Maryland Sample Letter to Client regarding Real Estate Documents related to Homestead

Description

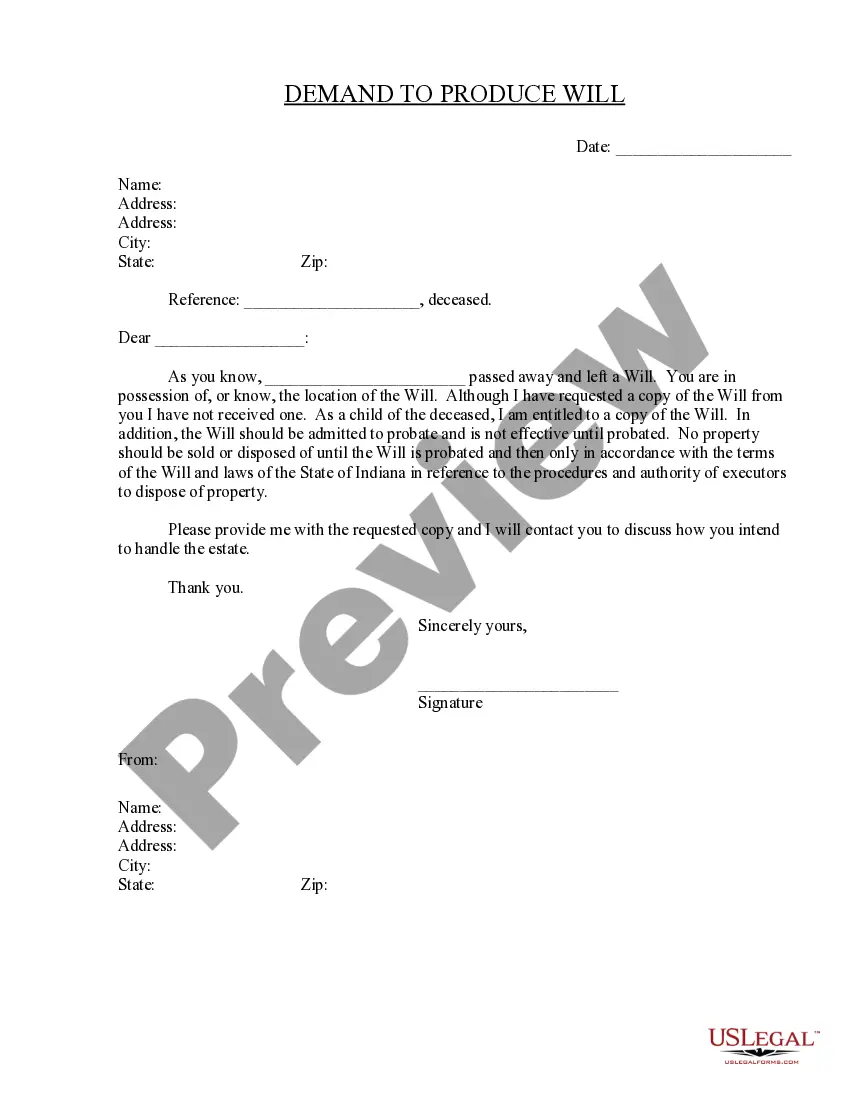

How to fill out Sample Letter To Client Regarding Real Estate Documents Related To Homestead?

You may invest hrs on the Internet looking for the legitimate record format that suits the federal and state requirements you require. US Legal Forms offers thousands of legitimate varieties which are evaluated by professionals. It is possible to obtain or print the Maryland Sample Letter to Client regarding Real Estate Documents related to Homestead from your support.

If you have a US Legal Forms bank account, you are able to log in and click the Acquire switch. After that, you are able to complete, modify, print, or sign the Maryland Sample Letter to Client regarding Real Estate Documents related to Homestead. Every single legitimate record format you acquire is your own property for a long time. To get another version of the bought form, go to the My Forms tab and click the corresponding switch.

If you work with the US Legal Forms web site the very first time, follow the basic recommendations beneath:

- Very first, be sure that you have chosen the best record format for your county/town of your liking. Browse the form outline to ensure you have picked out the proper form. If readily available, use the Review switch to search with the record format at the same time.

- If you wish to discover another model in the form, use the Search field to discover the format that meets your requirements and requirements.

- Once you have found the format you desire, click on Buy now to continue.

- Choose the pricing prepare you desire, type your accreditations, and register for an account on US Legal Forms.

- Total the purchase. You may use your bank card or PayPal bank account to fund the legitimate form.

- Choose the format in the record and obtain it to the gadget.

- Make changes to the record if possible. You may complete, modify and sign and print Maryland Sample Letter to Client regarding Real Estate Documents related to Homestead.

Acquire and print thousands of record themes while using US Legal Forms web site, that provides the most important variety of legitimate varieties. Use professional and condition-specific themes to take on your business or individual demands.

Form popularity

FAQ

? Once you've accessed your property's page, the status of your Homestead application is located at the bottom of the page.

If you have any questions, please email sdat.homestead@maryland.gov or call 410-767-2165 (toll-free 1-866-650-8783). This application can be filled out on your pc; if hand written please print legibly. Please use black or blue ink only.

The State of Maryland provides a credit for the real property tax bill for homeowners of all ages who qualify on the basis of gross household income. A new application must be filed every year if the applicant wishes to be considered for a tax credit.

The Senior Tax Credit is available to homeowners at least 65 for whom the property is their principal residence (see the HOTC page for details); Interested homeowners must submit the Homeowners Tax Credit Application to the Maryland State Department of Assessments and Taxation (SDAT).

You only need to apply and qualify once for your home. To apply online, you can visit or you can download a paper application at or request an application be sent to you by calling 410-767-2165 or 1-866-650-8783.

The Homestead Tax Credit (HTC) limits the increase in taxable assessment each year to a fixed percentage. Every county and municipality in Maryland is required to limit taxable assessment increases to no more than 10% per year, and the State also limits the taxable assessment for the State portion of the tax to 10%.

Apply for an Exemption Obtain an application for exemption from the State Department of Assessments and Taxation (SDAT) and file it with that agency. For more information, contact SDAT by calling 410-512-4900.

Homestead Property Tax Credit This credit is used to assist homeowners who are impacted by large assessment increases, the State of Maryland, Frederick County, and several municipalities limit the annual taxable assessment increase for owner-occupied residential properties. The county limit is 5% and the state is 10%.