Maryland Notice of Meeting of LLC Members To Consider Dissolution of the Company

Description

How to fill out Notice Of Meeting Of LLC Members To Consider Dissolution Of The Company?

If you seek to be thorough, acquire, or print legitimate document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site’s straightforward and user-friendly search to find the documents you require. A variety of templates for business and personal use are organized by categories and states, or keywords.

Employ US Legal Forms to locate the Maryland Notice of Meeting of LLC Members To Consider Dissolution of the Company with just a few clicks.

Each legal document template you purchase is yours permanently. You have access to every form you downloaded within your account. Go to the My documents section and select a form to print or download again.

Fill out and download, and print the Maryland Notice of Meeting of LLC Members To Consider Dissolution of the Company with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms customer, Log In to your account and click the Acquire button to get the Maryland Notice of Meeting of LLC Members To Consider Dissolution of the Company.

- Additionally, you can access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the directions below.

- Step 1. Ensure you have chosen the form applicable to the correct city/state.

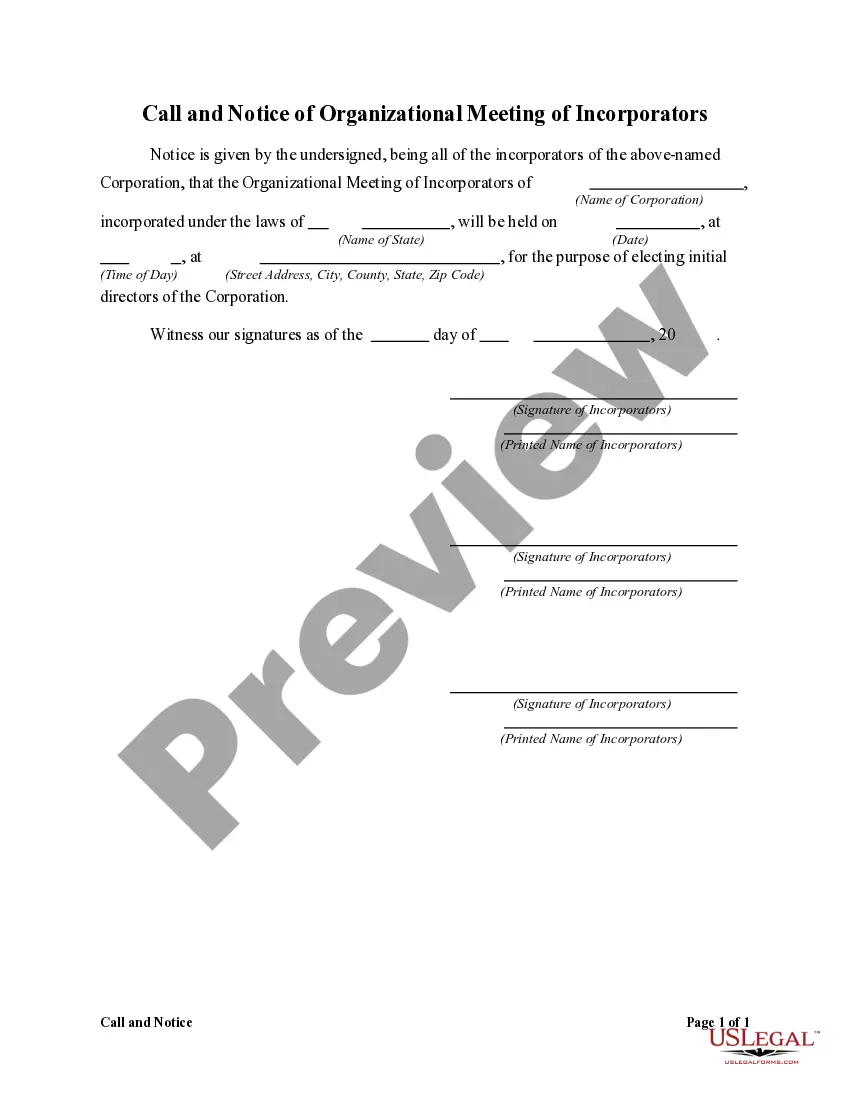

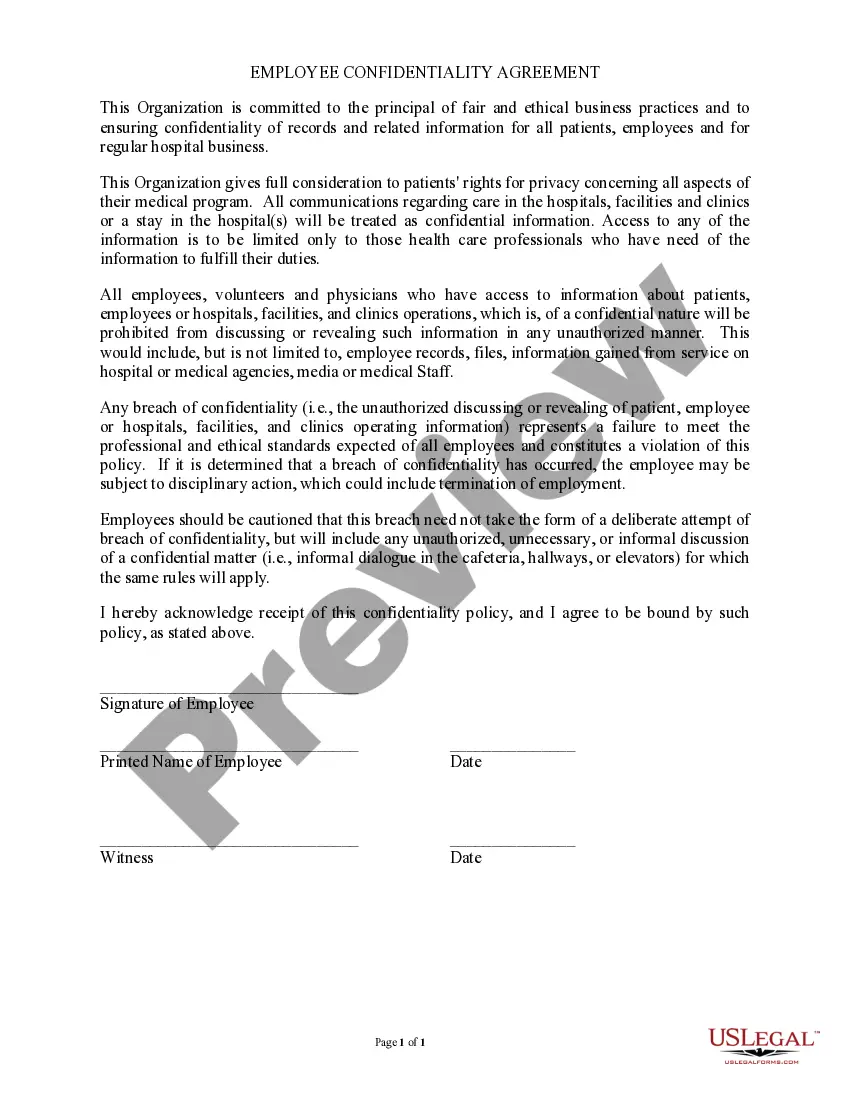

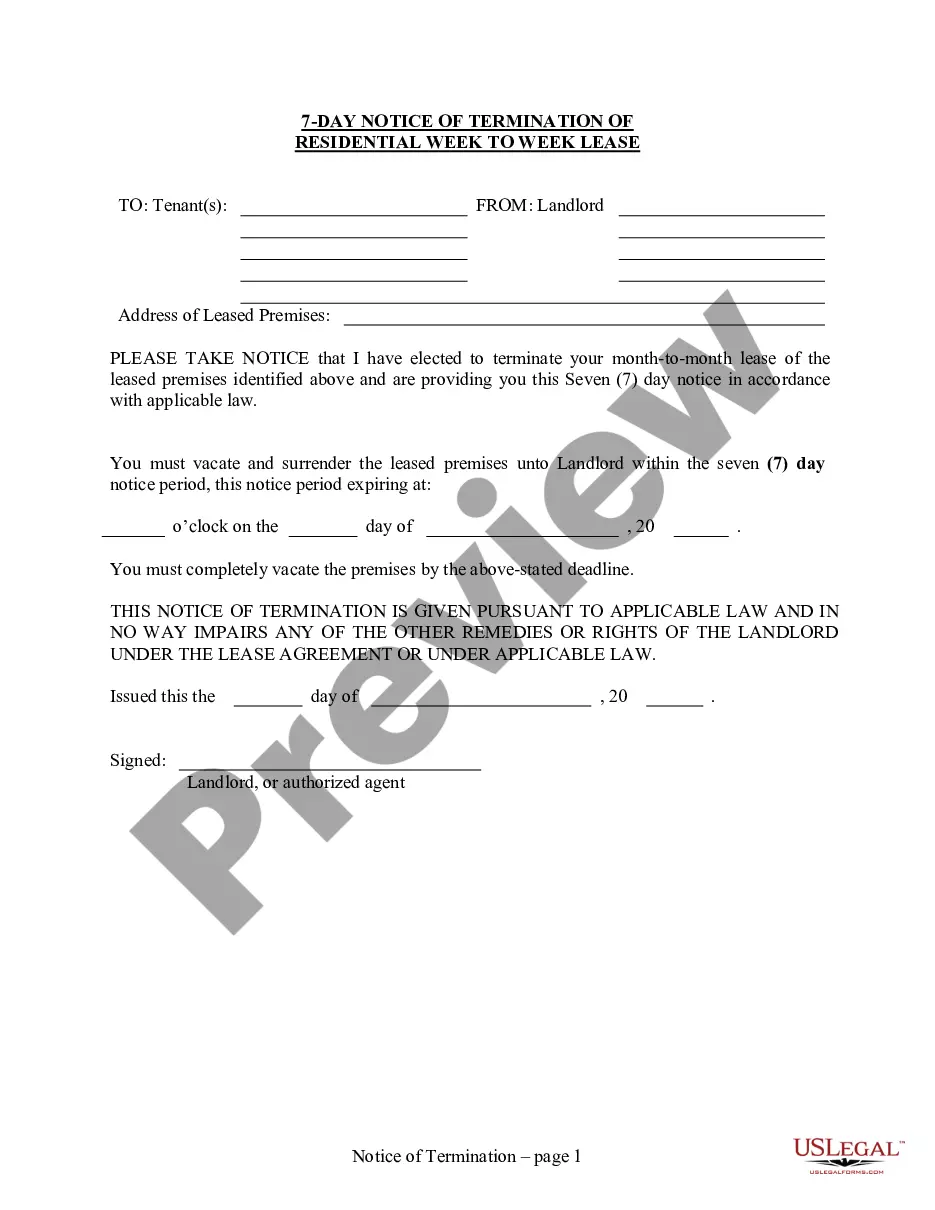

- Step 2. Use the Review option to examine the content of the form. Remember to read the details.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other variations of the legal form style.

- Step 4. Once you have found the form you need, click the Buy now button. Select the pricing plan you prefer and enter your details to create an account.

- Step 5. Process the payment. You can utilize your Visa or Mastercard or PayPal account to complete the payment.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the Maryland Notice of Meeting of LLC Members To Consider Dissolution of the Company.

Form popularity

FAQ

There is a $100 filing fee to file the articles. It will take about 8 weeks for SDAT to process your filing. For an additional $50, you can get expedited service, which means your filing should be processed within 7 business days.

The certificate of intent to dissolve serves as public notice that the corporation is no longer carrying on its activities, except to the extent necessary for the liquidation.

Removal may be as simple as the member submitting a letter of resignation, depending on the relevant provisions. However, if the member is not willing to voluntarily resign, the provisions might provide, for example, a voting procedure allowing the other members to vote for the removal of the recalcitrant member.

To dissolve an LLC in Maryland, simply follow these three steps: Follow the Operating Agreement....Step 1: Follow Your Maryland LLC Operating Agreement. For most LLCs, the steps for dissolution will be outlined in the operating agreement.Step 2: Close Your Business Tax Accounts.Step 3: File Articles of Dissolution.

How to Dissolve an LLCVote to Dissolve the LLC. Members who decide to dissolve the company are taking part in something called a voluntary dissolution.File Your Final Tax Return.File an Article of Dissolution.Settle Outstanding Debts.Distribute Assets.Conduct Other Wind Down Processes.

To dissolve your LLC in Maryland, you file Articles of Cancellationwith the Maryland State Department of Assessments and Taxation (SDAT) by mail, fax, or in person. If you use the Maryland SDAT form, you have to type or print your information in ink. You don't have to use SDAT forms, though.

The only way a member of an LLC may be removed is by submitting a written notice of withdrawal unless the articles of organization or the operating agreement for the LLC in question details a procedure for members to vote out others. The steps to follow are: Determine the procedure for withdrawing members.

Below is a list of actions required when closing a business in Maryland.Step 1 End or Cancel Your Business with the Maryland Department of Assessments & Taxation.Step 2 Close Your Business with the Comptroller of Maryland.Step 3 Close Your Business with the IRS.Step 4 Close Your Business with local agencies.More items...

In general, the operating agreement will have a buyout provision for any member who no longer wants to be part of the LLC, stipulating how much the company is worth and how much each remaining member needs to pay in order to buy out the leaving member's ownership percentage of the company.