Maryland Assignment of Personal Property

Description

How to fill out Assignment Of Personal Property?

Are you presently in a situation where you require documents for both business or personal reasons nearly every day.

There are numerous legal document templates available online, but finding ones you can trust is not simple.

US Legal Forms offers thousands of template documents, such as the Maryland Assignment of Personal Property, which can be tailored to meet federal and state requirements.

Once you find the correct form, click Purchase now.

Choose the pricing plan you want, fill in the necessary information to create your payment, and complete the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you will be able to download the Maryland Assignment of Personal Property template.

- If you don’t have an account and wish to start using US Legal Forms, follow these steps.

- Acquire the form you need and ensure it is for the correct city/region.

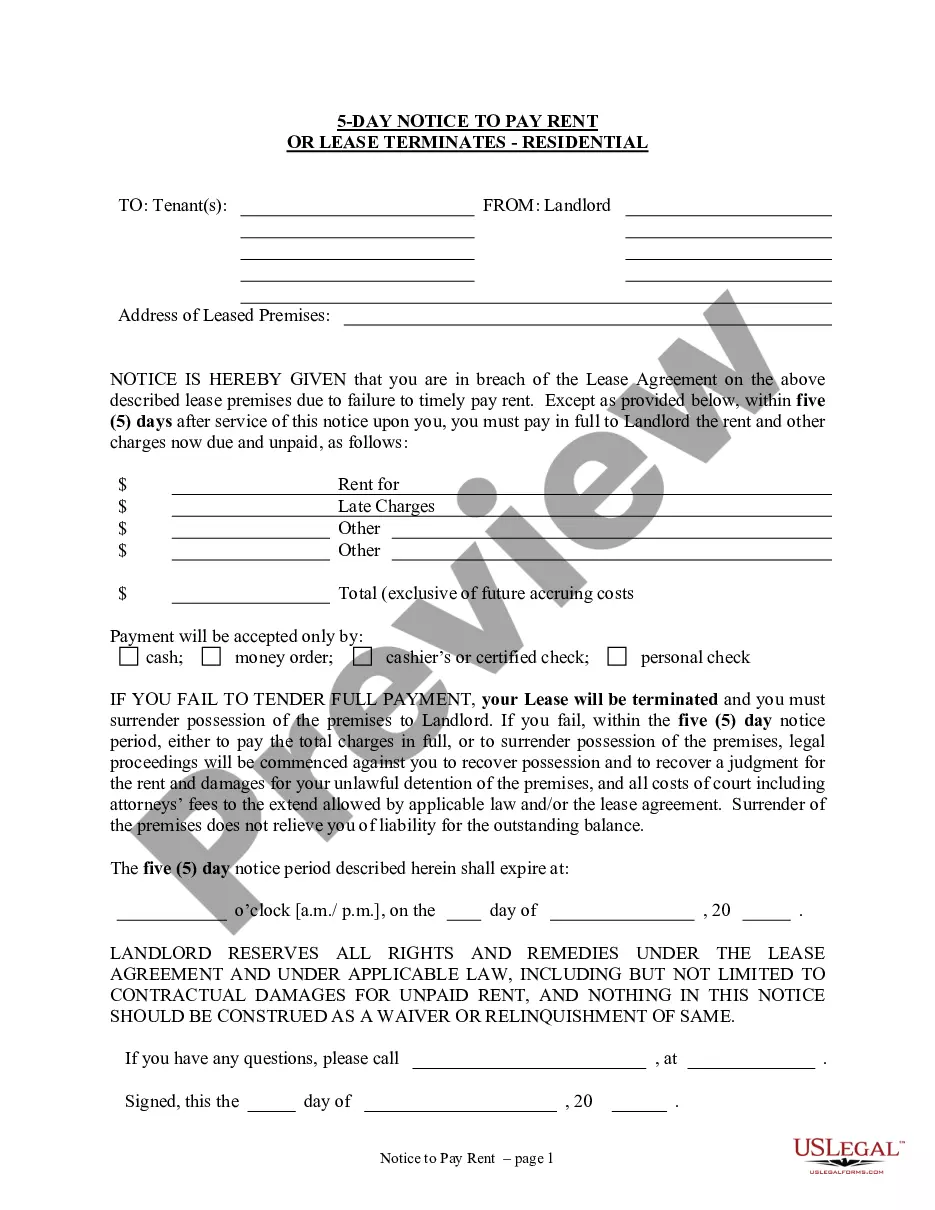

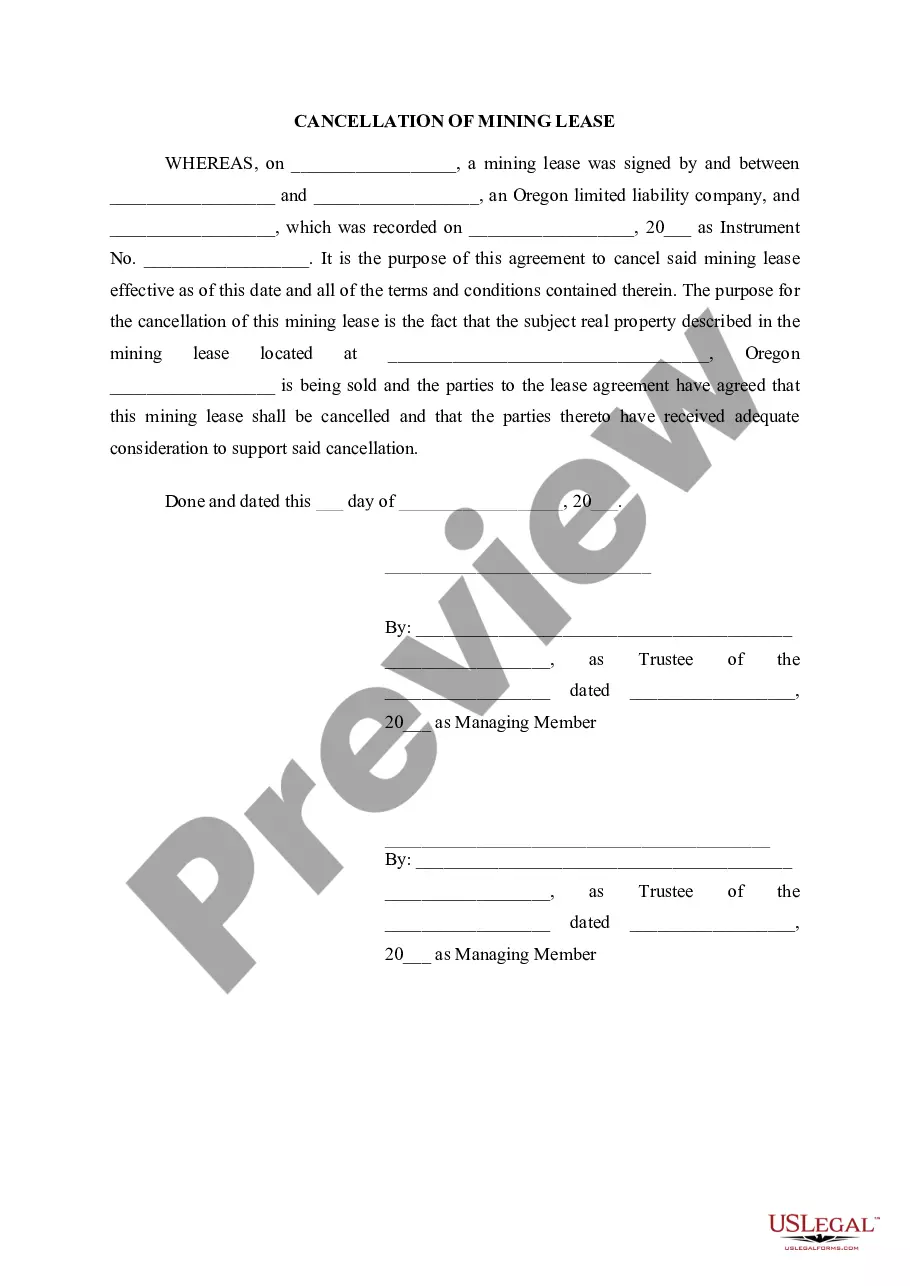

- Utilize the Preview button to review the form.

- Read the description to confirm that you have selected the correct form.

- If the form is not what you are looking for, utilize the Search box to locate the form that meets your needs.

Form popularity

FAQ

Do I need to file an Annual Report? All legal business entities formed, qualified, or registered to do business in Maryland MUST file an Annual Report: Legal business entities (Corporations, LLC, LP, LLP, etc.), whether they are foreign or domestic, must file a Form 1 Annual Report (fees apply)

Yes! The state of Maryland requires all annual reports and tax returns to be filed with original signatures and documents.

Yes, businesses must pay an annual tax based on the value of their personal property (furniture, fixtures, tools, machinery, equipment, etc.). The Maryland Department of Assessments & Taxation administers the valuation process while the counties and towns collect the tax based on the location of the property.

Responsibility for the assessment of all personal property throughout Maryland rests with the Department of Assessments and Taxation. Personal property generally includes furniture, fixtures, office and industrial equipment, machinery, tools, supplies, inventory and any other property not classified as real property.

Business owners must know annual reporting requirements required by state agencies. Some annual filings that may affect sole proprietors and single-member LLCs include fictitious name statements, business permits, and licenses, Articles of Amendment, and Statements of Information.

All corporations, limited liability companies (LLCs), limited liability partnerships (LLPs), and limited partnerships must file personal property returns with the Department of Assessments and Taxation. 2.

Personal Income TaxA percentage of the Maryland Adjusted Gross Income for Calendar Year 20192.83 percent and starting Calendar Year 20203.2 percent. Personal Property$2.75 per $100 of assessed value. Real Property$1.10 per $100 of assessed value.

Required Annual FilingsAll business entities formed, qualified, or registered to do business in Maryland must file an Annual Report every year.

In Maryland, an annual report is a regular filing that your LLC must complete every year to update your business information, including: Company mailing address. Nature of business activity. Business personal property status.