Maryland Unrestricted Charitable Contribution of Cash

Description

How to fill out Unrestricted Charitable Contribution Of Cash?

Have you ever been in a situation where you needed documents for either business or personal purposes almost all the time.

There are numerous authentic document templates available online, but finding reliable ones is challenging.

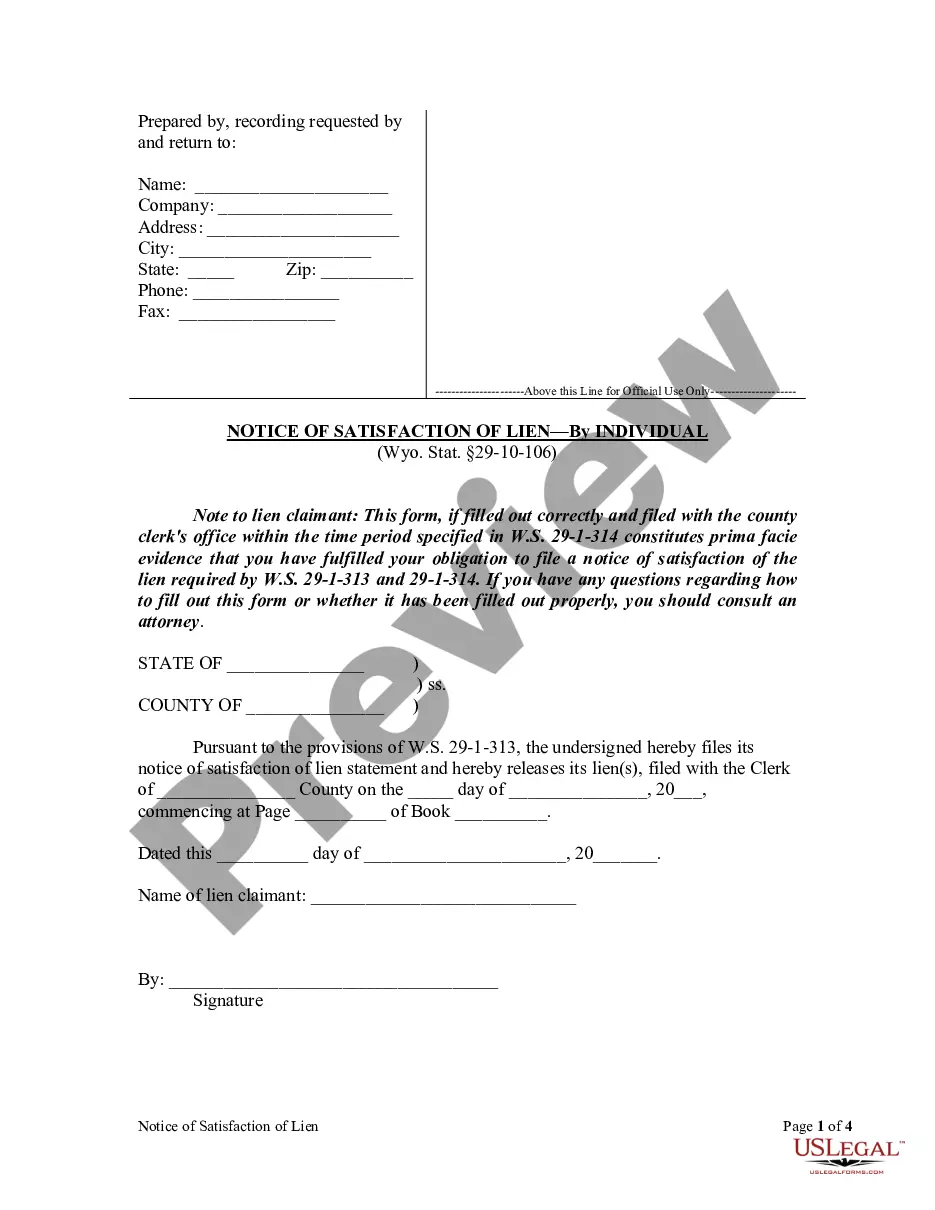

US Legal Forms offers a vast array of form templates, such as the Maryland Unrestricted Charitable Contribution of Cash, specifically designed to comply with state and federal regulations.

Once you find the right form, click Acquire now.

Select the pricing plan you want, fill in the necessary information to create your account, and pay for the transaction using your PayPal or credit card. Choose a preferred file format and download your copy.

- If you are already familiar with the US Legal Forms site and possess an account, simply Log In.

- Then, you can download the Maryland Unrestricted Charitable Contribution of Cash template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you require and ensure it is for the correct city/region.

- Click the Preview button to review the form.

- Check the description to confirm that you have chosen the correct form.

- If the form does not match your needs, use the Search box to find the form that suits your requirements.

Form popularity

FAQ

Classifying charitable contributions involves determining the nature and purpose of your donations. The IRS distinguishes between cash contributions, property donations, and other types. For example, a Maryland Unrestricted Charitable Contribution of Cash falls under cash donations and has specific guidelines for reporting on your taxes. It is essential to keep accurate records of your contributions to ensure proper classification and maximize your deductions.

Yes, charitable donations are generally tax deductible in Maryland, provided that you follow the state's tax regulations. When you make a Maryland Unrestricted Charitable Contribution of Cash, you can claim it on your state tax return. Check with your state tax agency or a tax advisor to confirm which contributions qualify and how they can impact your tax liability.

Yes, you can deduct charitable contributions without itemizing if you meet certain criteria. For example, the IRS allows a deduction for cash donations up to a specific limit even if you are taking the standard deduction. This includes the Maryland Unrestricted Charitable Contribution of Cash, which can be beneficial for taxpayers. Be sure to consult tax guidelines or professionals to understand the specifics and ensure compliance.

The highest amount you can deduct for charitable donations varies based on your income and the type of organization. Generally, cash contributions can be deducted up to 60% of your adjusted gross income for Maryland Unrestricted Charitable Contribution of Cash. It's important to keep accurate records of your donations and consult tax guidelines to maximize your deductions. Utilizing resources from uslegalforms can provide clarity and support through the deduction process.

Yes, Maryland does allow charitable deductions for contributions made to qualifying organizations. These deductions can apply to your Maryland Unrestricted Charitable Contribution of Cash, benefiting both your finances and the community. To take advantage of these deductions, ensure that your donations are recorded correctly and reported on your tax return. Familiarizing yourself with Maryland’s tax regulations can help you navigate the process smoothly.

To claim charitable contributions, start by gathering receipts and records of your donations. For Maryland Unrestricted Charitable Contribution of Cash, you will need to detail each contribution on your tax return. Utilize online platforms like uslegalforms for guidance on the necessary forms and documentation. This way, you can accurately report your contributions and maximize your potential deductions.

The COF 85 form in Maryland is used for reporting unrestricted charitable contributions of cash. This form is essential for individuals and organizations wishing to document their charitable donations properly. By completing the COF 85, you can ensure that your Maryland Unrestricted Charitable Contribution of Cash is officially recognized. This recognition can enhance your tax benefits and support your philanthropic efforts.

Yes, non-profit organizations can be tax-exempt in Maryland, provided they meet certain criteria established by the IRS and the state. Tax-exempt status allows these organizations to receive the Maryland Unrestricted Charitable Contribution of Cash without incurring income tax on donations. This status helps non-profits allocate more resources towards their missions and community service. For accurate guidance on applying for tax exemption, platforms like USLegalForms can provide valuable resources.

The Maryland Charitable Solicitation Act regulates the activities of charitable organizations in Maryland. It ensures that these organizations follow specific guidelines when soliciting donations, including the Maryland Unrestricted Charitable Contribution of Cash. This act protects the public from misleading fundraising practices and maintains transparency within the charitable sector. Understanding this act is vital for both donors and charities to foster trust.

When you consider a Maryland Unrestricted Charitable Contribution of Cash, you may wonder about the limits on your tax deductions. For cash donations, you can generally write off up to 60% of your adjusted gross income. However, it's important to document your contributions and ensure that you are donating to qualified organizations. To maximize your potential deductions and navigate the rules effectively, you may want to explore uslegalforms, which offers resources designed to assist you in understanding and documenting your charitable contributions.