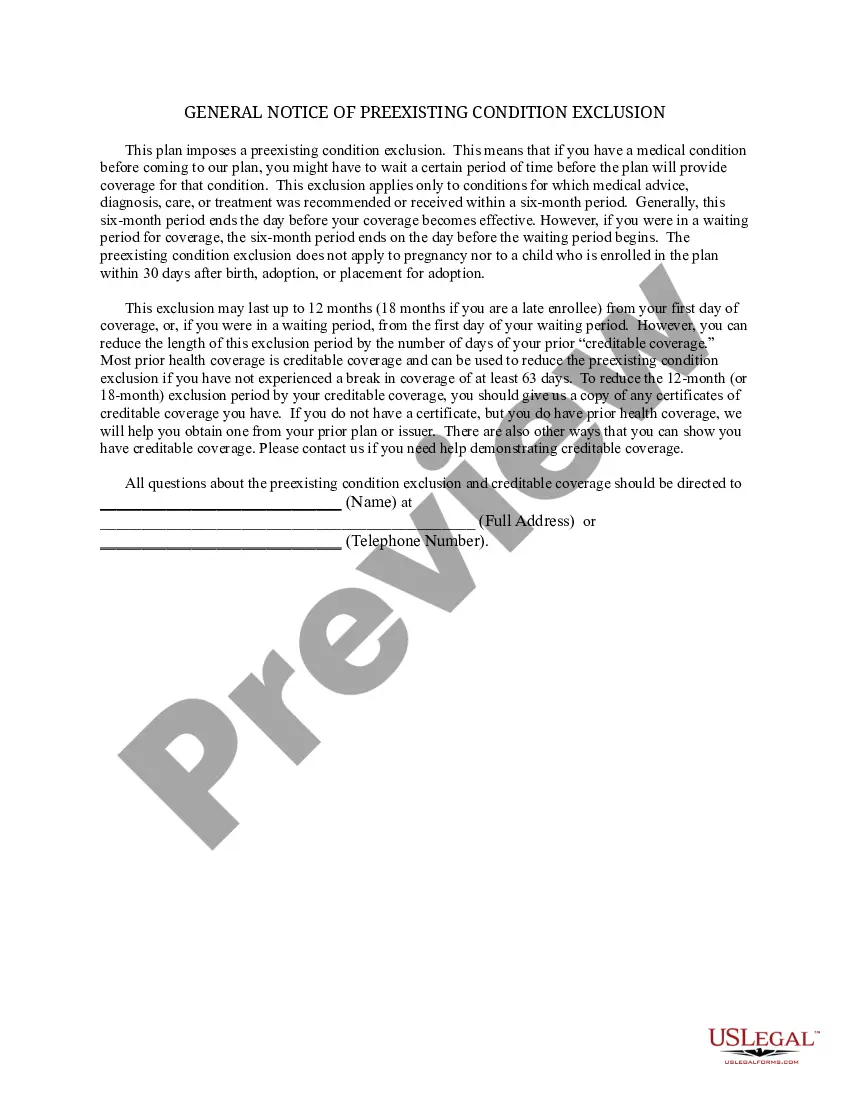

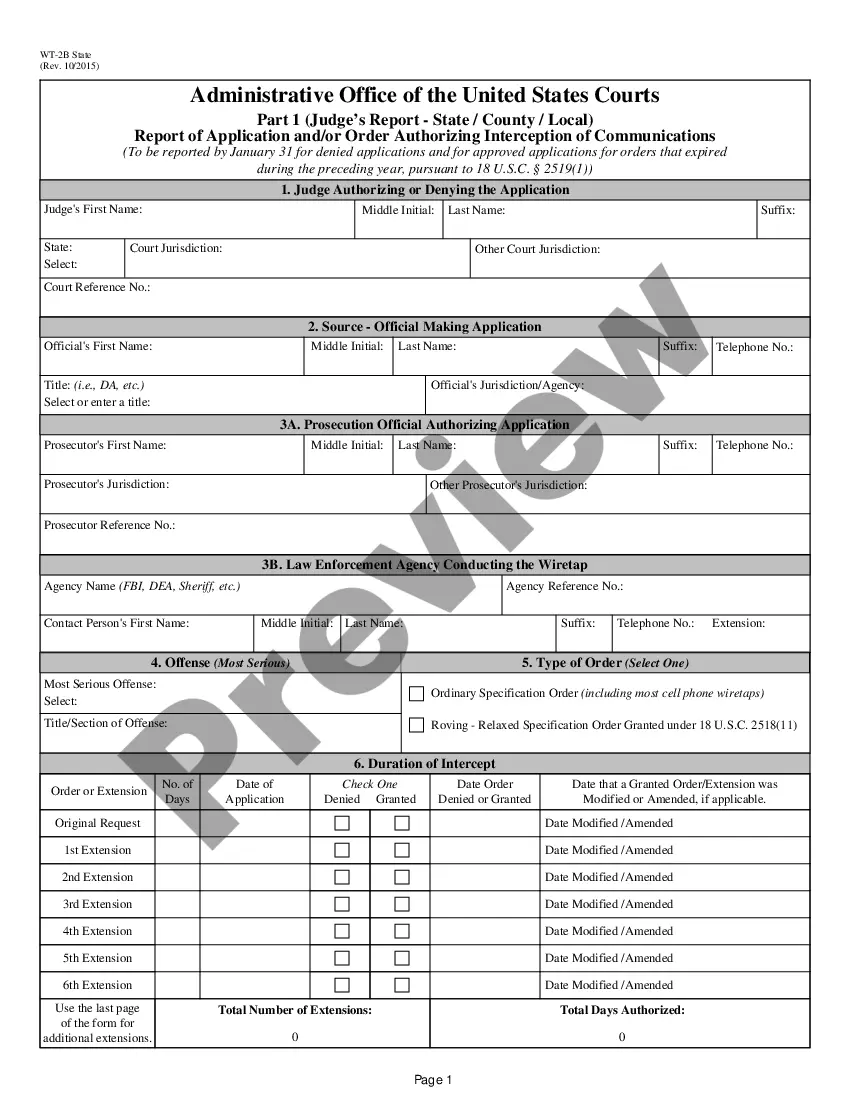

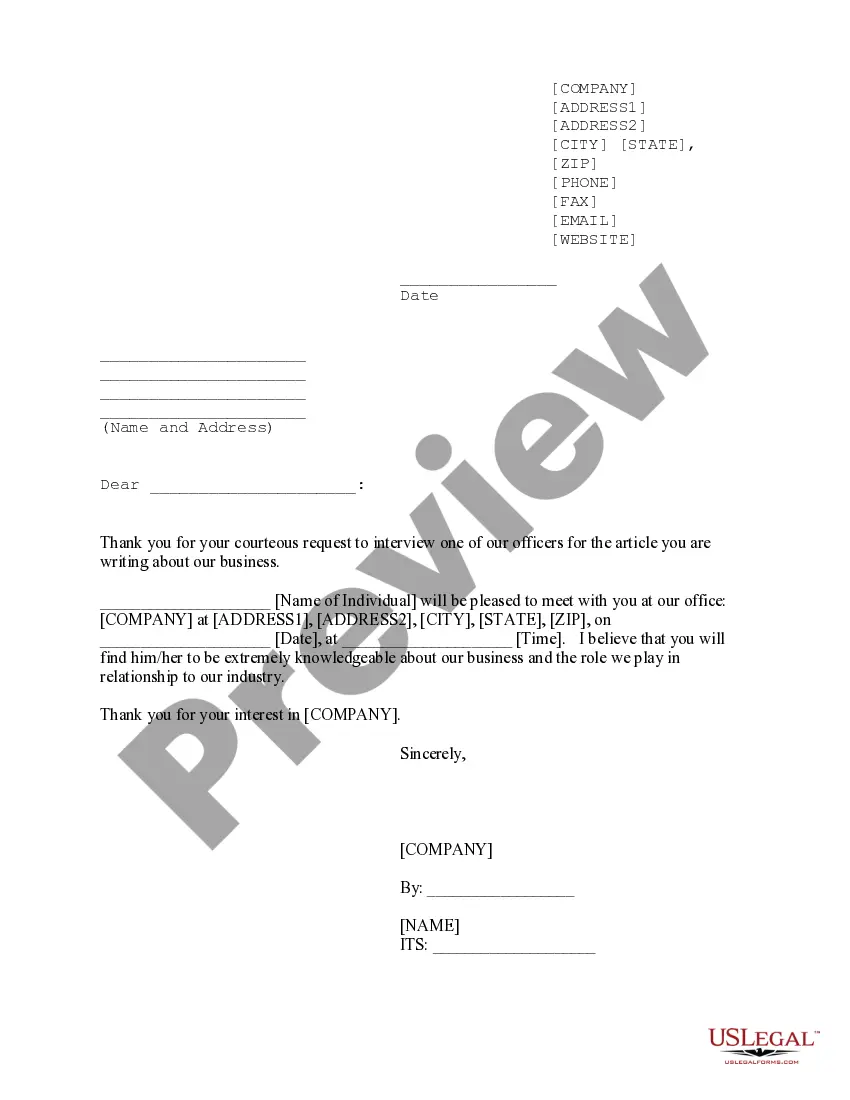

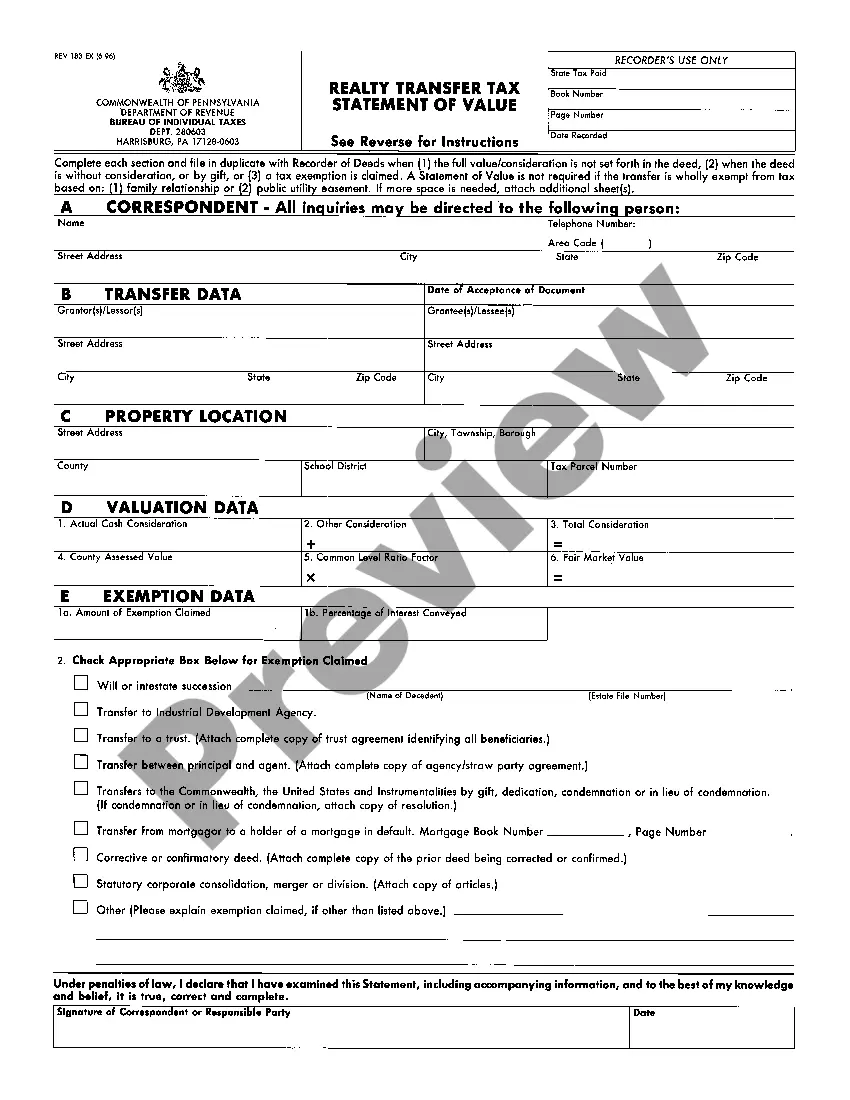

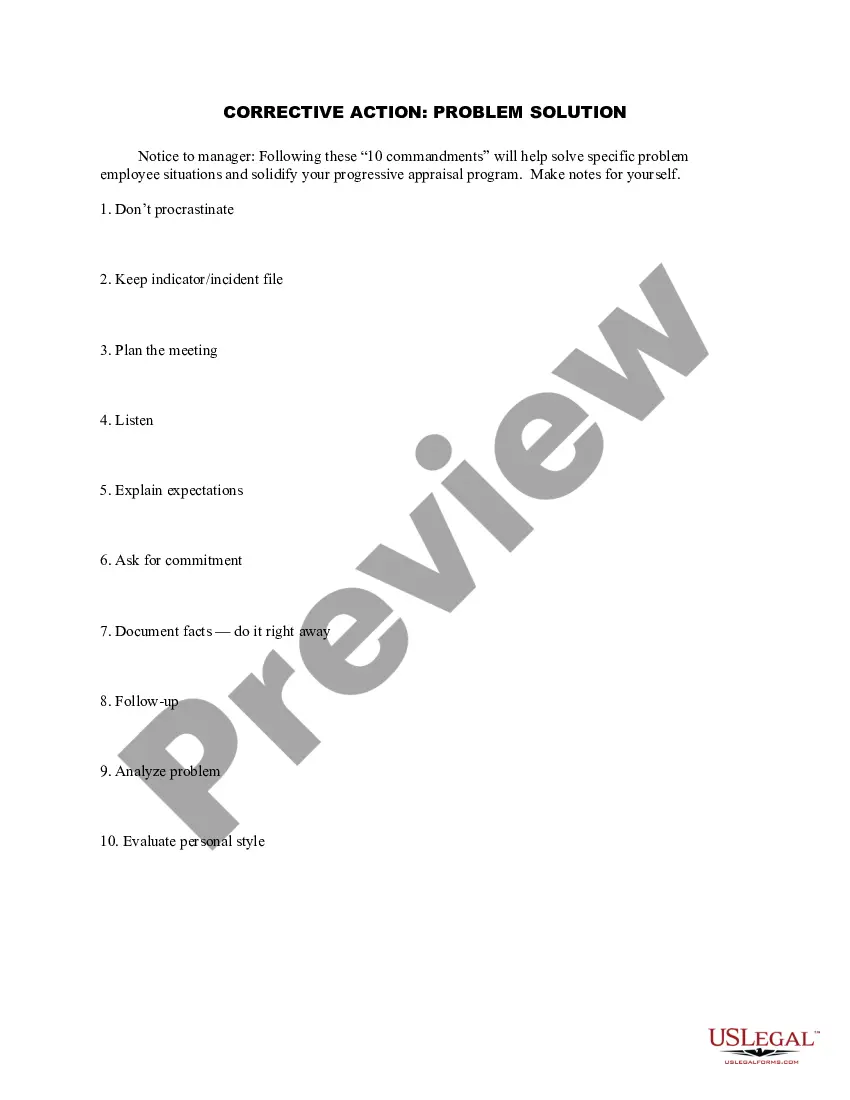

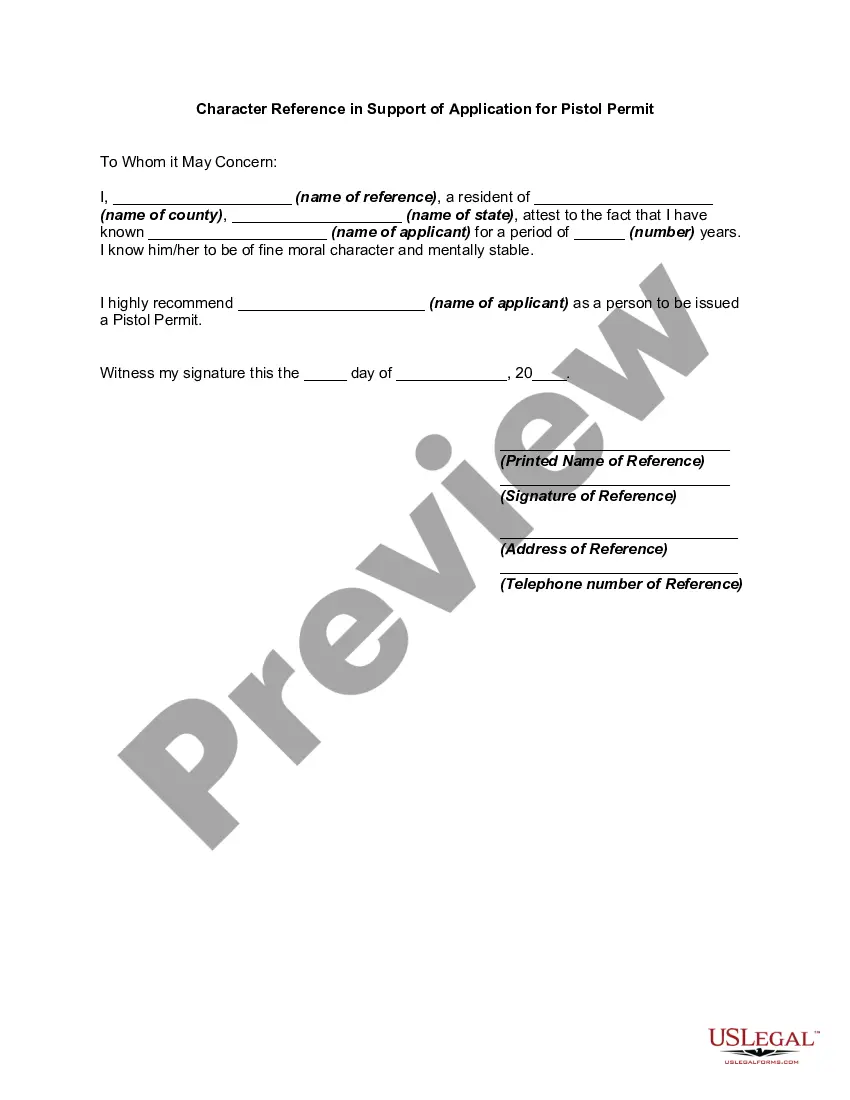

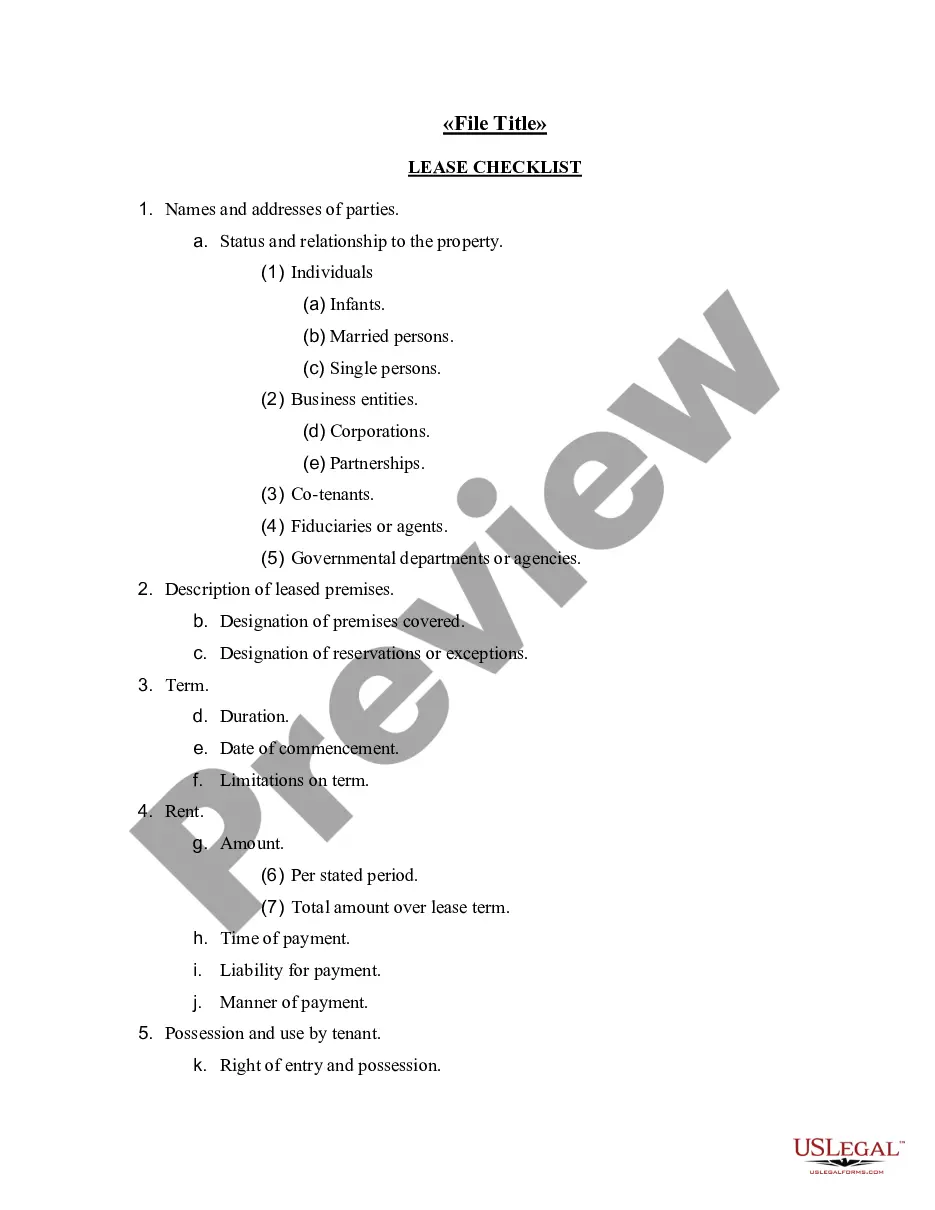

If available, use the Preview option to review the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Obtain option.

- Afterward, you can complete, modify, print, or sign the Maryland Affidavit of No Coverage by Another Group Health Plan.

- Each legal document template you purchase is your property permanently.

- To access another copy of a purchased form, go to the My documents tab and click the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, make sure you have selected the correct document template for the region/city of your choice.

- Review the form description to confirm you have chosen the right form.

Form popularity

FAQ

Who Does the Deemer Statute Apply to? The deemer statute applies to any out of state driver who drives their car in New Jersey and gets into an accident. Therefore, the statute will apply to residents of Pennsylvania, New York, Delaware, Maryland, etc.

With the exception of Florida, every state requires bodily injury liability insurance (BI), while all 50 states plus Washington, D.C., require property damage liability (PD). Roughly half of the states require a type of uninsured/underinsured motorist insurance (UIM).

Maryland law requires all owners of motor vehicles to purchase and maintain the minimum coverage for bodily injury liability, personal injury protection, property damage, and uninsured/underinsured motorist protection .

Personal injury protection is not mandatory in Maryland. However, Maryland insurance companies are required to offer a minimum of $2,500 of PIP coverage when writing auto insurance policies.

In India, as per the Motor Vehicles Act, it is mandatory that all vehicles that operate in any public space must have a motor vehicle insurance cover. Policyholders must have at least 'third party liability' motor insurance cover even when opting for the basic insurance plans.

Maryland is an at-fault state for determining who has financial liability for harm caused in a vehicle crash. Typically, the driver who authorities find legally to blame for an accident is responsible for the financial costs of injuries and other damage caused.

Comprehensive Coverage (Optional): Maryland law does not require that you purchase comprehensive coverage . However, if you take out a loan to purchase your vehicle, most lenders will require that you purchase comprehensive coverage .

Yes, Maryland requires vehicle owners to carry uninsured motorist coverage of at least: $30,000 bodily injury coverage per person per accident. $60,000 total bodily injury coverage per accident, and. $15,000 per accident for property damage.

So, an FR-19 simply verifies that you had insurance at the time it was filed and can be used to verify this fact if requested. The Maryland Motor Vehicle Administration (MVA) and the Delaware Department of Motor Vehicles (DMV) requests an FR-19 from your insurance company each time you go to renew your registration.

Currently, ten states have no pay, no play laws on the books: Alaska, California, Iowa, Kansas, Louisiana, Michigan, New Jersey, North Dakota, Oklahoma, and Oregon.