A contract is usually discharged by performance of the terms of the agreement. A contract may be discharged pursuant to a provision in the contract or by a subsequent agreement. For example, there may be a discharge by the terms of the original contract when it says it will end on a certain date. There may be a mutual cancellation when both parties agree to end their contract. There may be a mutual rescission when both parties agree to annul the contract and return to their original positions as if the contract had never been made. This would require returning any consideration (e.g., money) that had changed hands.

Other examples of discharge by agreement are:

• accord and satisfaction;

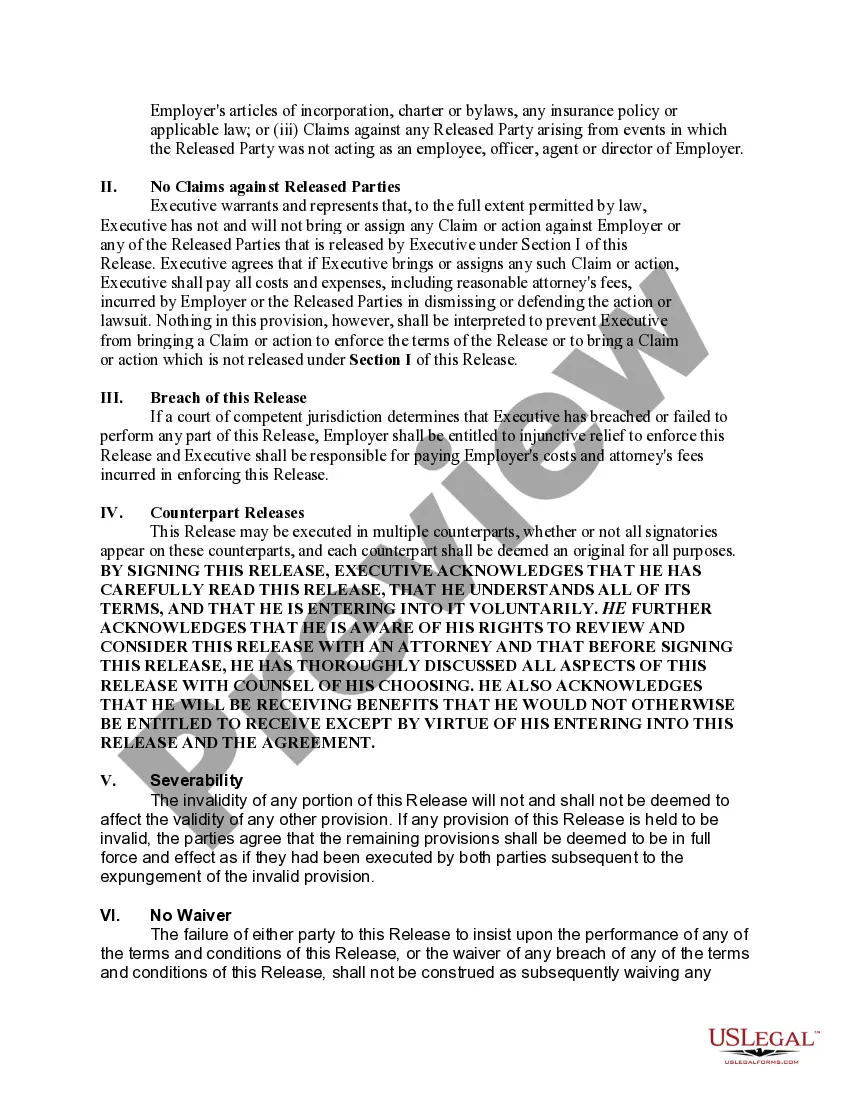

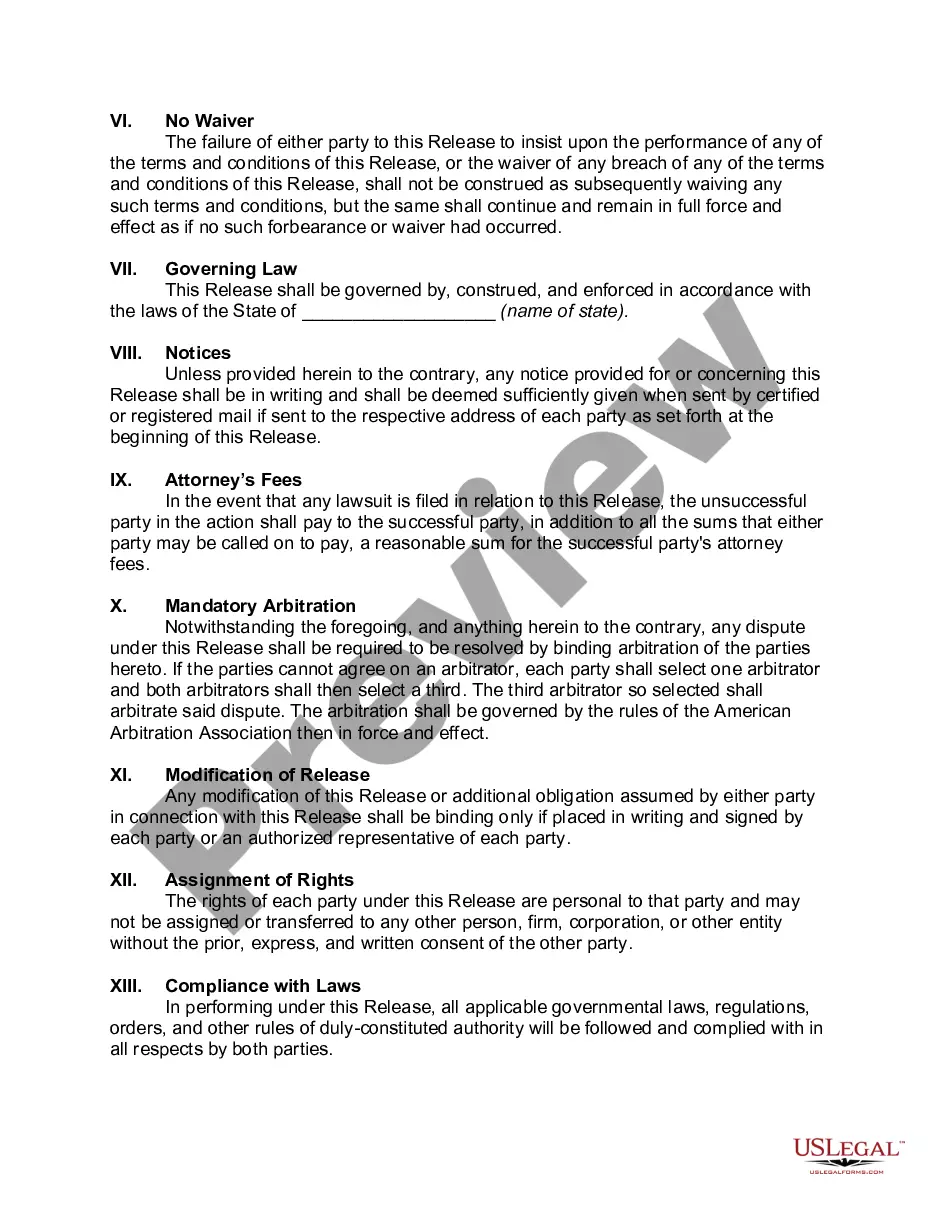

• a release; and

• a waiver.