Maryland Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse

Description

How to fill out Marital-deduction Residuary Trust With A Single Trustor And Lifetime Income And Power Of Appointment In Beneficiary Spouse?

Are you currently within a placement in which you require documents for sometimes company or individual functions virtually every day time? There are tons of legal record web templates available online, but finding ones you can rely on isn`t simple. US Legal Forms gives a huge number of type web templates, like the Maryland Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse, that are published to fulfill state and federal needs.

When you are already familiar with US Legal Forms web site and also have a merchant account, basically log in. Afterward, it is possible to obtain the Maryland Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse template.

Unless you provide an bank account and wish to begin using US Legal Forms, abide by these steps:

- Discover the type you want and make sure it is for the proper metropolis/state.

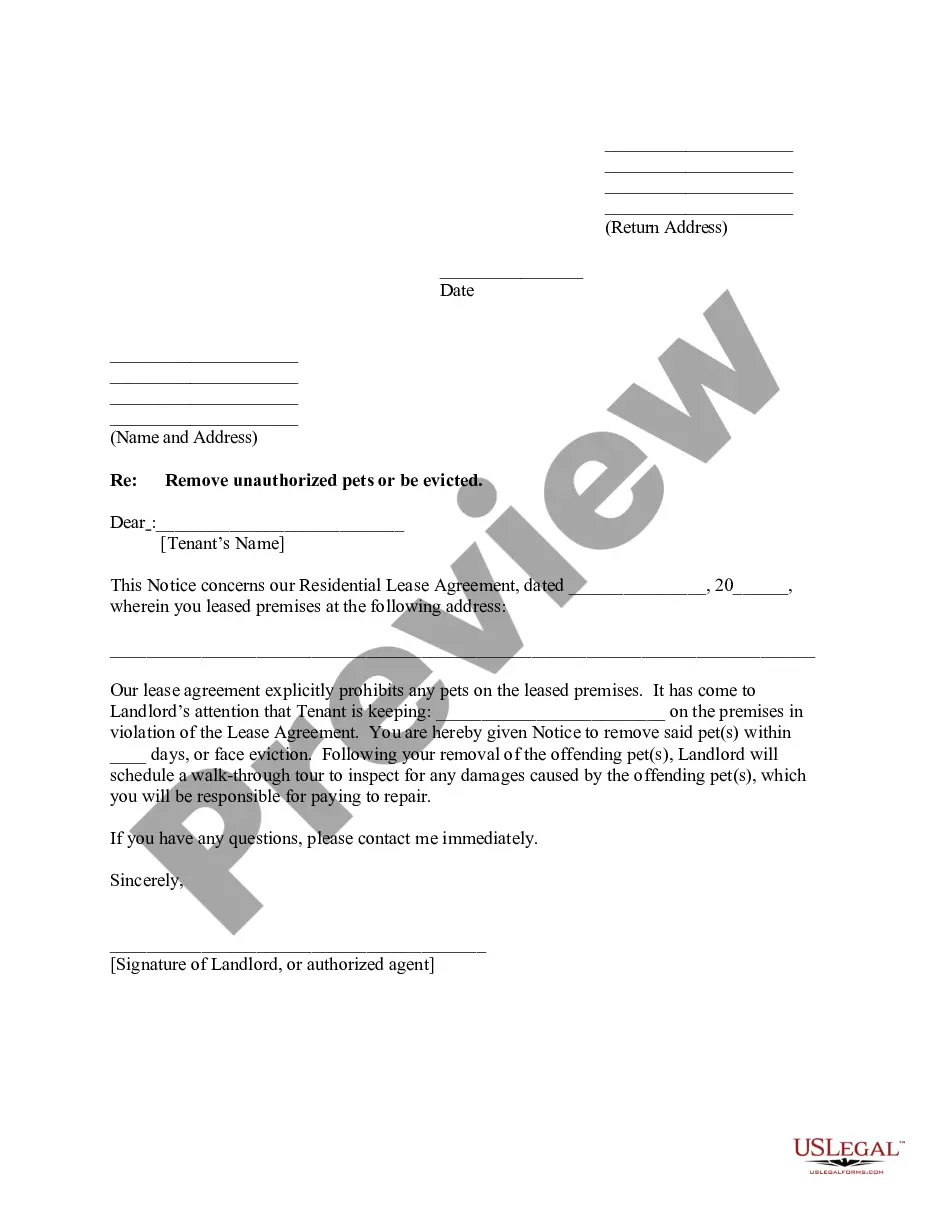

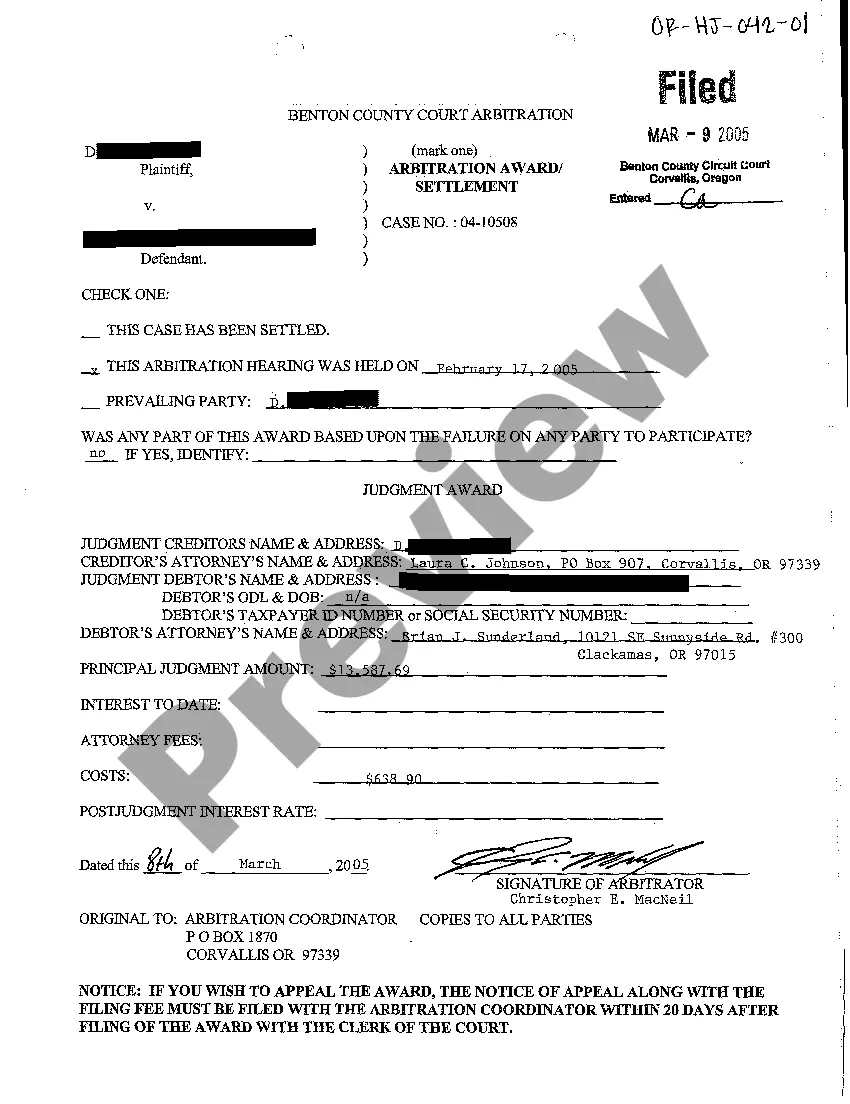

- Take advantage of the Preview switch to analyze the shape.

- Look at the explanation to actually have chosen the proper type.

- If the type isn`t what you`re seeking, take advantage of the Research industry to discover the type that fits your needs and needs.

- When you obtain the proper type, click on Purchase now.

- Select the pricing strategy you need, submit the desired information and facts to create your money, and purchase the order utilizing your PayPal or credit card.

- Pick a convenient document file format and obtain your copy.

Locate each of the record web templates you have bought in the My Forms menus. You may get a additional copy of Maryland Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse whenever, if necessary. Just go through the necessary type to obtain or print out the record template.

Use US Legal Forms, by far the most extensive selection of legal varieties, to save efforts and steer clear of mistakes. The services gives appropriately made legal record web templates which can be used for a variety of functions. Create a merchant account on US Legal Forms and start producing your life a little easier.

Form popularity

FAQ

Property interests passing to a surviving spouse that are not included in the decedent's gross estate do not qualify for the marital deduction. Expenses, indebtedness, taxes, and losses chargeable against property passing to the surviving spouse will reduce the marital deduction. Chapter 6 Use of the Marital Deduction in Estate Planning timbertax.org ? publications ? Chapter6.Use... timbertax.org ? publications ? Chapter6.Use...

In order to qualify the trust instrument must provide that at least one trustee be a United States citizen or domestic corporation, and that any distribution from the trust principal be subject to the United States trustee's right to withhold the estate tax due on the distribution.

If the surviving spouse has a general power of appointment, he or she can name anyone to receive the trust property during life or after death. The surviving spouse is also entitled to designate himself or herself as the recipient of the trust property.

The marital deduction is a tax provision that allows an individual to transfer an unlimited amount of assets to a surviving spouse without paying any federal gift or estate taxes. This means that the surviving spouse will not have to pay taxes on the assets they receive. Maryland Estate Tax Explained ? Learn with Valur valur.io ? maryland-estate-tax valur.io ? maryland-estate-tax

A marital deduction trust is a trust where transfers of property between married partners are free of federal transfer tax. A marital deduction trust can take one of two forms: A life estate coupled with a general power of appointment given to the spouse, or. A Qualified Terminable Interest Property (QTIP) trust.

Marital deduction refers to exceptions to gift and estate taxes for transfers made to spouses. Almost all property qualifies for this deduction and there is no limit. The deduction does not avoid taxes completely, but rather, the spouse receiving the property must pay the eventual estate taxes. marital deduction | Wex | US Law | LII / Legal Information Institute cornell.edu ? wex ? marital_deduction cornell.edu ? wex ? marital_deduction

The effect of the marital deduction trust is that it shields both spouse's assets and estates from federal estate taxes because when the first spouse dies, the assets indicated by the settlor (the spouse who created the trust) pass to the marital trust without federal estate taxes. marital deduction trust | Wex | US Law | LII / Legal Information Institute cornell.edu ? wex ? marital_deduction_t... cornell.edu ? wex ? marital_deduction_t...

In Maryland, the marital deduction rule is an estate tax concept that allows for an individual, during his or her lifetime and after, to make unlimited gifts to his or her spouse.