The proper form and necessary content of a certificate of incorporation depend largely on the requirements of individual state statutes, which in many instances designate the appropriate form and content. While the certificate must stay within the limitations imposed by the various statutes and by the policies and interpretations of the responsible state officials and agencies, the certificate may usually be drafted so as to meet the business needs of the proposed corporation. In many states, official forms are provided; in some of these jurisdictions, use of such forms is mandatory. Although in some jurisdictions, the secretary of state's printed forms are not required to be used, it is wise to use the language found in the forms since much of the language found in them is required.

Maryland Certificate of Incorporation - General Form

Description

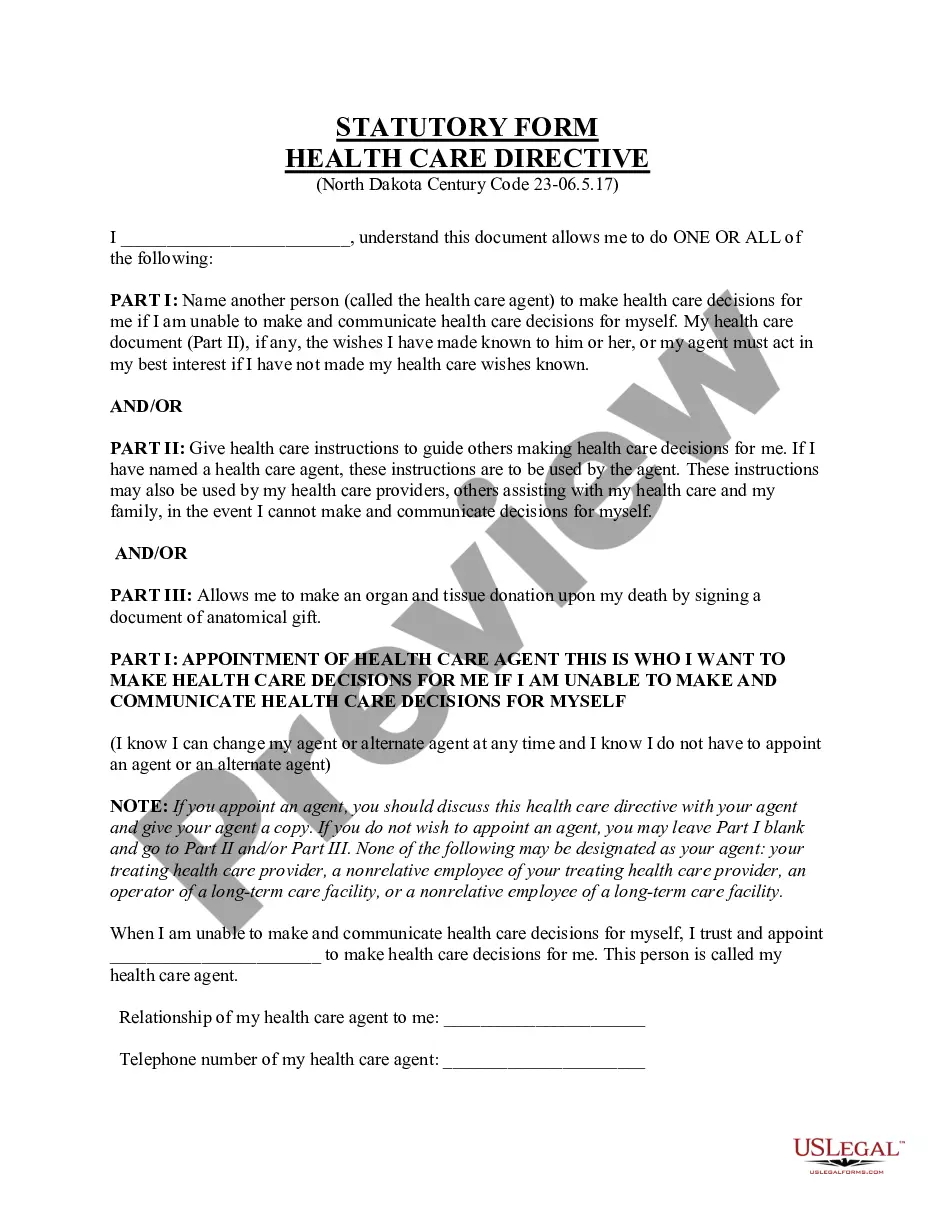

How to fill out Certificate Of Incorporation - General Form?

Are you presently in the place in which you need papers for both organization or personal reasons almost every time? There are a lot of authorized file layouts accessible on the Internet, but discovering ones you can depend on isn`t effortless. US Legal Forms offers a large number of type layouts, like the Maryland Certificate of Incorporation - General Form, which can be written to meet federal and state needs.

If you are currently familiar with US Legal Forms site and also have a free account, merely log in. Next, you can down load the Maryland Certificate of Incorporation - General Form design.

Should you not offer an profile and need to start using US Legal Forms, abide by these steps:

- Obtain the type you will need and ensure it is to the appropriate town/region.

- Utilize the Review switch to check the form.

- Read the outline to ensure that you have chosen the correct type.

- In the event the type isn`t what you`re seeking, make use of the Research field to obtain the type that meets your needs and needs.

- If you obtain the appropriate type, click Buy now.

- Pick the prices plan you desire, fill in the required details to produce your money, and pay money for the order utilizing your PayPal or Visa or Mastercard.

- Pick a handy data file formatting and down load your copy.

Find all of the file layouts you possess purchased in the My Forms menu. You can aquire a additional copy of Maryland Certificate of Incorporation - General Form whenever, if required. Just select the necessary type to down load or printing the file design.

Use US Legal Forms, the most extensive variety of authorized types, to save lots of time as well as steer clear of faults. The support offers skillfully created authorized file layouts which you can use for a range of reasons. Generate a free account on US Legal Forms and begin creating your daily life easier.

Form popularity

FAQ

You must register with the Department of Assessments & Taxation in order to receive an SDAT number. If you are a Sole Proprietor (work for yourself, pay no wages to staff, and are solely liable for any damages), you can register, and get a FEIN, without cost.

An Annual Report must be filed by all business entities formed, qualified or registered to do business in the State of Maryland, as of January 1st. Failure to file the Annual Report may result in forfeiture of the entity's right to conduct business in the State of Maryland. The deadline to file is April 15th.

All legal business entities formed, qualified, or registered to do business in Maryland MUST file an Annual Report: Legal business entities (Corporations, LLC, LP, LLP, etc.), whether they are foreign or domestic, must file a Form 1 Annual Report (fees apply) Credit Unions must file a Form 3 Annual Report (fees apply)

Articles of incorporation are filed with the Maryland State Department of Assessments & Taxation (SDAT). Preparing and filing articles of incorporation is the first step in starting your business or nonprofit corporation.

Same-day if filed in-person with expedite fee by pm. Choose a Corporate Structure. ... Check Name Availability. ... Appoint a Registered Agent. ... File Maryland Articles of Incorporation. ... Establish Bylaws & Corporate Records. ... Appoint Initial Directors. ... Hold Organizational Meeting. ... Issue Stock Certificates.

Generally, you are required to file a Maryland income tax return if: You are or were a Maryland resident; You are required to file a federal income tax return; and.

Personal property generally includes furniture, fixtures, office and industrial equipment, machinery, tools, supplies, inventory and any other property not classified as real property.

The state of Maryland requires all corporations, nonprofits, LLCs, LPs, and LLPs to submit a Maryland Annual Report each year. In addition, your business may have to file a Personal Property Tax Return if your business owns, leases, or uses personal property located in the state or maintains a trader's license.