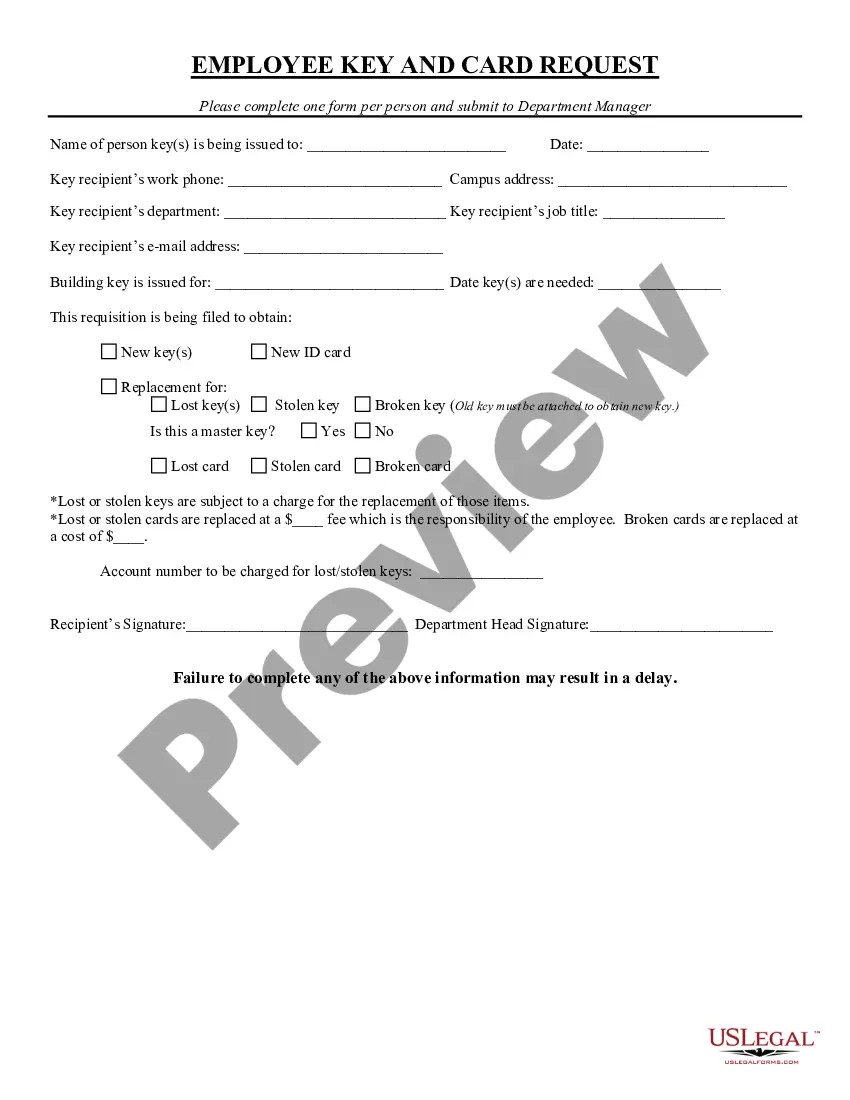

Maryland Employee Key and Card Request

Description

How to fill out Employee Key And Card Request?

It is feasible to spend hours online looking for the legal document template that satisfies the federal and state requirements you need.

US Legal Forms offers an extensive collection of legal forms that are evaluated by professionals.

You can easily download or print the Maryland Employee Key and Card Request from the service.

If available, use the Review button to examine the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click on the Download button.

- Afterwards, you can complete, modify, print, or sign the Maryland Employee Key and Card Request.

- Each legal document template you acquire is yours to keep indefinitely.

- To obtain another copy of a purchased form, go to the My documents tab and select the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions outlined below.

- First, ensure you have selected the correct document template for the area/city of your choice.

- Review the form description to confirm you have chosen the correct template.

Form popularity

FAQ

Maryland 1099 State Filing Requirements The State of Maryland mandates the filing of 1099 forms, including 1099-NEC, 1099-MISC, 1099-G, 1099-R. Maryland also mandates the filing of Form MW508, Annual Employer Withholding Reconciliation Return.

Q1 - What is the Maryland Central Registration Number? The Maryland Central Registration Number is an eight-digit number assigned by Maryland when you open a state withholding account. The number is located under the label "REGISTRATION NBR" in the coupon books sent to each employer.

Form MW-506 is Maryland's reporting form for Return of Income Tax Withheld. In other words, it documents that you withheld your employees' estimated income tax liability and remitted these funds to the state.

Maryland Central Registration NumberLook up your Central Registration Number online by logging into the Comptroller of Maryland's website.Locate your eight digit (XXXXXXXX) Central Registration Number on any previously filed Annual Reconciliation Return (Form MW-508).Call the Comptroller's office: 800-MD-TAXES.

Maryland Income Taxes for Tax Year 2021 (January 1 - Dec. 31, 2021) can be completed and e-filed via eFile.com along with a Federal Tax Return (or you can learn how to only prepare and file a MD state return). The Maryland tax filing and tax payment deadline is April 18, 2022.

Complete Form MW507 so that your employer can withhold the correct Maryland income tax from your pay. Consider completing a new Form MW507 each year and when your personal or financial situation changes.

You are not required by law to withhold Maryland income taxes from the wages paid to a domestic employee in a private residence. However, you may do so as a courtesy to the employee. If you wish, you can register your withholding account online and use bFile to file your withholding returns electronically for free.

Form MW-506 is Maryland's reporting form for Return of Income Tax Withheld. In other words, it documents that you withheld your employees' estimated income tax liability and remitted these funds to the state.

You are required to fill out a MW506 form on an accelerated, monthly, quarterly, seasonal or annual basis, depending upon the amount of tax withheld. You must file your MW506 form by the due dates, even if no tax was withheld. If no tax is due, file by telephone by calling 410-260-7225.