Maryland Business Start-up Checklist

Description

How to fill out Business Start-up Checklist?

Selecting the appropriate legitimate paperwork template can be quite a challenge.

Of course, there are many designs available online, but how can you secure the legitimate version you require.

Utilize the US Legal Forms website. The service offers a vast array of templates, such as the Maryland Business Start-up Checklist, which you can utilize for business and personal purposes.

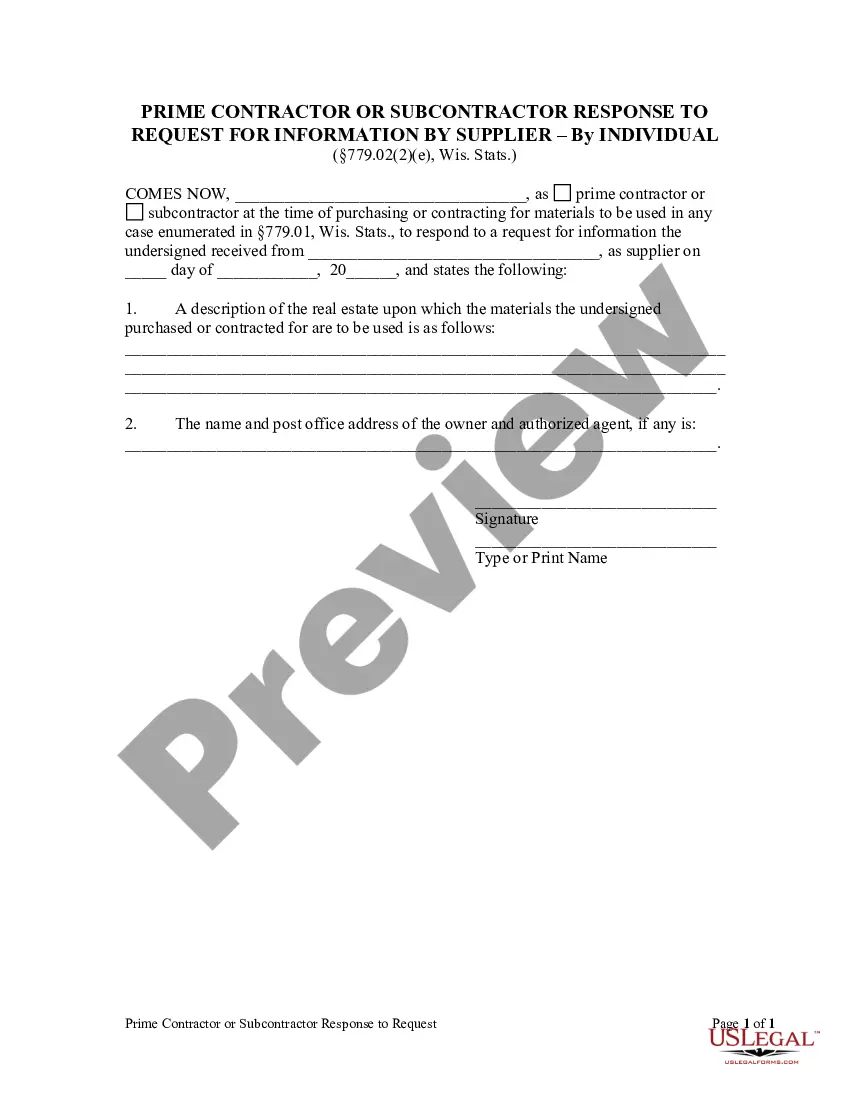

You can review the form using the Review button and read the form description to confirm it is suitable for your needs.

- All the documents are reviewed by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click on the Download button to obtain the Maryland Business Start-up Checklist.

- Use your account to review the legitimate documents you have previously acquired.

- Visit the My documents tab of your account and obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, make sure you have selected the correct type for your state/region.

Form popularity

FAQ

A business license is required for most businesses, including retailers and wholesalers. A trader's license is required for buying and re-selling goods. And you, or the professionals you hire, may need individual occupational and professional licenses.

Almost all businesses in Maryland need a business license issued by the Clerks of the Circuit Court. Contact the Clerk of the Circuit Court in your county or Baltimore City. Construction licenses are issued by the Clerks of the Circuit Court and are required for commercial work and new home construction.

Business Plan. Almost every business needs a little funding to get started.Partnership Agreement.LLC Operating Agreement.Buy/Sell Agreement.Employment Agreement.Employee Handbook.Non-Disclosure Agreement.Non-Compete Agreement.More items...

To file Articles of Incorporation for a corporation in Maryland, you must submit formation documents to the State Department of Assets and Taxation online, by mail, or in person, along with a minimum $120 filing fee.

Forming an LLC in Maryland costs $100, but there are additional fees to consider. All Maryland LLCs must file an annual report and pay a $300 annual fee. If your LLC owns, leases or uses personal property in Maryland, you must also file a personal property tax return.

Maryland businesses must register using the Maryland Business Express200b portal, administered by the Department of Assessments and Taxation. The portal offers a step-by-step process to register a business online. Many businesses require permits or licenses to operate.

In most states, forming an LLC doesn't require a business license, but you'll need to follow your state's procedures. An LLC requires registering with the state and filing the appropriate forms. But even though you don't need a business license to form an LLC, you probably need one to operate the LLC as a business.

Online: You can complete business registration and document filing online via the Maryland EGov Business portal at . The cost is $100.00, and all online filed documents are considered expedited and will be processed within 7 business days.

There is a booming economy in Maryland and now is the best time for new businesses to get a piece of the growing pie. Maryland is growing and can be a great location for starting a new business and allow you to grow bigger and faster than you likely ever dreamed.

The filing fee is $25. Your business may need to obtain business licenses or professional licenses depending on its business activities. Maryland provides a comprehensive database of every profession and occupation that requires a license by any sole proprietorship.