Maryland Sales Prospect File

Description

How to fill out Sales Prospect File?

Are you currently in a situation where you require documents for business or personal purposes almost every day.

There are numerous legal document templates available online, but locating ones that you can depend on is challenging.

US Legal Forms provides thousands of template forms, similar to the Maryland Sales Prospect File, that are designed to comply with federal and state regulations.

Once you find the correct form, simply click Buy now.

Select your preferred pricing plan, complete the required information to create your account, and pay for the transaction using your PayPal or Visa or Mastercard.

- If you're already acquainted with the US Legal Forms site and have an account, simply Log In.

- After that, you can download the Maryland Sales Prospect File template.

- If you do not possess an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it corresponds to the correct city/region.

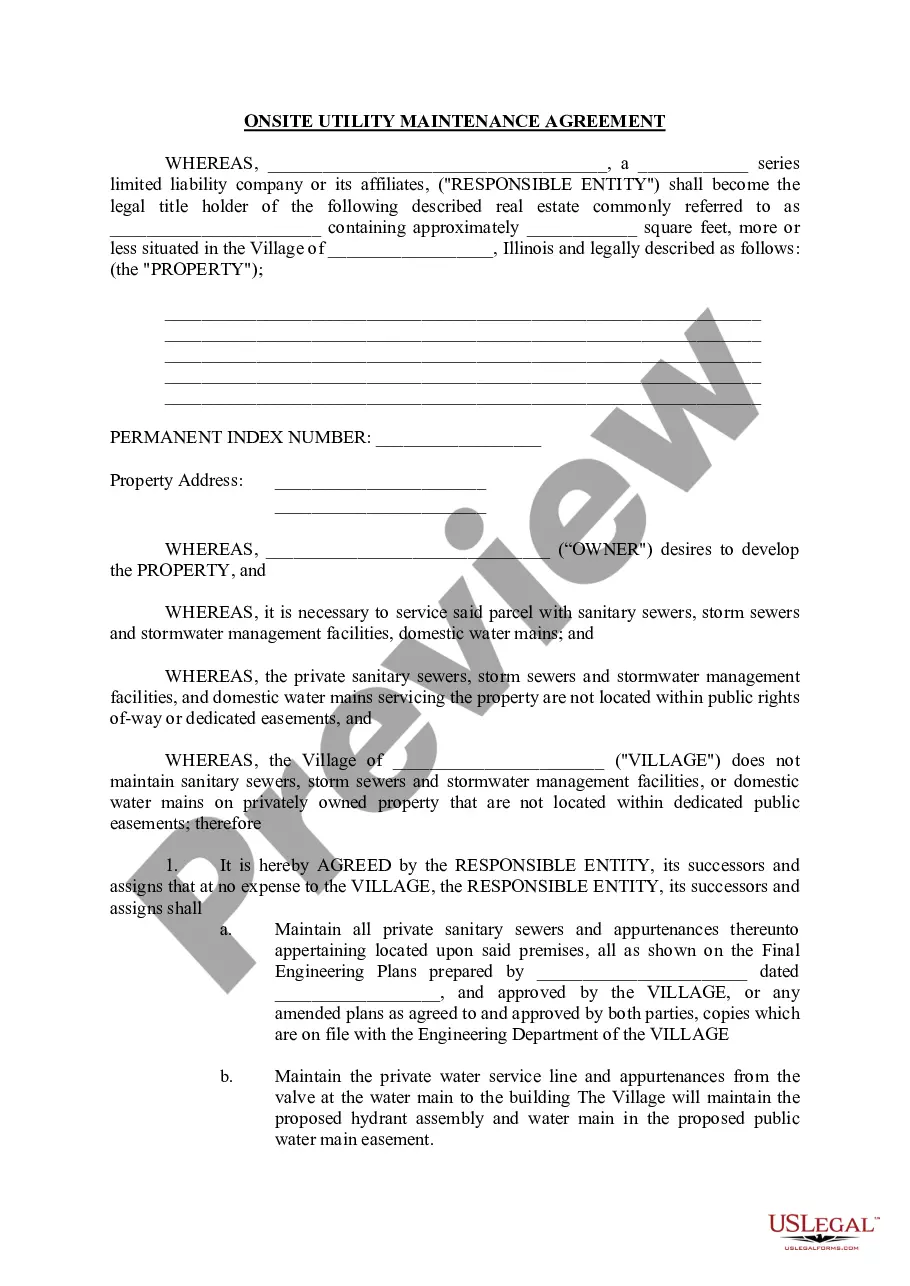

- Use the Preview button to review the document.

- Verify the details to ensure you’ve selected the correct form.

- If the form does not meet your needs, use the Search field to find the document that suits your requirements.

Form popularity

FAQ

A CRN number for taxes is the Central Registration Number that businesses use to register for various Maryland taxes. This number facilitates the filing process and helps state agencies track tax accounts. Keeping your CRN number organized is beneficial for your Maryland Sales Prospect File.

A CRN number, or Central Registration Number, in Maryland is a unique identifier assigned to businesses for state tax purposes. It is used to track your tax obligations and administrative filings. Understanding your CRN is fundamental for maintaining compliance within your Maryland Sales Prospect File.

Your Maryland employer account number can be found on the registration confirmation you received after registering your business. If you misplaced this document, you can contact the Maryland Department of Labor for help. It's important to have this number handy, especially when managing your Maryland Sales Prospect File.

Filing Maryland sales tax involves completing the relevant forms, which you can find on the Maryland Comptroller's website. Make sure to gather all sales records to ensure accuracy. After filling out the forms, you can submit them online or by mail. Proper filing supports a comprehensive Maryland Sales Prospect File.

You can locate your Maryland state tax ID number by checking official correspondence from the Maryland Comptroller's office. This number is included in your tax filings and other relevant documents. Alternatively, you can contact their office directly for more information. Knowing your tax ID is crucial for maintaining an accurate Maryland Sales Prospect File.

To find your Maryland CRN number, you can visit the Maryland Department of Labor website. They provide online resources where you can search for your number. If you encounter any difficulties, consider reaching out to their customer service for assistance. Having your CRN is essential for managing your Maryland Sales Prospect File.

MD form 510 must be filed by partnerships and S corporations doing business in Maryland. It's essential to ensure compliance with the state's tax laws. You can find the necessary resources in the Maryland Sales Prospect File, making it easier to manage your filing responsibilities efficiently.

A 1099G form in Maryland is used to report income received from state tax refunds, credits, or offsets. If you received such income, you must report it on your tax return. The Maryland Sales Prospect File provides valuable insights on how to handle these forms and integrate them into your overall tax strategy.

Yes, you must file an estate tax return in Maryland if the estate meets the minimum value threshold established by the state. This filing is vital for managing the estate's tax obligations. The Maryland Sales Prospect File contains useful information to help you understand your responsibilities and streamline the process.

Yes, if you sell goods or services in Maryland, you generally need to collect sales tax. Understanding your sales tax obligations is crucial for compliance. Utilizing resources from the Maryland Sales Prospect File can help you navigate the specifics of Maryland's sales tax laws effectively.