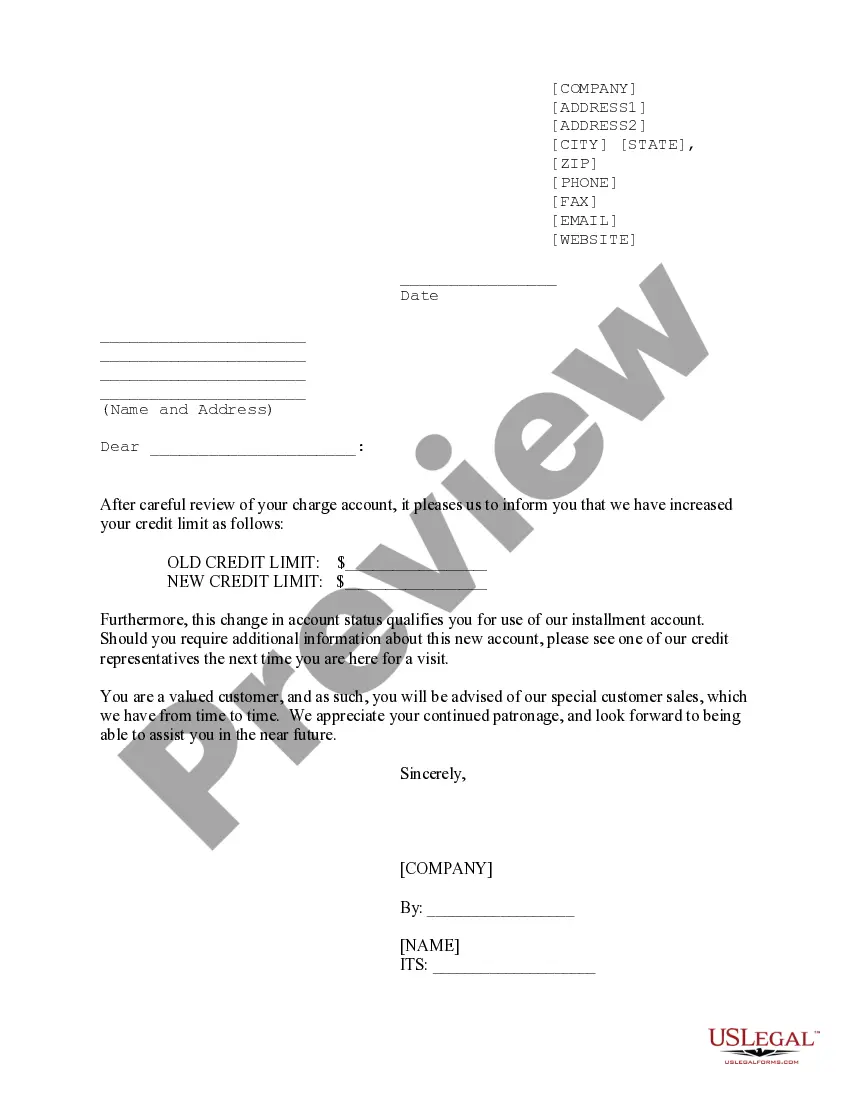

Maryland Sample Letter for Notice of Charge Account Credit Limit Raise

Description

How to fill out Sample Letter For Notice Of Charge Account Credit Limit Raise?

US Legal Forms - one of the largest collections of legal forms in the United States - provides a broad spectrum of legal document templates that you can purchase or create.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest templates of documents such as the Maryland Sample Letter for Notice of Charge Account Credit Limit Increase within moments.

If you already have a subscription, Log In to acquire the Maryland Sample Letter for Notice of Charge Account Credit Limit Increase from the US Legal Forms database. The Download button will be visible on each form you view. You have access to all previously obtained forms from the My documents section of your account.

Select the format and download the form onto your device.

Make modifications. Fill out, edit, print, and sign the acquired Maryland Sample Letter for Notice of Charge Account Credit Limit Increase. Each template added to your account does not expire and belongs to you forever. Therefore, if you wish to acquire or print another copy, simply go to the My documents section and click on the form you need.

- If you are using US Legal Forms for the first time, here are simple steps to help you begin.

- Ensure you have selected the correct form for your city/county. Click the Review button to examine the form's contents.

- Read the form description to confirm that you have chosen the right document.

- If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Get now button. Then, choose your pricing plan and provide your details to register for an account.

- Complete the transaction. Use a Visa or Mastercard or PayPal account to finalize your purchase.

Form popularity

FAQ

Increasing your credit limit can lower credit utilization, potentially boosting your credit score. A credit score is an important metric lenders use to determine a borrower's ability to repay. A higher credit limit can also be an efficient way to make large purchases and provide a source of emergency funds.

Use Your Card Responsibly Have higher than average credit scores. Make at least the minimum payment every month. Pay on time (or early) every month. Keep their account open for at least six months or preferably much longer.

Respected Sir/ Madam, My name is (Name) and I do hold a cash credit limit in your branch i.e. (Branch Name) bearing account number (Account number). I look forward to your kind and quick support. In case of any queries, you may contact me at (Contact number).

How to Raise Your Credit LimitPay your bills on time.Ask the card company to raise your credit limit.Apply for a new card with a higher limit.Balance transfer.Roll two cards into one.Increase your income.Wait for an Automatic Credit Limit Increase.Increase your Security Deposit.

I am writing to request an increase of $5,000.00 in my credit limit with Doe. My current limit is insufficient to cover my monthly purchases at your firm. As you know, my credit history with you is spotless. I have always made payments on time, so I do not anticipate problems handling the increased limit.

You pay every credit card bill on time. As a reward, the credit card issuer may automatically grant you a higher credit limit, or invite you to request one. It could be just a small bump, or it may be as much as 30%. The news may come to you out of nowhere, but it's no reason to be concerned.

Creditors will review your credit, income and payment history on a regular basis moving forward. If they feel you can afford an increase and refrain from abusing the added spending power, they may automatically grant a credit limit increase without you asking.

It's often automatic, and you may not be notified that it's happening. But it'll improve your credit score as long as all other factors remain the same. That means you shouldn't start spending more or otherwise change your payment habits.

Respected Sir/Madam, I like to state that my name is (Name) and, I hold a (name of credit card) credit card with your bank having credit card number (credit card number). I am writing this letter to ask you to kindly increase the limit of my credit card.