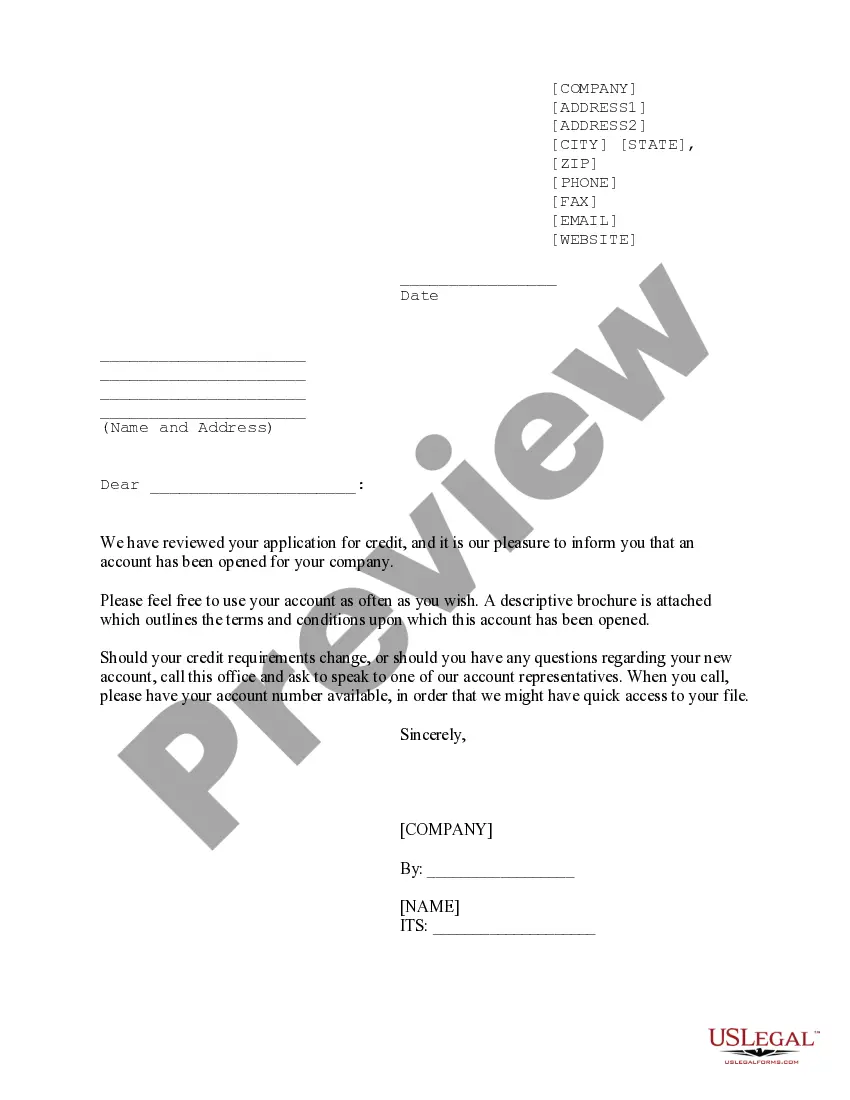

Maryland Credit Approval Form

Description

How to fill out Credit Approval Form?

If you want to aggregate, retrieve, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site's straightforward and convenient search feature to find the documents you need.

A selection of templates for business and personal purposes are organized by categories and states, or keywords.

Every legal document template you obtain is yours indefinitely. You can access all forms you have downloaded in your account. Go to the My documents section and choose a form to print or download again.

Complete and download, and print the Maryland Credit Approval Form with US Legal Forms. There are numerous professional and state-specific forms you can use for your business or personal needs.

- Utilize US Legal Forms to acquire the Maryland Credit Approval Form in just a few clicks.

- If you are a current US Legal Forms customer, Log In to your account and click on the Obtain button to receive the Maryland Credit Approval Form.

- You can also access forms you have previously downloaded from the My documents section of your account.

- If you are accessing US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have selected the form for the correct state/territory.

- Step 2. Use the Review option to examine the form's details. Remember to check the information carefully.

- Step 3. If you are not satisfied with the form, make use of the Search field at the top of the page to find alternative versions of the legal form.

- Step 4. After locating the form you need, select the Get now option. Choose your pricing plan and enter your information to create an account.

- Step 5. Complete the payment. You can pay with your credit card or PayPal account.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the Maryland Credit Approval Form.

Form popularity

FAQ

Use Form 510 (Schedule K-1) to report the distributive or pro rata share of the member's income, additions, subtractions, nonresident tax and credits apportioned to Maryland.

Fiduciary Filing Information Nonresident fiduciaries must also file Form 504NR which is used to calculate their nonresident tax. At this time, fiduciary tax returns cannot be filed electronically.

You can now submit the Form 1040-X, Amended U.S. Individual Income Tax Return electronically using available tax software products. Only tax year 2019 and 2020 Forms 1040 and 1040-SR returns that were originally e-filed can be amended electronically.

In addition, some Forms 1040, 1040-A, 1040-EZ, and 1041 cannot be e-filed if they have attached forms, schedules, or documents that IRS does not accept electronically.

The Homestead Tax Credit limits the amount of assessment increase on which eligible homeowners actually pay county, municipal, and state property taxes each year; regardless of your property's value or your income level.

Choose the Right Income Tax Form If you are a Maryland resident, you can file long Form 502 and 502B if your federal adjusted gross income is less than $100,000. If you lived in Maryland only part of the year, you must file Form 502.

Your combined gross household income cannot exceed $60,000.

You can file both your Maryland and federal tax returns online using approved software on your personal computer.

First, the homeowner(s) must have owned and occupied the property as a principal residence for at least 3 full tax years immediately preceding the razing or the commencement of the substantial improvements.

You must file your Maryland Amended Form 502X electronically to claim, or change information related to, business income tax credits from Form 500CR. Changes made as part of an amended return are subject to audit for up to three years from the date that the amended return is filed.