Maryland Checklist - Key Record Keeping

Description

How to fill out Checklist - Key Record Keeping?

It is feasible to allocate multiple hours on the web trying to locate the legal document template that meets the federal and state requirements you will need.

US Legal Forms offers an extensive collection of legal forms that are verified by professionals.

You can easily download or print the Maryland Checklist - Key Record Keeping from our service.

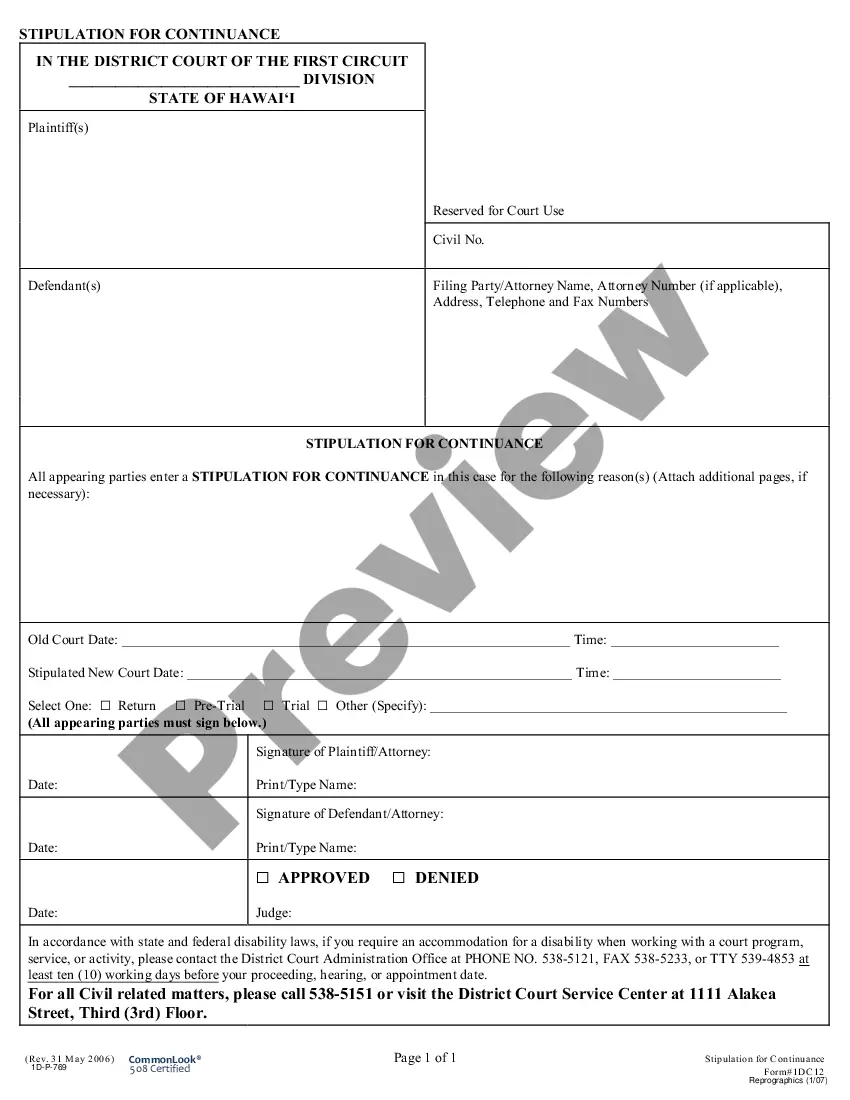

If available, utilize the Preview button to view the document template as well.

- If you possess a US Legal Forms account, you can Log In and select the Download button.

- After that, you can fill out, adjust, print, or sign the Maryland Checklist - Key Record Keeping.

- Every legal document template you purchase is yours for a long time.

- To obtain another copy of a purchased form, visit the My documents section and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have chosen the correct document template for the state/city of your choice.

- Review the form description to confirm you have selected the right form.

Form popularity

FAQ

IRB records required under 45 CFR 46.115 (Department of Health and Human Services DHHS) are retained for at least 3 years, and records relating to research which is conducted shall be retained for at least three years after completion of the research.

Maryland Health General Article, Section 4-301 et seq, and HIPAA regulations require that patient records be retained for six (6) years.

Process of Record or POR means documents and/or systems that specify a series of operations that a semiconductor wafer must process through. The POR includes the process recipes and parameters at each operation for the specified Tool of Record.

Overview. The records management phase of the records life-cycle consists of creation, classification, maintenance and disposition. Creation occurs during the receipt of information in the form of records. Records or their information is classified in some logical system.

The 8 Principles are: Accountability, Transparency, Integrity, Protection, Compliance, Accessibility, Retention and Disposition. These are the Principles of good management of Records. ISO 15489: Records management is a globally recognized requirement.

6 Types of Business Records and Receipts Every Small Business Should KeepProof of Income Received. Documentation showing income received will differ depending on the type of business you run.Documentation for Expenses.Prior Tax Returns.Employment Tax Forms.Documentation for Assets.Records for Purchases Made.

Organisations are required to keep records of: 2022 the name of each branch of the organisation 2022 the name of each branch that commenced operation in the previous 12 months 2022 the name of each branch that ceased operation in the previous 12 months 2022 the address of the office of the organisation; and 2022 the address of the

"Official records" are: records having the legally recognized and judicially enforceable quality of establishing some fact, policy, or institutional position or decision.

The following documents may show this information. There are specific employment tax records you must keep. Keep all records of employment for at least four years....Supporting Business DocumentsCash register tapes.Deposit information (cash and credit sales)Receipt books.Invoices.Forms 1099-MISC.

5 Steps to an Effective Records Management ProgramStep 1: Set-up a Records Retention Schedule.Step 2: Policies and Procedures.Step 3: Accessibility, Indexing, and Storage.Step 4: Compliance Auditing.Step 5: Disposal of Obsolete Records.