Maryland Subordination Agreement Subordinating Existing Mortgage to New Mortgage

Description

How to fill out Subordination Agreement Subordinating Existing Mortgage To New Mortgage?

You are able to invest hrs on the Internet attempting to find the lawful papers design that fits the federal and state specifications you want. US Legal Forms provides 1000s of lawful forms that happen to be reviewed by pros. You can actually down load or printing the Maryland Subordination Agreement Subordinating Existing Mortgage to New Mortgage from our assistance.

If you currently have a US Legal Forms accounts, you can log in and click the Obtain switch. Afterward, you can complete, revise, printing, or indicator the Maryland Subordination Agreement Subordinating Existing Mortgage to New Mortgage. Each lawful papers design you buy is your own property permanently. To obtain another duplicate associated with a acquired form, check out the My Forms tab and click the related switch.

If you use the US Legal Forms site for the first time, stick to the basic guidelines listed below:

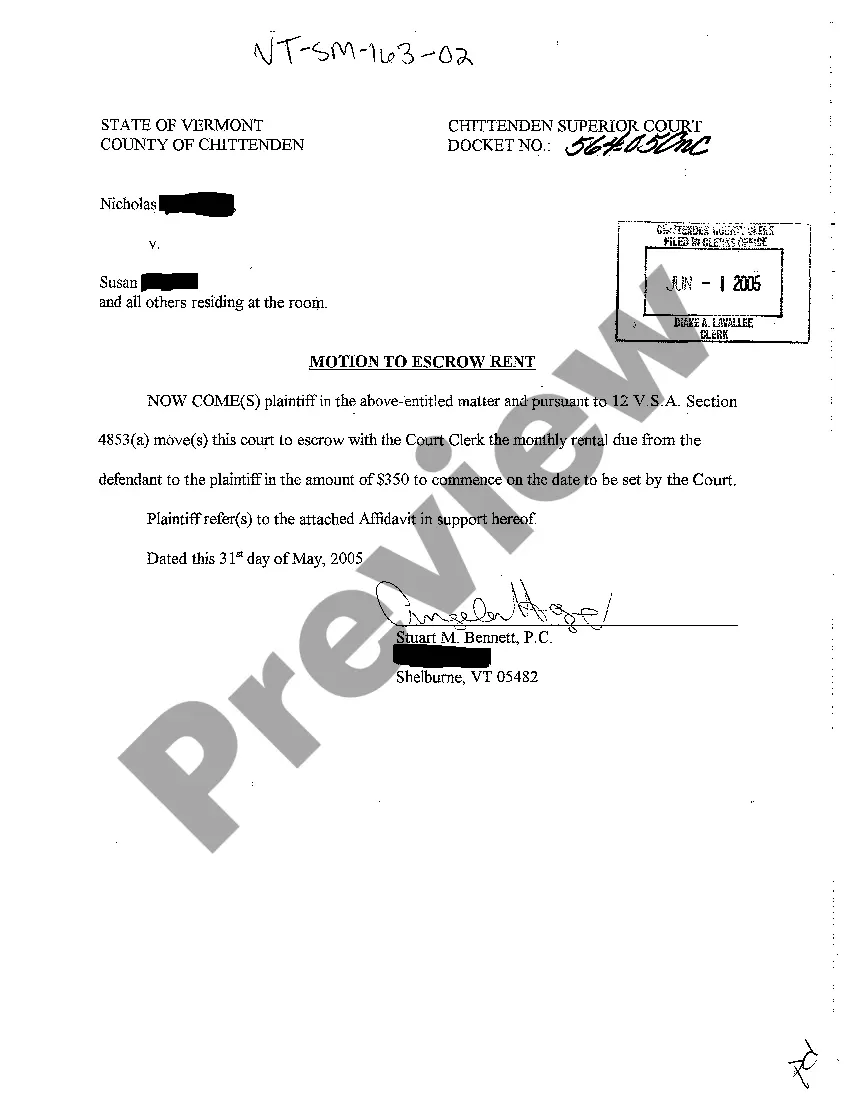

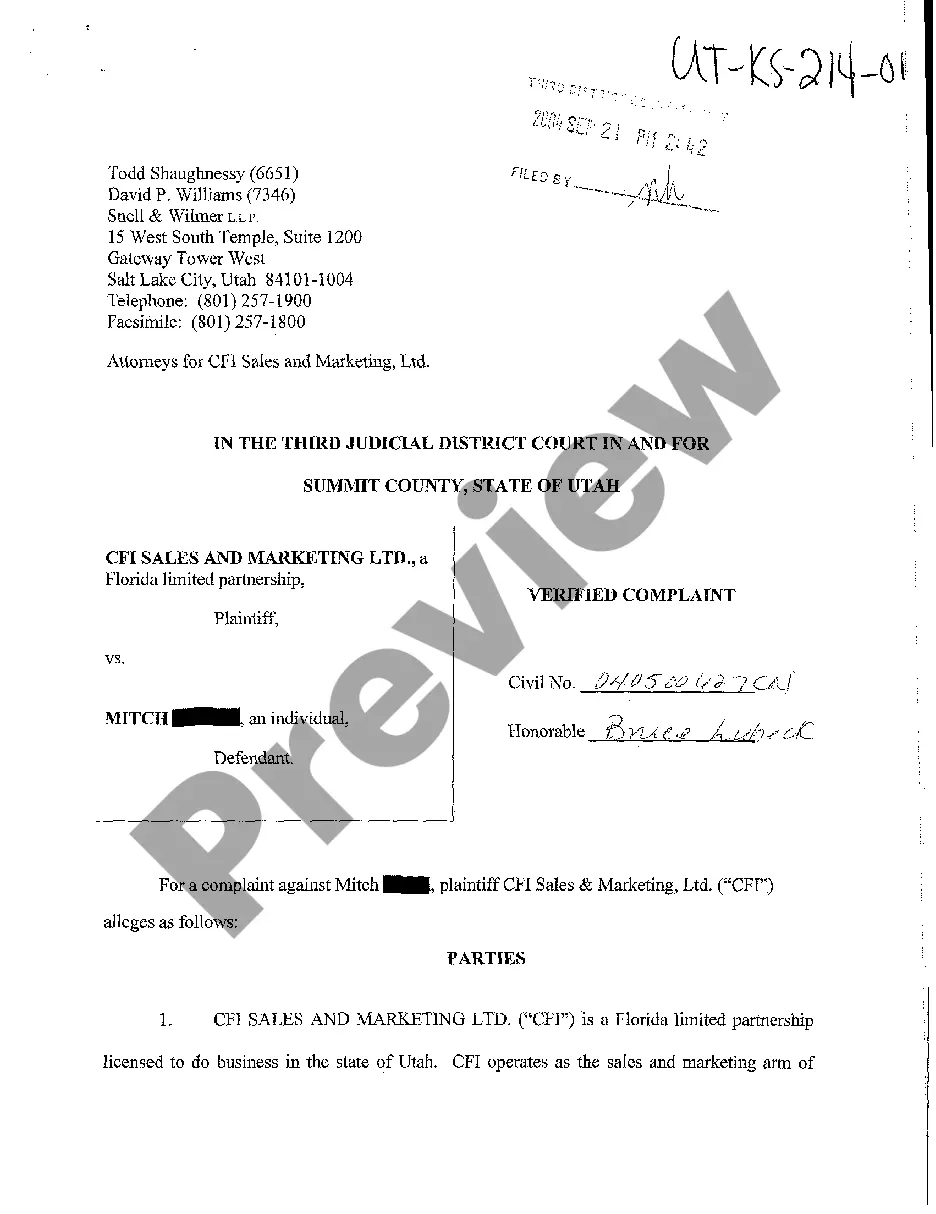

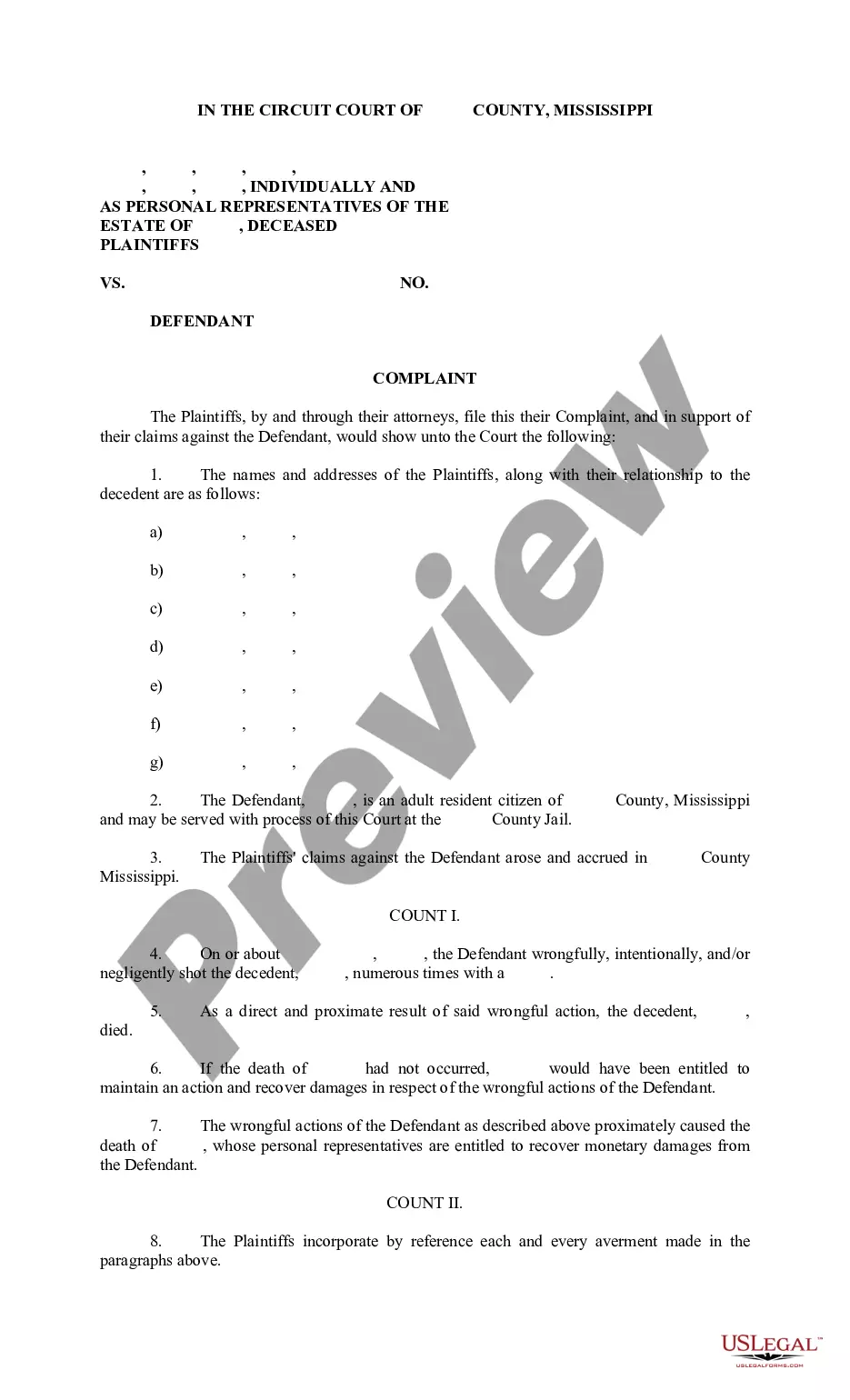

- Initial, ensure that you have chosen the correct papers design for that region/area of your liking. Look at the form explanation to ensure you have chosen the appropriate form. If offered, take advantage of the Review switch to appear from the papers design at the same time.

- If you would like find another edition of your form, take advantage of the Look for field to find the design that meets your needs and specifications.

- When you have discovered the design you want, click Get now to carry on.

- Find the prices prepare you want, enter your credentials, and sign up for a free account on US Legal Forms.

- Full the deal. You may use your Visa or Mastercard or PayPal accounts to pay for the lawful form.

- Find the structure of your papers and down load it for your system.

- Make adjustments for your papers if needed. You are able to complete, revise and indicator and printing Maryland Subordination Agreement Subordinating Existing Mortgage to New Mortgage.

Obtain and printing 1000s of papers web templates making use of the US Legal Forms site, that offers the largest collection of lawful forms. Use expert and express-particular web templates to deal with your business or personal needs.

Form popularity

FAQ

Any subsequent loan that is taken out after your initial purchase loan is considered to be a junior-lien or subordinate mortgage. Therefore, subordinate financing is the use of two or more mortgages to finance the purchase of real estate or using your home's equity for liquid cash.

Subordination clauses are most common in mortgage refinancing agreements, home equity loans, and HELOCs. Subordination clauses don't take effect until a second lien is made on a home.

Over time, as the homeowner makes good on their monthly payments, the home also tends to appreciate in value. Second mortgages are often riskier because the primary mortgage has priority and is paid first in the event of default.

Many people have a subordinate mortgage in the form of a home equity line of credit or home equity loan. A subordinate mortgage is secured by your property but sits in second position, if you have a primary mortgage, for getting paid in the event you default.

Many people have a subordinate mortgage in the form of a home equity line of credit or home equity loan. A subordinate mortgage is secured by your property but sits in second position, if you have a primary mortgage, for getting paid in the event you default.

Getting A Second Mortgage A second mortgage will become a subordinate loan. If you repay the primary loan within the term of the second mortgage, the second mortgage can take its place as the primary loan.

There are also situations where your first purchase loan can become subordinate by law or regulation, without your lender's agreement. Here are two examples: If you have a Federal tax lien for unpaid income taxes, this debt automatically becomes a primary lien ahead of your first mortgage.

Subordination agreements may be included in existing deeds of trust or may be outlined in an independent contract. In situations where two deeds of trust are being recorded concurrently, the lien priority is typically handled by instructing the title company as to which security instrument will be recorded first.