Maryland Accident Policy

Description

How to fill out Accident Policy?

US Legal Forms - one of the most important collections of legal documents in the United States - offers a variety of legal templates that you can download or print.

By utilizing the website, you can obtain thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can locate the latest editions of forms such as the Maryland Accident Policy in a matter of seconds.

If you possess a membership, Log In and download the Maryland Accident Policy from the US Legal Forms library. The Download option will be visible on each form you encounter. You can access all previously downloaded forms from the My documents section of your account.

Make adjustments. Fill out, edit, and print as well as sign the downloaded Maryland Accident Policy.

Every template you added to your account does not have an expiration date and is yours indefinitely. Therefore, if you would like to download or print another version, simply navigate to the My documents section and click on the form you need. Access the Maryland Accident Policy with US Legal Forms, one of the largest libraries of legal document templates. Utilize thousands of expert and state-specific templates that fulfill your business or personal requirements and specifications.

- If you are using US Legal Forms for the first time, here are simple instructions to help you get started.

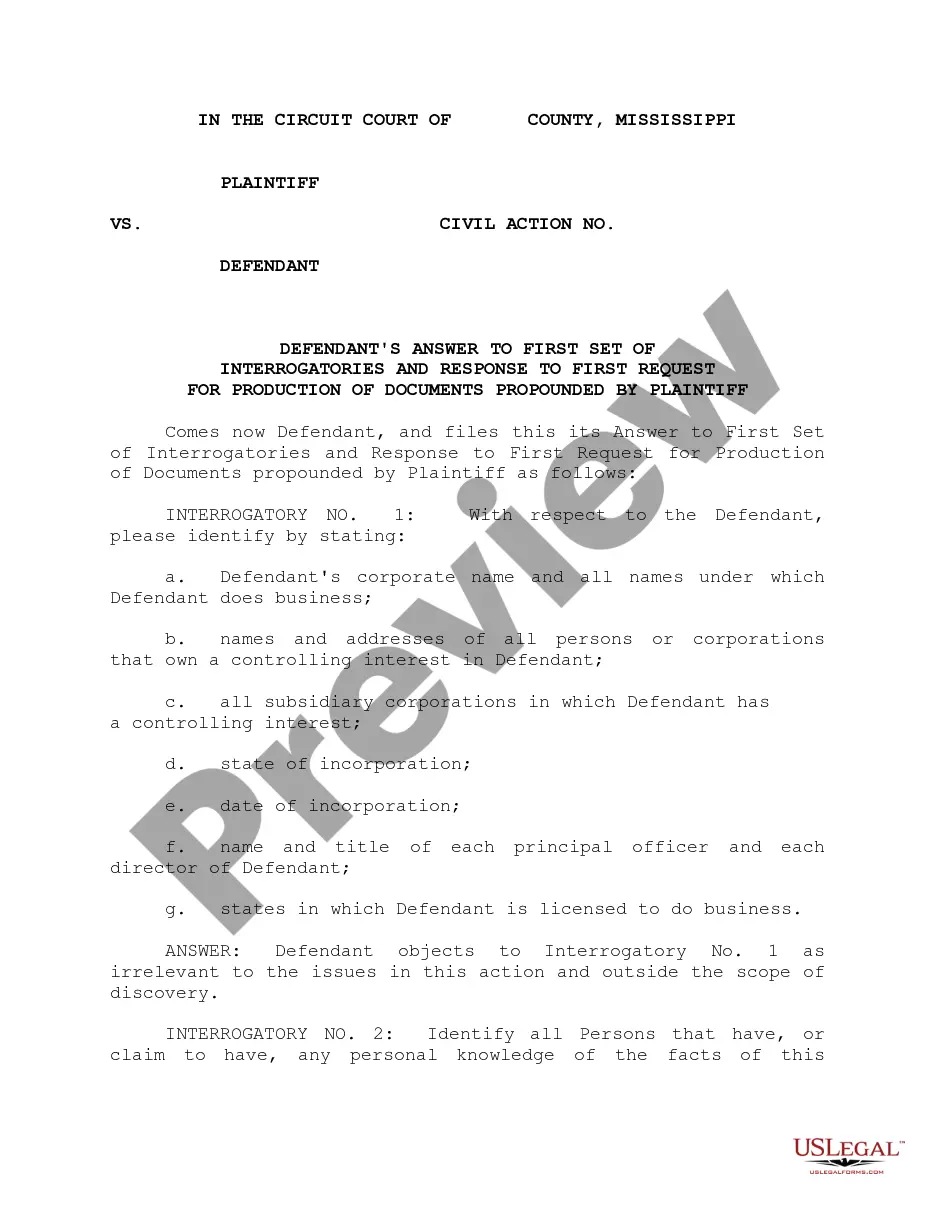

- Ensure you have selected the appropriate form for your city/region. Click on the Preview button to review the details of the form. Check the form description to confirm that you have chosen the correct form.

- If the form does not meet your needs, use the Search box at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Buy now button. Then, select the pricing plan you prefer and enter your information to create an account.

- Complete the purchase. Use your credit card or PayPal account to finalize the transaction.

- Choose the format and download the form onto your device.

Form popularity

FAQ

Other times it might be as many as 7 years. Or even 10. But generally, insurers will ask about the last 5 years. If your insurer asks about the last 5 years, claims you made and accidents you had more than 5 years ago won't affect the price of your car insurance.

Maryland is an at-fault state for car accidents. That means that drivers are allowed to sue another driver for compensation after a crash. However, there are certain insurance benefits that are not based on fault, which gives drivers additional options to recover damages after a collision.

How Long Do I Have to Report an Accident to My Insurance Company? If you're involved in an accident, you must tell your insurance company as soon as possible. Most insurers specify that you must inform them within 24 hours of the incident.

In Maryland, code 20-107 governs accidents and accident reporting. The law requires that people in a car accident filing an accident report with the Motor Vehicle Administration for accidents that result in bodily injury or death. Both drivers have 15 days to file.

Under Maryland Transportation Code § 27-113, leaving the scene of an accident resulting in serious bodily injury is a felony punishable by up to 5 years in prison and a fine of up to $5,000. If the accident results in death, hit and run carries a maximum penalty of 10 years in prison and a $10,000 fine.

Home » FAQs A» Can I Sue Somebody Personally After a Car Accident? Under Maryland law, personal injury victims are able to sue the alleged offenders in an attempt to recover economic and non-economic damages related to their injuries.

Usually, your car insurance rates will decrease over time as long as you are not involved in another at-fault accident. For example, if you are found at fault in a car accident that resulted in damages to your vehicle over $2000, you can expect increases in your car insurance to last for 3-5 years.

Failure to report an accident can lead to your policy being declared void by your insurers which could result in you being uninsured in respect of vehicle damage in the event of a later accident.

The average car insurance premium increase in Maryland after an at-fault car accident is $1,900, compared to the average increase in the United States of $2,010. As for percentages, you should expect your car premium to increase after the accident by 21.5%.

You must report the collision to the police if you were unable to exchange details at the scene, if anyone was injured, or if you suspect that the other person may have committed a driving offence.