A check disbursements journal is a book used to record all payments made in cash such as for accounts payable, merchandise purchases, and operating expenses.

Maryland Check Disbursements Journal

Description

How to fill out Check Disbursements Journal?

If you desire to be thorough, obtain, or generate legal document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Take advantage of the site's simple and user-friendly search to locate the documents you require.

Various templates for business and personal uses are organized by categories and states, or by keywords.

Step 4. After you have found the form you want, click the Buy now button. Choose the pricing plan you prefer and provide your information to create an account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction. Step 6. Download the legal form format onto your device.

Step 7. Fill out, modify, and print or sign the Maryland Check Disbursements Journal.

Each legal document format you acquire belongs to you permanently. You have access to every form you downloaded in your account. Click the My documents section and select a form to print or download again.

Be proactive and acquire, and print the Maryland Check Disbursements Journal with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal needs.

- Utilize US Legal Forms to find the Maryland Check Disbursements Journal in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and then click the Acquire button to retrieve the Maryland Check Disbursements Journal.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

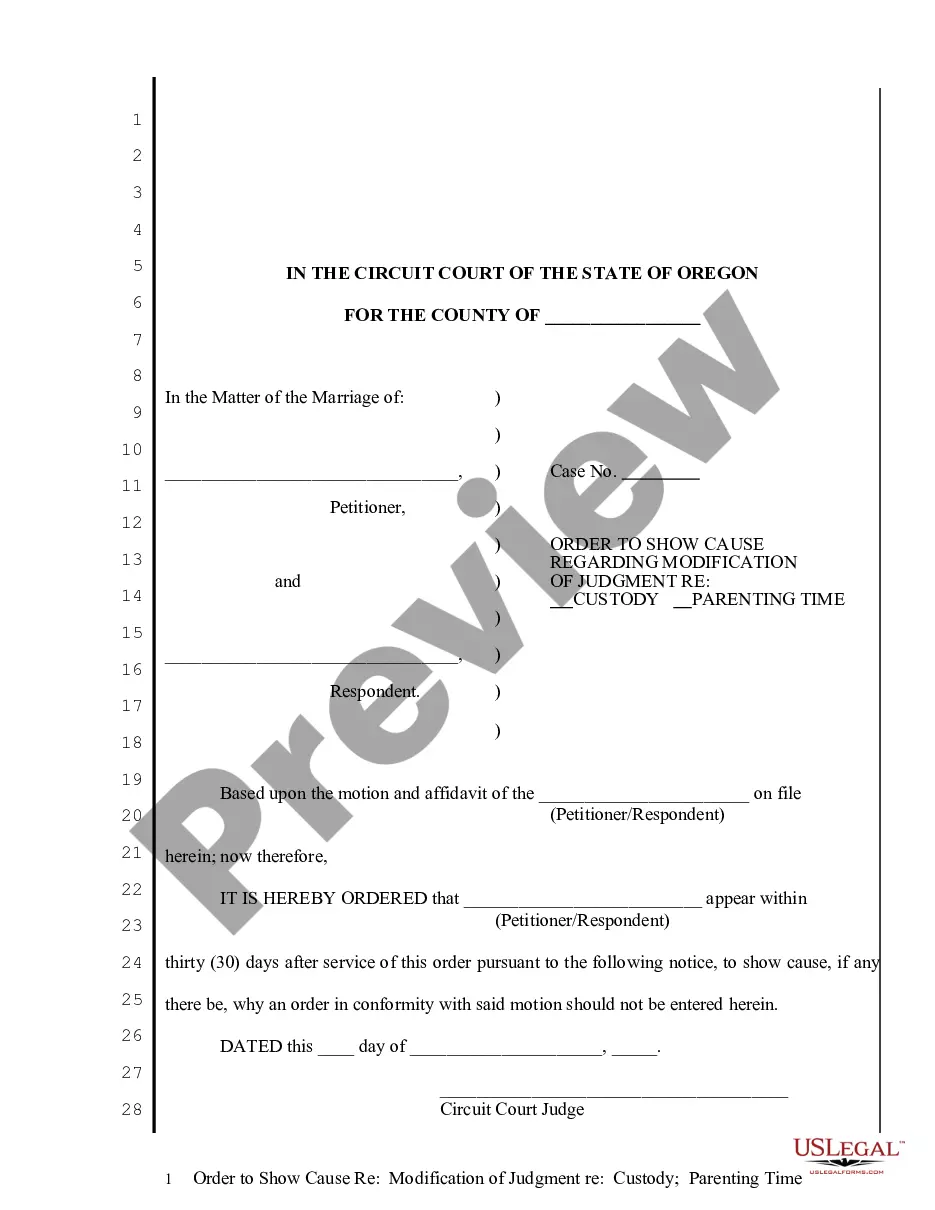

- Step 2. Use the Preview option to review the form's contents. Don't forget to read the description.

- Step 3. If you are dissatisfied with the form, use the Lookup field at the top of the screen to find alternative versions of the legal form format.

Form popularity

FAQ

To check your Maryland state refund, visit the Maryland Comptroller's website and use their online refund tracking system. This tool is user-friendly and allows you to view the status of your Maryland Check Disbursements Journal refund. Make sure to have your details handy for a smoother experience while checking your refund status.

Receiving a letter from the Comptroller of the Maryland Revenue Administration Division could be due to various reasons, such as discrepancies in your tax filings or updates regarding your Maryland Check Disbursements Journal. It’s essential to read the letter carefully and address any issues promptly to ensure your tax records are accurate. If you need further clarity, reaching out directly to the Comptroller's office is advisable.

You can email Maryland taxpayer services by using the dedicated email found on their homepage. When composing your email, make sure to mention the Maryland Check Disbursements Journal if it pertains to your question. Sharing specific information about your needs may help expedite the assistance you require.

To email Maryland withholding, you should use the contact form available on their official site. Be clear and concise in your message, and refer to the Maryland Check Disbursements Journal if your question relates to it. Provide any necessary details to enhance the clarity of your inquiry for a quicker reply.

Contacting Maryland withholding tax can be done through their official hotline or by visiting their website. Whenever you reach out, mention the Maryland Check Disbursements Journal if it's relevant to your query, as this ensures that representatives understand your situation better. They can provide assistance tailored to your needs.

To change your tax withholding in Maryland, you need to complete a new Form MW507 and provide it to your employer. This form allows you to adjust your state tax deductions based on your current situation. For detailed instructions on managing your taxes, including references to the Maryland Check Disbursements Journal, you may want to consult the Maryland Comptroller’s website.

You can reach out to Maryland Tax Connect by using the email address provided on their official website. For inquiries related to Maryland Check Disbursements Journal, it is beneficial to mention this keyword in your email to guide them on your specific concern. Make sure to include relevant details about your query to receive a prompt response.

Writing a check to the Comptroller of Maryland is straightforward. Ensure that you make the check payable to the 'Comptroller of Maryland' and include your tax identification number in the memo line for proper processing. Furthermore, familiarize yourself with your payment details by reviewing the Maryland Check Disbursements Journal, which can guide you on payment amounts and dates, ensuring your check is accurate.

To get in touch with your Maryland Comptroller, visit their official website where you'll find contact information, including phone numbers and email addresses. They also offer live chat options for immediate assistance. Engaging with the Comptroller's office can provide you with useful insights and resources, such as the Maryland Check Disbursements Journal, which can help you manage your state finances effectively.

If you owe Maryland state taxes, you should contact the Maryland Comptroller's office directly. They can assist you with your tax-related inquiries and provide guidance on payment options. You can find their contact information on the official state website. Additionally, using resources like the Maryland Check Disbursements Journal can help you keep track of any payments or disbursements related to your state taxes.